Tag Archive: Daily Market Update

London House Prices Fall At Fastest Rate Since Height Of Financial Crisis

– London house prices fall at the fastest annual rate since height of the financial crisis

– London house prices fall in 5th month in row, worst falls since 2009

– London rents dropped at the fastest rate in eight years – ONS

– Brexit, London property slump put brake on UK house price growth

– Consumer spending declined in July as inflation increased

Read More »

Read More »

Jim Rogers – Making China Great Again! (Video)

We are delighted to announce a very special guest for our next episode of the Goldnomics Podcast, due for release later this week. We recently had the opportunity to speak with the legendary investor and adventure capitalist Jim Rogers. Jim is an American businessman, investor, traveler, financial commentator and author. He is the Chairman of Rogers Holdings and Beeland Interests, Inc. He was the co-founder of the Quantum Fund and creator of the...

Read More »

Read More »

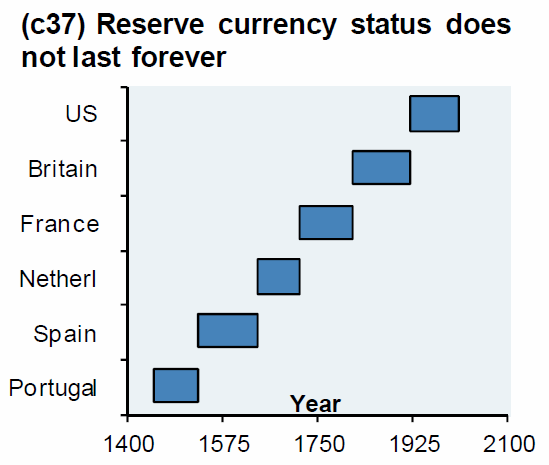

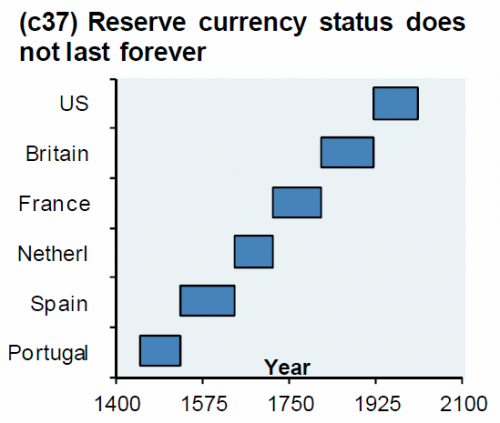

Jim Rogers and the World’s New Reserve Currency

Today we’re bringing you another clip from our upcoming Episode of the Goldnomics Podcast with the legendary investor and “Adventure Capitalist”, Jim Rogers. In this clip Jim tells us what he thinks about the long-term safe-haven status of the US dollar and what he sees as the future for the Euro currency.

Read More »

Read More »

The Stock Market is Stretched to Double Tech-Bubble Extremes

Leuthold Group has sounded the alarm on a valuation metric that shows the S&P 500 is twice as expensive as it was at the peak of the tech bubble. This development could have large implications for stock investors of all types, particularly value traders who make their living by finding discounts in the market. With the stock market within shouting distance of an all-time high, traders are readying their Champagne bottles. Just don’t tell them about...

Read More »

Read More »

Gold—Even at its Lowest Levels in 2018—is Behaving Just as Prescribed

Gold’s sharp decline over the past month serves as little surprise to the investors who want the asset to perform in just this fashion—that is, as an alternative to assets perceived as risky, like stocks. They’re betting that the opposite will be true as well, that gold will resume its role as protector and diversifier, even inflation hedge, when what they see as bloated price-to-earnings ratios, heavy debt-to-GDP ratios among major economies and...

Read More »

Read More »

Gold to Enter New Bull Market – Charles Nenner

Gold to Enter New Bull Market – Charles Nenner. “Gold is going to enter a new bull market”. “The first cycle will bottom after the summer”. “$1,212 per ounce is our downside target”. “It’s going to top $2,500 per ounce . . . in about two years or so”. “Gold is in a bull market even though it came down from $1,900 per ounce”

Read More »

Read More »

Russia Sells 80 percent Of Its US Treasuries

Russia Sells 80% Of Its US Treasuries. Description: In just over 2 months Russia has sold-off over 85% of its holdings of U.S. Treasuries, should the U.S. be concerned? – Russia has liquidated 85% of its US Treasury holdings in just two months. – Russia dumps over $90 billion of Treasuries in April and May as holdings collapse from near $100 billion to just $9 billion.

Read More »

Read More »

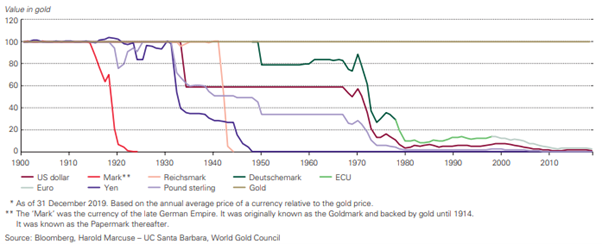

Physical Gold Is The “Best Defence” Against “Escalating Currency Wars”

Physical Gold Is The “Best Defence” Against “Escalating Currency Wars”. As governments around the world debase their currencies, you need an asset that can ride out the hard times. And nothing fits the bill like gold writes John Stepek of Money Week

Read More »

Read More »

Gold $10,000 In Currency Reset as Russia, China Gold Demand To Overwhelm Futures Manipulation (GOLDCORE VIDEO)

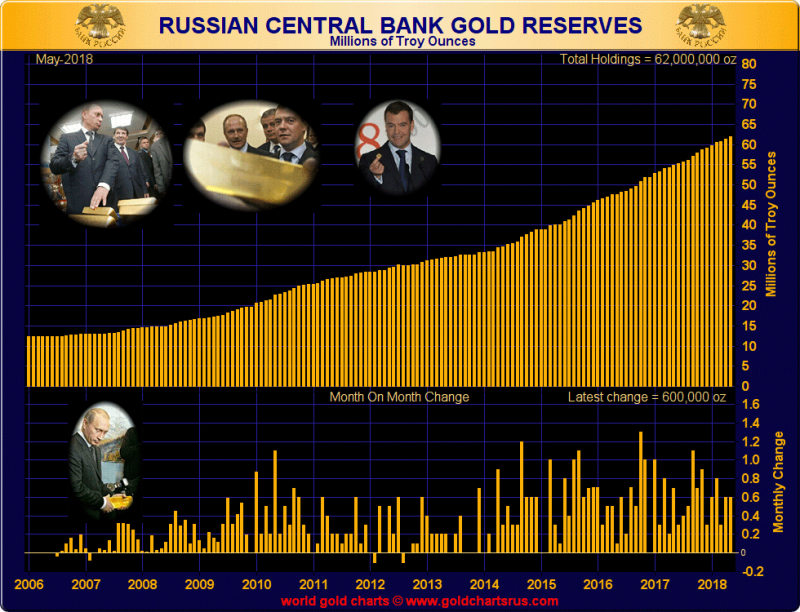

Is the currency reset or global monetary reset (GMR) upon us? Russia dumped half their US Treasuries in April ($47.4 billion out of the $96.1 billion it had held) and bought 600k ozs of gold worth less than $800 million in May. Has the IMF “pegged” gold to SDRs at 900 SDR per ounce? China stops buying US Treasuries and quietly accumulates gold.

Read More »

Read More »

London House Prices Fall 1.9 percent In Quarter – Bubble Bursting?

London house prices down 1.9 per cent in Q2 (yoy). London house prices still 50% above 2007 bubble peak (see chart). Brexit and weak consumer confidence to blame say experts. Little sign that U.K. property “weakness” is likely to change. London property bubble appears to be bursting.

Read More »

Read More »

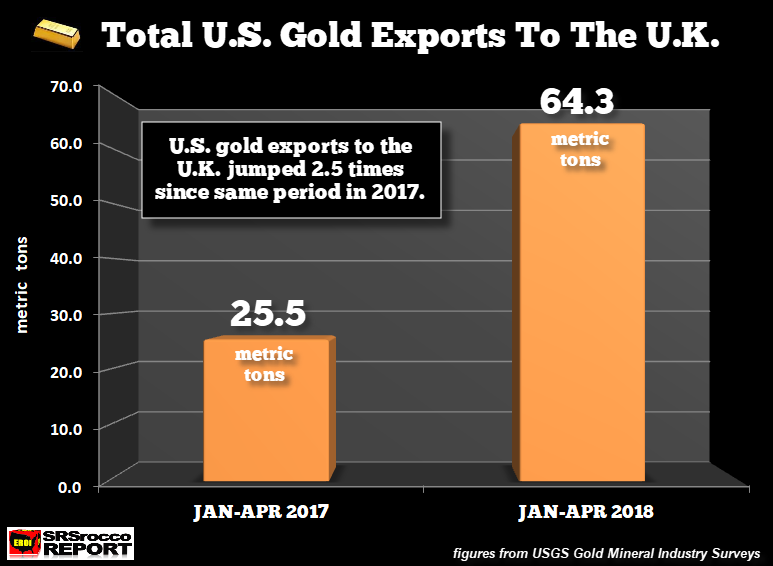

Gold Exports To London From U.S. Surge 152 percent In 2018

Gold Exports To London From U.S. Surge 152% In 2018. – U.S. gold exports to UK (primarily) London jumped over 150% from 25.5 metric tons to 64.3 mt in the first four months of 2018 (yoy). – Largest countries receiving U.S. gold exports are China/ Hong Kong, Switzerland and the UK. – U.S. gold exports to London (UK) alone nearly as much as total U.S. gold production. – Gold flowing from weak hands in West to strong hands in the East

Read More »

Read More »

Manipulation of Gold and Silver Is “Undeniable”

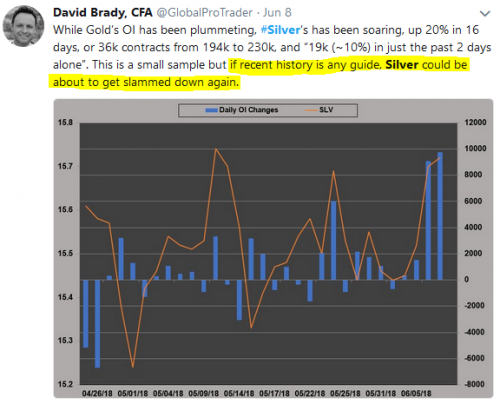

Manipulation in precious metals is undeniable. Now so chronic that it is obvious and therefore predictable. Central banks around the world are repatriating their gold from the U.S. in preparation for some major event to come. I want to be long … “when that event occurs”.

Read More »

Read More »

Russia Buys 600,000 oz Of Gold In May After Dumping Half Of US Treasuries In April

Russia adds another 600,000 oz to it’s gold reserves in May. Holdings of U.S. government debt slashed in half to $48.7 billion in April. ‘Keeping money safe’ from U.S. and Trump – Danske Bank. Trump increasing the national debt by another 6% to $21.1 trillion in less than 18 months. Asian nations accumulating gold as shield against dollar devaluation and trade wars.

Read More »

Read More »

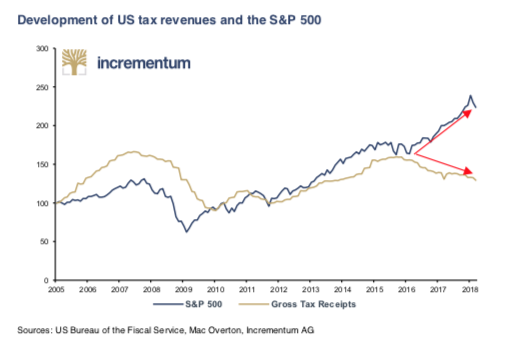

In Gold, Silver and Bitcoin We Trust? Goldnomics Podcast with Ronald-Peter Stoeferle

In Gold, Silver and Bitcoin We Trust? Goldnomics Podcast (Episode 5) interview with Ronald-Peter Stoferle. We interview our friend Ronald-Peter Stoeferle, partner in Incrementum in Liechtenstein and author of the must read, annual gold report ‘In Gold We Trust’ in this the fifth episode of the Goldnomics Podcast.

Read More »

Read More »

“Without Gold I Would Have Starved To Death” – ECB Governor

– “Without gold I would have starved to death” – Ewald Nowotny, governor of Austrian central bank and member of ECB’s governing council

– “I was born in 1944. When I was a baby, my mother could only buy food because she still had some gold coins…”

– “When the going gets tough, gold becomes the ultimate money” reports Die Presse

Read More »

Read More »

Swiss Government Pension Fund To Buy Gold Bars Worth Some $700 Million

Swiss Government Pension Fund Allocating 2% Of Pension Fund To Gold Bars. The Swiss government pension fund, Switzerland’s AHV/AVS fund, has decided to diversify into physical gold bars in their substantial CHF35.2bn (€30.5bn) pension portfolio. At the end of last week the first pillar buffer fund tendered a custodianship and storage for CHF 700m (EUR 600m / USD 700m / GBP 525m) in gold bars via IPE Quest.

Read More »

Read More »

Get “Positioned In Gold” Now As “You Will Not Have Time To Get Positioned” Later

Get “Positioned In Gold” Now As “You Will Not Have Time To Get Positioned” In Physical Later. Guest post by Dominic Frisby of Money Week. This year’s “gold standard” of gold-related research has just come out. Conveniently enough – given gold’s “safe haven” reputation – it’s arrived just in time for another major financial market scare, this time in the form of Italy. Below, I consider some of the most pertinent points…

Read More »

Read More »

Gold And Silver Bullion Obsolete In The Crypto Age?

What is the outlook for the global economy, financial markets, crypto currencies such as bitcoin and gold and silver bullion in the digital age? Fresh insights as CrushtheStreet.com interview Mark O’Byrne who gives his diagnosis on the outlook for gold in 2018, and looks at the long-term relevance of precious metals in the digital age of crypto and the blockchain alongside Bitcoin’s emergence as a potential digital store of value.

Read More »

Read More »

Gold Back Above $1300 – Trump Cancels Historic Summit – Silver “Ready To Breakout”

– Trump Cancels Historic Summit with North Korea. – US 10-Year Falls Below 3%, Gold Jumps Back Above $1300. – “Inflation Overshoot Could Be Helpful” – Latest FOMC Minutes. – Gold Demand in Turkey as Lira falls sharply, true inflation near 40%. – EU Crisis Looming as Italy Plan Outright ‘Money Printing’ with ‘Mini-Bots’. – Silver Trading in Tight $1 range, Pressure Building for a Breakout.

Read More »

Read More »

‘Nightmare Scenario’ For EU Bond Markets As Anti-Euro Italian Goverment Takes Power

Firebrand populists of Left and Right are poised to take power in Italy, forming the first “anti-system” government in a major West European state since the Second World War. Leaders of the radical Five Star Movement and the anti-euro Lega party have been meeting to put the finishing touches on a coalition of outsiders, the “nightmare scenario” feared by foreign investors and EU officials in equal measure.

Read More »

Read More »