Tag Archive: Daily Market Update

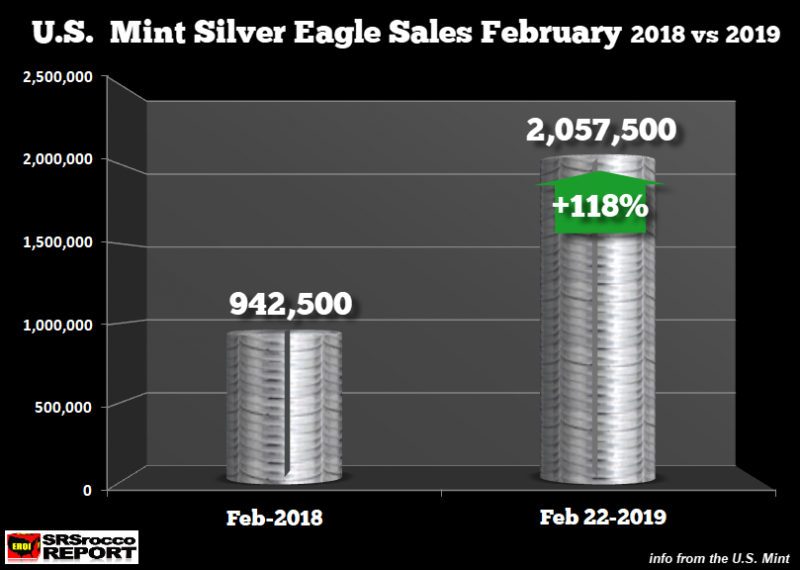

U.S. Mint Suspends Silver Bullion Coin Sales After Sales Double In February

U.S. Mint suspends silver bullion coin sales after sales double in February. Silver investment demand for American Eagles (one ounce) silver bullion coins depletes West Point Mint inventories. U.S. Mint suspended sales of American Eagle (1 oz) coins on Feb. 21 because it had no coins left to sell.

Read More »

Read More »

Gold Prices In Pounds and Euros Gain More as Economic Growth Falters in the UK and EU

Gold prices in pounds and euros as economic growth falters in UK and EU. Euro & pound gold tests multi year resistance; likely to surpass due to strong demand. Improved risk appetite sees stocks rise which may be hampering stronger gains for gold.

Read More »

Read More »

Large Gold Bullion Shipment Moves From London to Dublin Gold Vaults As Brexit Concerns Deepen

-Large Gold Bullion Shipment Moves From London to Dublin Gold Vaults As Brexit Concerns Deepen. – Growing demand from investors to relocate tangible assets out of the UK. – “Zurich continues to be the most sought-after location for storage, but Dublin has already surpassed Hong Kong and will likely usurp the second spot from London”.

Read More »

Read More »

Buy Bitcoin or Gold? Bitcoin Buyers Investing In Gold In 2019

Buy bitcoin or gold? Bitcoin buyers are investing in gold in 2019. Poll of 4,000 bitcoin buyers shows their No 1 investment in 2019 is gold. “Gold lost to bitcoin and now it’s going the other way…” says ETF strategist.

“Gold is a store of value and there’s no disputing that…”

Read More »

Read More »

Gold Consolidates Above $1,300 After 1.2 percent Gain Last Week

Gold futures settled above $1,300 an ounce on Friday, with prices for the yellow metal at their highest since June as the U.S. dollar pulled back and investors eyed geopolitical turmoil and global growth worries. Rising gold prices reflect “political uncertainty” in the U.S., Eurozone, Venezuela and pockets of South America, as well as China-U.S. trade talks, said George Gero, managing director in RBC.

Read More »

Read More »

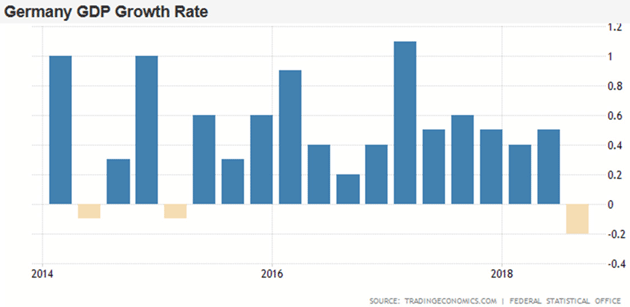

Brexit, EU, Germany, China and Yellow Vests In 2019 – Something Wicked This Way Comes

“Something wicked this way comes” warns John Mauldin. Shaky China: Chinese landing could be harder than expected. Brexit and EU Breakage: “I have long thought the EU will eventually fall apart”. Helpless Europe: If Germany sneezes, their banks & the rest of continent catches cold. We may see “yellow vests” spread globally: Economics is about to get interesting …

Read More »

Read More »

Political Turmoil in UK & US Sees Gold Hit 2 Week High

For first time in over 16 years, palladium futures settle at a premium to gold futures. Gold futures on Wednesday resumed their climb toward the psychologically important price of $1,300 an ounce, settling at their highest in nearly two weeks on the back of political turmoil in the U.K. and U.S.

Read More »

Read More »

Gold Holds Steady Near $1,300/oz As Geopolitical Risks Including Brexit Loom Large

Gold Holds Steady Over £1,000 – Increased Likelihood Of A Disorderly Brexit. – Gold supported near $1,300/oz ahead of important British Brexit no-confidence vote. – Gold is consolidating in range between $1,280 and $1,300/oz (over £1,000/oz and €1,100/oz) – A break of resistance at $1,300 will likely see gold rise rapidly in all currencies.

Read More »

Read More »

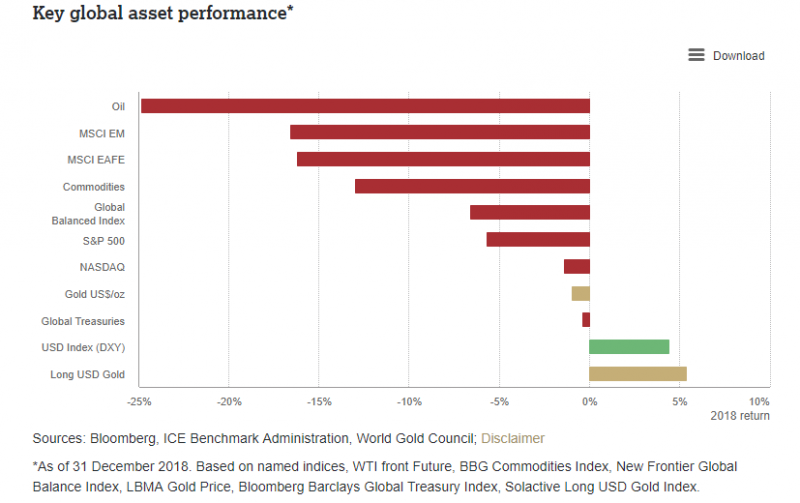

Gold Outlook 2019: Uncertainty Makes Gold A “Valuable Strategic Asset” – WGC

As we look ahead, we expect that the interplay between market risk and economic growth in 2019 will drive gold demand. And we explore three key trends that we expect will influence its price performance: financial market instability, monetary policy and the US dollar, structural economic reforms.

Read More »

Read More »

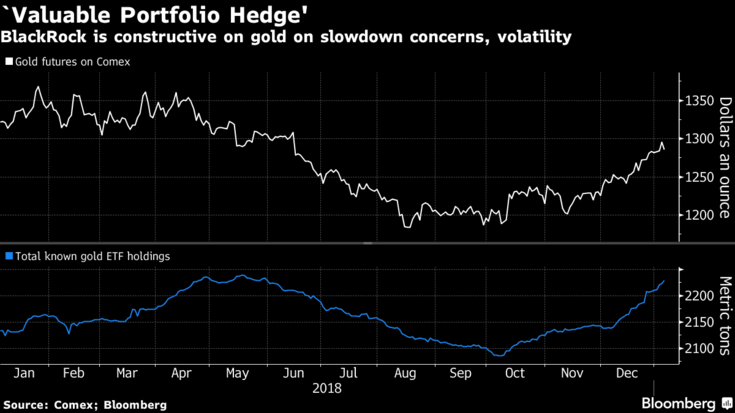

Blackrock Say Gold Will Be A “Valuable Portfolio Hedge” In 2019

“We’re experiencing a slowdown,” says Blackrock fund manager. Global Allocation Fund adding to gold exposure through ETFs. Gold “has had a very consistent record of helping mitigate equity risk when volatility is rising”. Gold bullion has been a “store of value for a very long time”.

Read More »

Read More »

China Adds 320,000 Ounces To Gold Reserves – First PBOC Purchase Since October 2016

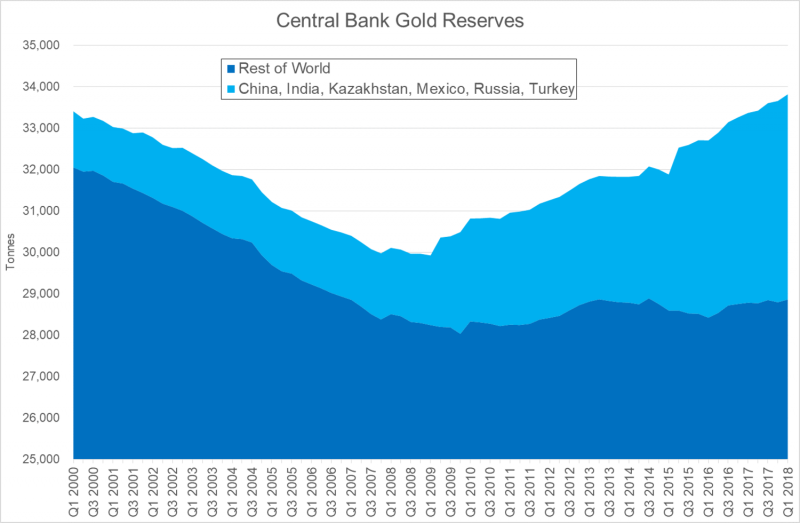

China increases gold holdings by large 320,000 ounces. Gold bullion remains a tiny component of the People’s Bank of China massive foreign exchange (FX) reserves which rose to $3.073 trillion. China’s gold reserves rose for first time since October 2016 to 59.56 million ounces by the end of December (1,853 metric tons) from 59.24 million ounces. Gold climbed 5% in December on equity rout, growth concerns

Read More »

Read More »

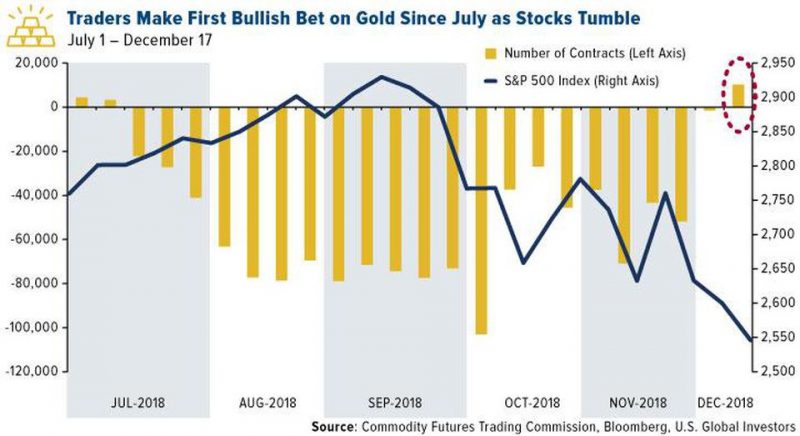

Gold Prices Likely To Go Higher In 2019 After 4 percent Gain So Far In Q4

Gold traders appear excited about gold again as stocks are on pace for their worst year since 2008, and their worst December since 1931. Bullish bets on the yellow metal outnumbered bearish ones for the week ended December 11, resulting in the first instance of net positive contracts since July, according to Commodity Futures Trading Commission (CFTC) data.

Read More »

Read More »

EU Recession Imminent – Euro Disunion as Brexit, Italy and End of QE Loom

Someone asked recently how many times I had “crossed the pond” to Europe. I really don’t know. Certainly dozens of times. It’s been several times a year for as long as I remember. That makes me an extremely unusual American. Most of us never visit Europe, except maybe for a rare dream vacation. And that’s okay because our own country is wonderful and has a lifetime of sights to see.

Read More »

Read More »

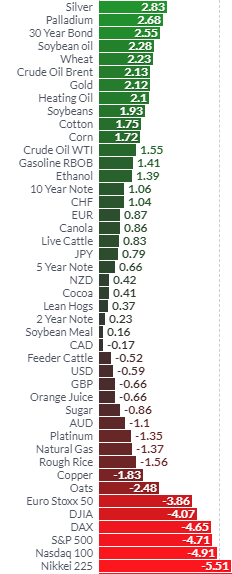

Gold and Silver Gained 2 percents and 3 percents Last Week While Stocks Dropped Nearly 5 percents

Gold acted as a safe haven last week and is again acting as a safe haven in December. It has performed well despite the rout in stocks in Ireland and globally. U.S. stocks including the S&P500 and Nasdaq were down nearly 5% last week, while gold was 2% higher and silver over 3% higher.

Read More »

Read More »

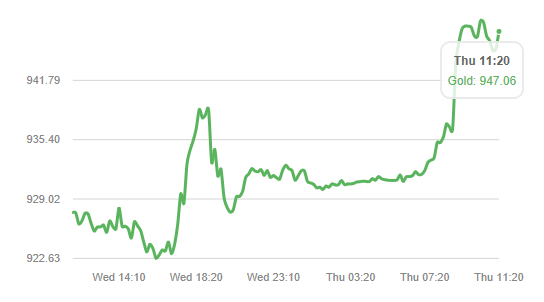

Pound Falls 2.5 percent Against Gold as UK Government in Turmoil Over Brexit

The pound plunged against the euro, the dollar, gold and all leading currencies today as Theresa May’s UK government appeared vulnerable to collapsing and political turmoil risked creating a hard Brexit. The pound has fallen 2.6% against gold in less than twenty four hours seeing gold rise from £923 to £947 per ounce in sterling terms.

Read More »

Read More »

Gold ETFs See Strong Demand In Volatile October After Robust Global Gold Demand In Q3

Gold ETFs saw inflows in volatile October as investors again hedged risk. Gold ETFs see demand of 16.5 tonnes(t) in October to total of 2,346t, the equivalent of US$1B in inflows. Global gold demand was robust in Q3 – demand of 964.3 tonnes – plus 6.2t yoy.

Read More »

Read More »

Gold Analysts At LBMA See 25percent Return To $1,532/oz In 12 months

The price of gold is expected to rise to $1,532 an ounce by October next year, delegates to the London Bullion Market Association’s (LBMA) annual gathering predicted on Tuesday. A poll of delegates at the LBMA conference in Boston also predicted higher prices in a year’s time for silver, platinum and palladium.

Read More »

Read More »

Perth Mint’s Gold and Silver Bullion Coin Sales Soar In September

Sales of gold products by the Perth Mint surged in September to their highest since January 2017, while silver sales more than doubled from August to mark an over two-year peak, boosted by lower bullion prices, the mint said on Wednesday.

Read More »

Read More »

Central Banks Positivity Towards Gold Will Provide Long Term “Support To Gold Prices”

– There has been a recent change for the better in central bank attitudes to gold. – There has been “net gold demand by central banks – approx. 500 tonnes per year – as a source of return, liquidity and diversification”. – Policy shift to maintaining stable gold holdings reflects central bank concerns about financial markets and geopolitics. – Little in the current global economic and political environment to support any reason to change in this...

Read More »

Read More »

Silver Is ‘Undervalued’ Relative to Stocks, Bonds, Gold – GoldCore

– Silver is ‘undervalued’ relative to stocks, bonds and gold: GoldCore. – Silver at $14/oz is cheap relative to gold with gold-silver ratio over 85. – Silver drops to 32-month lows prompting sellout of Silver Eagle coins at U.S. Mint. – U.S. Mint said “recent increased demand” prompted a “temporary sell out” of its American Silver Eagle bullion coins as investors see silver coins as a bargain.

Read More »

Read More »