Tag Archive: Daily Market Update

Outlook 2020 | Buy Gold and Silver To Hedge Massive Risks including U.S. ‘Insolvency’

Buy gold and silver to hedge risks in 2020. IG interview Mark O’Byrne of GoldCore

With late cycle risks and concerns about global growth, many Wall Street analysts are increasingly bullish on gold. Mark O’Byrne, founder at GoldCore spoke to IGTV’s Victoria Scholar about the outlook for gold in 2020.He explained why most analysts including GoldCore are optimistic on both gold and silver.

Read More »

Read More »

Fed Is Monetizing 90 percent of U.S. Deficit to Keep Interest Rates from Rising and Crashing Markets

By Daniel R. Amerman, CFAAs can be seen in the graph above, for the last 12 weeks there has been a stunning visual correlation between the yellow bars of the total weekly funding of deficits by the Federal Reserve, and the green bars of the weekly deficit spending by the United States government.

Read More »

Read More »

Gold Coins Worth Thousands Generously Donated To Salvation Army

◆ Gold coins worth thousands generously gifted to the charity again this year ◆ It just means so much … because it means that they went out of their way to do something extra special…” ◆ Salvation Army gold donors keep giving gold coins including Gold Krugerrands anonymously every year◆ At least three gold coins worth some $4,500 have again been generously gifted to charity this year (that we know of)

Read More »

Read More »

The Most Important UK Election of the Century So Far

There’s only one story in the UK this morning – it’s the day Britain goes to the polls. It’s no exaggeration to say that this election is probably the most important of the century so far. If the ruling Conservative party wins a clear majority, then some form of Brexit is almost certain to go ahead.

Read More »

Read More »

Gold $1600 In 2020 as Case for Diversifying into Gold ‘as Strong as Ever’ – Goldman

Gold will climb to $1,600 over the next year – Goldman. ◆ Goldman is still forecasting that gold will climb to $1,600 over the next year due to investment demand. ◆ Investors should diversify their long-term bond holdings with gold, citing “fear-driven demand” for the precious metal – Goldman Sachs Group Inc.

Read More »

Read More »

Largest Gold Nugget in Britain Found in River in Scotland – “Experts” Concerned About a Scottish Gold Rush

The largest gold nugget in Britain has been found in a Scottish river, as experts reveal that members of the public are taking up hunting after watching YouTube clips. The diver, who wishes to remain anonymous, discovered the £80,000 “doughnut-shaped” nugget using a method called “sniping”, in which a prospector uses a snorkel and hand tools to scan the riverbed for treasures.

Read More »

Read More »

Global ‘Gold Rush’ Beginning As Investors and Central Banks Buy, Repatriate and Move Gold

◆ Gold is flowing to strong hands in safer forms of gold ownership, in safer jurisdictions. ◆ Gold and silver bullion coins and bars owned by GoldCore’s clients have been moved from Hong Kong to Singapore. ◆ Central bank and institutional gold rush is beginning as prudent money diversifies fx reserves by buying gold & repatriates their gold from London and New York.

Read More »

Read More »

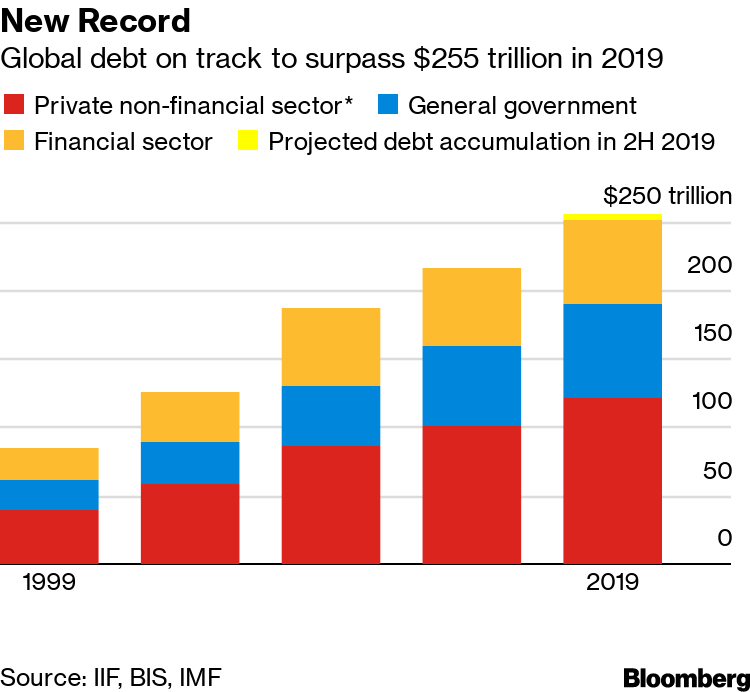

$255 Trillion Global Debt Bubble May Burst In 2020 – Prepare Now

◆ Global debt has risen to another record at $255 trillion due to cheap borrowing costs. ◆ A decade of easy money has left the world with a record $250 trillion of government, corporate and household debt. ◆ This is almost three times global economic output and equates to about $32,500 for every man, woman and child on earth.

Read More »

Read More »

Eastern European Nations Buy and Repatriate Gold Due To Growing Risks To Euro and Dollar

◆ Prudent leaders in Eastern European countries are repatriating their national gold reserves and diversifying into gold due to geopolitical risks and monetary risks posed to the dollar, euro and pound◆ Slovakia has joined China, Russia and a host of countries buying gold or seeking to repatriate their gold from the Bank of England and the New York Federal Reserve◆ “Brexit and the risk of a global economic crisis put Slovak gold stored in Britain...

Read More »

Read More »

Global Gold Buyers Are ‘Confident’ in Gold

‘Retail Gold Insights 2019’ has just been published by the World Gold Council. It is a thematic analysis of their new consumer research survey. With a base of 18,000 participants across India, China, Russia, Germany, the US and Canada, we believe it is the largest ever consumer survey on the global gold market.

Read More »

Read More »

CNBC is careful to admit that owning GLD is not owning gold

Chris Powell of GATA writes today about how he finds it interesting that CNBC are careful to admit that owning the GLD ETF is not the same thing as owning physical gold, a theme that has run strongly throughout our market commentaries for many years.

Read More »

Read More »

True US Economy About To Be ‘Revealed’ – Stockman Interview

David Stockman is the former budget director for President Ronald Reagan and author of “Peak Trump: The Undrainable Swamp and the Fantasy of MAGA”. He believes that the market “can’t digest” all the money flooding into Wall Street and that the Federal Reserve responded with panic.

Read More »

Read More »

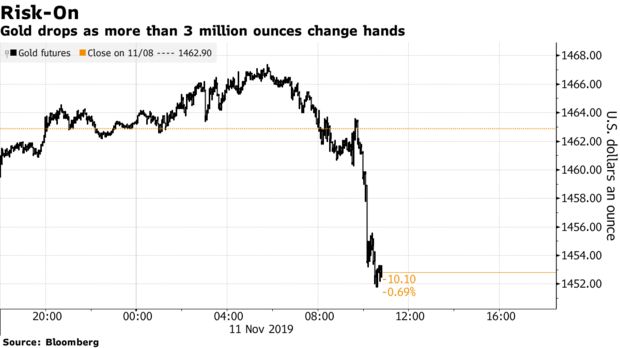

Gold Price Falls on Selling of Gold Futures Equal to 3 Million Ounces in 30 Minutes

◆ Gold price falls to a three-month low as concentrated selling of COMEX gold futures contracts equal to over 3 million ounces are sold in 30 minutes◆ 33,596 contracts were aggressively sold in the 30 minutes between 10:00 and 10:30 a.m. New York time which is more than triple the 100-day average for that time of day

Read More »

Read More »

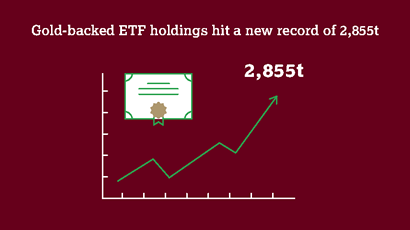

Gold ETF and Central Bank Gold Buying Supports Gold Demand In Q3

Gold demand grew modestly to 1,107.9 tonnes (t) in Q3 thanks to the largest ETF inflows since Q1 2016. A surge in ETF inflows (258t) outweighed weakness elsewhere in the market to nudge gold demand 3% higher in Q3. Global central bank buying remained healthy but significantly lower than the record levels of Q3 2018.

Read More »

Read More »

Time To Replace Bonds With Gold

◆ “It may be time to replace bonds with gold”according to the just released excellent new Investment Update by the World Gold Council.◆ Central banks have shifted to a new regime of easy monetary policy, thus reducing expected bond returns.

Read More »

Read More »

Global Economy Faces ‘Scary Situation’ – Billionaire Investment Manager Dalio Warns

Likely to have a downturn while “there is not effective monetary policy and that is a ‘scary situation’ – Billionaire Investment Manager Ray Dalio

Read More »

Read More »

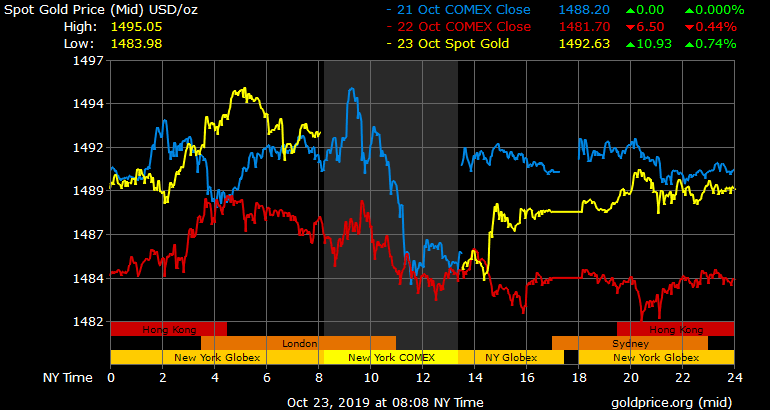

Trump Pumps Market With Trade Talks, Stocks Move Higher, Gold Lower

Sue Trinh, Managing Director of global macro strategy at Manulife Investment Management, speaking on Bloomberg. She had some interesting comments regarding the current market structure, in the shadow of the FED, which is expected to drop rates yet again.

Read More »

Read More »

Bundesbank Buys Gold – Increasing Concerns About Deutsche Bank, European Banks, the Euro and Dollar

◆ The End Of Fiat In One Chart?◆ For the first time in 21 years, Germany has openly bought gold into its reserve holdings◆ With ECB mutiny and Deutsche Bank’s rapid demise, fears are rising of a looming financial crisis, and with that, Germany has shown a renewed interest in gold

Read More »

Read More »

JPMorgan Warns U.S. Money Market Stress to ‘Get Much Worse’

◆ Severe funding pressures in U.S. money markets tipped to resurface heading into year-end by JPMorgan who warn that financial stresses are likely to ‘get much worse’ ◆ Goldman Sachs and Bank of America also warn funding issues remain (see below) ◆ Federal Reserve will start buying $60 billion of Treasury bills every month ◆ Funding markets are on notice for a possible year-end liquidity crunch

Read More »

Read More »

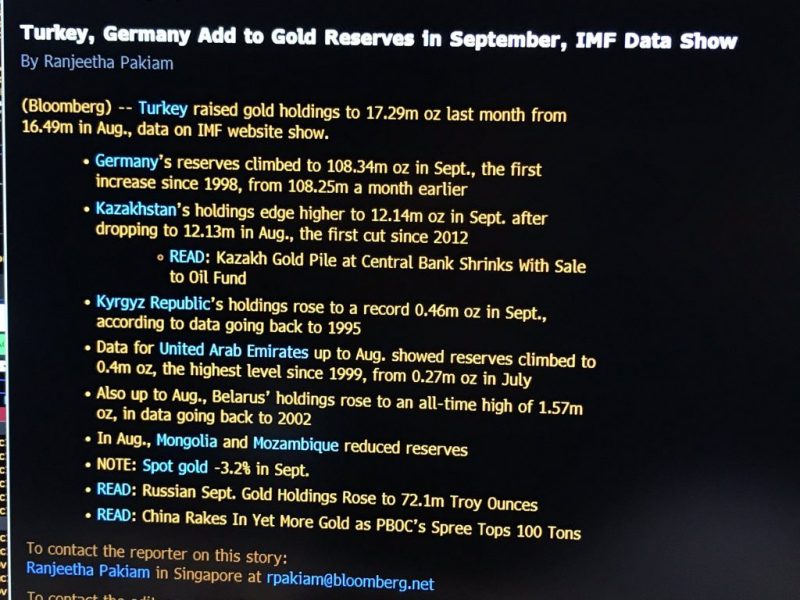

Germany Increase Gold Reserves In September For The First Time In 21 Years – IMF

◆ The gold reserves of the German Bundesbank rose in September for the first time in 21 years; German gold reserves rose to 108.34 million ounces in September from 108.25 million ounces last month◆ It was the Germany’s first gold purchase since 1998 and while the amounts are not huge at 90,000 troy ounces, it highlights the Bundesbank and German concerns about the global monetary system and euro itself as Christine Lagarde takes over the ECB

Read More »

Read More »