Tag Archive: Daily Market Update

Where Next for Gold & Silver

Markets have struggled to find a clear direction as they attempt to digest US election news, debate performance, the impact of increased Covid-19 restrictions in many countries and vaccine news.

Read More »

Read More »

Heavy Metal Selling

Anxiety about an increase in Covid19 cases and fears of a second wave coupled with revelations of historic money laundering practices of major global banks weighed heavily on financial markets yesterday.

Read More »

Read More »

Gold is Looking Strong as it Tests Resistance

Since it’s sell-off from it’s early August high, gold has been stuck in an ever decreasing range. Having had a remarkable rally to an intra-day high of $2,078 on the 7th of August Gold has traded sideways and consolidated. This has been viewed by many market commentators as a healthy pause in gold’s bull rally as when markets go parabolic they tend to retrace just as fast.

Read More »

Read More »

Gold, Silver Jump After Swings Amid Weak Dollar and Economic Woe

Spot gold headed for back-to-back gains as investors weighed the outlook for the metal’s record-setting rally after this week’s dramatic price swings. Silver climbed the most in more than five years.

Read More »

Read More »

Value of gold stored by Irish metals broker GoldCore surges past €100m

Investment in gold has risen during pandemic. The value of gold coins and bars stored for clients by Irish precious metals broker GoldCore has surged 68pc so far this year to more than €100m.

The value of gold coins and bars stored for clients by Irish precious metals broker GoldCore has surged 68pc so far this year to more than €100m.

Gold prices last week topped the $2,000-per-ounce level for the first time as investors seek havens...

Read More »

Read More »

Perfect Storm for Precious Metals Leads to Price Correction

Gold fell by nearly 6% yesterday and silver by a whopping 15%, the largest one day loss in over 7 years. The futures market saw massive volumes of selling with over 1.6 bn ounces of silver contracts sold yesterday. That’s a value of over $40 billion.

Read More »

Read More »

Short Term Weakness Likely Prior To A “Massive Short Squeeze Propels” Gold and Silver “To Much Higher Levels” – GoldCore

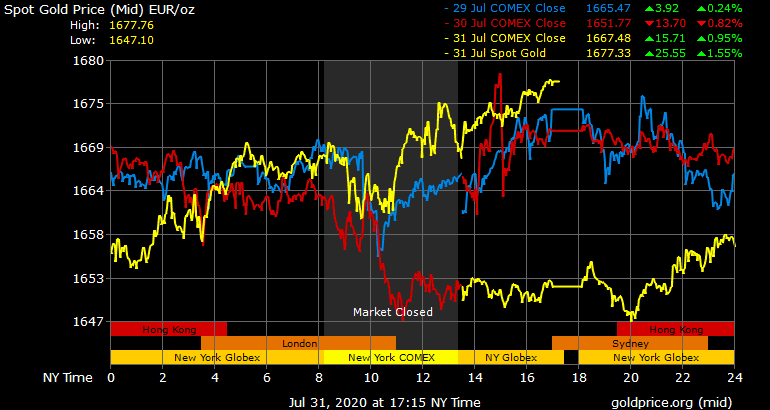

Gold and silver are set for a 5% and 6% gain this week and a significant 11% and 30% gain in the month of July.

Read More »

Read More »

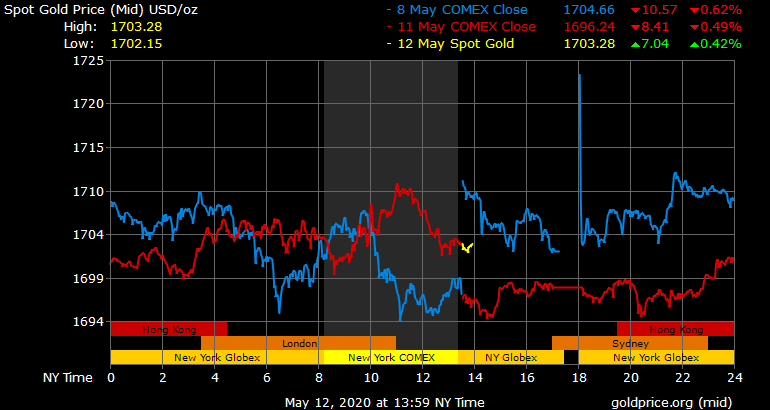

Gold Reaches $2,000/oz Prior to Two “Concerted Attacks” In Futures Market

The King Report“Anyone that’s been around the block a few times with gold knows that at some point ‘they’ will stage a concerted effort to drive gold lower.” December gold hit $2,000 at 21:19 ET Monday. It then retreated and traded sideways until 22:50 ET. Then someone slammed gold down to $1,955 in 20 minutes. This is obvious “impact trading.” Gold then traded sideways for over four hours.

Read More »

Read More »

Gold futures end a stone’s throw away from a record

Gold futures ended higher for a fifth straight session Thursday, with the most-active contract just short of notching a settlement record, highlighting feverish demand for bullion amid the worst pandemic in over a century.

Read More »

Read More »

Gold Protects from Financial Crisis and Crashes Throughout History – Lucey and O’Connor

This is an interesting interview between Professor Brian Lucey and Dr. Fergal O’Connor, lecturer in finance and economics at University College Cork (UCC) on gold’s performance as a safe haven asset in the last 200 hundred years and in recent history including the 2008-2012 global financial crisis.

Read More »

Read More »

‘Death Cross’ Strikes U.S. Dollar As Virus Cases Grow

A resurgent coronavirus pandemic in the United States and the prospect of improving growth abroad are souring some investors on the dollar, threatening a years-long rally in the currency.

Read More »

Read More »

Gold Will “Trend Toward $10,000 Per Ounce Or Higher” Over The Next Four Years

You’re likely aware of the price action in gold lately. Gold has rallied from $1,591 per ounce on April 1 to $1,782 per ounce as of today. That’s a 12% gain in less than three months.

Read More »

Read More »

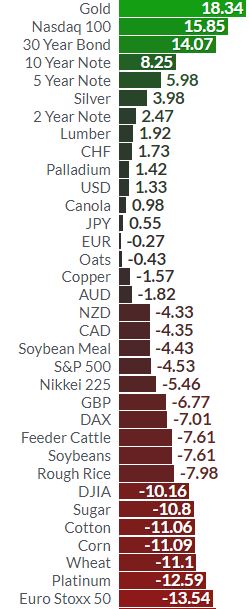

Gold Outperforms All Assets In 2020 YTD as Enters Seasonal Sweet Spot of July, August and September

Source: Finiz.com

◆ Gold is the top performing asset in the world in the first half of 2020, outperforming all stock markets including the S&P 500 and the Nasdaq and outperforming “safe haven” U.S. government bonds (see table above).Gold had an 18% gain in dollars in the first half of 2020 as risk assets, especially stock markets, fell sharply with the S&P down 4.5% and other stock markets down more than 10% (see table). Gold gained...

Read More »

Read More »

World’s Ultra Wealthy Urged By Financial Advisers and Largest Banks to “Hold More Gold”

◆ World’s wealthy are being urged by their financial advisers to hold more gold as they question the strength of the stock market rally and are concerned about the long-term impact of global central banks’ cash splurge.

Read More »

Read More »

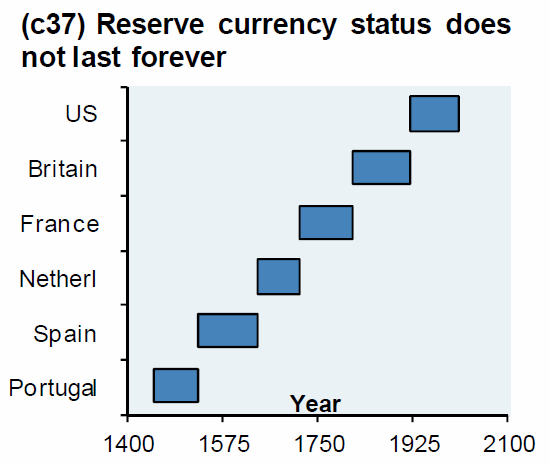

A Dollar Crash Is Coming

◆The world is having serious doubts about the once widely accepted presumption of American exceptionalism. The era of the U.S. dollar’s “exorbitant privilege” as the world’s primary reserve currency is coming to an end. In the 1960s French Finance Minister Valery Giscard d’Estaing coined that phrase largely out of frustration, bemoaning a United States that drew freely on the rest of the world to support its overextended standard of...

Read More »

Read More »

Why Gold Is Safe Haven Money And Will Go Over $3,000/oz

That’s a question I’m asked frequently. It’s usually followed by a comment along the lines of, “I don’t get it. It’s just a shiny rock. People dig it out of the ground and then put it back in the ground. What’s the point?”

Read More »

Read More »

Global Silver Investment Demand To Surge While Supply Weak (World Silver Survey 2020)

◆ WORLD SILVER SURVEY 2020 from the SILVER INSTITUTE GLOBAL SILVER DEMAND EDGED HIGHER IN 2019, WITH INVESTMENT DEMAND UP 12%, WHILE SILVER MINE SUPPLY FELL FOR THE FOURTH CONSECUTIVE YEAR Global silver demand was pushed higher in 2019, with a 12 percent increase in investment demand as retail and institutional investors focused their attention on the long-term investment appeal of the white metal.

Read More »

Read More »

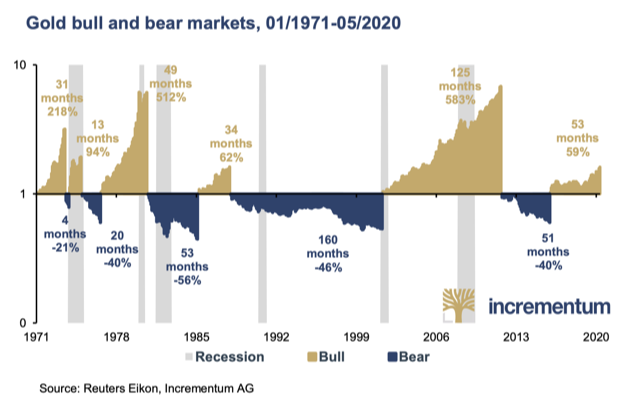

Pandemic, Economic Shutdowns, Debt Crisis and Gold At $5,000/oz

◆ GoldCore are delighted to publish the 14th edition of the annual “In Gold We Trust” report, “The Dawning of a Golden Decade” by by our friends Ronald-Peter Stoeferle & Mark J. Valek of Incrementum AG.Gold prices should rise to over $5,000/oz and may rise as high as $9,000/oz in the coming decade and by 2030, according to the respected report.

Read More »

Read More »

Is Your Pension ‘Good as Gold’?

With the current level of uncertainty in world markets we have received numerous requests for information on how self directed pension schemes (pre and post retirement) can hold gold and silver.It is accepted that if gold bullion is held via a gold certificates ( Perth Mint Certificates with GoldCore) or in Secure Storage in a variety of local or international locations with GoldCore, then it is not considered a ‘pride in possession’ article or...

Read More »

Read More »

Pandemic, Lockdowns, Fake and Manipulated Markets – Gold and Silver Outlook

◆ The massive global debt driven “Everything Bubble” is bursting due to the pandemic and more specifically the governments draconian economic lockdowns. ◆ A dollar crisis is inevitable with U.S. government debt surging by some $2 trillion in a matter of weeks and ballooning to over $25 trillion

Read More »

Read More »