Tag Archive: Current Market News

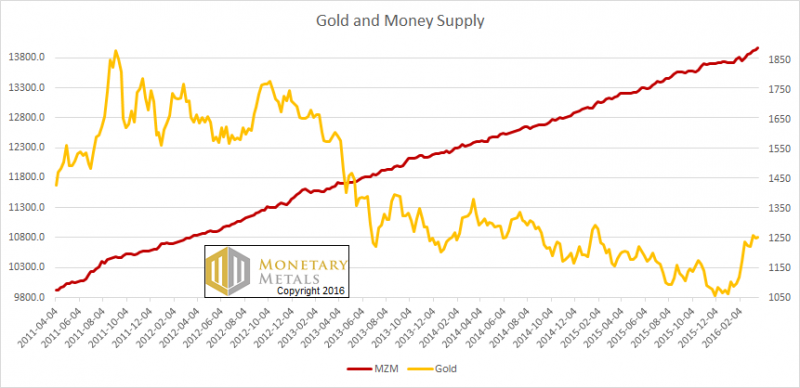

The Gold Money Supply Correlation Report, 3 Apr, 2016

There were some fireworks this week. Gold went up on Tuesday (it was a shortened week due to Easter Monday), from a low of $1,215 to $1,244 over the day, a move of over 2 percent. Silver moved from $15.02 to $15.44, almost 3 percent. What happened on...

Read More »

Read More »

Silver Relative Strength Report, 27 Mar, 2016

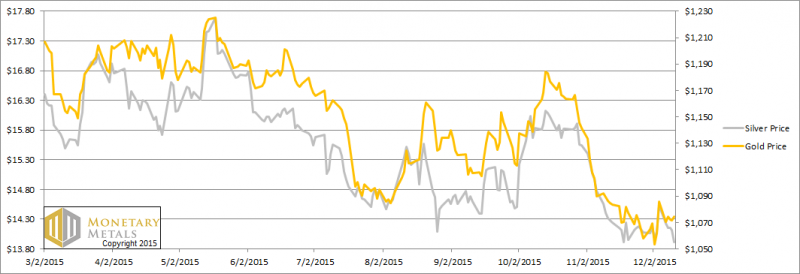

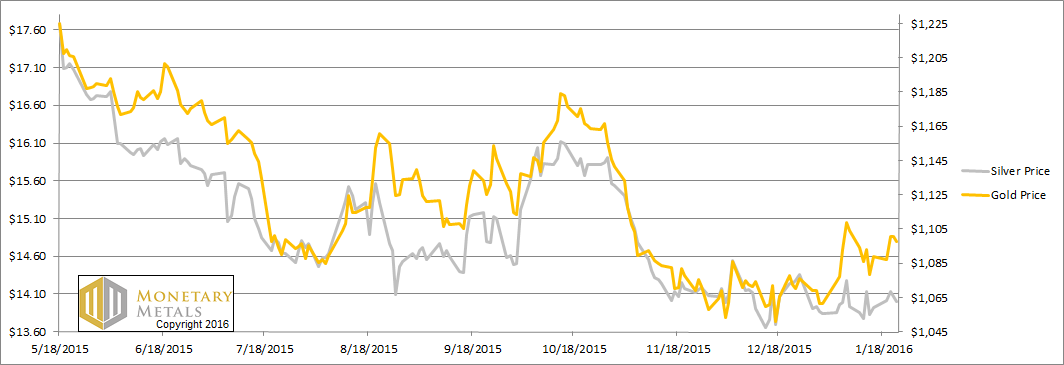

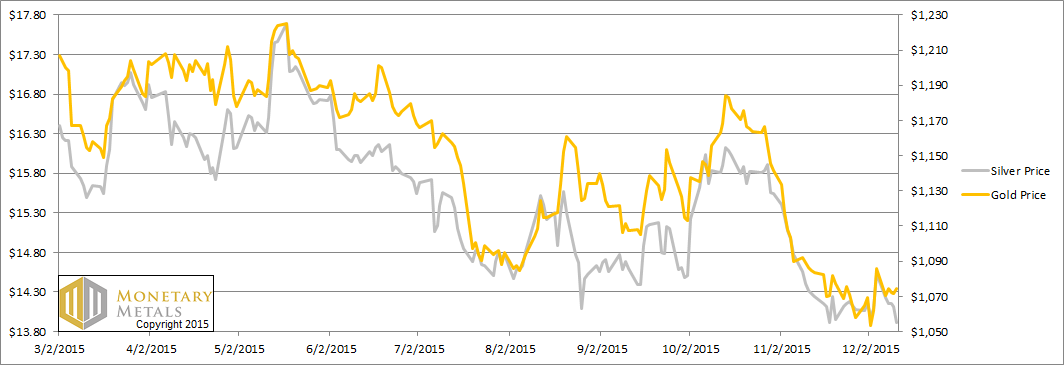

Gold went down (as the muggles would measure it, in dollars). It dropped almost 40 bucks. Silver fell almost 60 cents. Since silver fell proportionally farther than gold, the gold-silver ratio went up.

Read More »

Read More »

Silver Gone Wild Report, 20 Mar, 2016

Early on Monday morning (Arizona time), silver began to rise. From its close on Friday of $15.46, it ran up to $15.82. Then it began to slide, eventually dropping to $15.17 by midmorning on Wednesday. Then…

Read More »

Read More »

Supply and Demand Report, 13 Mar, 2016

On the week, the prices of the metals didn’t move all that much. However, the move around 6am (Arizona time) on Thursday is notable. The price of silver spiked up from around $15.12 to $15.64—3.4%—by around 8am. Twelve hours later, the price touched ...

Read More »

Read More »

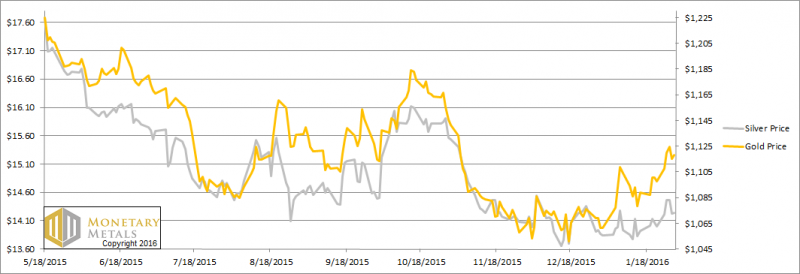

Gold-Silver Ratio Reversal Report, 6 Mar, 2016

So the price of silver rocketed up 80 cents, while the price of gold jumped $37. Silver is now more expensive than it was two weeks ago; the price decline of last week was more than overcompensated. This pushed the gold-silver ratio down about two wh...

Read More »

Read More »

Interest on Gold Is the New Tempest in a Teapot

Zero Hedge published an article on Canadian Bullion Services (CBS) last week. Other sites ran similar articles. The common thread through these articles, and in the user comments section, is that CBS is committing criminal fraud. Or, if not, then it’...

Read More »

Read More »

Gold-Silver Ratio Breakout Report, 28 Feb, 2016

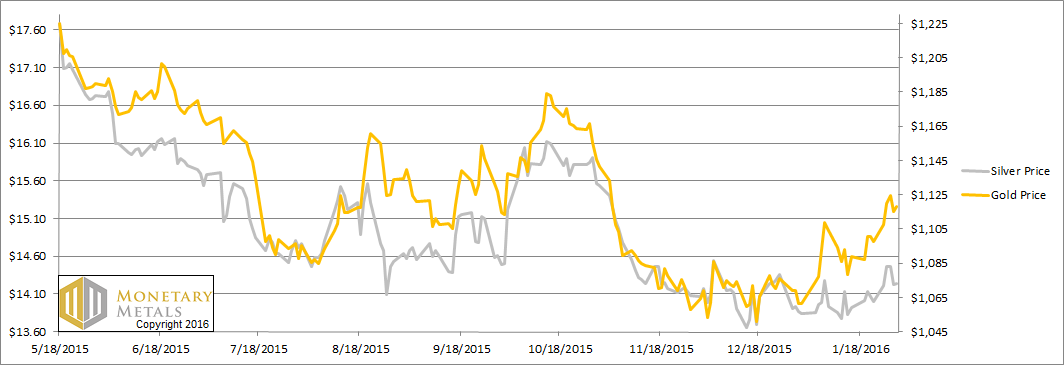

The gold to silver ratio moved up very sharply this week, +4.2%. How did this happen? It was not because of a move in the price of gold, which barely budged this week. It was due entirely to silver being repriced 66 cents lower.

Read More »

Read More »

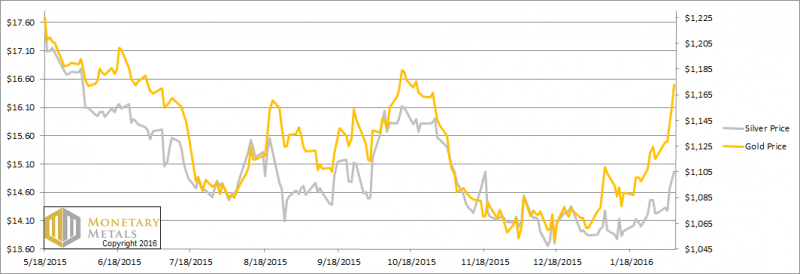

Gold Costs 80oz of Silver, Report 21 Feb, 2016

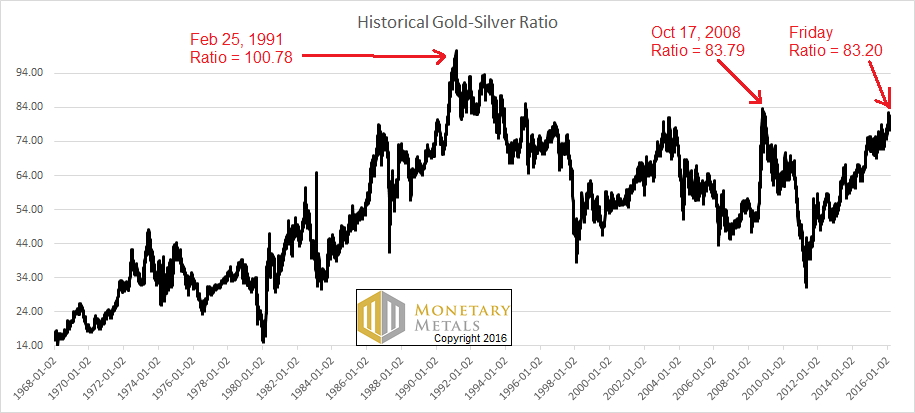

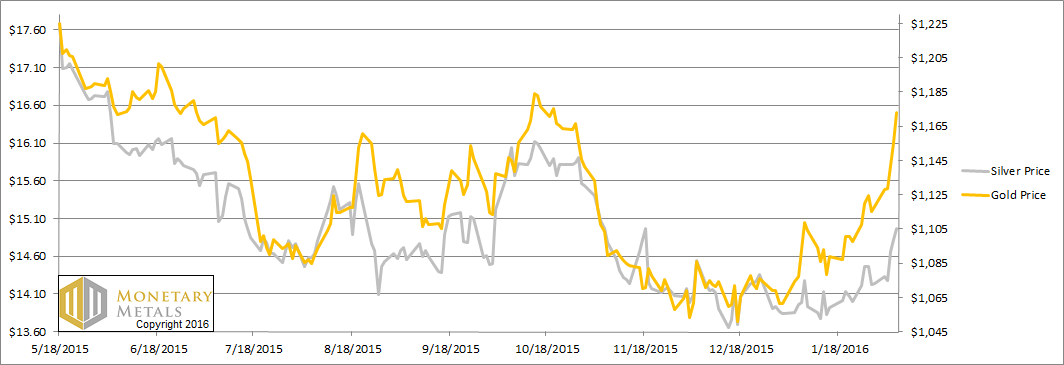

The big news is that the gold-silver ratio closed at 80. This is not only a new high for the move. It’s higher than it has been since 2008. It’s also exactly what Monetary Metals has been calling for. Last week, we said the gold fundamental was $1,45...

Read More »

Read More »

The Silver Blaze Report, 14 Feb, 2016

Again, we had another big drop in the dollar this week. No, we don’t mean against the dollar derivatives known as the euro, pound, etc. We mean by the only standard capable of measuring it: gold. The dollar fell 1.4 milligrams, to 25.1mg gold. Or, if...

Read More »

Read More »

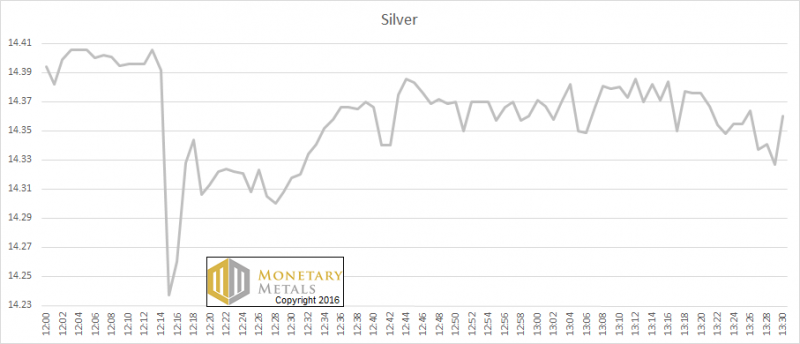

They Broke the Silver Fix (Part I)

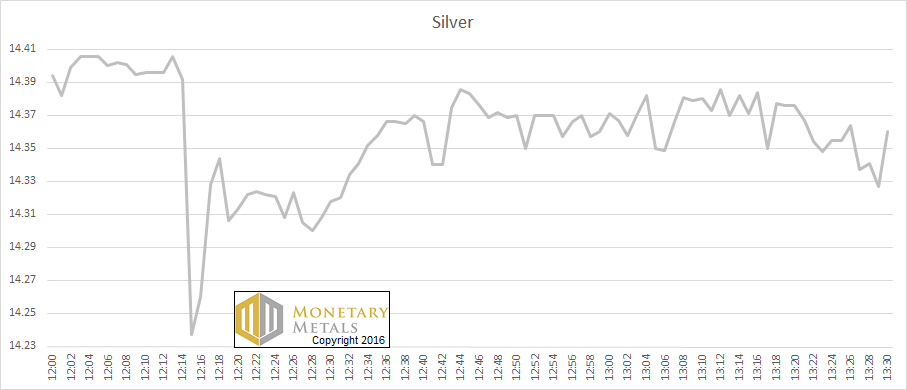

Last Thursday, January 28, there was a flash crash on the price chart for silver. Here is a graph of the price action. The Price of Silver, Jan 28 (All times GMT) If you read more about it, you will see that there was an irregularity around the silve...

Read More »

Read More »

Possible Silver U-Turn Report, 7 Feb

Wow, did the dollar move down this week! It dropped more than it has in quite a while. It fell 1.3mg gold, or 0.1g silver. Gold and silver bugs of course are excited, as they look at it as the prices of the metals going up $55 and 72 cents respective...

Read More »

Read More »

Possible Sign of Silver Turn, Report 31 Jan, 2016

The price of the dollar was down 50mg gold, to 27.8mg, or if you prefer 0.04g silver to 2.18g. Why do we measure the volatile dollar in terms of gold and silver? There’s nothing else to measure it, certainly not the dollar-derivatives called euro, po...

Read More »

Read More »

Monetary Metals Brief 2016

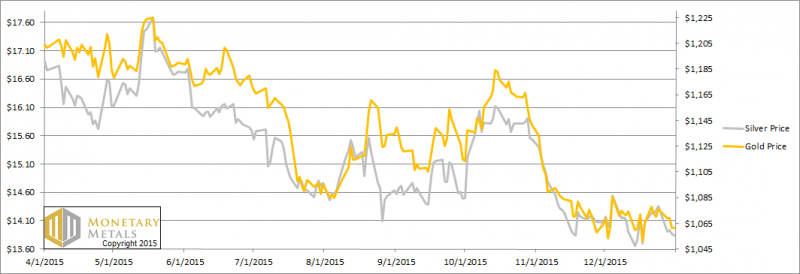

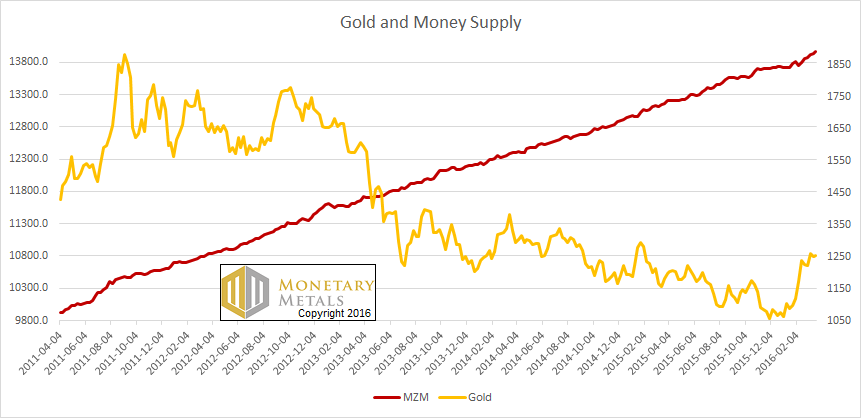

We have consistently been making the contrarian call for a falling silver price and a rising gold to silver ratio for years. This ratio has risen a lot during this time. So are we ready to change our call yet?

Read More »

Read More »

Silver Goes Foom, Report 24 Jan, 2016

This will be a brief report, as we’re focused on releasing our Outlook 2016 Report which is over 8,000 words of our assessment of the gold, silver, currency, and credit markets. Also, this was a holiday-shortened week (Monday was Martin Luther King D...

Read More »

Read More »

Won’t Get Fooled Again, Report 17 Jan, 2016

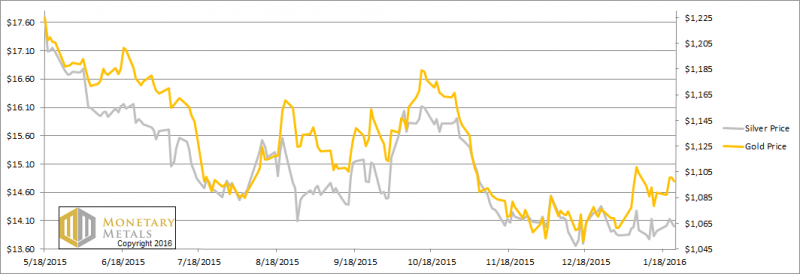

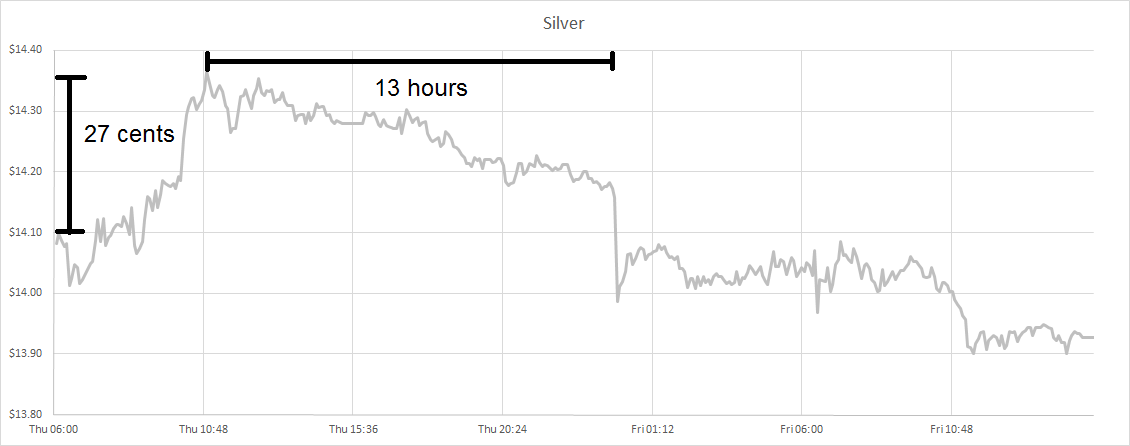

There is a great lyric in Won’t Get Fooled Again by The Who: Then I’ll get on my knees and prayWe don’t get fooled again Remember last week, when the price of silver spiked? On Thursday that week, the price was moving sideways around $14. Then around...

Read More »

Read More »

Silver Flash in the Pan, Report 10 Jan, 2016

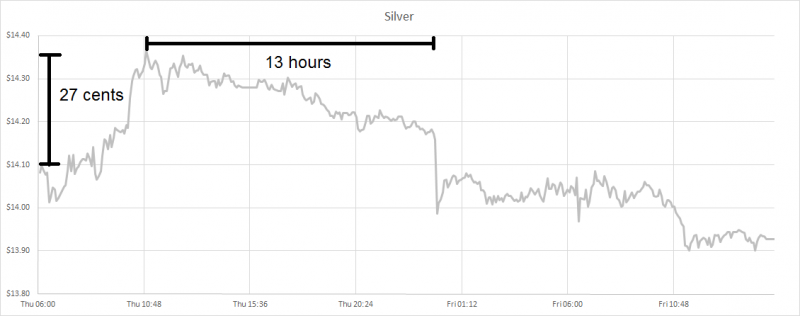

No doubt, many people were excited on Thursday to see a spike in the silver price. The big news almost seemed like it would be a spike in the silver price. We were not quite so exuberant, tweeting (follow us on Twitter @Monetary_Metals):

Read More »

Read More »

Murphy’s Law of Gold Analysis, Report 3 Jan, 2016

Perhaps it may be lesser known than his other Laws, but Murphy wrote one for the basis analysis. It goes like this. If we observe that the fundamental price of a metal is far removed from the market price, the two won’t likely converge the next week....

Read More »

Read More »

Supply and Demand Report 27 Dec, 2015

The prices of the metals rose a bit this quiet, holiday week. Merry Christmas! Speaking of Christmas, Keith’s brother who is an amateur woodworker of growing skill, gave him this present on Friday.

Read More »

Read More »

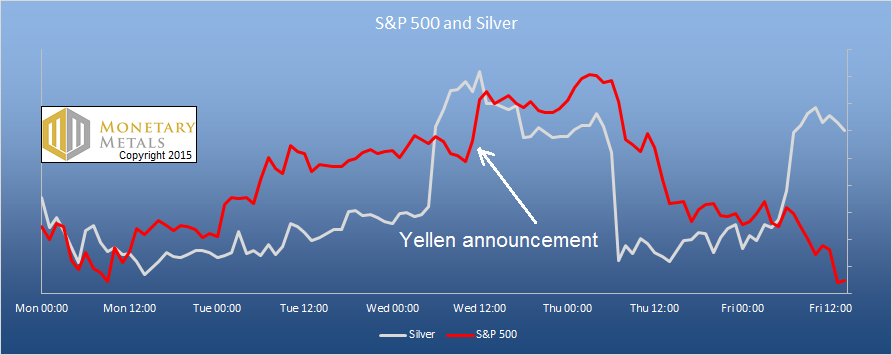

Janet Yellen Lit the Fuse Report 20 Dec, 2015

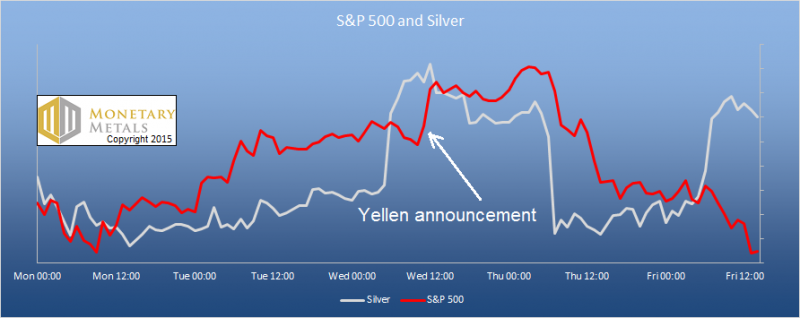

The prices of the metals were sagging. Silver was trading around $13.80. On Wednesday, Janet “Good News” Yellen said the magic words. The Federal Reserve hiked the federal funds rate by 25 basis points. The price of silver was surging in anticipation...

Read More »

Read More »

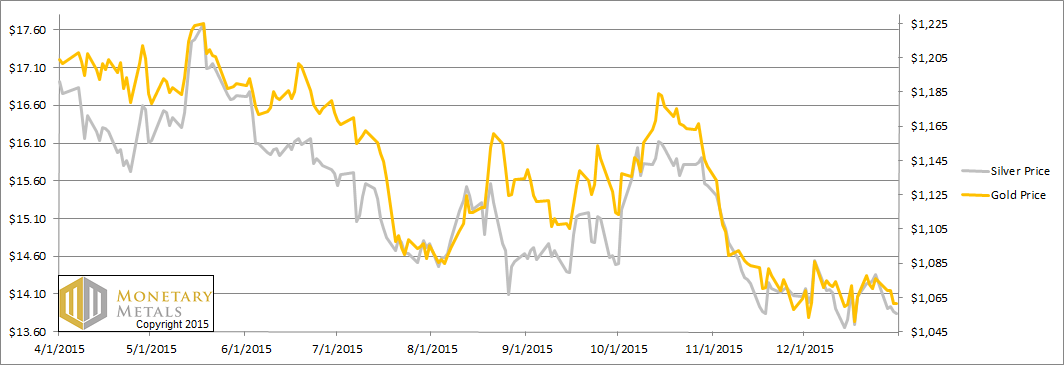

What Silver Rocket? Report 13 Dec, 2015

“That [half a dollar of buying] frenzy was not stackers lining up to buy phyz. It was speculators buying paper. Why does that matter? Speculators, who typically use leverage, can’t hold the market price against the tide of the hoarders. They can push...

Read More »

Read More »