Tag Archive: competitiveness

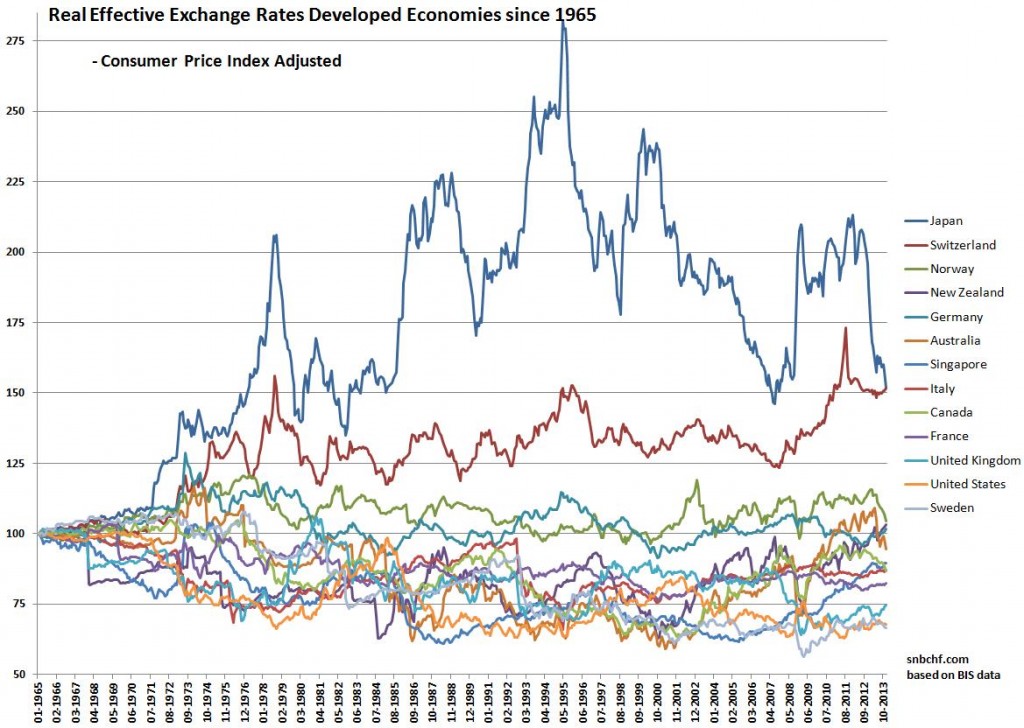

(2.6) CPI-based Real Effective Exchange Rate Since 1965: Yen Still Most Overvalued Currency

If we calculate Real Effective Exchange rates on the base year 1965, the Japanese yen remains the most overvalued currency.

This analysis is based on the real effective exchange rate (REER) provided by the Bank of International Settlement (BIS) and a consumer price-index adjusted exchange rate.

The real value of the yen is around 50% higher than 1965, the same applies to the Swiss franc.

Read More »

Read More »

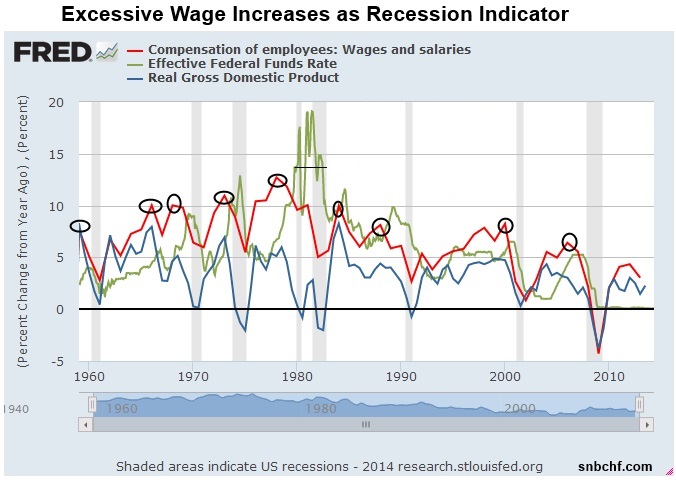

A Little History of Wages, Inflation, Treasuries and the Fed – And What We Learn from it

On this page we show that

Inflation expectations and wages drive the behaviour of the Fed and Treasury bond yields.

Excessive wage increases lead to recessions, more or less voluntarily caused by central bank tightening

Central banks pin down the short end of the yield curve, while financial-market participants price longer-dated yields

Some Emerging Markets seem to copy strong wage increases and inflation that we lived in the 1970s

Quickly...

Read More »

Read More »

ECB Measures Background: How to Reduce German Competitiveness and Talk down the Euro

In our view, the ECB measures of June 2014 want to increase German lending, spending, salaries and inflation. Finally they target a reduction of German competitiveness. The ECB wanted to talk down the euro but will not succeed. We explain why the measure are bullish for the euro. We expect EUR/USD of 1.40 in the … Continue...

Read More »

Read More »

Sinn: The Euro Crisis Is Not Solved

In 2012, austerity, the commitment of ECB and Fed and the weak euro helped to reduce peripheral yields, current account and partially fiscal deficits. The euro zone has possibly won the war. Now the weak countries need to win the peace, namely generate growth via competitiveness says

Read More »

Read More »

Who Says No to Austerity and Global Imbalances, Must Say Yes to the Northern Euro

Eventually the euro will be abolished, a Northern Euro introduced: politicians and their economic advisors might just be waiting for a calm moment, especially with upcoming German inflation.

Read More »

Read More »

About the Impossibilities of the Common-Currency-Recession-Austerity Cycle

Charles Wyplosz, Professor of International Economics, Graduate Institute, Geneva repeats our arguments in "Who says No to Austerity, Says Yes to the Northern Euro" about the impossibility of getting out of the common currency - recession - austerity - cycle. Similar as we do, he proposes a public...

Read More »

Read More »

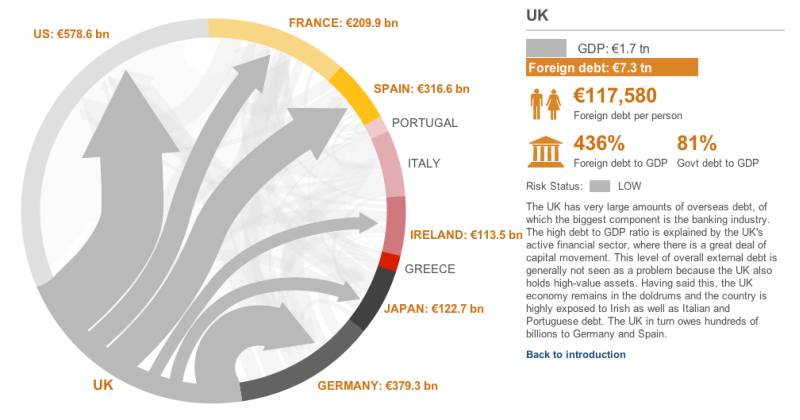

Who is the Biggest Debt Time Bomb: Japan, France, the UK or the United States?

Some must reads: According to the Economist the biggest time bomb in the euro zone crisis is France.

We wonder why the United States and Britain, that have same weak trade balances, the same weak competitiveness and a debt overhang, shouldn't have a problem?

Just because France must do austerity according to the German Fiscal Compact wish, and the US and Britain do not need to do this?

Or like Ray Dalio called it, are the US and Britain...

Read More »

Read More »

Euro Morons: Hyperinflation Successfully Avoided, Stagflation Successfully Created

Keeping Greece in euro zone, eurocrats or better “euro morons” have successfully avoided a weak drachma and a following Greek hyperinflation. Instead they successfully created stagflation. Currently European HICP inflation is at 2.5%, far above the max. 2.0% official ECB mandate, but the euro is becoming weaker and weaker. German salaries are rising with 2.6% …

Read More »

Read More »

Who’s the Next Downgrade Domino to Fall?…The UK?

Who Downgrades France MUST downgrade the UK, too After Moody’s downgraded France, we are waiting the next major sovereign to suffer the same fate. According to the must-read interactive graph on the BBC, France now has a medium risk of default, but the UK is still in risk status “low”. According to the BBC, each citizen …

Read More »

Read More »

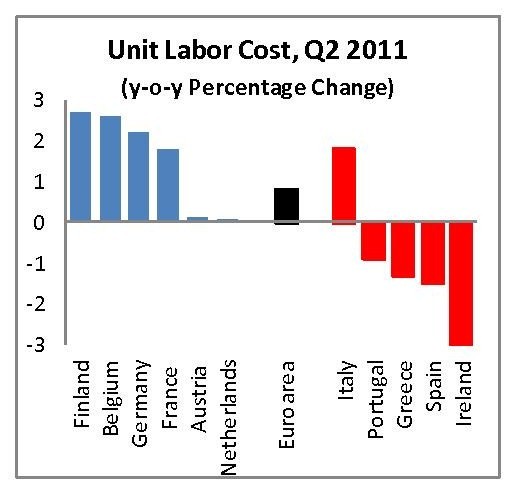

Falling Unit Labour Costs, but Rising Production Prices in the Periphery. Is this Competitiveness?

Currently European HICP inflation is at 2.5%, far above the 2.0% official ECB mandate, but the euro is becoming weaker and weaker. German salaries are rising with 2.6% per year. At the same time, the ECB cannot hike interest rates, because it wants to provide cheap money to the periphery. The periphery continues to buy German products, even …

Read More »

Read More »

All roads lead to a euro zone break-up

For us all roads lead to a euro zone break-up and multiple sovereign defaults. Our reasoning can be summarized as follows: Equities are worthless when associated debt becomes encumbered (risk capital takes the first loss). Equity is not an asset; it is merely the remainder that is left over once debt is subtracted from …

Read More »

Read More »

Guest Post: Six Reasons Why Italy May Exit the Euro Before Spain; Ultimate Occupy Movement

Six Reasons Why Italy May Exit Before Spain

1) Rise of the Five Star Movement

2) 44% of Italians view the euro negatively, only 30% favorably. That is biggest negative spread in the eurozone. In Spain more view the euro positively than negative, albeit by a small 4 percentage point spread.

Read More »

Read More »

The Northern Euro introduction: A retrospective from the year 2030

A retrospective from the year 2030 on two decades of failed european integration policy and 10 years of successful disintegration policy The following essay shows that currency regimes come and go over the time. Nothing is stable with the time, especially the use of a currency. What has never happened in history is the use …

Read More »

Read More »

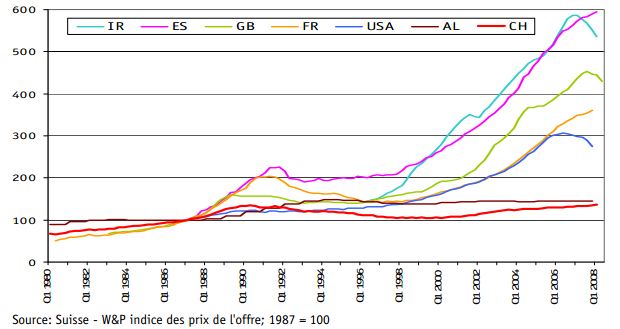

Why the Euro Crisis may last another 15 years

Abstract In the following article we will explain which types of crisis occur in the euro area and will argue that this crisis will last at least another fifteen years. (1) Competitiveness crisis: Before the euro introduction peripheral countries regularly saw their currency depreciate against the German Mark and helped them to increase their competitiveness. …

Read More »

Read More »