Tag Archive: collateral

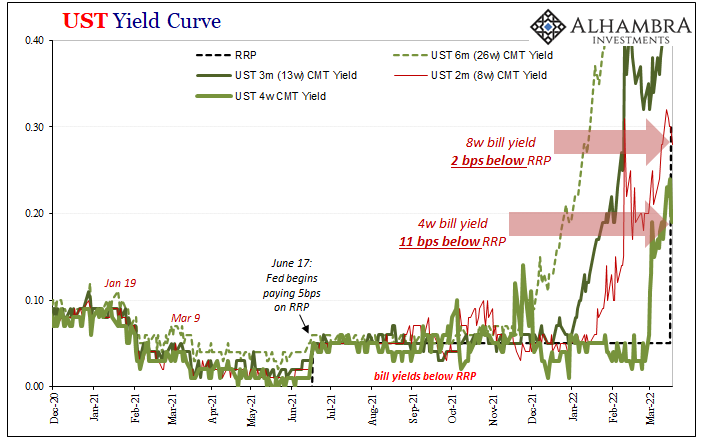

RRP No Collateral Coincidences As Bills Quirk, Too

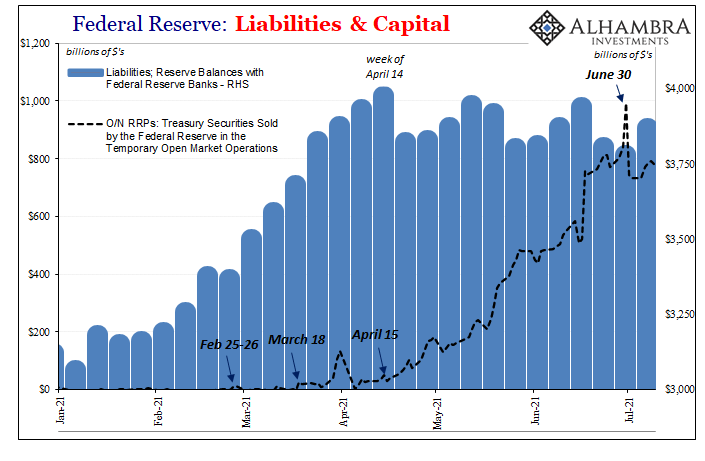

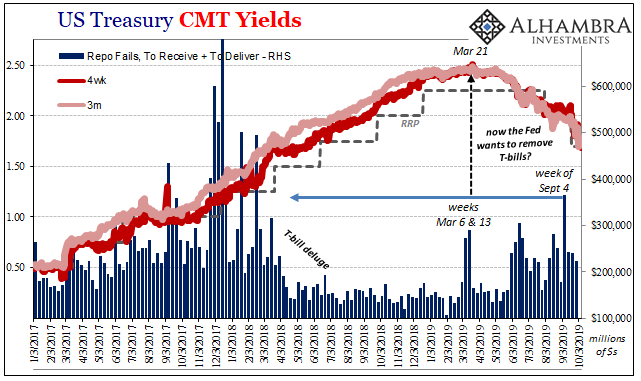

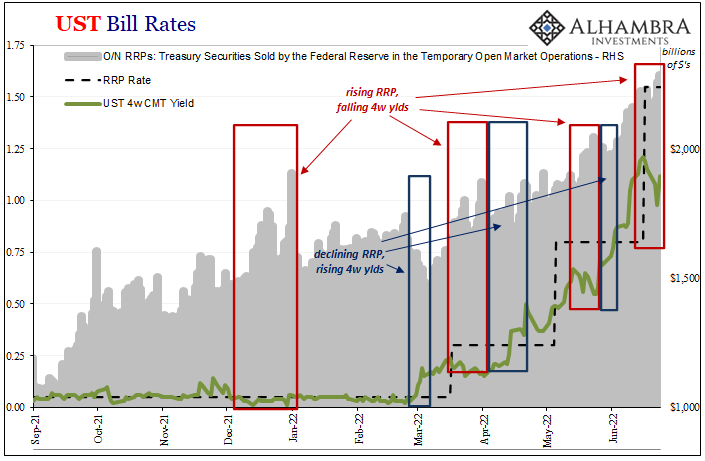

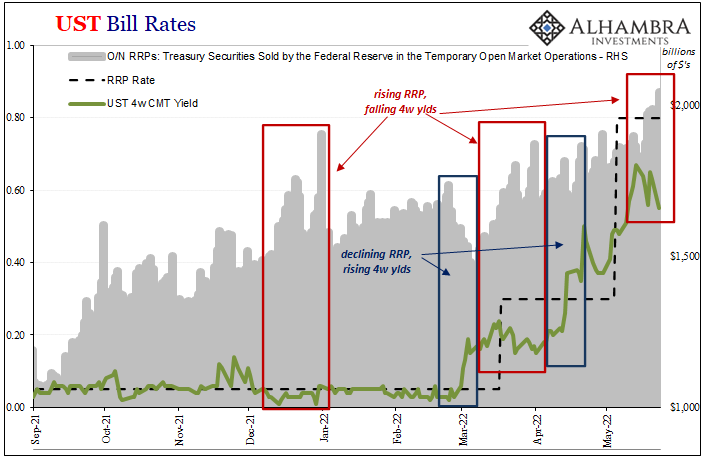

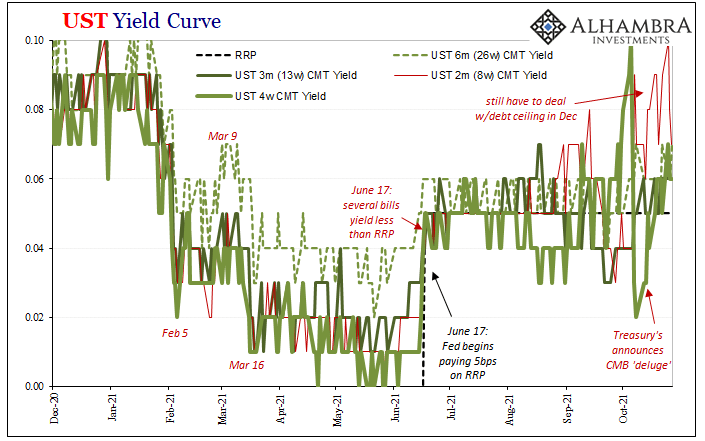

So much going on this week in the bond market, it actually overshadowed the ridiculous noise coming from the Fed’s reverse repo. Some maybe too many want to make a huge deal out of this RRP if only because the numbers associated with it have gotten so big.

Read More »

Read More »

Rechecking On Bill And His Newfound Followers

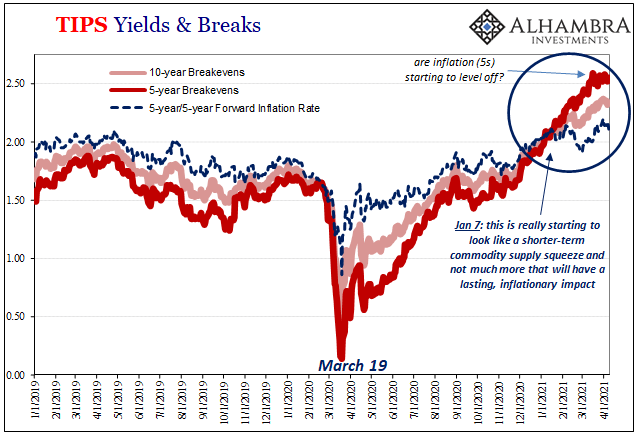

The benchmark 10-year US Treasury has obtained some bids. Not long ago the certain harbinger of bond rout doom, the long end maybe has joined the rest of the world in its global pause if somewhat later than it had begun elsewhere (including, importantly, its own TIPS real yield backyard).

Read More »

Read More »

Deja Vu: Treasury Shorts Meet Treasury Shortages

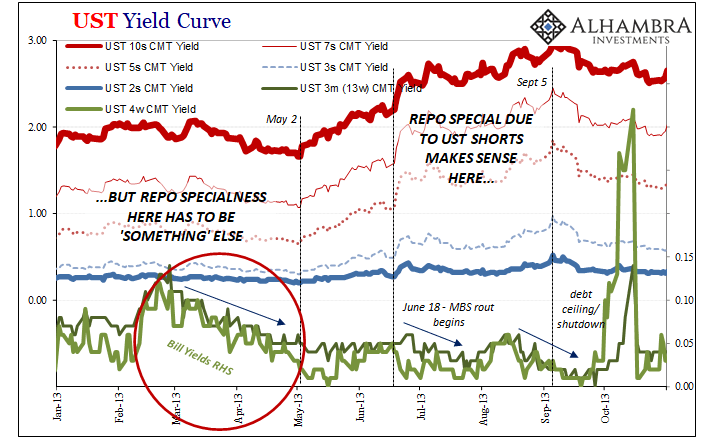

Investors like to short bonds, even Treasuries, as much as they might stocks and their ilk. It should be no surprise that profit-maximizing speculators will seek the best risk-adjusted returns wherever and whenever they might perceive them.

Read More »

Read More »

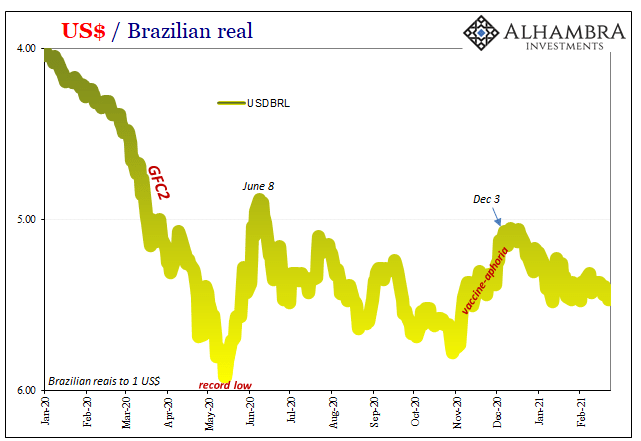

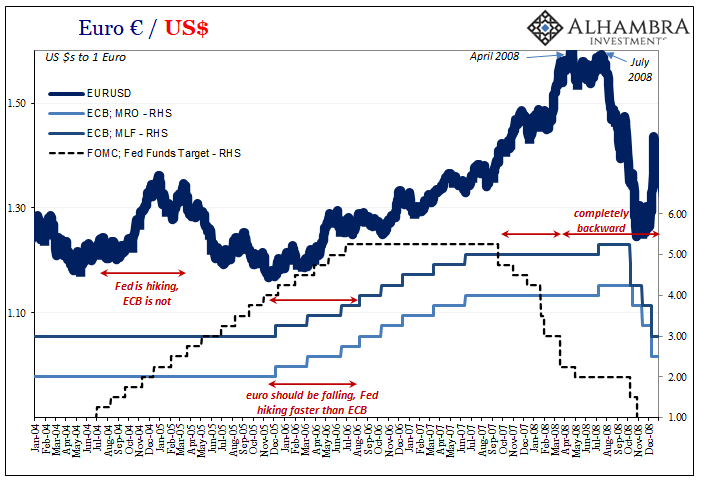

For The Dollar, Not How Much But How Long Therefore How Familiar

Brazil’s stock market was rocked yesterday by politics. The country’s “populist” President, Jair Bolsonaro, said he was going to name an army general who had served with Bolsomito (a nickname given to him by supporters) during that country’s prior military dictatorship as CEO of state-owned oil giant Petróleo Brasileiro SA. Gen. Joaquim Silva e Luna is being installed, allegedly, to facilitate more direct control of the company by the federal...

Read More »

Read More »

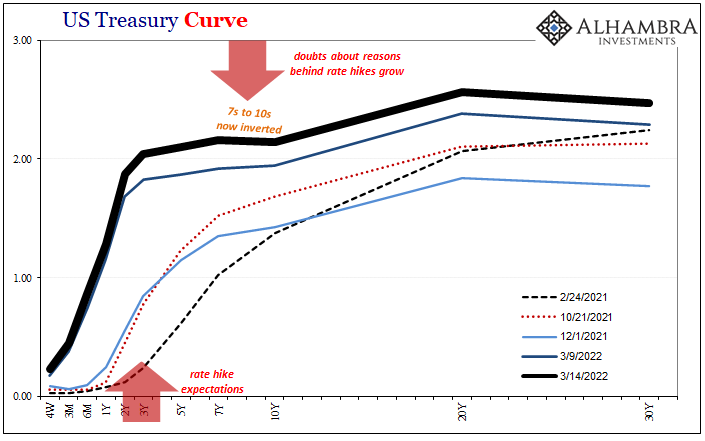

What Might Be In *Another* Market-based Yield Curve Twist?

With the UST yield curve currently undergoing its own market-based twist, it’s worth investigating a couple potential reasons for it. On the one hand, the long end, clear cut reflation: markets are not, as is commonly told right now, pricing 1979 Great Inflation #2, rather how the next few years may not be as bad (deflationary) as once thought a few months ago.

Read More »

Read More »

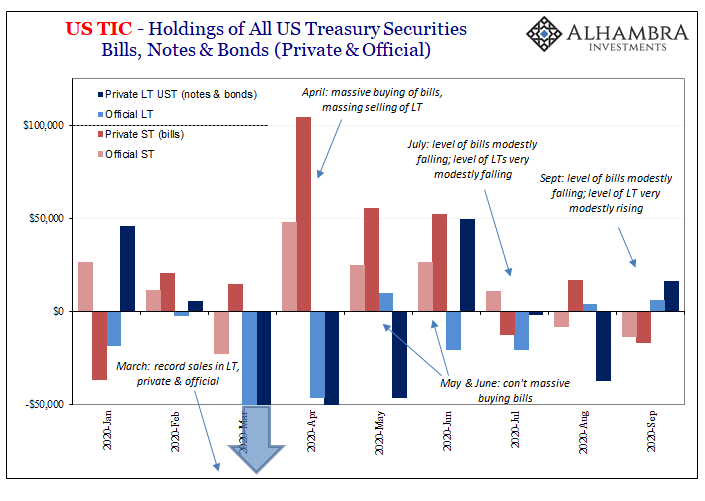

Just Who Is, And Who Is Not, Selling T-Bills

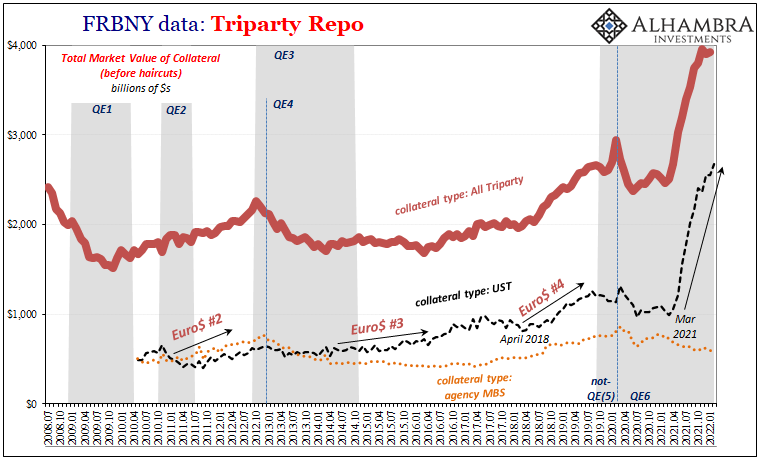

Are foreigners selling Treasury bills? If they are, this would seem to merit consideration for the reflation argument. After all, the paramount monetary deficiency exposed by March’s GFC2 (and the Fed’s blatant role in making it worse) was the dangerous degree of shortage over the best collateral.

Read More »

Read More »

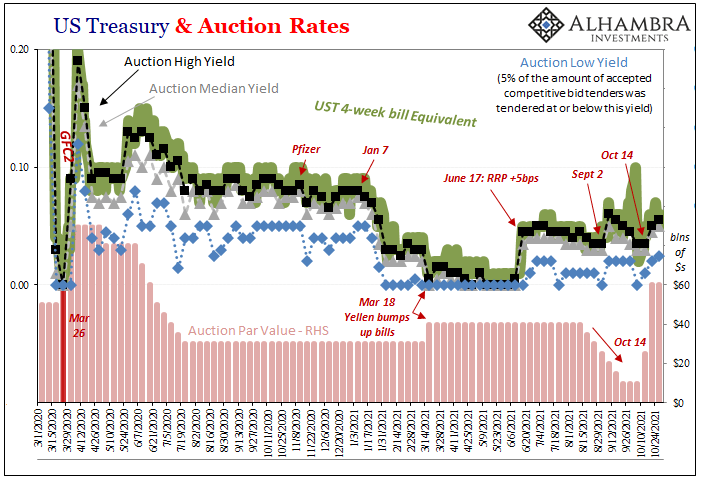

Treasury Auctions Are Anything But Sorry Because They’ve Never Been Sorry About Solly

Twenty years ago, in November 2000, the Treasury Department changed one aspect of the way the government would sell its own debt. Auctions of these and other kinds of securities had been ongoing for decades, back to the twenties, and they had been transformed many times along the way. In the middle of the 1970’s Great Inflation, for example, Treasury gradually phased out all other means for issuing securities, by 1977 relying exclusively on...

Read More »

Read More »

Not This Again: Too Many Treasuries?

Tomorrow, the Treasury Department is going to announce the results of its latest bond auction. A truly massive one, $47 billion are being offered of CAH4’s notes dated August 31, 2020, maturing out in August 31, 2027. In other words, the belly of the belly, the 7s.We’ve already seen them drop for two note auctions this week, both equally sizable.

Read More »

Read More »

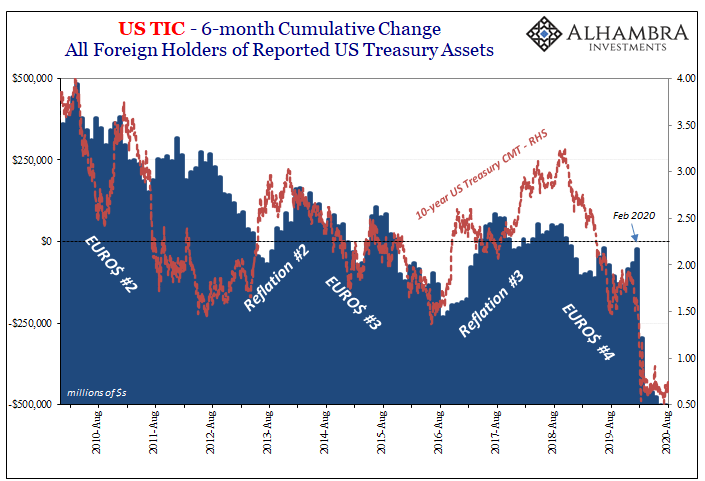

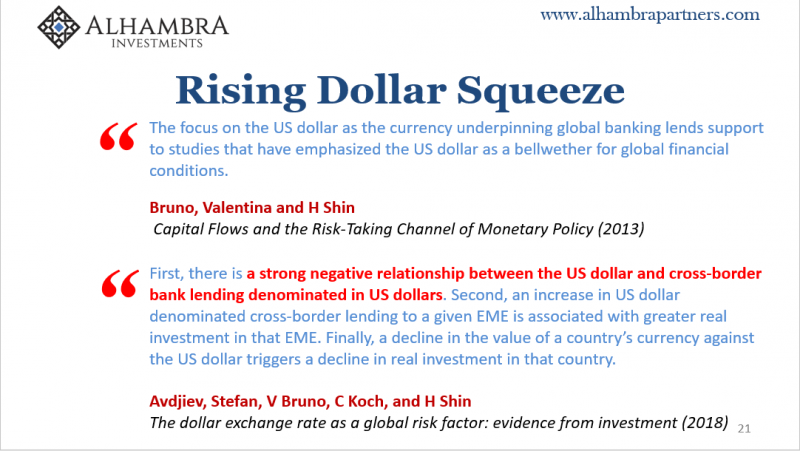

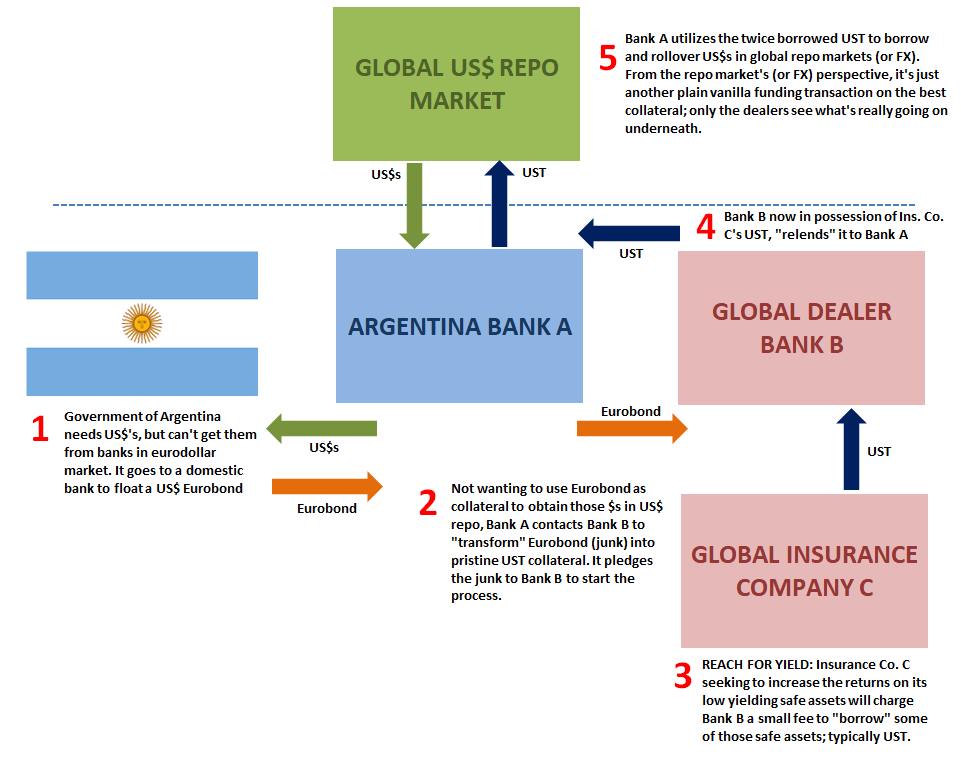

Part 2 of June TIC: The Dollar Why

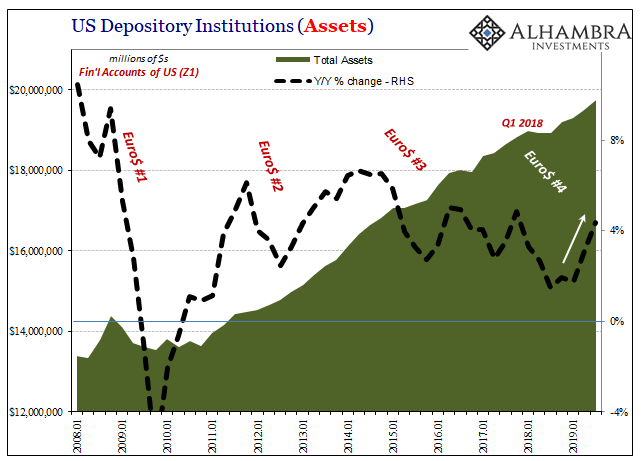

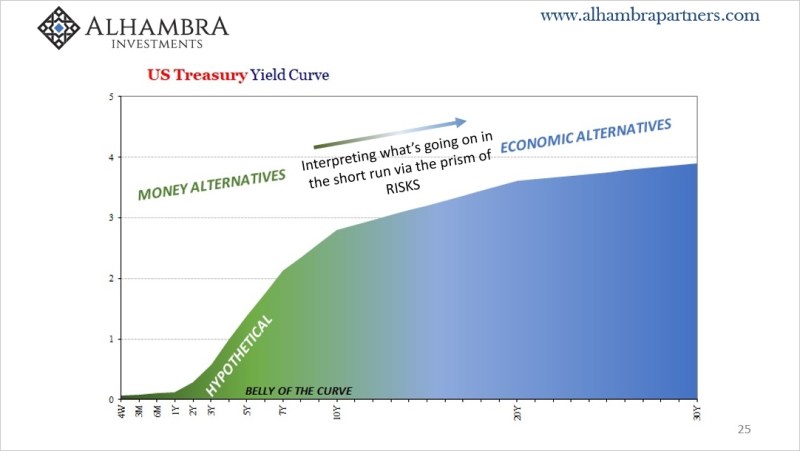

Before getting into the why of the dollar’s stubbornly high exchange value in the face of so much “money printing”, we need to first go back and undertake a decent enough review of the guts maybe even the central focus of the global (euro)dollar system.

Read More »

Read More »

The Global Engine Is Still Leaking

An internal combustion engine that is leaking oil presents a difficult dilemma. In most cases, the leak itself is obscured if not completely hidden. You can only tell that there’s a problem because of secondary signs and observations.If you find dark stains underneath your car, for example, or if your engine smells of thick, bitter unpleasantness, you’d be wise to consider the possibility.

Read More »

Read More »

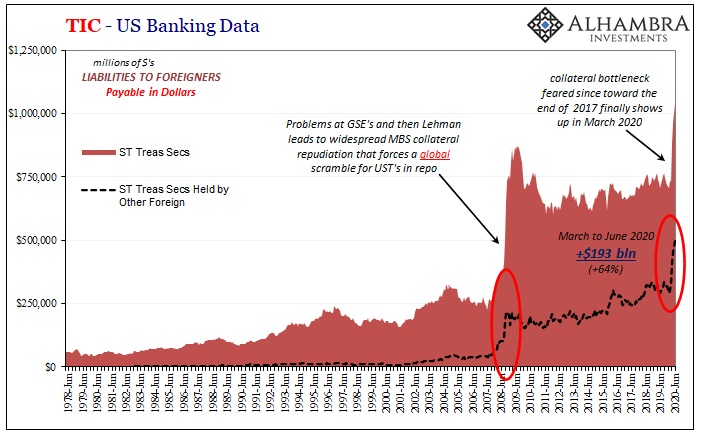

Banks Or (euro)Dollars? That Is The (only) Question

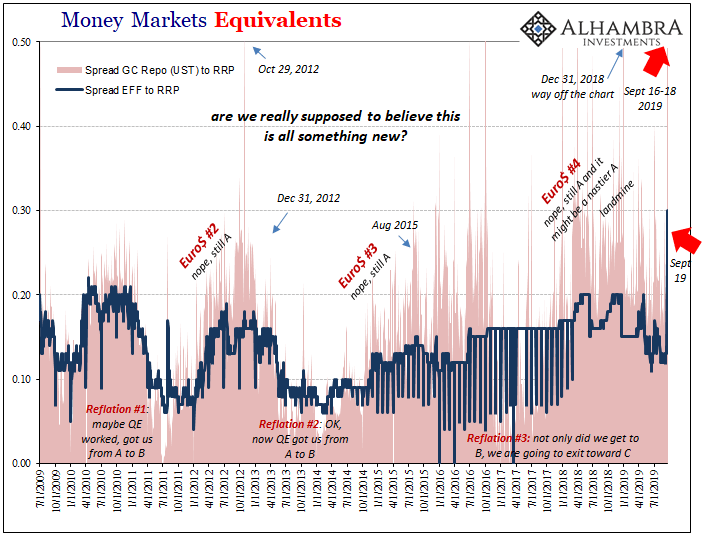

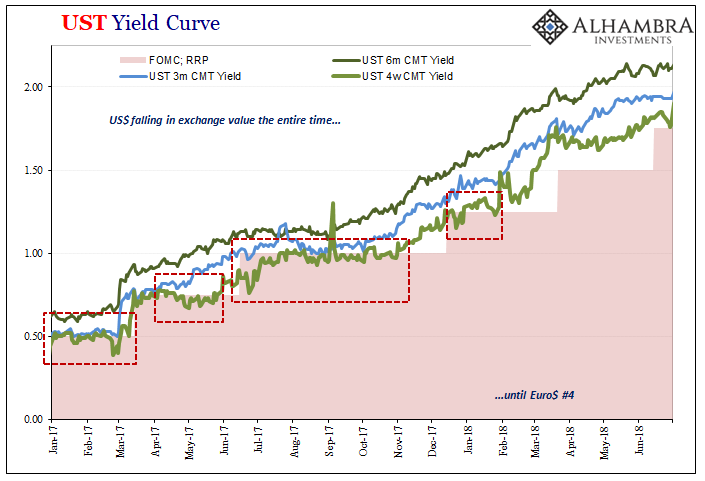

It used to be that at each quarter’s end the repo rate would rise often quite far. You may recall the end of 2018, following a wave of global liquidations and curve collapsing when the GC rate (UST) skyrocketed to 5.149%, nearly 300 bps above the RRP “floor.” Chalked up to nothing more than 2a7 or “too many” Treasuries, it was to be ignored as the Fed at that point was still forecasting inflation and rate hikes.

Read More »

Read More »

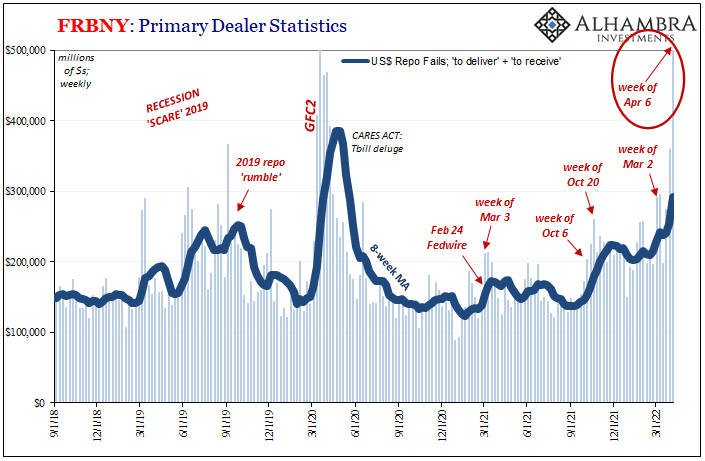

No Further Comment Necessary At This Point

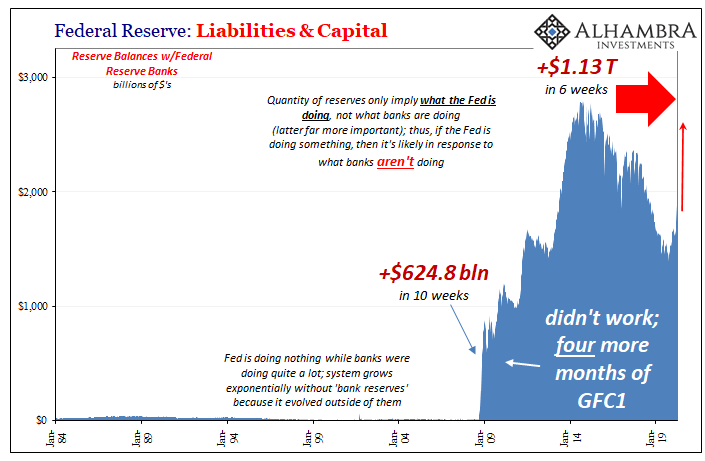

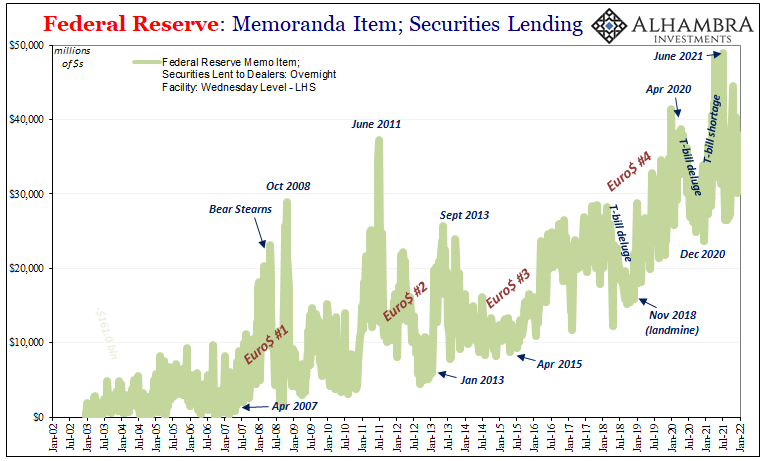

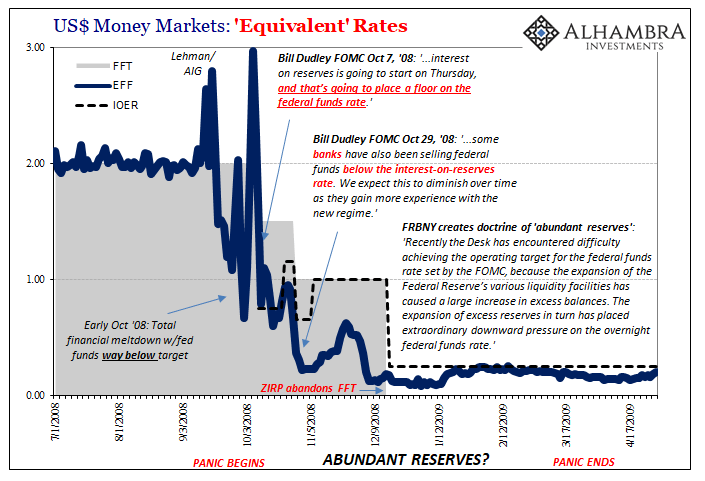

I would write something snarky about bank reserves, but why bother at this point? It’s already been said. If Jay Powell doesn’t mention collateral, no one else does even though it’s the whole ballgame right now. Note: FRBNY’s updated figures shown below are for last week.

Read More »

Read More »

Is GFC2 Over?

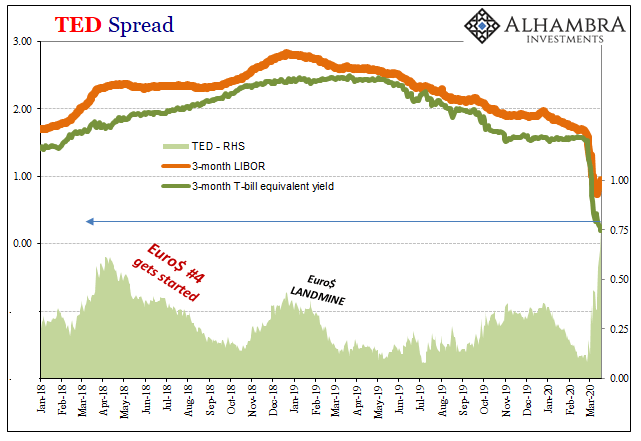

Is it over? That’s the question everyone is asking about both major crises, the answer is more obvious for only the one. As it pertains to the pandemic, no, it is not. Still the early stages. The other crisis, the global dollar run? Not looking like it, either.

Read More »

Read More »

Low Rates As Chaos, Not ‘Stimulus’

Basic recession economics says that when you end up with too much of some commodity, too much inventory that you can’t otherwise sell, you have to cut the price in order to move it. Discounting is a feature of those times. What about a monetary panic? This might sound weird, but same thing.

Read More »

Read More »

Everything Comes Down To Which Way The Dollar Is Leaning

Is the global economy on the mend as everyone at least here in America is now assuming? For anyone else to attempt to answer that question, they might first have to figure out what went wrong in the first place. Most have simply assumed, and continue to assume, it has been fallout from the “trade wars.”

Read More »

Read More »

A Repo Deluge…of Necessary Data

Just in time for more discussions about repo, the Federal Reserve delivers. Not in terms of the repo market, mind you, despite what you hear bandied about in the financial media the Fed doesn’t actually go there. Its repo operations are more RINO’s – repo in name only. No, what the US central bank actually contributes is more helpful data.

Read More »

Read More »

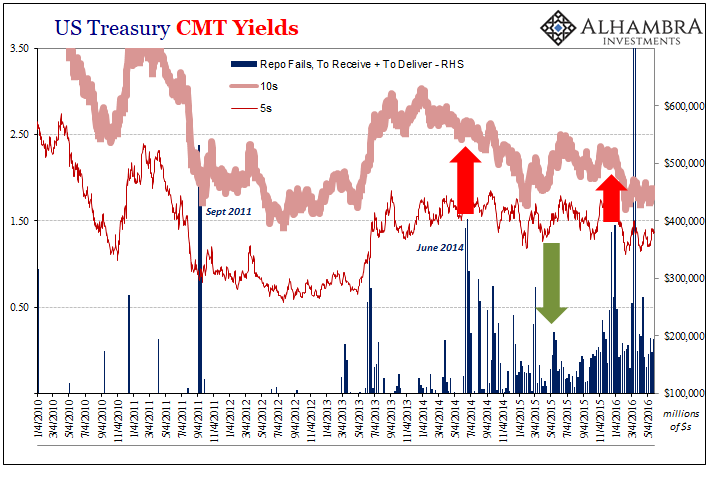

Fails Swarms Are Just One Part

There it was sticking out like a sore thumb right in the middle of what should have been the glory year. Everything seemed to be going just right for once, success so close you could almost feel it. Well, “they” could. The year was 2014 and the unemployment rate in the US was tumbling, the result of the “best jobs market in decades.” Real GDP in that year’s two middle quarters was pretty near 5% in both.

Read More »

Read More »

Never Attribute To Malice What Is Easily Explained By Those Attributing Anything To Term Premiums

There will be more opportunities ahead to talk about the not-QE, non-LSAP which as of today still doesn’t have a catchy title. In other words, don’t call it a QE because a QE is an LSAP not an SSAP. The former is a large scale asset purchase plan intended on stimulating the financial system therefore economy. That’s what it intends to do, leaving the issue of what it actually does an open question.

Read More »

Read More »

What’s The Verdict On This Week?

Jay Powell’s disastrous week is coming to a close, not yet his long nightmare. He has been battling fed funds (meaning repo) for his entire tenure dating back to February 2018. This week wasn’t the conclusion to the contest, just the latest and biggest round of it.

Read More »

Read More »

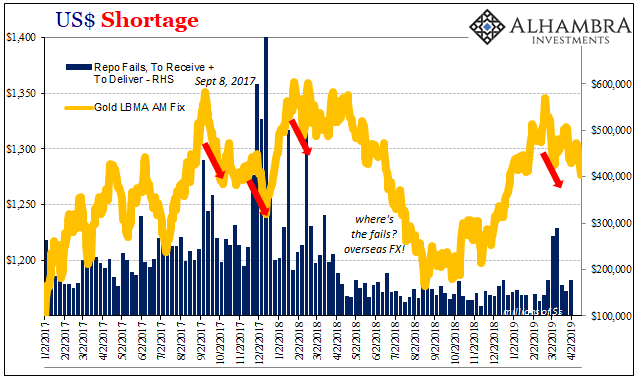

COT Blue: Distinct Lack of Green But A Lot That’s Gold

Gold, in my worldview, can be a “heads I win, tails you lose” proposition. If it goes up, that’s fear. Nothing good. If it goes down, that’s collateral. In many ways, worse. Either way, it is only bad, right? Not always. There are times when rising gold signals inflation, more properly reflation perceptions. Determining which is which is the real challenge.

Read More »

Read More »