Tag Archive: China

China: Services Companies Benefit on Lower Tax with VAT introduction

Yesterday, China announced one of the most important tax reforms of the past twenty years. It is replacing a business tax on gross revenue for non-manufacturing companies with a VAT. Manufacturing companies have been subject to a VAT approach subject

Read More »

Read More »

Negative Rates: Jim Bianco Warns “The Risk Of An ‘Accident’ Is Very High”

In an interesting interview with Finanz und Wirtschaft, Bianco Research president Jim Bianco discusses a variety of topics such as negative interest rates turning the entire credit process upside down, bank balance sheets being even more complex and ...

Read More »

Read More »

With Tech Tanking, Can Anything Save The System?

Submitted by John Rubino via DollarCollapse.com,

First it was the banks reporting horrendous numbers — largely, we were told, because of their exposure to recently-cratered energy companies. Now it’s Big Tech, which is a much harder thing t...

Read More »

Read More »

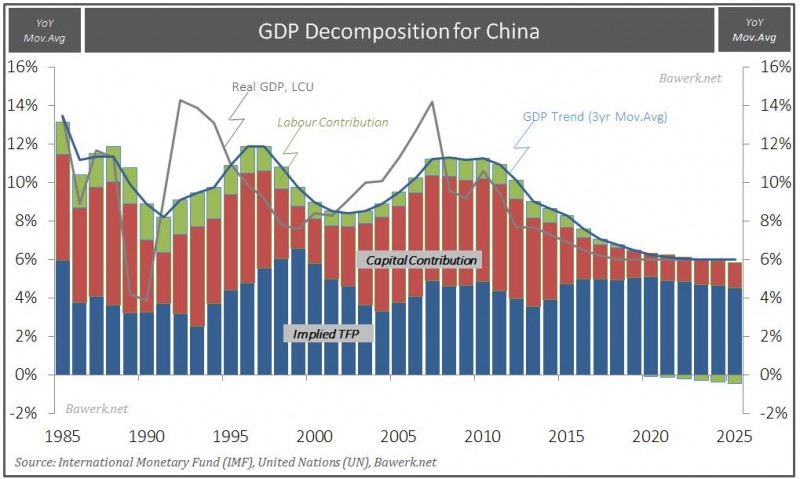

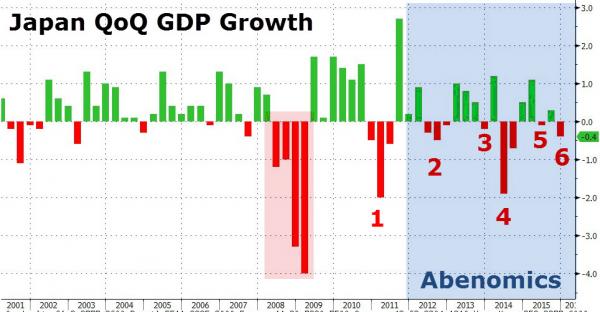

Chinese Dragon: Breathing Credit Fumes

Economic forecasting, no matter how complex the underlying model may be, is essentially about extrapolating historical trends. We showed last week how economic models completely fail to pick up on structural shifts using Japan as an example. On the other hand, if an economy doesn’t really change much, as in the case of Australia over the last thirty years, model “forecast” are generally quite accurate.

Read More »

Read More »

The Shocking Reason For FATCA… And What Comes Next

Submitted by Nick Giambruno via InterntionalMan.com,

If you’ve never heard of the Foreign Account Tax Compliance Act (FATCA), you’re not alone.

Few people have, and even fewer fully grasp the terrible things it foreshadows.

FATCA is a U.S. ...

Read More »

Read More »

Making Sense of China’s Gold Fix and Hungary’s Dim Sum Offering

Earlier today, China launched its first gold fix. It will offer a fixing twice a day going forward yuan. The Shanghai Gold Exchange established the fix the same way it is done in London and New York, by prices submitted by financial institutions. In China’s case, 18 institutions, including two foreign banks, participate in the …

Read More »

Read More »

Panama Papers Names Revealed: Multiple Connections to Clinton Foundation, Marc Rich

There has been much confusion, at time quite angry, how in the aftermath of the Soros-funded Panama Papers revelations few, if any, prominent U.S. name emerged as a result of the biggest offshore tax leak in history. Now, thanks to McClatchy more U.S...

Read More »

Read More »

What Happens Next (In Europe)?

A year ago today, European equities hit their highest levels ever. But, as Bloomberg reports, the euphoria about Mario Draghi’s stimulus program didn’t last, and trader skepticism is now rampant. The Stoxx Europe 600 Index has lost 17% sinc...

Read More »

Read More »

SDR Does Not Stand for Secret Dollar Replacement

At the IMF/World Bank meetings this week, Chinese officials are again pushing for greater use of the IMF's unit of account, Special Drawing Rights. It is China's turn as the rotating host of the G20, which gives it greater influence over its ag...

Read More »

Read More »

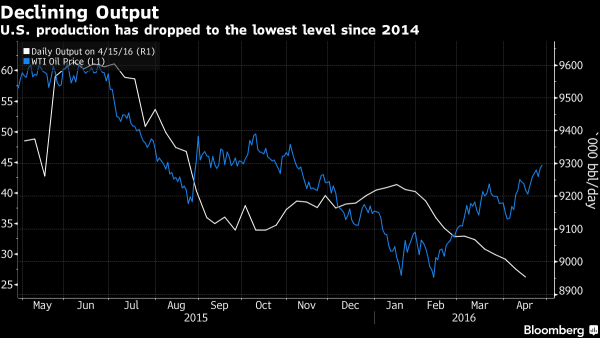

FX Daily, 04/15: Better Chinese Data Fails to Deter Pre-Weekend Profit-Taking

China’s slew of economic data lends credence to ideas that the world’s second-largest economy may be stabilizing. However, the data failed to have a wider impact on the global capital markets, including supporting Chinese equities. In fact, the seven-day advance in the MSCI Asia-Pacific Index was snapped with a fractional loss today. European shares are …

Read More »

Read More »

Inside The Most Important Building For U.S. Capital Markets, Where Trillions Trade Each Day

Ask people which is the most important structure that keeps the US capital markets humming day after day, and most will likely erroneously say the New York Stock Exchange, which however over the past decade has transformed from its historic role into...

Read More »

Read More »

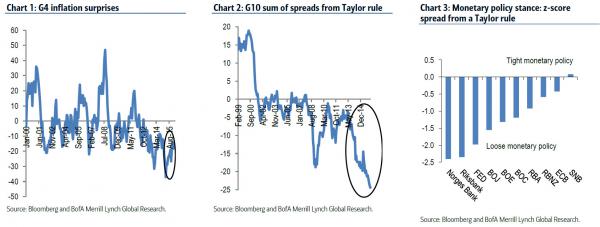

Bank Of America Reveals “The Next Big Trade”

Markets have stopped focusing on what central banks are doing and are "positioning for what they believe central banks may or may not do," according to BofA's Athanasios Vamvakidis as he tells FX traders to "prepare to fight the central banks," as th...

Read More »

Read More »

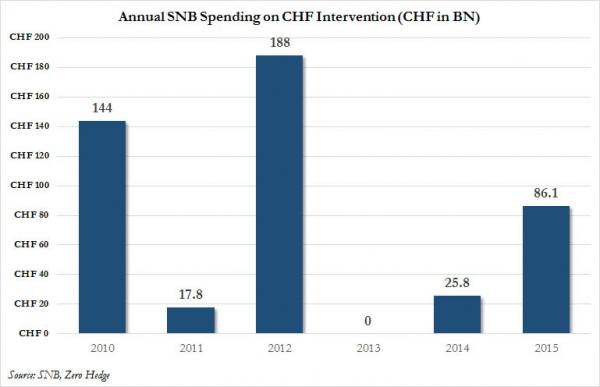

Swiss National Bank Admits It Spent $470 Billion On Currency Manipulation Since 2010

By now it is common knowledge that when it comes to massive, taxpayer-backed hedge funds, few are quite as big as the Swiss National Bank, whose roughly $100 billion in equity holdings have been extensively profiled on these pages, including its woef...

Read More »

Read More »

Thoughts on the Chinese Export Puzzle

Investors are skeptical of Chinese economic data. However, news yesterday that Chinese exports fell by a quarter in February was shocking. Many worry about the implications not just for China, but for world growth. It comes as the IMF is signaling it will likely cut its 3.4% global growth forecast next month. There are three … Continue...

Read More »

Read More »

Global Stocks Soar On Stimulus Hopes After Miserable Chinese, Japanese Data; Short Squeeze

Bad news is once again good news... for stocks that is.

After a month and a half of markets unable to decide if they should buy or sell on ugly data, over the weekend, People’s Bank of China Governor Zhou Xiaochuan expressed faith in the economy, ...

Read More »

Read More »

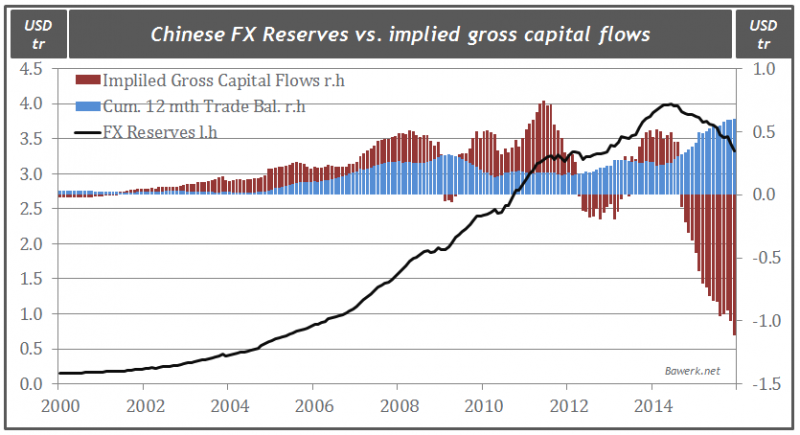

The Chinese Yuan Countdown Is On

Submitted by SaxoBank's Dembik Christopher via TradingFloor.com,

Currency stability is a prerequisite for China's economic transition

Defending the yuan is prohibitively expensive – China cannot beat the market

Progressive devaluation managed by PBoC...

Read More »

Read More »

China’s 3 trillion dollar mistake

When looking at the current state of the Chinese economy it is important to note what happened leading up the ongoing predicament. By managing the USD/CNY exchange rate the Chinese factory worker was essentially funding excess consumption in the Unit...

Read More »

Read More »

BoJ Adopts Negative Interest Rates, Fails To Increase QE

Well that did not last long. After initial exuberance over The BoJ's wishy-washy decision to adopt a 3-tiered rate policy including NIRP, markets have realized that without further asset purchases (which were maintained at the current pace), there is...

Read More »

Read More »