Tag Archive: China

Commodities And The Future Of China’s Stall

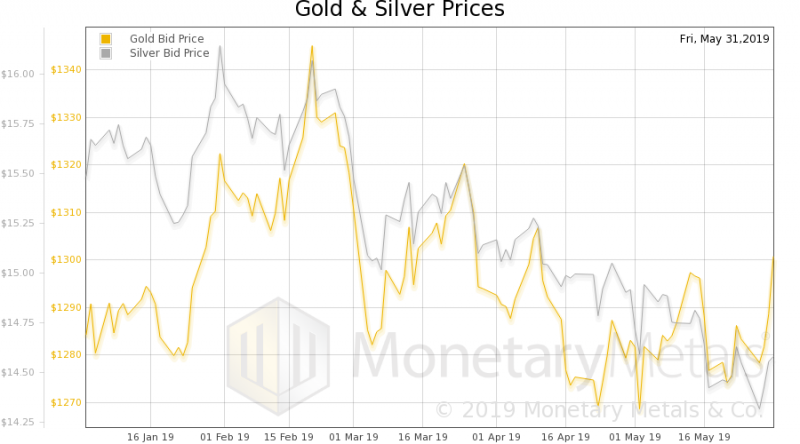

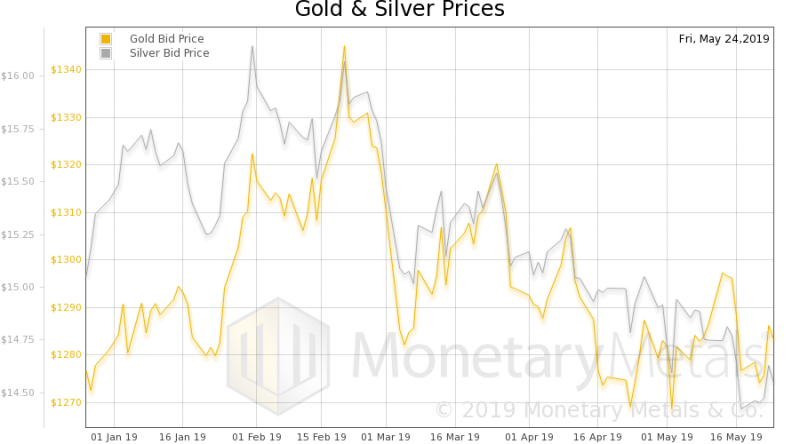

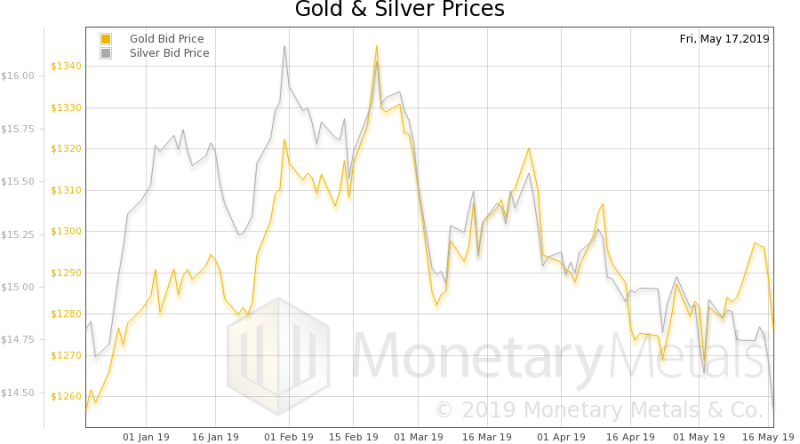

Commodity prices continued to fall last month. According to the World Bank’s Pink Sheet catalog, non-energy commodity prices accelerated to the downside. Falling 9.4% on average in May 2019 when compared to average prices in May 2018, it was the largest decline since the depths of Euro$ #3 in February 2016.

Read More »

Read More »

FX Daily, June 12: Anxiety Ticks Up, Risks Pared

Overview: The S&P 500 snapped a five-day advance yesterday and set the heavier tone for equities today. Continued protests in Hong Kong were not shrugged off as they have been in the last couple of sessions. The Hang Seng's nearly 1.9% decline was the largest in a month and led the region lower.

Read More »

Read More »

FX Daily, June 05: Dollar Remains on Back Foot

Overview: The Federal Reserve's patience never excluded a rate cut should conditions warrant. The acknowledgment of this without signaling a change its stance is being seized upon to justify aggressive pricing of rates. At the same time, there has some tempering of trade anxiety on the margin that is also constructive. Asia and European equities were pulled higher after the strongest rally in several months in the US.

Read More »

Read More »

FX Weekly Preview: The Evolution of Three Issues are Key in the Week Ahead

As May winds down, the light economic calendar will allow investors to take their cues from the evolution of three disruptive forces--trade, Brexit and the US economy. With actions against Huawei and possibly a handful of Chinese surveillance equipment producers, the US raised the stakes. The retaliatory tariffs are effective on June 1, but Beijing has not formally responded to the moves against Chinese companies.

Read More »

Read More »

FX Daily, May 22: Sterling Can’t Get Out of Its Own Way

Overview: There is a nervous calm in the capital markets. Yesterday's rally in US shares failed to excite global investors. China, Hong Kong, and Taiwan markets fell, while Japan was mixed. Foreign investors continued to sell Korean shares, but the Kospi rose. European shares narrowly mixed, leaving the Dow Jones Stoxx 600 little changed.

Read More »

Read More »

Rare Earths may Provide Leverage

Many American observers argue that the trade imbalance gives the US an advantage in a trade war with China. The US enjoys escalation dominance in tariffs because Chinese imports of US goods are so much less than the US imports of Chinese goods. However, the focus on quantities may be misleading.

Read More »

Read More »

FX Daily, May 21: Equities Find Some Traction while the Dollar Firms

Overview: Equities are paring some of their recent losses. The MSCI Asia Pacific Index is posting its first back-to-back gain in a month, led by a more than 1% rally in China. Heightened prospects for an Australian rate cut in a few weeks helped extend the run in the local equity market to a new record high. European bourses are higher, with the Dow Jones Stoxx 600 rising around 0.3% in the morning session.

Read More »

Read More »

FX Weekly Preview: The Week Ahead featuring the Battle for 7.0

The strategic objective is to integrate China into the world economy. The liberal international solution was trade, investment flows, and cultural exchanges. The rise of nationalism and China's own willingness to flaunt the international rules are defeating the strategy.

Read More »

Read More »

FX Weekly Preview: Trade, the Dollar, and the Week Ahead

China is isolated on trade. No one supports its trade practices. The idea that China was going to "naturally" evolve to be more like the US, or Europe for that matter, was always fanciful and naive. The emergence of China, as Napoleon warned two centuries ago, would make the world shake.

Read More »

Read More »

Trade Wars Have Arrived, But It’s Trade Winter That Hurts

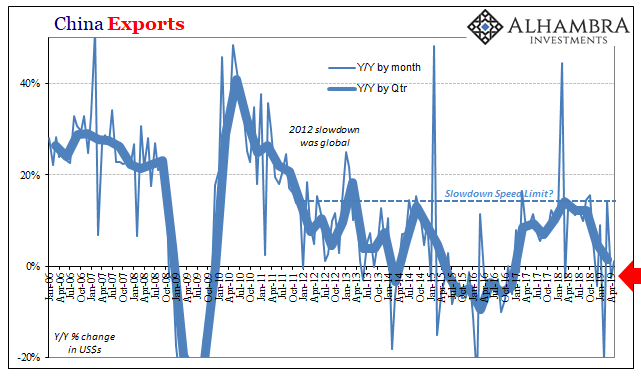

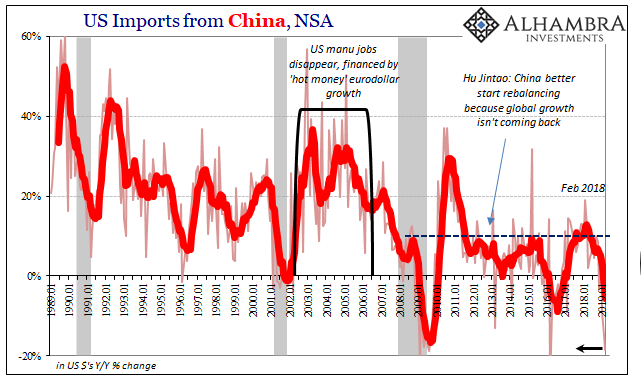

There is truth to the trade war. That’s a big problem because it’s not the only problem. It isn’t even the main one. Given that, it’s easy to look at tariffs and see all our current ills in them. The Census Bureau reports today that the trade wars have definitely arrived. In March 2019, US imports from China plummeted by nearly 19% year-over-year.

Read More »

Read More »

China’s Export Story Is Everyone’s Economic Base Case

The first time the global economy was all set to boom, officials were at least more cautious. Chastened by years of setbacks and false dawns, in early 2014 they were encouraged nonetheless. The US was on the precipice of a boom (the first time), it was said, and though Europe was struggling it was positive with a more aggressive ECB emerging.

Read More »

Read More »

FX Daily, May 09: De-Risking as US-China Trade Talks Resume

The end of the tariff truce between the US and China continues to dominate investment considerations. The truce was often cited in narratives explaining the recovery of equities from the Q4 18 slide. Ahead of the midnight US tariff hike, global equities are being smashed. Korea's Kospi was off 3%, and Hong Kong's Hang Seng was shed 2.4%. Shanghai lost 1.5%.

Read More »

Read More »

FX Daily, May 06: Trump’s Tariff Tweets Help Investors Discover Volatility

Reports that a US-China deal could be struck by May 10 before the weekend left investors ill-prepared for the presidential tweets yesterday that announced that the US was ending the tariff truce. Trump indicated that the 10% tariff on $200 bln of Chinese goods would be lifted to 25% at the end of the week and that the remaining $325 bln of Chinese goods that have not been subject to an extra levy, will be slapped with a 25% tariff soon.

Read More »

Read More »

FX Daily, May 01: No Help on May Day, which is also Fed Day

The May Day holiday has shut most markets in Asia and Europe, making for subdued market action. Equity markets that are open, like Australia and the UK, advanced and US shares are trading higher helped by Apple's upbeat forecasts and sales that beat expectations.

Read More »

Read More »

FX Weekly Preview: Six Events to Watch

The divergence thesis that drives our constructive outlook for the dollar received more support last week than we expected. A few hours after investors learned that Japan's flash PMI remained below the 50 boom/bust level, Europe reported disappointing PMI data as well. And a few hours after that the US reported that retail sales surged in March by the most in a year and a half (1.6%).

Read More »

Read More »

China’s Blowout IP, Frugal Stimulus, and Sinking Capex

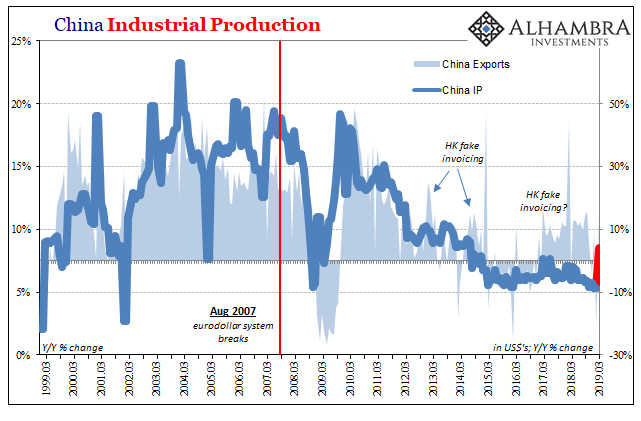

It had been 55 months, nearly five years since China’s vast and troubled industrial sector had seen growth better than 8%. Not since the first sparks of the rising dollar, Euro$ #3’s worst, had Industrial Production been better than that mark. What used to be a floor had seemingly become an unbreakable ceiling over this past half a decade. According to Chinese estimates, IP in March 2019 was 8.5% more than it was in March 2018. That was far more...

Read More »

Read More »