Tag Archive: China

FX Daily, May 10: The Dollar Remains on the Defensive

Last week's cyberattack on the largest US gasoline pipeline continues to lift oil and gasoline prices. The June gasoline futures gapped higher to extend last week's 2.4% gain but has subsequently moved lower to enter the gap.

Read More »

Read More »

FX Daily, April 26: Big Week Begins Quietly, with the Greenback Still Under Pressure

Overview: What promises to be a notable week has begun off quietly: the US, EMU, and South Korea report Q1 GDP. The eurozone also provides its first estimate of April inflation. Corporate earnings feature tech and financial firms. Equities are mostly firmer in the Asia Pacific region and Europe.

Read More »

Read More »

FX Daily, April 20: Market has Second Thoughts about Timing of First Fed Hike

Overview: Even as US yields edge higher, the dollar struggles. With the 10-year Treasury yields now at 1.62%, nine basis points above last week's lows, the greenback has turned mixed against the major currencies. After briefly slipping below JPY108, the dollar has recovered to around JPY108.55.

Read More »

Read More »

FX Daily, April 12: Capital Markets Look for Direction

Overview: Risk appetites have not returned from the weekend. Equities are heavy, and bond yields softer. The dollar is drifting lower in Europe. China's unusually candid admission of the shortcomings of its vaccine and record new cases in India saw all the equity markets in the region fall. Only South Korea and Taiwan escaped the carnage that saw the Indian market tumble 3.5%.

Read More »

Read More »

FX Daily, April 5: Market Pushes First Rate Hike into 2022

Overview: Many financial centers in Asia and Europe remain closed for the extended holiday. Although several markets that were open were higher in the Asia Pacific region, India was an exception as a record contagion sent stocks down the most in five weeks. US futures are pointing higher, led by the Dow, while the NASDAQ lags.

Read More »

Read More »

FX Daily, March 30: US Yields Push Higher, Lifting the Greenback Especially Against the Euro and Yen

The US 10-year yield is at new highs since January 2020, pressing above 1.77% and helping pull up global yields today. European benchmarks yields are up 4-5 bp, and the Antipodean yields jump 8-9 bp. The impact on equities has been minor, and the talk is still about the unwinding of Archegos Capital.

Read More »

Read More »

FX Daily, March 29: Markets Look for Direction after Large Block Trade and Before Key Data

The large block trade (~$20 bln) before the weekend, apparently from a family office, continued to have ripple effects today, but the MSCI Asia Pacific Index barely noticed. It extended its pre-weekend rally of 1.3%, and only South Korea and Australia fell among the major markets.

Read More »

Read More »

FX Daily, March 16: Equities Firm, but Markets Tread Gingerly

Overview: Yesterday's new record highs in the S&P 500 and Dow Jones Industrial helped set the tone for today's advance in the Asia Pacific region and Europe. The MSCI Asia Pacific Index snapped a two-day decline, with other major markets rising today.

Read More »

Read More »

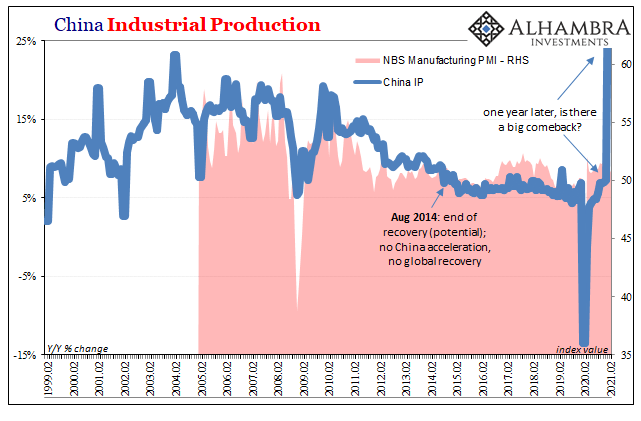

Looking Past Gigantic Base Effects To China’s (Really) Struggling Economy

The Chinese were first to go down because they had been first to shut down, therefore one year further on they’ll be the first to skew all their economic results when being compared to it. These obvious base effects will, without further scrutiny, make analysis slightly more difficult.

Read More »

Read More »

FX Daily, March 15: Big Week Begins Quietly

The capital markets are beginning a new and busy week in a non-committal fashion. Equities are mixed. Except for Japan, Hong Kong, and Australia, most markets in the Asia Pacific region were lower, led Chinese and Indian shares.

Read More »

Read More »

FX Daily, March 10: Markets are not Yet Convinced that Yesterday’s Move Signaled a Trend Change

Fear that yesterday's reversals represent little more than one-day wonders is contributing to the overall consolidative tone today. Most equity markets in the Asia Pacific region and Europe edged higher. China's stocks tumbled yesterday, despite reports of official assistance, were mixed with the Shanghai Composite posting small gain and Shenzhen a small loss.

Read More »

Read More »

FX Daily, March 8: Greenback Trades Higher in Asia before Momentum Stalls in Europe

Overview: The attack on Saudi Arabia's largest crude terminal reverberated through the capital markets, where sentiment was already fragile, despite the lack of disruption. Brent rose to nearly $71.40, and April WTI to almost $68 extended their gains for the fourth consecutive session before being fully unwound.

Read More »

Read More »

FX Daily, March 2: The Dollar Finds Better Footing

Overview: A warning from China's top banking regulator about the frothiness of foreign markets appeared to blunt the knock-on effect of yesterday's largest rise in the S&P 500 since last June (~2.4%) and weighed on global equities. The large markets in the Asia Pacific region but India and South Korea fell.

Read More »

Read More »

FX Daily, February 18: Markets Chill

The bout of profit-taking in equities continued today, and most markets in Asia Pacific and Europe are lower. China's markets re-opened but struggled to sustain early gains. However, the Shanghai Composite rose by about 0.5%, and a smaller increase was recorded in Taiwan and an even smaller gain in Australia.

Read More »

Read More »

FX Daily, February 11: Oil Set to Snap 8-day Advance while Consolidative Tone Emerges in FX

Overview: The S&P 500 and NASDAQ were unable to sustain the gap higher opening to new record levels and reversed lower and fell to new three-lows. The settlements were just inside Tuesday ranges, though the Dow Industrials set a record close. Yet, there was spillover to equity trading in the Asia Pacific region and Europe today.

Read More »

Read More »

FX Daily, February 10: China’s Expansion Does not Prevent Deflation

Despite a soft close in US indices yesterday, global shares are on the march again today. Led by China and Hong Kong, most large markets in the Asia Pacific region advanced today. Officials gave approval for a new game from Tencent, which helped lift the Hang Seng.

Read More »

Read More »

FX Daily, February 9: Players are Not Buying Everything Today

The rally of US benchmarks to new record highs helped lift most Asia Pacific markets today, but the bulls are pausing in Europe, and there has been little follow-through buying of US shares. Australia, South Korea, and Indonesia did not participate in today's regional advance led by a 2% rally in China's main indices.

Read More »

Read More »

FX Daily, February 8: Limited Follow-Through Dollar Selling to Start the Week

Overview: The US dollar has drifted higher against the major currencies and most of the freely accessible emerging market currencies, paring the losses seen before the weekend in response to the disappointing employment report. Easing pressure from the pandemic as the surge in cases after the holidays may also be encouraging risk-taking to extend the global equity rally.

Read More »

Read More »

FX Daily, February 4: Negative Rates and the Bank of England: Having Your Cake and Eating it Too

Overview: The euro has been sold through $1.20 for the first time since December 1 and has now given back roughly half of the gains scored from the US election (~$1.16) to the early January high (~$.1.2350). More broadly, the greenback is bid against most of the major currencies, with the Australian dollar more resilient after reported record iron ore exports and all but a handful of emerging market currencies.

Read More »

Read More »

FX Daily, January 27: The Fed and Earnings on Tap

Overview: Risk appetites seem subdued even if GameStop's surge draws attention. Asia Pacific equities mostly slipped lower, and profit-taking was seen in Hong Kong and Seoul, which are off to an incredibly strong start to the year. Small gains were reported in Tokyo, Beijing, and Taipei.

Read More »

Read More »