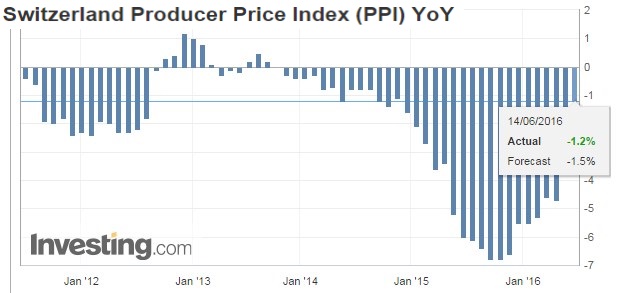

The Producer and Import Price Index rose in June 2016 by 0.1% compared with the previous month, reaching 99.9 points (base December 2015 = 100). Whereas the Producer Price Index declined by 0.2%, the Import Price Index rose by 0.8%. The slight increase of the overall index is due in particular to higher prices for petroleum products. Compared with June 2015, the price level of the whole range of domestic and imported products fell by 1.0%.

Read More »

Tag Archive: Swiss Franc Overvaluation

Purchasing Power Parity, REER: Swiss Franc Overvalued?

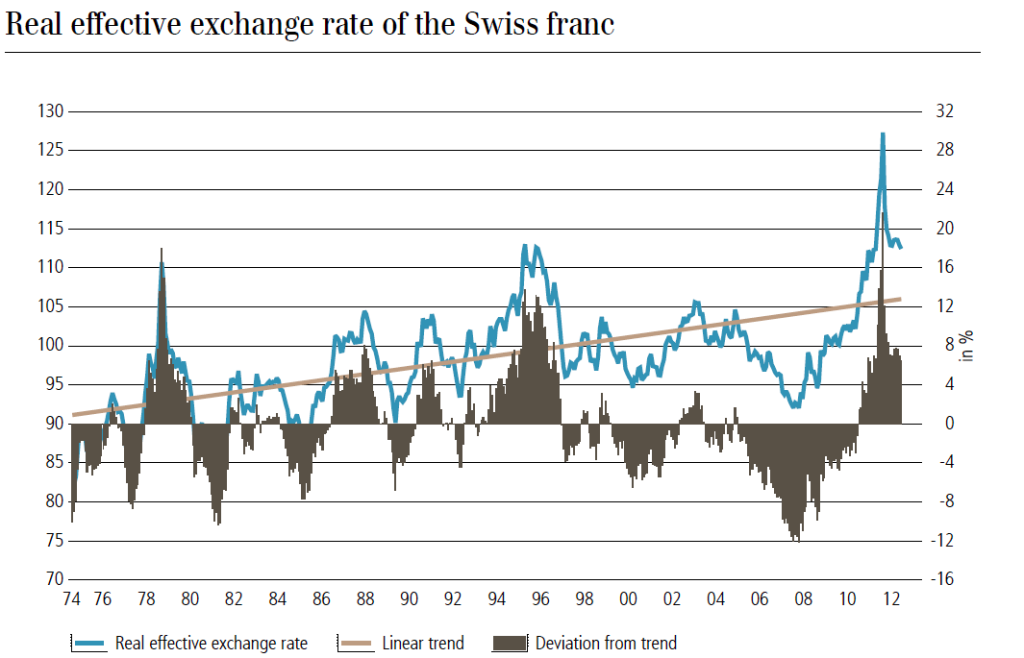

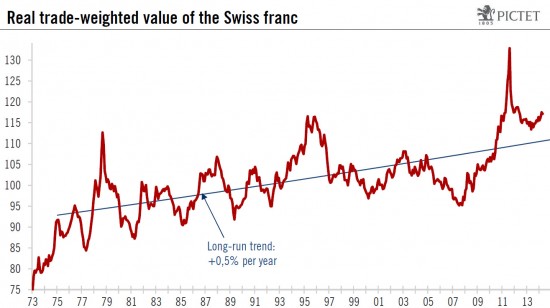

Most economists, like the ones at the Swiss National Bank (SNB), claim that the franc is overvalued. Many use misleading Purchasing Power Parity (PPP) measures like the Big Mac index, the OECD index or the PPP based on consumer prices for computing fair values.

The second big mistake is to compute the Real Effective Exchange Rate (REER) with the wrong "base year"The third error is to ignore massive Swiss current account surpluses, helped by high...

Read More »

Read More »

FX Daily, June 15: Key Data and FOMC

The Swiss Franc was today on the back-foot against the euro, while the FOMC helped him to rise against the dollar.

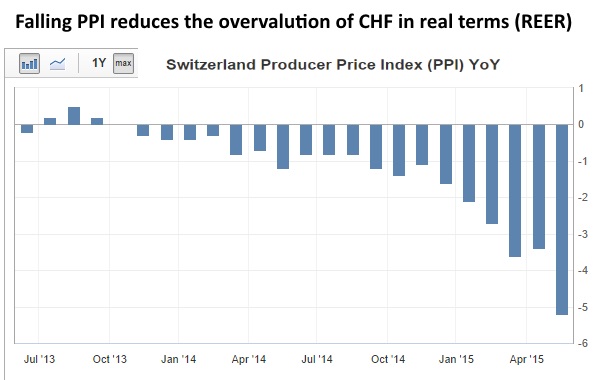

Yesterday Swiss producer prices were published. Negative changes in producer prices in 2015 reduce the Swiss franc overvaluation in terms of the Real Effective Exchange strongly. Now, however, changes producer prices are approaching zero again.

Read More »

Read More »

Swiss Producer and Import Price Index, May 2016: 0.4 percent MoM, -1.2 YoY

The strongly negative change in producer prices in 2015 reduced the Swiss franc overvaluation in terms of the Real Effective Exchange. Now, however, producer prices are approaching the zero change again.

It must also be noted that producer prices had fallen by 6% in 2015, while consumer prices went down only by 1.5%. Large margins are remaining for the Swiss retail sector.

Read More »

Read More »

Where does SNB intervene against overvalued CHF, do they sell EUR & USD? (April Update)

In his first response to the Swiss financial tsunami on January 15, George Dorgan suggested that the EUR/CHF of 1.10 will not be reached any time soon. He explains where the SNB should intervene and if they sell Euros and dollars.

Read More »

Read More »

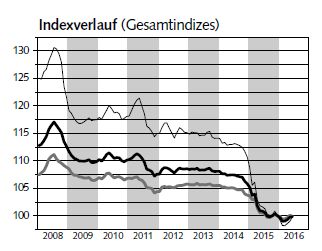

(2.5) Real Effective Exchange Rate, Swiss Franc, Yen and Renminbi

The weighted average of country's currency relative to index or basket of other major currencies adjusted for inflation. We explain the Real Effective Exchange Rate for the Franc, the Yen and Renmimbi

Read More »

Read More »

SNB Follows ECB? Pictet’s Negative SNB Interest Call

Pictet calls for negative interest rates in Switzerland in order to maintain rate differentials between the euro zone and Switzerland. Maintaining rate differentials would be useful for FX speculators and for money market funds that still invest in the euro zone.

Read More »

Read More »

The IMF Assessment for Switzerland 2014 and our critique

In the 2014 assessment for Switzerland by the International Monetary Fund, several sentences sparked in our eyes; we will contrast them with our recent critique.

Read More »

Read More »

Swiss Public Discussion Switched from Floor to Housing Bubble

Why there is no real estate bubble in Switzerland yet and why the SNB will help to create one With the current recovery in the United States the discussion in Switzerland switched from a discussion about the EUR/CHF floor to the Swiss real estate boom, the so-called “housing bubble”. It seems that the Swiss …

Read More »

Read More »

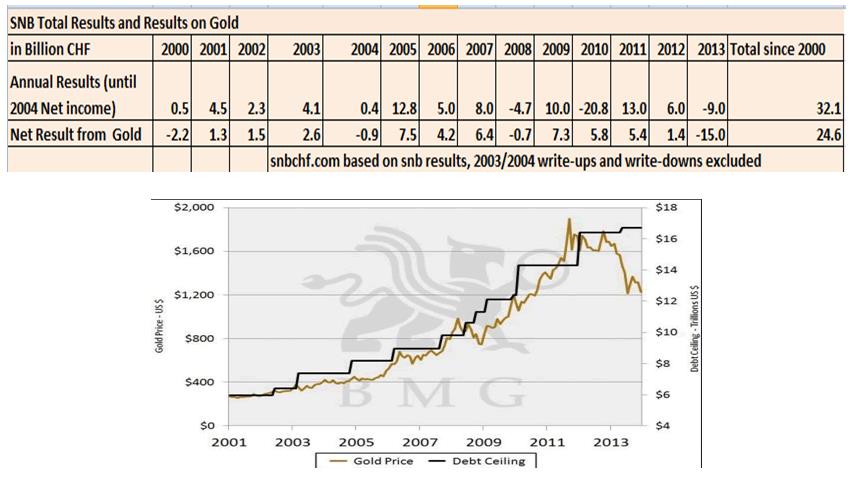

Because They Knew What They Were Doing: The Parallels between European and SNB Leaders

Similarly as European leaders knew what they were doing with the euro, namely introducing a not feasible currency, Swiss National Bank did between 2005 and 2008, namely the absolutely wrong thing.

Read More »

Read More »

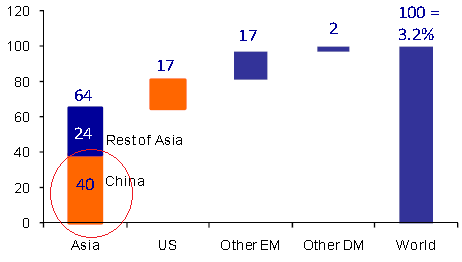

Warum die SNB nicht Hongkong, sondern Singapur imitieren wird

Im Gegensatz zu Hongkong mit dem USD/HKD-Peg kann die Schweiz ein Currency Board, einen fixen Kurs zum Euro nicht für Jahre durchhalten. Die Gründe auf snbchf.com

Read More »

Read More »

5) FX Theory

Content : What Determines FX Rates? Purchasing Power Parity, Real Effective Exchange Rate, Balance of Payments Model, (Reverse) Carry Trade, Asset Market Model, Real Mean Reversion, lots more

Read More »

Read More »