Tag Archive: Central Bank

SNB: It’s A Bonfire Of The Absurdities

This week’s letter will take a look at the growing number of ridiculous, inane, and otherwise nonsensical absurdities that fill the daily economic headlines. I have gone from the occasional smile to scratching my head now and then to “WTF” moments several times a week.

Read More »

Read More »

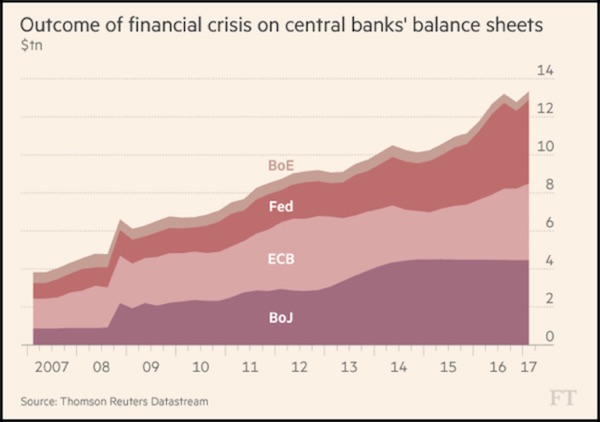

Fed’s Asset Bubbles Now At The Mercy Of The Rest Of The World’s Central Bankers

"Like watching paint dry," is how The Fed describes the beginning of the end of its experiment with massively inflating its balance sheet to save the world. As former fund manager Richard Breslow notes, however, Yellen's decision today means the risk-suppression boot is on the other foot (or feet) of The SNB, The ECB, and The BoJ; as he writes, "have no fear, The SNB knows what it's doing."

Read More »

Read More »

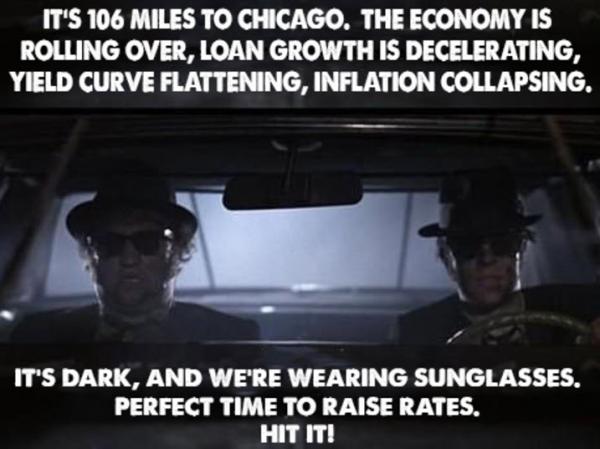

“Financial Crisis” In 2017 Or By End Of 2018 – Prepare Now

John Mauldin of Mauldin Economics latest research note, Prepare for Turbulence, is excellent and a must read warning about the coming financial crisis. Mind refreshed from what sounds like a wonderful honeymoon and having had the time to read some books outside his “comfort zone” he has come to the conclusion that we are on the verge of a “major financial crisis, if not later this year, then by the end of 2018 at the latest.”

Read More »

Read More »

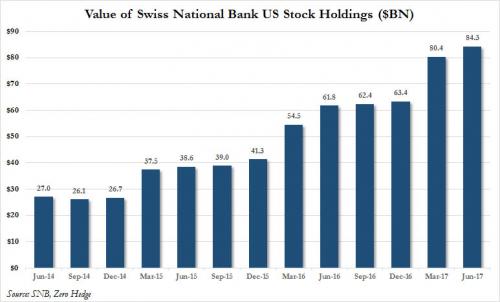

The Swiss National Bank Owns $80 Billion In US Stocks – Here’s The Catch

Switzerland is a small country of just 8 million people, but they make an outsized impact on economics and finance and money. Because Switzerland is considered a safe haven and a well-run country, many people would like to hold large amounts of their assets in the Swiss franc. This makes the Swiss franc intolerably strong for Swiss businesses and citizens. So the Swiss National Bank (SNB) has to print a great deal of money and use nonconventional...

Read More »

Read More »

“It’s A Perfect Storm Of Negativity” – Veteran Trader Rejoins The Dark Side

After many months of fighting all the naysayers predicting the next big stock market crash, I am finally succumbing to the seductive story of the dark side, and getting negative on equities. I am often early, so maybe this means the rally is about to accelerate to the upside.

Read More »

Read More »

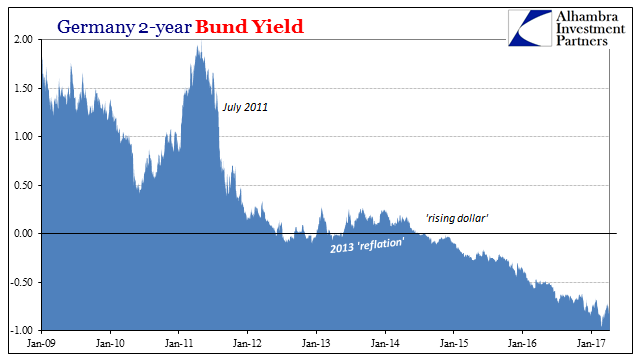

The Global Burden

Bundesrepublik Deutscheland Finanzagentur GmbH (German Finance Agency) was created on September 19, 2000, in order to manage the German government’s short run liquidity needs. GFA took over the task after three separate agencies (Federal Ministry of Finance, Federal Securities Administration, and Deutsche Bundesbank) had previously shared responsibility for it.

Read More »

Read More »

Video: The Swiss National Bank Is Acting Like A Hedge Fund

We discuss the fact that Central Banks have basically morphed into Hedge Funds with similar risky investing strategies, except they buy without any regard to the underlying fundamentals of the assets they are buying. When did the Swiss Citizens say it was the proper role for the Swiss National Bank to be buying US Stocks? How is this stimulating the Swiss Economy?

Read More »

Read More »

What Will Trump Do About The Central-Bank Cartel?

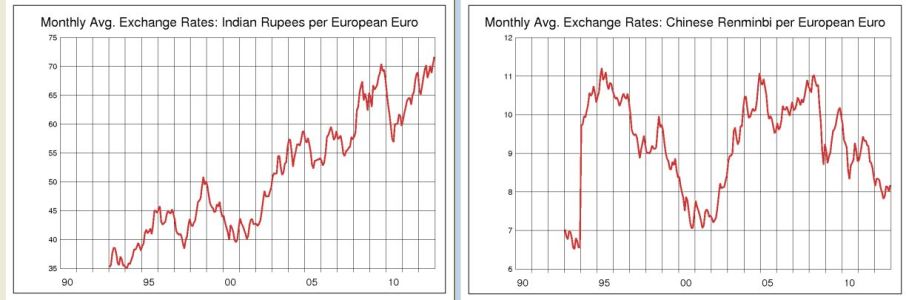

The US is by far the biggest economy in the world. Its financial markets — be it equity, bonds or derivatives markets — are the largest and most liquid. The Greenback is the most important transaction currency. Many currencies in the world — be it the euro, the Chinese renminbi, the British pound or the Swiss franc — have actually been built upon the US dollar.

Read More »

Read More »

80 percent Of Central Banks Plan To Buy More Stocks

Regular readers remember how, when we first reported around the time of our launch eight years ago that central banks buy stocks, intervene and prop up markets, and generally manipulate equities in order to maintain confidence in a collapsing system, and avoid a liquidation panic and bank runs, it was branded "fake news" by the established financial "kommentariat."

Read More »

Read More »

Kosten eines Vollgeld-Systems sind hoch (Costly Sovereign Money)

Eine Umsetzung der Vollgeld-Initiative würde grossen Schaden anrichten und dürfte im Ergebnis selbst die Initianten enttäuschen. Verbesserungen verspricht dagegen eine «sanfte» Reform: die Einführung von elektronischem SNB-Geld für alle.

Read More »

Read More »

We’re All Hedge Funds Now – Central Banks Become World’s Biggest Stock Speculators

At first, the idea of central banks intervening in the equity markets was probably seen even by its fans as a temporary measure. But that’s not how government power grabs work. Control once acquired is hard for politicians and their bureaucrats to give up. Which means recent events are completely predictable.

Read More »

Read More »

SNB & CHF, the blog on a beleaguered central bank, its currency, on gold and astute investments

SNBCHF.com tracks Swiss macro-economic news and the Swiss National Bank. The SNB finally gave up the euro peg and agreed with the authors of this blog. Over years this blog expressed opposition against the EUR/CHF peg in about 900 different pages. They track the strong Swiss economic performance over these years. They explain all logical and fundamental Forex background why this peg did not have any reason to exist or, at least, why it was doomed...

Read More »

Read More »

(1) What Determines FX Rates?

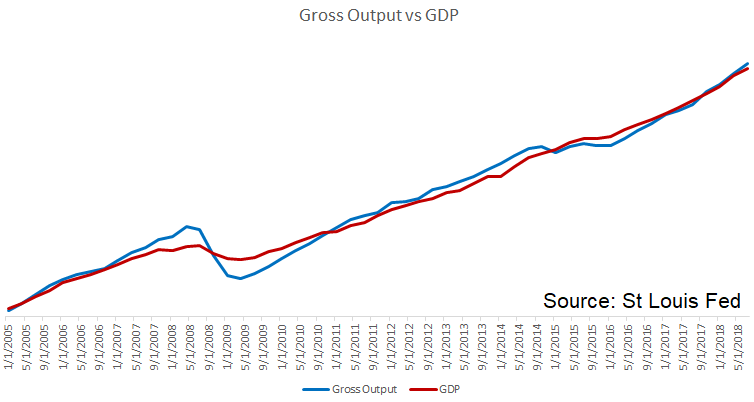

The effects of so-called “currency wars” and other central bank actions are small compared to the long-term impact made by these five catalysts, which include credit cycles, trade balance, differences in economic growth, and more.

Read More »

Read More »

(6) FX Theory: Carry Trade and Reverse Carry Trade

This page discusses two closely related concepts: the carry trade and the reverse carry trade.

Read More »

Read More »

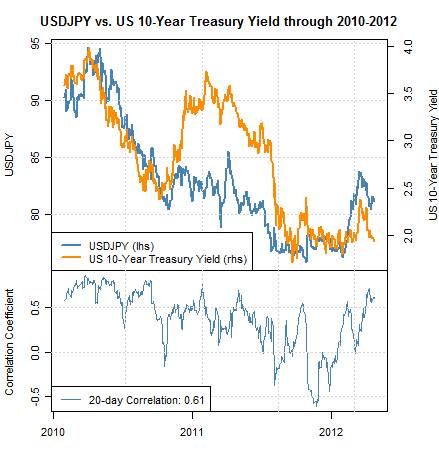

(7) FX Theory: The Asset Market Model

The Asset Market Model implies that a currency will be in higher demand and should appreciate in value, if the flow of funds into financial market of the country such as equity and bonds markets increase.

Read More »

Read More »

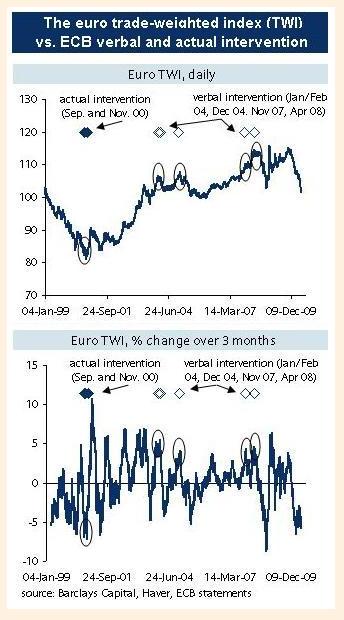

(8) Currency Wars: How to Push and Talk Down Your Currency?

Direct or indirect intervention is credible only in countries where domestic asset prices are undervalued and CPI/asset price inflation are no issues. Otherwise they create medium-term risks.

Read More »

Read More »