Tag Archive: Brazil

Is GFC2 Over?

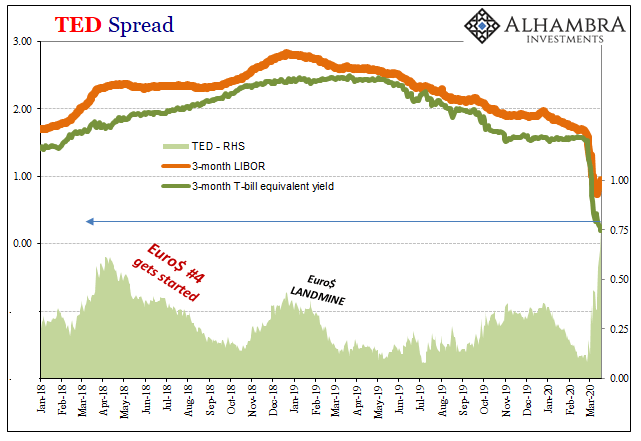

Is it over? That’s the question everyone is asking about both major crises, the answer is more obvious for only the one. As it pertains to the pandemic, no, it is not. Still the early stages. The other crisis, the global dollar run? Not looking like it, either.

Read More »

Read More »

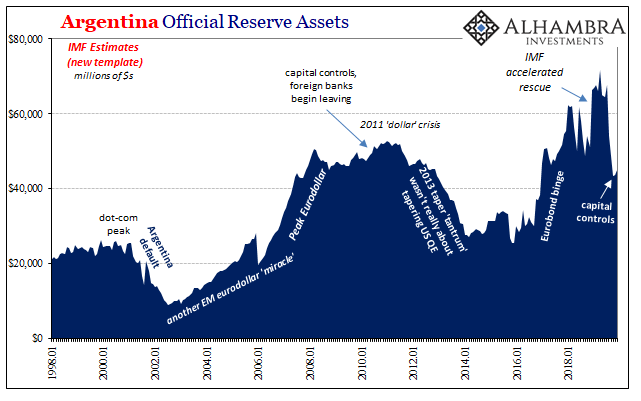

Time Again For Triple Digit Dollar

Being a member of the institutional “elite” means never having to say you’re sorry; or even admit that you have no idea what you are doing. For Christine Lagarde, Mario Draghi’s retirement from the European Central Bank could not have come at a more opportune moment. Fresh off the Argentina debacle, she failed herself upward to an even better gig.

Read More »

Read More »

You Shouldn’t Miss The Cupom

I actually wanted to focus on this yesterday but confirmation wasn’t forthcoming until today. So, it ended up being a broader note on the dollar which only included some mention of Brazil in passing. Still a worthwhile couple of minutes.

Read More »

Read More »

FX Daily, February 6: Stocks Push Higher but more Cautious Tone may be Emerging

Overview: The bullish enthusiasm that carried the S&P 500 to new closing highs yesterday is helping Asia Pacific and European shares today. The MSCI Asia Pacific Index rose for the third session with Tokyo, Hong Kong, and Korea jumping two percent. Europe's Dow Jones Stoxx 600 gapped to new record highs before stabilizing in mid-morning turnover. US shares are mostly firmer.

Read More »

Read More »

FX Daily, February 5: Markets Extend Recovery, but Look for a Pause

Overview: The S&P 500 gapped higher and surged 1.5% yesterday, the most since in six months, helping set the stage for a continued recovery in global equities, and stoked risk appetites more broadly. An experimental antiviral treatment is to begin clinical testing. All of the markets in the Asia Pacific region advanced, with Japan, China, and Singapore gaining more than 1%.

Read More »

Read More »

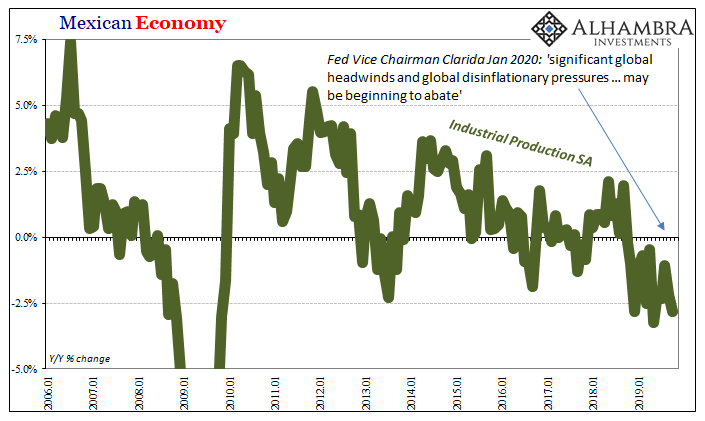

Global Headwinds and Disinflationary Pressures

I’m going to go back to Mexico for the third day in a row. First it was imports (meaning Mexico’s exports) then automobile manufacturing and now Industrial Production. I’ll probably come back to this tomorrow when INEGI updates that last number for November 2019. For now, through October will do just fine, especially in light of where automobile production is headed (ICYMI, off the bottom of the charts).

Read More »

Read More »

FX Daily, January 9: Animal Spirits Roar Back

Overview: The S&P 500 recovered from a 10-day low to reach a new record high, which set the tone for the Asia Pacific and European markets today. The MSCI Asia Pacific Index jumped by the most in a month with the Nikkei's 2% advance leading the way. More broadly, the markets in Taiwan, South Korea, Hong Kong, India, and Thailand all rose more than 1%.

Read More »

Read More »

FX Daily, December 12: Enguard Lagarde

With the FOMC meeting delivered no surprises, attention turns to the ECB meeting as the UK go to the polls. Lagarde will hold her first press conference as ECB president today, and it will naturally command attention. Equities are advancing today, and tech appears to be leading the way. In Asia Pacific, Taiwan and South Korea rallied more than 1%, while the Hang Seng gapped higher to almost its best level in three weeks.

Read More »

Read More »

FX Daily, December 3: US Brandishes Tariff Weapon and Weakens Animal Spirits

Asia Pacific equities mostly declined in sympathy with yesterday's large sell-off in the US and Europe. China and Taiwan were the notable exceptions, while Australia's 2.2% decline, following the central bank meeting that resulted in what many are seeing as a hawkish hold, led the move lower. Europe's Dow Jones Stoxx 600 fell 1.6% yesterday, the largest loss in two months, and is extending the losses for a third session today.

Read More »

Read More »

FX Daily, November 6: Markets Catch Collective Breath as Dollar Consolidates Yesterday’s Advance

Overview: Investors seem to be catching their collective breath today, and the global capital markets are consolidating recent moves. A notable exception is the Chinese yuan, which has continued to strengthen, and the dollar has slipped back below CNY7.0. Asia Pacific equities were mixed, and the four-day advance in the regional benchmark stalled today.

Read More »

Read More »

FX Daily, October 31: No Good Deed Goes Unpunished

Overview: The equity and bond rally in North America yesterday carried over into today's session. With some notable exceptions, like China, Taiwan, Australia, and Indonesia, most bourses in Asia Pacific and Europe traded higher. US shares are little changed in early Europe after the S&P 500 rose to new record highs.

Read More »

Read More »

Dollar Mixed on Central Bank Thursday

As expected, the Fed cut rates by 25 bp; the dollar firmed after the decision but has since given back some gains. During the North American session, there will be a fair amount of US data. BOE is expected to keep rates steady; UK reported August retail sales. SNB and BOJ kept rates steady, as expected; Norges Bank unexpectedly hiked 25 bp.

Read More »

Read More »

FX Daily, September 19: Investors Looking for New Focus

Overview: Central bank activity is still very much the flavor of the day, but investors are looking for the next focus. The Bank of Japan and the Swiss National Bank stood pat, while Indonesia cut for the third consecutive time and the Hong Kong Monetary Authority and Saudi Arabia quickly followed the Fed. Brazil cut its Selic rate yesterday by 50 bp as widely expected.

Read More »

Read More »

FX Daily, September 16: Oil Surge Pared, Markets Remain on Edge

Overview: Oil prices surged in the initial reaction to the unprecedented drone attack on Saudi Arabia facilities. Saudi Arabia may be able to restore around half of the lost production in a few days. Saudi Arabia and other countries, including the US, prepared to tap strategic reserves, oil prices have seen the initial gains halved. Brent is trading near $65 after finishing last week near $60.

Read More »

Read More »

FX Daily, July 11: Powell Spurs Equity and Bond Market Rally, While the Greenback Falls Out of Favor

Overview: Fed's Powell confirmed a Fed rate cut at the end of this month by warning that uncertainties since the June FOMC had "dimmed the outlook" and that muted price pressures may be more persistent. It ignited an equity and bond market rally (bullish steepening) while the dollar was sold.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX ended mixed in Friday, capping off an up and down week. RUB and TRY initially firmed on their respective rate hikes but gave back some of those gains heading into the weekend. Trade tensions are likely to remain high, as press reports suggest President Trump is pushing ahead with tariffs on $200 bln of Chinese imports even as high-level talks are planned.

Read More »

Read More »

Emerging Markets: What has Changed

Philippine central bank signaled another big hike. Poland central bank appears to be moving its forward guidance out further. Russia officials are sending confusing signals regarding monetary policy. Russia officials stand ready to support the ruble debt market if new US sanctions negatively impact it. South Africa’s African National Congress pledged to undertake land reform responsibly.

Read More »

Read More »

Emerging Market Week Ahead Preview

EM FX ended last week on a firm note, but weakness resumed Monday. Higher than expected Turkish inflation hurt the lira, which in turn dragged down BRL, ARS, ZAR, and RUB. We expect EM to remain under pressure this week when the US returns from holiday Tuesday.

Read More »

Read More »

FX Weekly Preview: Macroeconomic Considerations

The force that had pushed the US 10-year Treasury yield to 3% and the dollar above JPY113 at the start of the month, and the euro to $1.13 a couple of weeks ago has dissipated. The 10-year yield is near 2.80%. The dollar was near two-month lows against the yen a week ago, and the euro was back toward the middle of its previous $1.15-$1.18 trading range.

Read More »

Read More »