Tag Archive: Bonds

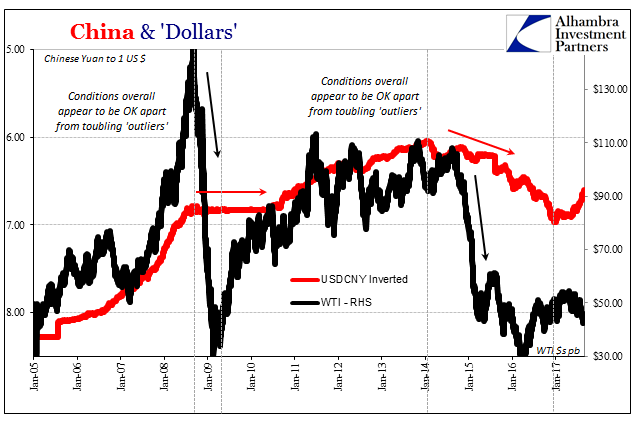

Moscow Rules (for ‘dollars’)

In Ian Fleming’s 1959 spy novel Goldfinger, he makes mention of the Moscow Rules. These were rules-of-thumb for clandestine agents working during the Cold War in the Soviet capital, a notoriously difficult assignment. Among the quips included in the catalog were, “everyone is potentially under opposition control” and “do not harass the opposition.” Fleming’s book added another, “Once is an accident. Twice is coincidence. Three times is an enemy...

Read More »

Read More »

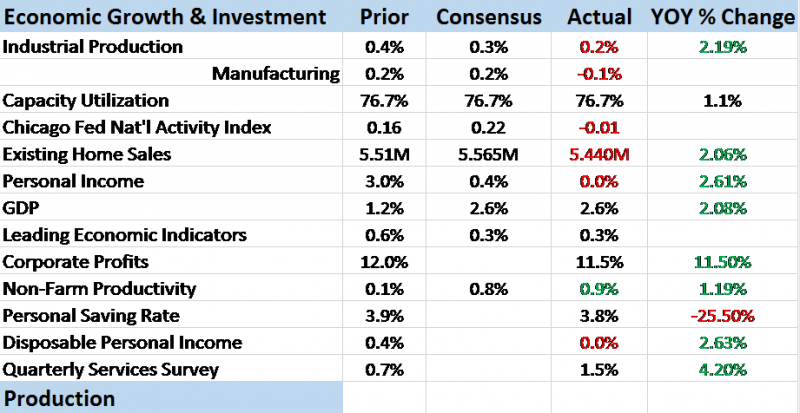

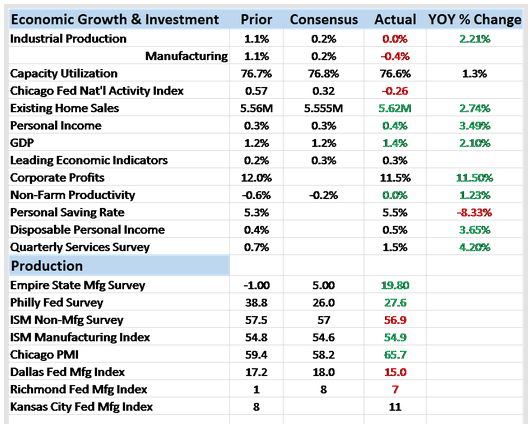

Bi-Weekly Economic Review: Don’t Underestimate Gridlock

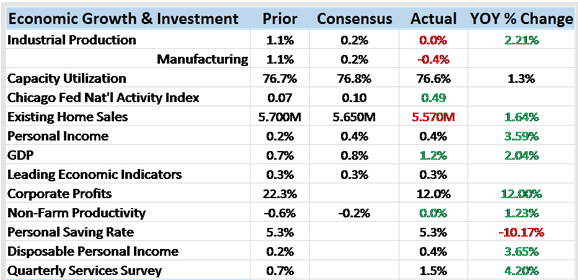

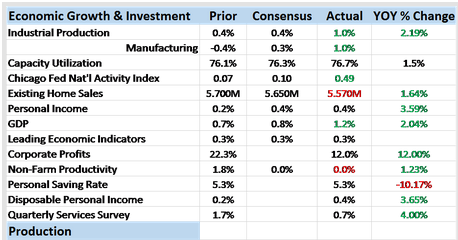

The economic reports released since the last update were slightly more upbeat than the previous period. The economic surprises have largely been on the positive side but there were some major disappointments as well. The economy has been doing this for several years now, one part of the economy waxing while another wanes and the overall trajectory not much changed. Indeed, the broad Chicago Fed National Activity index probably says it all, coming...

Read More »

Read More »

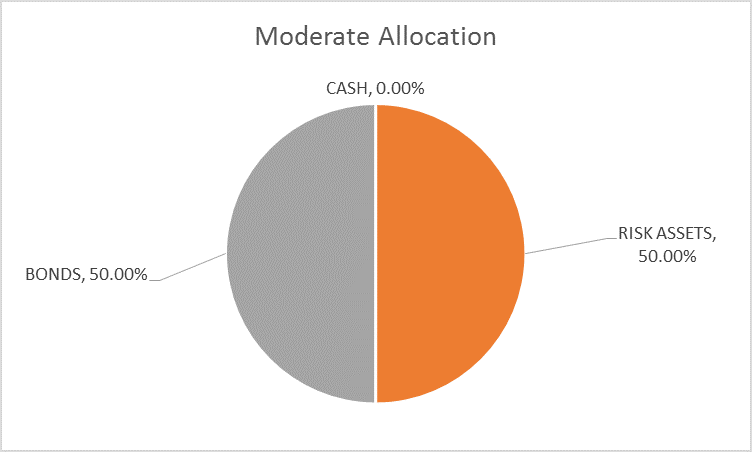

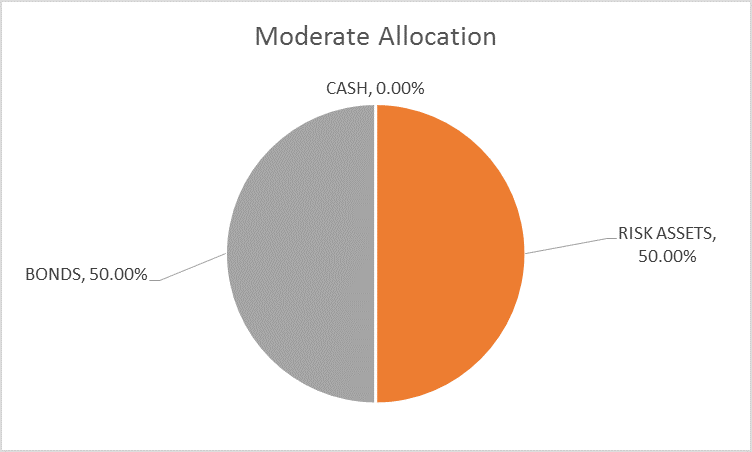

Global Asset Allocation Update: No Upside To Credit

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are other changes to the portfolio though so please read on. As I write this the stock market is in the process of taking a dive (well if 1.4% is a “dive”) and one can’t help but wonder if the long awaited and anticipated correction is finally at hand.

Read More »

Read More »

United States: Still No Up

The Asian flu of the late 1990’s might have been more accurately described as the Asian dollar flu. It was the first major global test of the mature eurodollar system, and it was a severe disruption in the global economy. It doesn’t register as much here in the United States because of the dot-com bubble and the popular imagination about Alan Greenspan’s monetary stewardship in general.

Read More »

Read More »

Data Dependent: Interest Rates Have Nowhere To Go

In October 2015, Federal Reserve Vice Chairman Bill Dudley admitted that the US economy might be slowing. In the typically understated fashion befitting the usual clownshow, he merely was acknowledging what was by then pretty obvious to anyone outside the economics profession.

Read More »

Read More »

Bi-Weekly Economic Review: Ignore The Idiot

Of the economic releases of the past two weeks the one that got the most attention was the employment report. That report is seen by many market analysts as one of the most important and of course the Fed puts a lot of emphasis on it so the press spends an inordinate amount of time dissecting it.

Read More »

Read More »

Oil Prices: The Center Of The Inflation Debate

The mainstream media is about to be presented with another (small) gift. In its quest to discredit populism, the condition of inflation has become paramount for largely the right reasons (accidents do happen). In the context of the macro economy of 2017, inflation isn’t really about consumer prices except as a broad gauge of hidden monetary conditions.

Read More »

Read More »

Bi-Weekly Economic Review: Extending The Cycle

This economic cycle is one of the longest on record for the US, eight years and counting since the end of the last recession. It has also been, as almost everyone knows, a fairly weak expansion, one that has managed to disappoint both bull and bear.

Read More »

Read More »

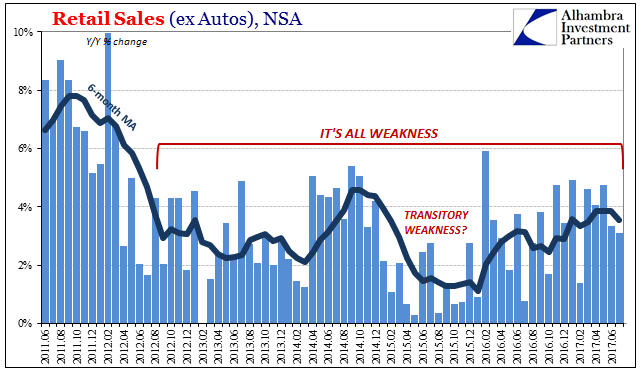

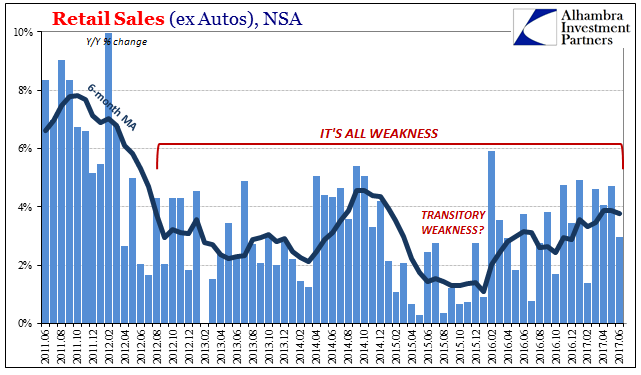

Retail Sales Conundrum

Retail sales were thoroughly disappointing in June. Whereas other accounts such as imports or durable goods had at least delivered a split decision between adjusted and unadjusted versions, for retail sales both views of them were ugly. Seasonally-adjusted first, spending last month was down for the second straight time. Worse than that, estimated sales were just barely more than in January.

Read More »

Read More »

Global Asset Allocation Update: Not Yet

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are no changes to the portfolio this month. Growth and inflation expectations rose somewhat since last month’s update. The change is minor though and within the range of what we’ve seen in recent months.

Read More »

Read More »

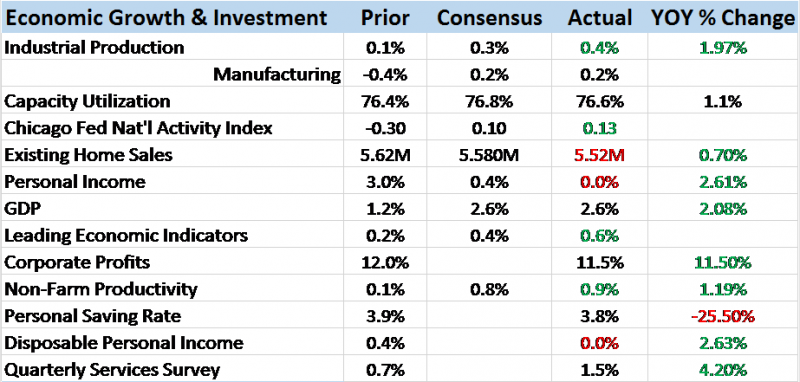

Bi-Weekly Economic Review: Attention Shoppers

The majority of the economic reports over the last two weeks have been disappointing, less than the consensus expectations. The minor rebound in activity we’ve been tracking since last summer appears to have stalled. Retail sales continue to disappoint and inventory/sales ratios are once again rising – from already elevated levels.

Read More »

Read More »

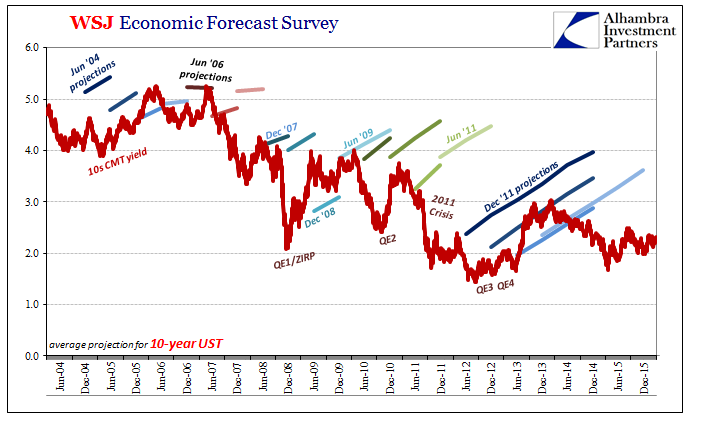

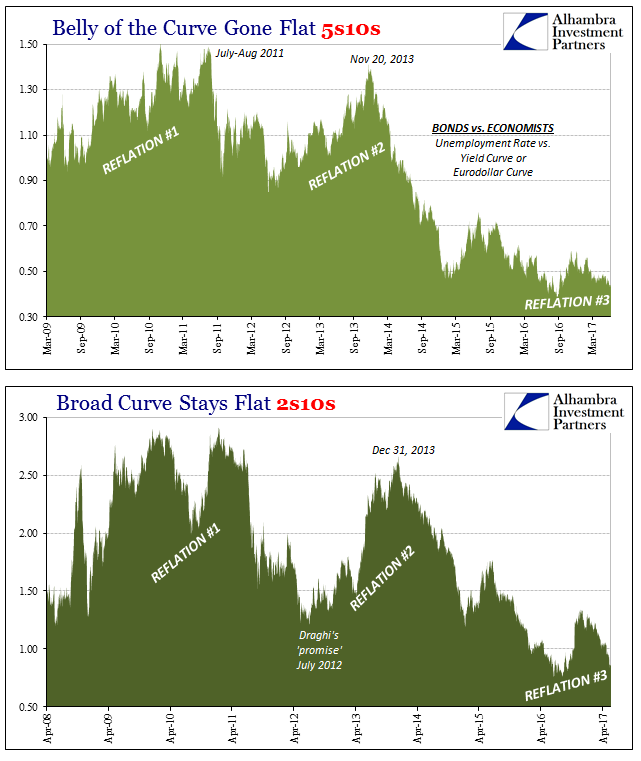

US Federal Funds, Bond Market and WSJ Economic Survey: The Hidden State of Money

Correctly interpreting the bond market is more than just how and when to invest your money in UST’s. Not that it isn’t useful in such a money management capacity, but interest rates starting at the risk-free tell us a lot about what is wholly unseen. There is simply no way to directly observe inside an economy what is taking place at all levels and in all transactions. We try to estimate as best we can in the aggregate, but the real economy works...

Read More »

Read More »

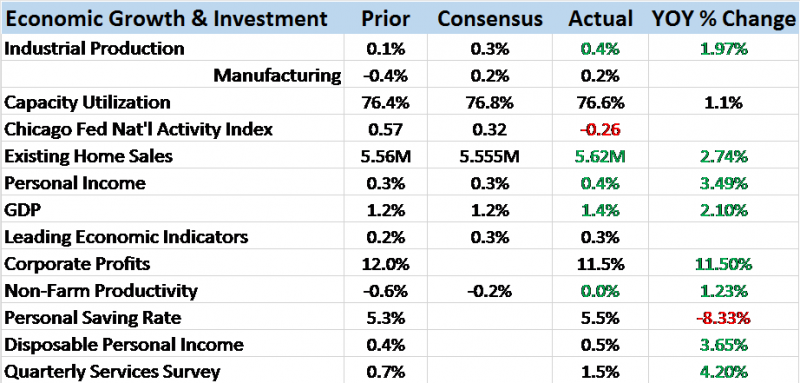

Bi-Weekly Economic Review: Draghi Moves Markets

In my last update two weeks ago I commented on the continued weakness in the economic data. The economic surprises were overwhelmingly negative and our market based indicators confirmed that weakness. This week the surprises are not in the economic data but in the indicators. And surprising as well is the source of the outbreak of optimism in the bond market and the yield curve.

Read More »

Read More »

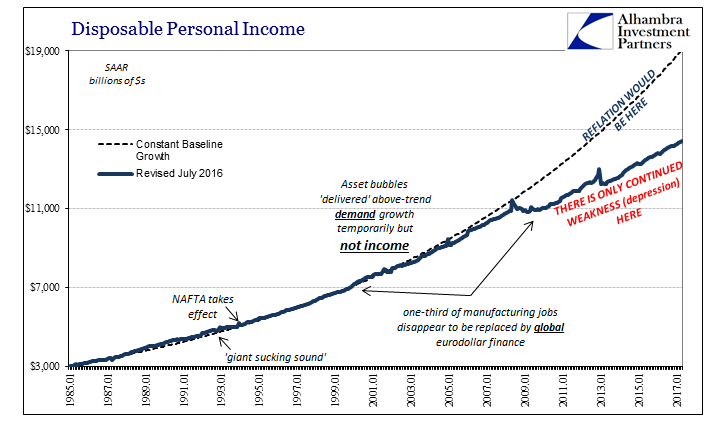

Fading Further and Further Back Toward 2016

Earlier this month, the BEA estimated that Disposable Personal Income in the US was $14.4 trillion (SAAR) for April 2017. If the unemployment rate were truly 4.3% as the BLS says, there is no way DPI would be anywhere near to that low level. It would instead total closer to the pre-crisis baseline which in April would have been $19.0 trillion. Even if we factor retiring Baby Boomers in a realistic manner, say $18 trillion instead, what does the...

Read More »

Read More »

Global Asset Allocation Update:

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are no changes to the portfolio this month.

Read More »

Read More »

Repeat 2015; An Embarrassing Day For The Fed

Today started out very badly for the FOMC. At 8:30am the Commerce Department reported “unexpectedly” weak retail sales while at the very same time the BLS published CPI statistics that were thoroughly predictable. Markets, at least credit and money markets, have gained a clearer idea what the Fed is actually doing and why. It’s not at all what the media suggests.

Read More »

Read More »

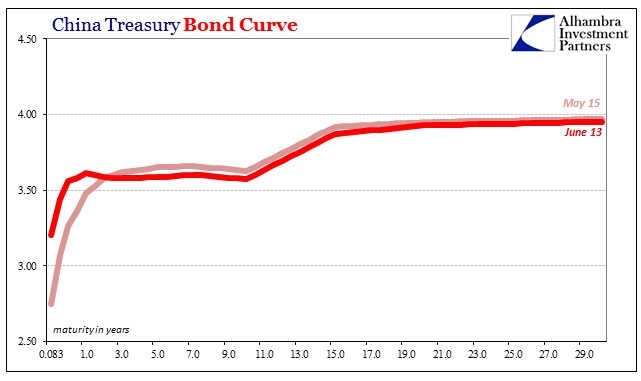

The ‘Dollar’ Devil Shows Itself Again In China

Some economic and financial conditions leave a yield curve as a more complex affair.Then there are others that are incredibly simple.The UST yield curve is the former, while right now the Chinese Treasury curve is the latter.

Read More »

Read More »

Bi-Weekly Economic Review: Has The Fed Heard Of Amazon?

The economic surprises keep piling up on the negative side of the ledger as the Fed persists in tightening policy or at least pretending that they are. If a rate changes in the wilderness can the market hear it? Outside of the stock market one would be hard pressed to find evidence of the effectiveness of all the Fed’s extraordinary policies of the last decade.

Read More »

Read More »

Deciphering Curves

What is the yield curve supposed to look like? It’s a simple question that doesn’t actually have an answer. And because it doesn’t, there is a whole lot of confusion about bond yields.

Read More »

Read More »

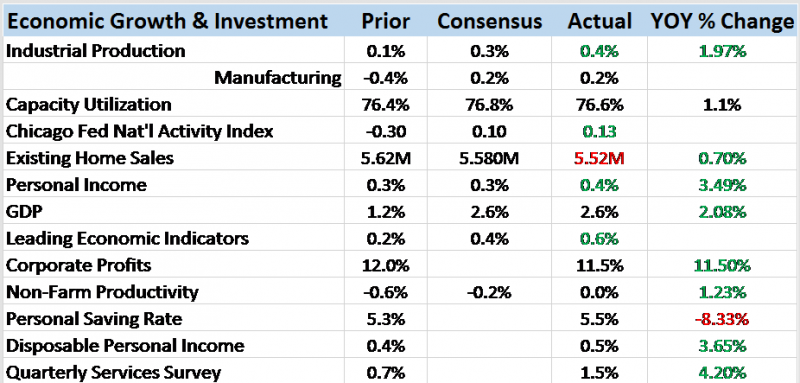

Bi-Weekly Economic Review: The Return of Economic Ennui

The economic reports released since the last of these updates was generally not all that bad but the reports considered more important were disappointing. And it should be noted that economic reports lately have generally been worse than expected which, if you believe the market to be fairly efficient, is what really matters.

Read More »

Read More »