Tag Archive: Blog

It’s Time for TINA to Retire

To listen to the audio version of this article click here. In the world of trends, history repeats more than it rhymes. Things which were considered “in” decades ago, reemerge as cool again decades later. From mom jeans to vinyl records and even Marxist ideology. The spotlight of today turns to things—both good and bad—once forgotten.

Read More »

Read More »

Oil, the Ruble and Gold Walk into a Bar…Part III

Part III – Gold Standards, the good, the bad, and the ugly. Gresham’s law and gold. Is it even possible to return to a gold standard today? Is Russia leading the push, or do we need something else?

Read More »

Read More »

Oil, the Ruble, and Gold Walk into a Bar…

Part I – Unpacking the narrative of how Russia is going to change the global monetary system. There is a Narrative about Russia and how it will change the monetary system. Many analysts in the gold community are promoting this story. There’s just one problem with this Narrative. It is like how Michael Crighton described the Gell-Mann Amnesia Effect, stating that the newspaper is full of stories explaining how “wet streets cause rain.”

Read More »

Read More »

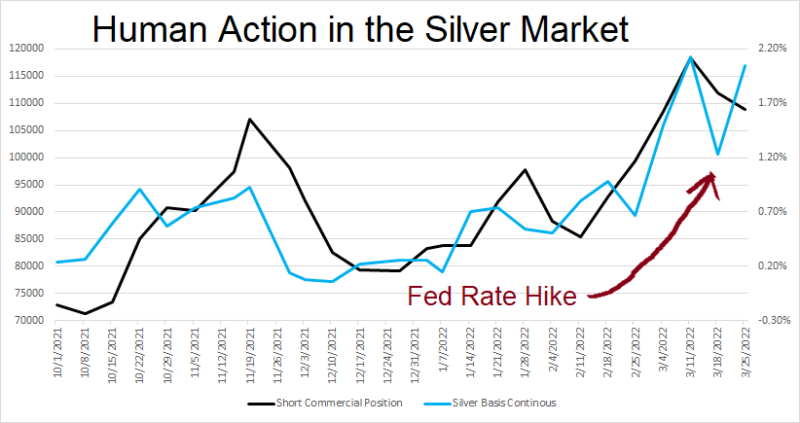

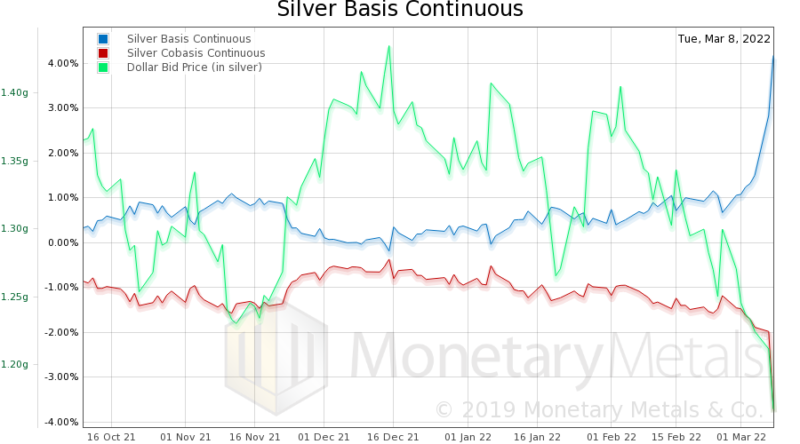

Human Action in the Silver Market

We have recently seen an increase in social media posts about the big increase in short positions by the bullion banks. What would motivate them to short a commodity during this period of inflation, much less a monetary metal when central banks are printing money with reckless abandon? And doesn’t their shorting of silver push down the price?

Read More »

Read More »

Six Reasons Why Gold is the Best Money

J.P. Morgan is famous for testifying before Congress saying “money is gold, and nothing else.” But why is gold so uniquely suited to be money? Here are our top six reasons why we think gold is the best money, and why dollars and bitcoin don’t come close.

Read More »

Read More »

How Much is the Gold Cube Worth?

Here at Monetary Metals we love providing investors with A Yield on Gold, Paid in Gold®. So when we heard that German artist Niclas Castello designed a 186 kilogram pure 24-karat gold cube called the “Castello Cube” as an art installation in the middle of Central Park we couldn’t help but start doing a little math on Mr. Castello’s art piece.

Read More »

Read More »

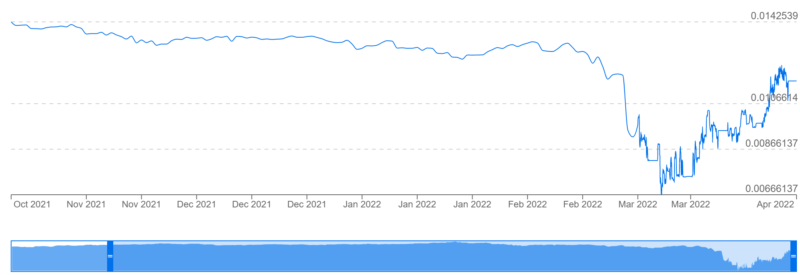

This is Not The Silver Breakout You’re Looking For!

Every once in a while, one regrets not acting sooner, or not acting soon enough. In our case, we did not publish this Tuesday evening. We should have. Today the price is down, and others may also call for lower silver prices.

Read More »

Read More »

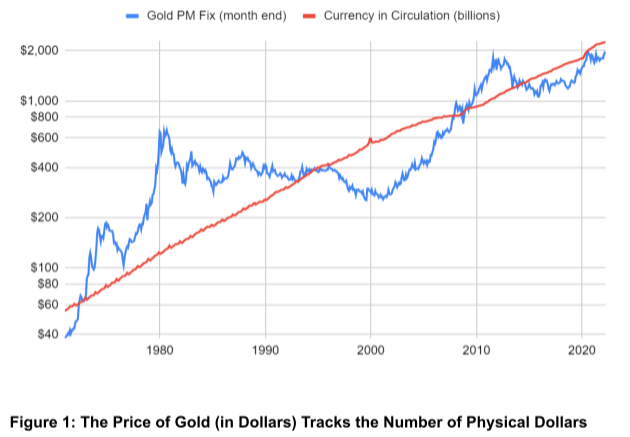

How Not to Think About Gold

Monetary Metals has been covering gold and silver markets for over ten years. Throughout that time, there’s been no shortage of new and old commentators talking about the drivers of gold and silver prices. Unfortunately, the vast majority of this analysis is just plain wrong.

Read More »

Read More »

Reflections Over 2021

In March, I flew for the first time since the start of Covid health theater. I was invited to speak at the Austrian Economics Research Conference in Auburn, AL. My talk covered Jimi Hendrix, and an infamous bridge collapse. In other words, I discussed my theory of interest and prices.

At the end of November, I flew to London for two weeks of business meetings. This was my first international trip since the Covid lockdown. I offer three comments....

Read More »

Read More »

Gold Under the Mattress vs Gold Investments

“If you can’t hold it in your hand, you don’t own it.”

That’s one of the most common refrains we hear from gold and silver investors. And while there is a kernel of truth in this saying, investing by these words alone could prove a costly mistake.

This popular phrase conflates and entangles two different concepts.

Read More »

Read More »

Mickey Fulp Interview: Investing in Interest-Bearing Gold Bonds

Mickey Fulp, aka the Mercenary Geologist, interviewed Monetary Metals’ CEO Keith Weiner to discuss the maturity of Monetary Metals’ recent gold bond. Gold bonds are denominated in gold, with principal and interest payable in gold.

Mickey and Keith have a wide ranging discussion which covers the history of gold as money in the United States, including the history of gold bonds, which were commonplace until 1933.

Read More »

Read More »

Why a Yield on Gold Matters

Picture, if you can, a world in which gold circulates as the medium of exchange. People pay for everything, from groceries to rent, in gold. Employers pay wages in gold. Productive enterprises borrow gold to finance everything from food production to constructing apartment buildings. In other words, picture a world where there’s abundant opportunities to earn a yield on gold and finance productive businesses in gold.

Read More »

Read More »

Can Interest on Gold Outpace Inflation?

Yield. It’s on the tip of every investor’s tongue, but it’s much harder to find than it used to be. A long time ago, in a galaxy far, far away (like the early 1980’s) one could simply open a savings account, purchase a CD or US 10-year notes, and earn between 7% to 14%.

Read More »

Read More »

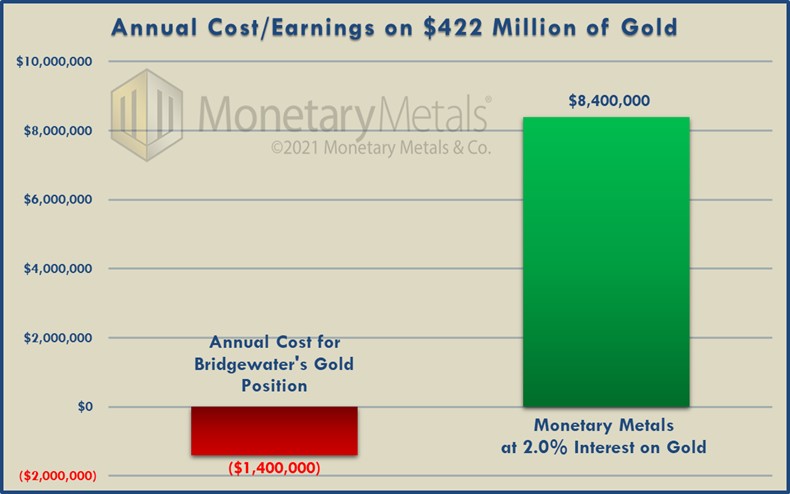

How to Invest in Gold Better than Ray Dalio

Ray Dalio made waves earlier this year when he acknowledged that Bridgewater bought an undisclosed amount of bitcoin. In a recent interview, however, Dalio made it clear that his love for gold is still greater.

Read More »

Read More »

China’s social credit system – a new Cultural Revolution

The Cultural Revolution of the 1960s was a comprehensive effort by Mao Zedong to regulate how people think and behave. Citizens were forced to read the “Red Bible” and honor the Communist Party with quasi-religious rituals. Mutual supervision was encouraged throughout all of society. People were told that the way of thinking and behavior advocated by Mao Zedong was the only correct one.

Read More »

Read More »

Palisades Gold Radio Interview

Monetary Metals CEO Keith Weiner was back on the Palisades Gold Radio podcast being interviewed by Tom Bodrovics. Keith revealed one key feature that gold has, which bitcoin does not.

Read More »

Read More »

Market Economy Beats Planned Economy

Throughout the next weeks, we will regularly feature the keynote speeches held by our distinguished experts at this year’s digital Free Market Road Show. The times we are living in – the pandemic – are times when our fundamental values are threatened maybe more than ever in modern times.

Read More »

Read More »

Is the Gold Standard the Economists’ Punching Bag?

The following article was written by Keith Weiner, CEO of Monetary Metals, as a counterpoint to this article, POINT: Should the US Return to the Gold Standard? No It was originally published at InsideSources, here: COUNTERPOINT: Is the Gold Standard the Economists’ Punching Bag?

Read More »

Read More »

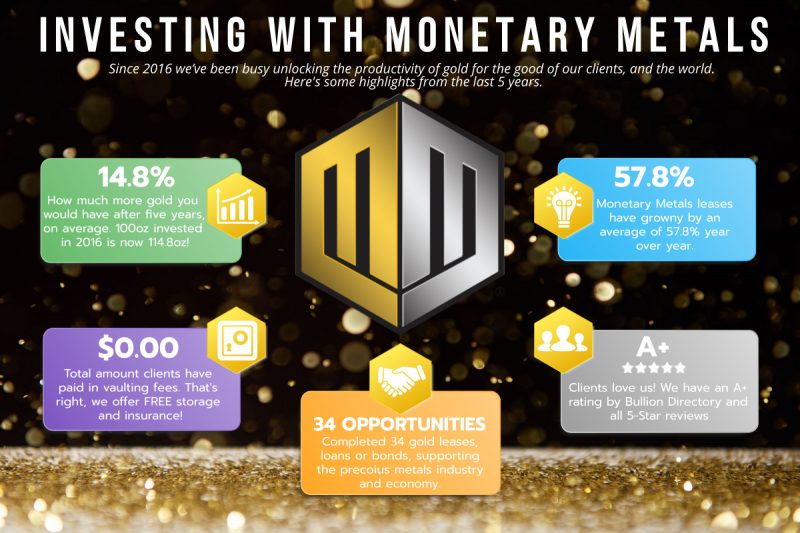

Celebrating Five Years of Interest on Gold

This month marks the five-year anniversary of Monetary Metals paying interest on gold. It was July 2016 when we offered our first Gold Fixed Income True Gold Lease. The gold lease was to Valaurum for manufacturing their flagship product, the Aurum®. It paid 3.0% interest on gold to investors (you can read the original press release here).

Read More »

Read More »

Prospects for China’s dual circulation strategy

Once again, the 2021 National People’s Congress, held from March 5-11, followed a strict choreography. The political leadership entered the Great Hall of the People to the sound of a military band and led by state and party leader, President Xi Jinping.

Read More »

Read More »

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

2 days ago -

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

28 days ago -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

2 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Was uns verschwiegen wurde: EU-Mail über Corona und Social-Media-Kontrolle

Was uns verschwiegen wurde: EU-Mail über Corona und Social-Media-Kontrolle -

Gott sei Dank, die Performance ist gerettet

Gott sei Dank, die Performance ist gerettet -

2-17-26 Overbought Cyclicals, Oversold Tech — Time to Rebalance?

2-17-26 Overbought Cyclicals, Oversold Tech — Time to Rebalance? -

CSU-Bürgermeister beißt sich an Höcke alle Zähne aus!

CSU-Bürgermeister beißt sich an Höcke alle Zähne aus! -

Ja, der Aktienmarkt ist ein Casino – wenn man ihn kurzfristig betrachtet

Ja, der Aktienmarkt ist ein Casino – wenn man ihn kurzfristig betrachtet -

Goldback Leather Wallets at Money Metals Exchange

Goldback Leather Wallets at Money Metals Exchange -

2-17-26 Bank, Brokerage, or Corporate Trustee?

2-17-26 Bank, Brokerage, or Corporate Trustee? -

„Wir müssen uns bei den Kindern entschuldigen.“

„Wir müssen uns bei den Kindern entschuldigen.“ -

Eklat: Deutscher Schauspieler entgleist komplett, weil seine ZDF Sendung abgesetzt wird!

Eklat: Deutscher Schauspieler entgleist komplett, weil seine ZDF Sendung abgesetzt wird! -

UK Unemployment Rises and Private Pay Increases Slow to Five-Year Lows, Pulling Sterling Lower

UK Unemployment Rises and Private Pay Increases Slow to Five-Year Lows, Pulling Sterling Lower

More from this category

The Anti-Concepts of Money: Conclusion

The Anti-Concepts of Money: Conclusion15 Apr 2024

Gold Outlook 2024 Brief

Gold Outlook 2024 Brief12 Mar 2024

CEO Keith Weiner Quoted in Barron’s

CEO Keith Weiner Quoted in Barron’s3 Feb 2023

Reflections Over 2022

Reflections Over 20222 Jan 2023

Sam Bankman-Fried FTX’ed Up

Sam Bankman-Fried FTX’ed Up17 Nov 2022

How to Build and Destroy a Pension Fund System in 22 Easy Steps

How to Build and Destroy a Pension Fund System in 22 Easy Steps26 Oct 2022

The Russians (Propaganda) Are Coming!

The Russians (Propaganda) Are Coming!15 Sep 2022

Keith Weiner on the VoiceAmerica Business Channel

Keith Weiner on the VoiceAmerica Business Channel7 Sep 2022

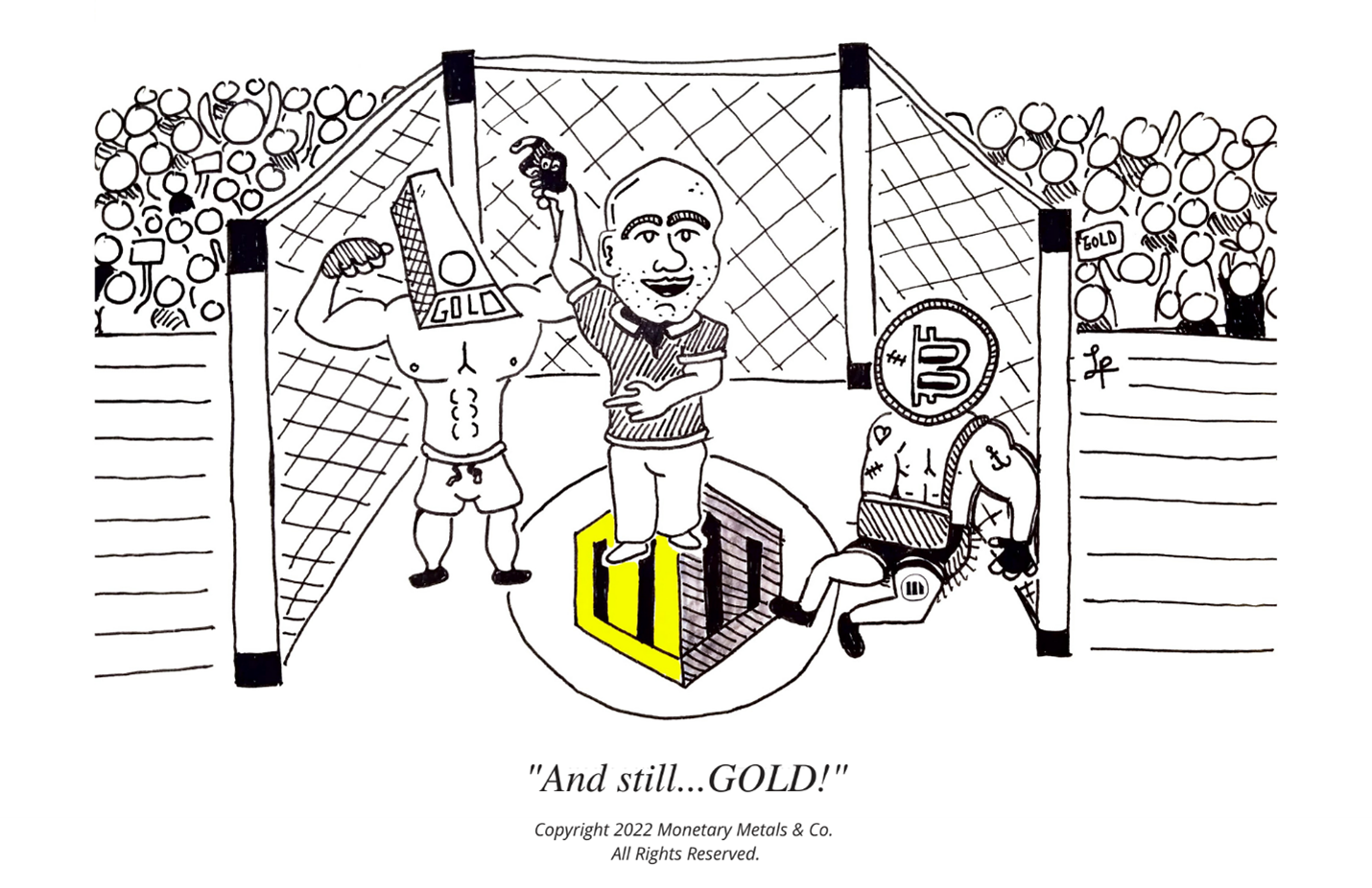

The Knockout Blow to Crypto

The Knockout Blow to Crypto24 Aug 2022

Soho Forum Debate: Gold vs Bitcoin

Soho Forum Debate: Gold vs Bitcoin19 Jul 2022

Is Gold About To Go Mainstream?

Is Gold About To Go Mainstream?16 Jul 2022

CEO Keith Weiner on Real Talk with Zuby

CEO Keith Weiner on Real Talk with Zuby28 Jun 2022

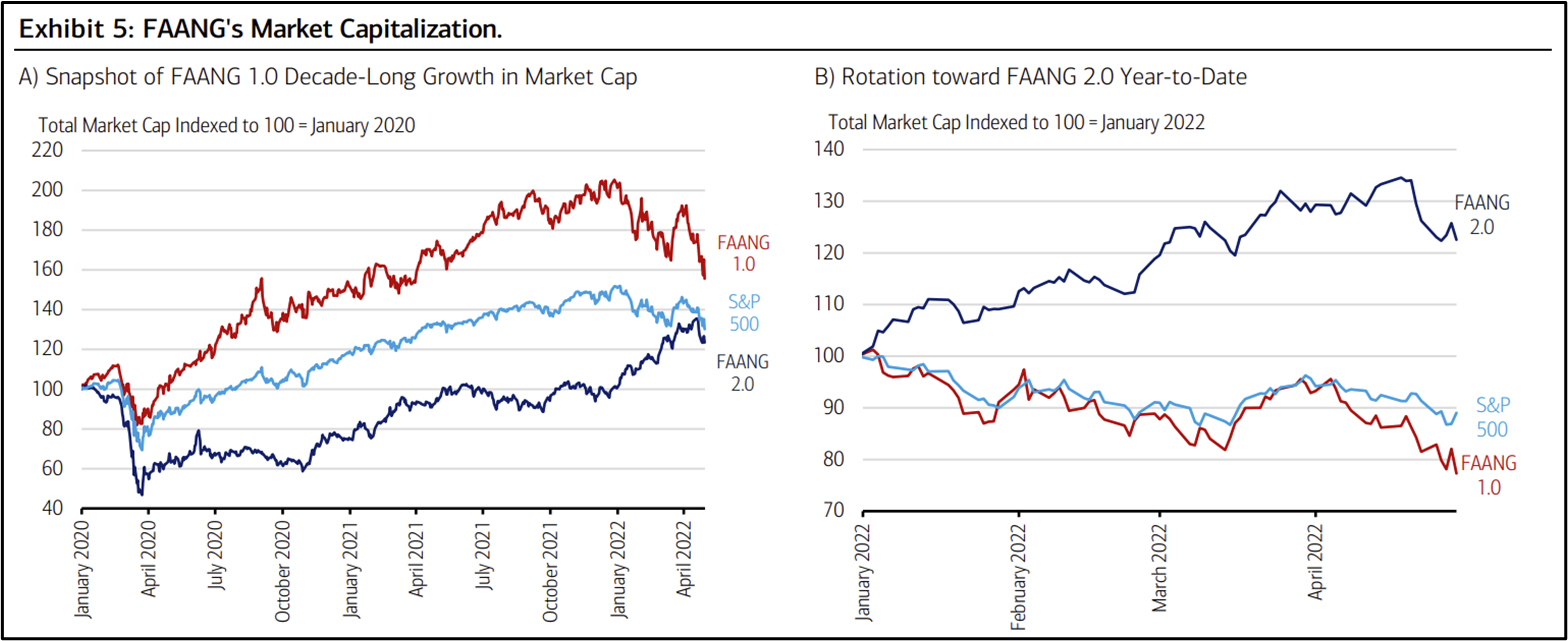

Unit of Account and Current Valuations by Paul Belanger

Unit of Account and Current Valuations by Paul Belanger27 Jun 2022

Investments, Speculations and Money by Paul Belanger

Investments, Speculations and Money by Paul Belanger24 Jun 2022

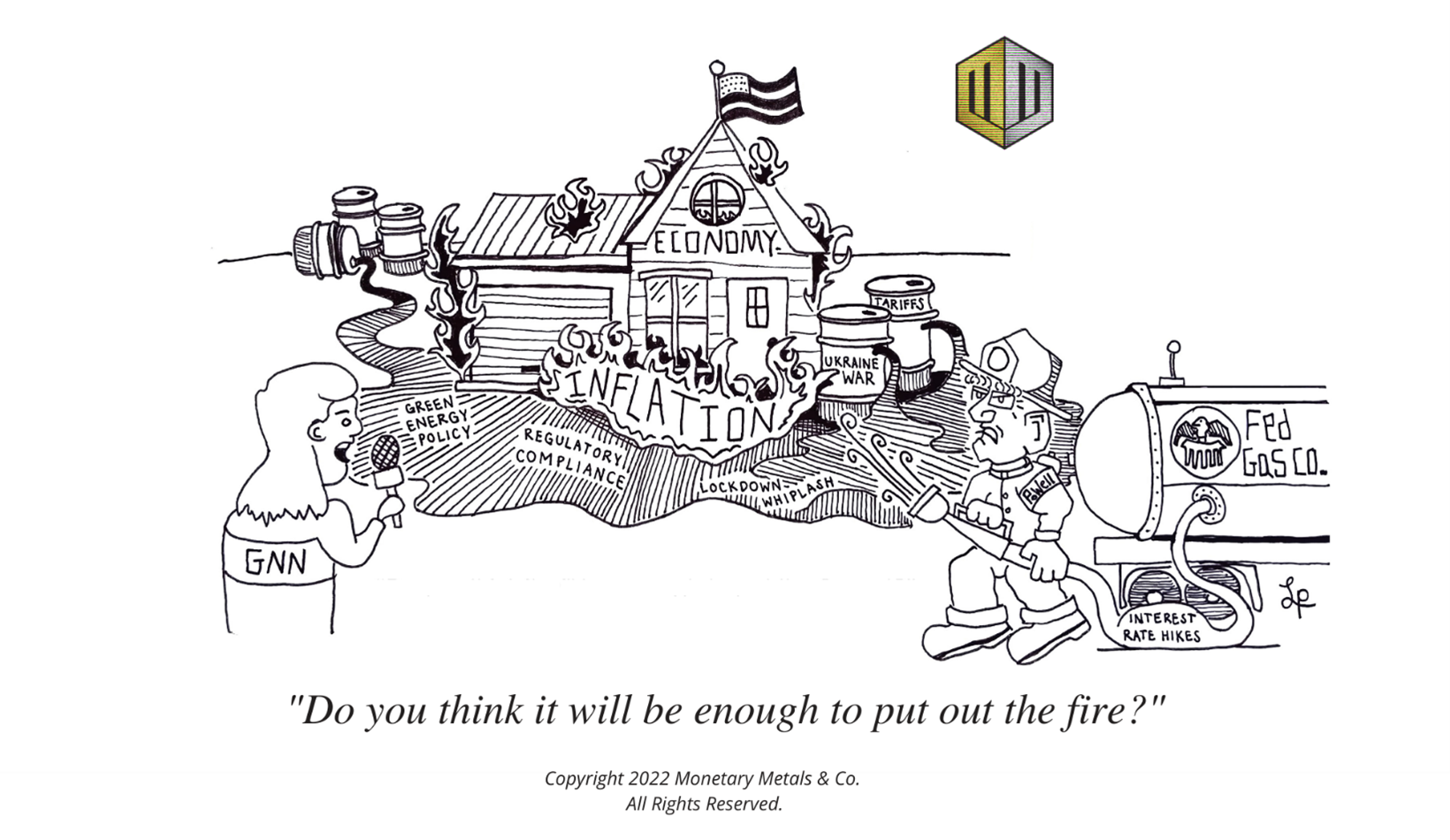

Will Interest Rate Hikes Fix Inflation?

Will Interest Rate Hikes Fix Inflation?19 Jun 2022

Analysis Featured In Gold We Trust Report 2022

Analysis Featured In Gold We Trust Report 202211 Jun 2022

Monetary Metals CEO Keith Weiner Interviewed on RealVision

Monetary Metals CEO Keith Weiner Interviewed on RealVision3 Jun 2022

Open Letter to Lex Fridman and Michael Saylor

Open Letter to Lex Fridman and Michael Saylor19 May 2022

Monetary Metals Completes Latest Capital Raise

Monetary Metals Completes Latest Capital Raise5 May 2022

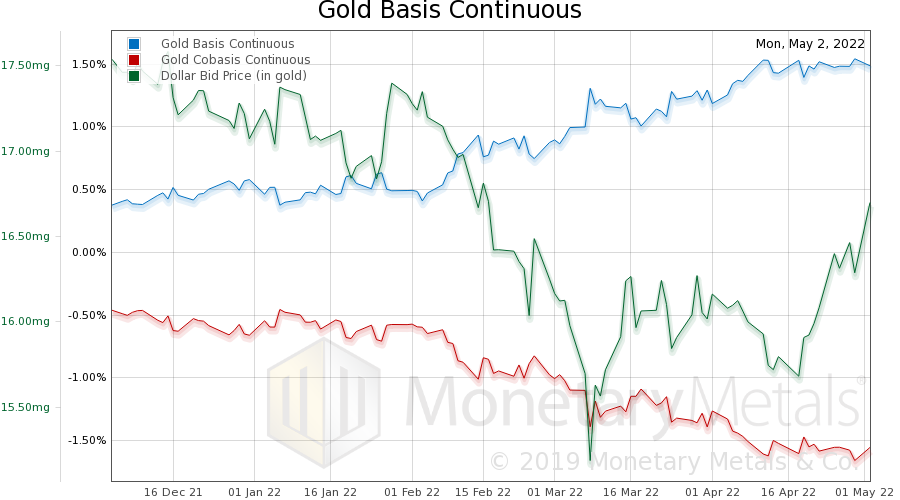

Time for a Silver Trade?

Time for a Silver Trade?4 May 2022