Tag Archive: Basic Reports

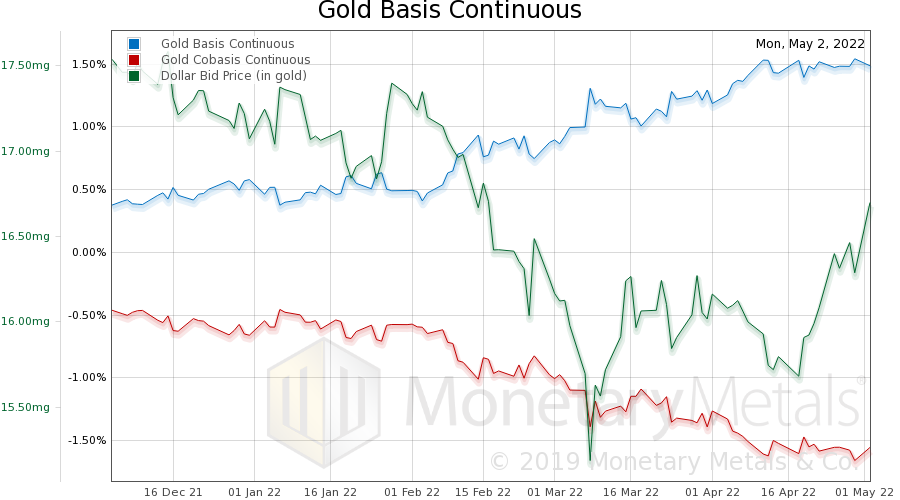

Why Isn’t Gold Going Up with Inflation?

Many voices in the gold community are making a simple point. Look at the prices of oil, copper, and other commodities. They are skyrocketing. The mainstream explanation—shared by Keynesians, Monetarists, and many Austrians—is that the cause of this skyrocketing is the increase in the quantity of what is called “money”.

Read More »

Read More »

Transitory Inflation and Useless Ingredients

Can you remember back to when you were two or three years old? Toddlers often think that there are little people inside the TV (or maybe this was only true when the TV was about as deep as it was wide—and maybe kids today don’t think this when looking at a 60-inch flatscreen…)

Read More »

Read More »

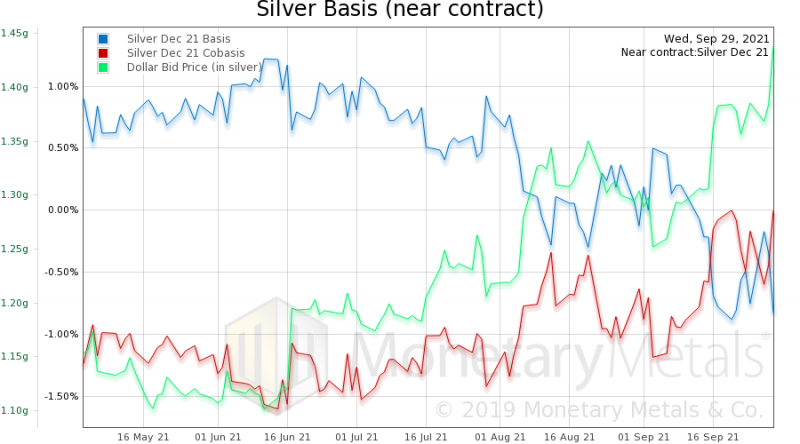

Silver Crash Makes Silver Trash?

The price of silver dropped a dollar, or over 4% on Wednesday. Some voices in the precious metals press want you to think that there is only one conceivable cause. We should coin a term for this form of logical fallacy: argumentum ad ignorantia. This is an argument of the form: “the cause must be XYZ, as I cannot conceive of anything else.”

Read More »

Read More »

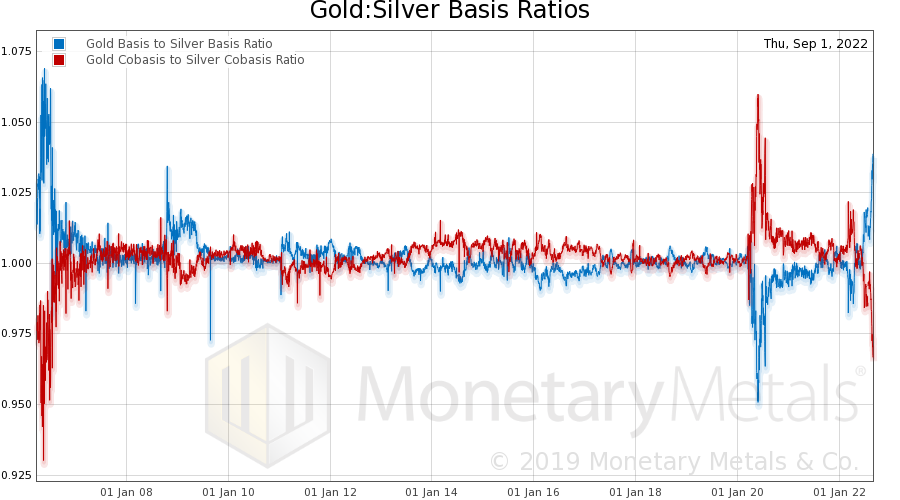

Gold and Silver Price Fundamentals Update

This time, we start with the gold-silver ratio. Let’s revisit something we said on 23 August:

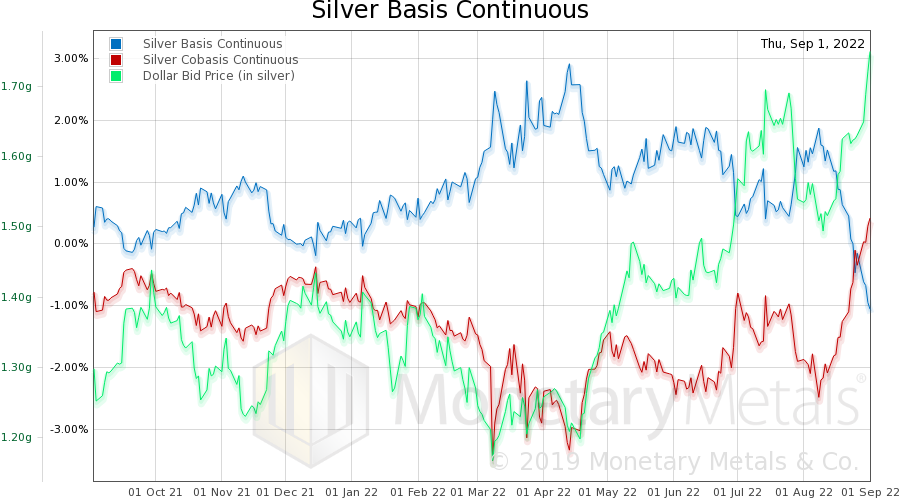

“…the supply and demand fundamentals of silver are stronger here than they have been since the Covid crisis

Read More »

Read More »

How Do They Get Away With It?

Picture, if you will, a government that deliberately inflicts bad policy on the people. I know this sounds crazy, and could never happen, but please bear with me. Suppose the government criminalizes hiring someone who produces less than an arbitrary threshold. Or it forces the closure of all businesses deemed to be non “essential”.

Read More »

Read More »

Where do gold and silver prices go from here?

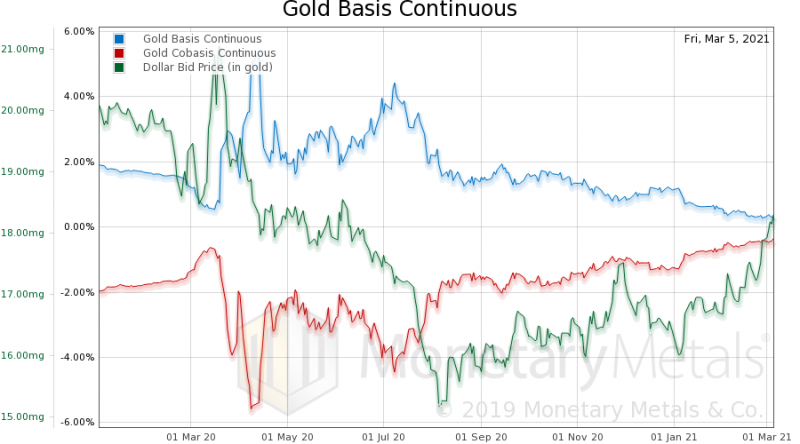

One way to look at the price of gold, is that it dropped from its high around $1,900 in early June. Another way is to zoom out, and look at the big picture. Here is a 10-year chart of gold and silver prices.

For over four years, after the peak around $1,900 ten years ago (early September 2011), the price of gold moved down. By December 2015, it was just over $1,000. Then it was a sideways market until three years ago (August 2018), when the price...

Read More »

Read More »

What Trick did Tricky Dicky Pull 50 Years Ago Today?

Sometimes, bad luck can strike. But other times, a catastrophe comes from a series of bad decisions, each the reaction to the consequences of the previous one.

On August 15, 1971, President Nixon decreed that the US dollar would no longer be redeemable for the gold owed, even to foreign governments.

Read More »

Read More »

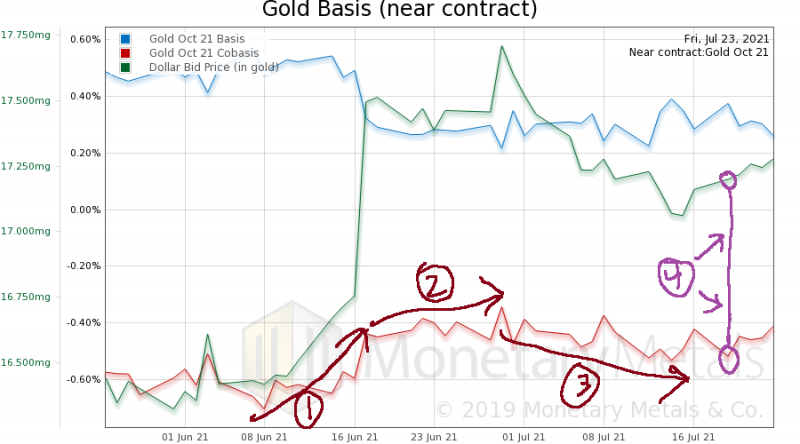

Gold Price Smashdown vs Gold on Fire

No sooner did we write Silver Rorschach Test, than the price of gold flash-crashed, or was smashed down. On Sunday afternoon in Arizona—i.e. Monday morning in Australia and Asia—the gold price dropped sharply. Gold bug sources claim that the drop was $100, but as we can see from the price graph included in this report, the actual crash itself was about $70.

Read More »

Read More »

Motivated Reasoning About Silver

We’re seeing the argument, again, that silver stocks are being consumed in solar panels, medical applications, and of course, electronics. This argument has a certain temptation. After all, the standard assumption is that value is inversely proportional to quantity. Purchasing power is widely believed to be 1 / N (N is number of units of currency issued).

Read More »

Read More »

Basel III’s Effect on Gold and Silver

There is sometimes a tendency to confuse ends and means. For example, in traveling through an airport there is extensive inspection of passengers. Before you are allowed to board an airplane, you must go through a process that is intrusive and increasingly invasive.

Read More »

Read More »

Inflation or Lockdown Whiplash?

Mainstream analysis sees rising consumer prices, and looks for a monetary cause. Also, when it sees an increase in the quantity of dollars, it looks for rising consumer prices. It is a fact that the quantity of what the mainstream calls money (i.e. the dollar) has risen at an extraordinary rate.

Read More »

Read More »

What the Heck Just Happened to the Price of Gold and Silver?!

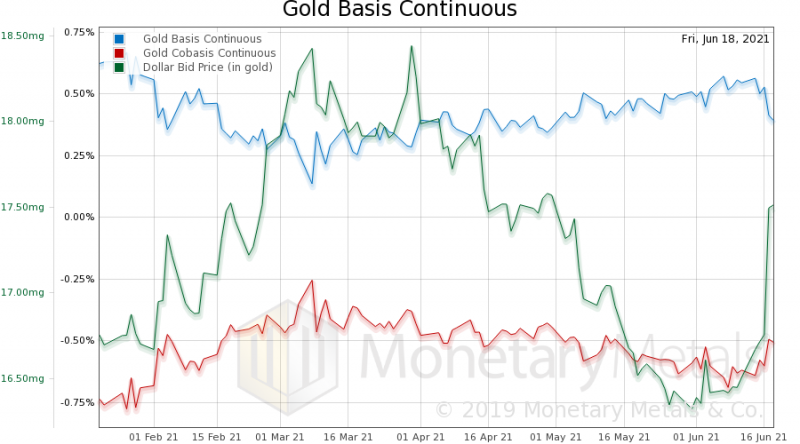

The price of gold (and silver) was on a tear in April and May. Then some sideways action. And then this week, thud. On Twitter, a popular meme is that the banks smashed the price by selling futures contracts, though there was no selling of gold bars. Let’s just say that if the price of an August contract fell by $120, while the price of a gold bar held steady, there would be a backwardation of around 40%!

Read More »

Read More »

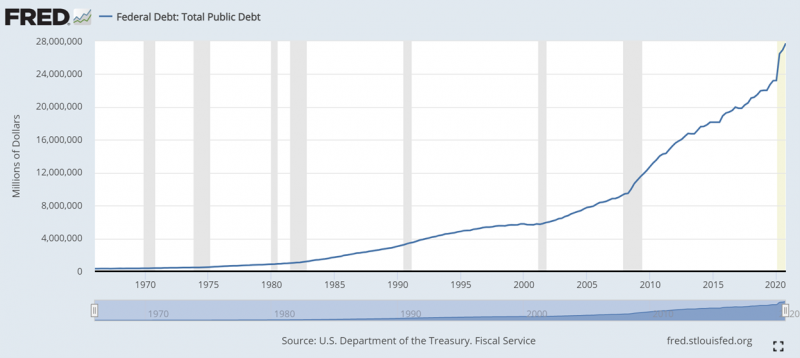

Resetting the Federal Debt

According to the US Treasury, the federal government owes $28.2 trillion. It crossed the “28” threshold on the last day of March. The debt was just under $25 trillion at the end of April a year ago. There’s no question it’s growing at a faster and faster pace, and now there’s the excuse of Covid to spend more.

Read More »

Read More »

A Deeper Dive Into Silver

The prices of the metals hit their lows by the end of April. Gold traded for around $1,685, and is now over $1,900. Silver was around $24, and is now over $28. These are big moves (though of course nothing like bitcoin).

Read More »

Read More »

The Truth about the Silver Squeeze

Some recent videos about the silver market are generating more buzz than we have seen in a while. They make several points, but the main one is that there is a global shortage of silver. This assertion stands in contradiction to the fact that the silver price has dropped. As of the date of the first of these videos, it had dropped around 10% from its level just a month earlier.

Read More »

Read More »

The Fedcoin is Coming, 8 March

Before we talk about Fedcoins, let’s look at the old school non-digital, non-blockchain, coin. Gold. And silver. Since January 4, the price has dropped about $244. And the price of silver has fallen about $4. Are these buying opportunities? Or the end of the brief gold bull market of 2020 (i.e. Covid)?

Read More »

Read More »

Reddit Residue on Silver, 3 February

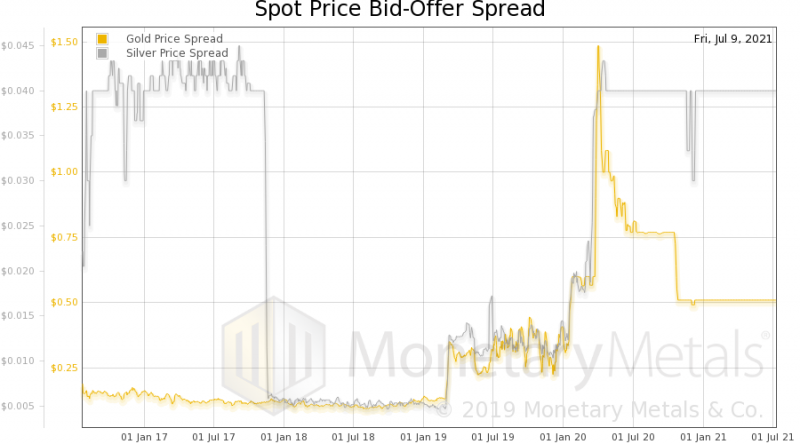

The price of silver is going up and down like a yo-yo. On Sunday and into the first part of Monday, the price skyrocketed on news that Reddit was touting the metal. But as the data clearly showed, the price was not driven up by retail buying of physical metal.

Read More »

Read More »

Ruh Roh Silver

Sometimes you can count on the manipulation conspiracy theorists to get it exactly wrong. Not just a little bit wrong, nor halfway wrong. Not even mostly wrong. Totally wrong, backwards.

Read More »

Read More »

That Precious Metals Rumor Mill, 30 November

We are hearing rumors this week of a shortage of the big silver bars, the thousand-ouncers. No, we don’t refer to bullion banks saying this. Nor big dealers, who are happy to sell us as many of these as we can buy. Nor our peeps in high places (we don’t claim to have any such peeps).

Read More »

Read More »

Yes, Virginia, There Is An Alternative, 11 November

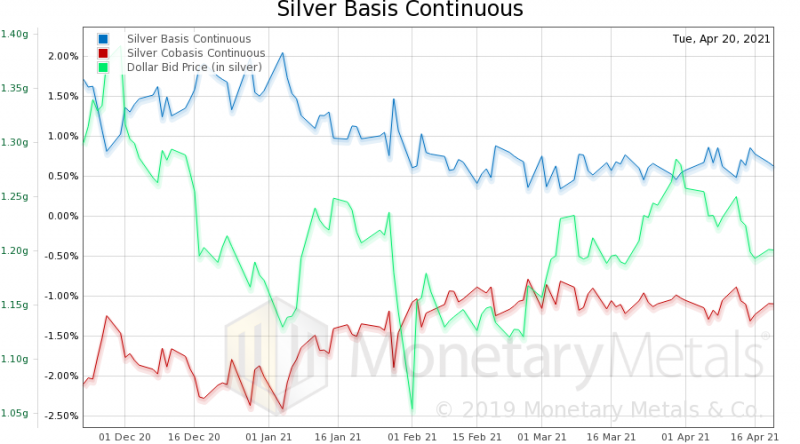

On Monday the dollar had a ferocious rally, moving up from 15.87mg gold to 16.77mg and from 1.21g silver to 1.32g. In mainstream terms, the price of gold dropped about a hundred bucks, and the price of silver crashed $2.20.

Read More »

Read More »

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

7 days ago -

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

2026-01-21 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

7 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Eilmeldung: Attentat auf Trump: Täter in Mar-A-Lago getötet!

Eilmeldung: Attentat auf Trump: Täter in Mar-A-Lago getötet! -

Eilmeldung: Supermarkt Fachkraft für Warenverräumung fleißig bei der “Arbeit”!

Eilmeldung: Supermarkt Fachkraft für Warenverräumung fleißig bei der “Arbeit”! -

Die Performance der Kryptowährungen in KW 8: Das hat sich bei Bitcoin, Ether & Co. getan

Die Performance der Kryptowährungen in KW 8: Das hat sich bei Bitcoin, Ether & Co. getan -

Robert Fico stellt Ultimatum an Selenski: “In 12 Stunden ist dein Strom weg!”

Robert Fico stellt Ultimatum an Selenski: “In 12 Stunden ist dein Strom weg!” -

EL SALVADOR NO HA PERDIDO AÑOS DE CRECIMIENTO

EL SALVADOR NO HA PERDIDO AÑOS DE CRECIMIENTO -

Eil: Total-Schaden für IG Metall: Mitglieder flüchten in Scharen!

Eil: Total-Schaden für IG Metall: Mitglieder flüchten in Scharen! -

Wie du 100 € skalierst und wirklich unabhängig wirst

Wie du 100 € skalierst und wirklich unabhängig wirst -

Big Banks Get Bullish on Gold, But Some Politicians Get Grabby

Big Banks Get Bullish on Gold, But Some Politicians Get Grabby -

EU-Stablecoins: Innovation bis die EZB den Knopf drückt!

EU-Stablecoins: Innovation bis die EZB den Knopf drückt! -

Galaktische Gewinne – die besten Ideen des Weltraum-Kapitalisten

Galaktische Gewinne – die besten Ideen des Weltraum-Kapitalisten

More from this category

Gold Outlook 2024 Brief

Gold Outlook 2024 Brief12 Mar 2024

Silver Fever, or Silver Fading?

Silver Fever, or Silver Fading?16 Sep 2022

Silver Update: Scarcity Gets More Extreme

Silver Update: Scarcity Gets More Extreme5 Sep 2022

The Silver Phoenix Market

The Silver Phoenix Market2 Sep 2022

Buy Gold, Because…

Buy Gold, Because…11 Aug 2022

What the Heck Is Happening to Silver?!

What the Heck Is Happening to Silver?!20 Jul 2022

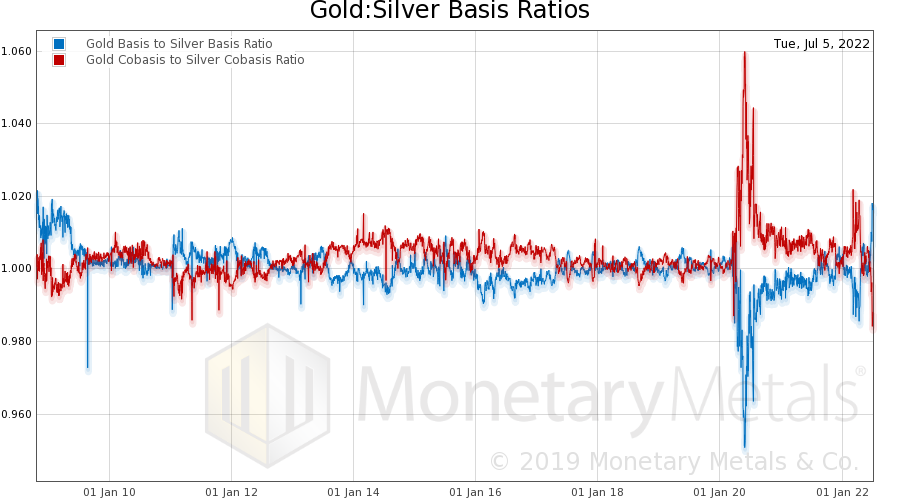

Rare Gold-Silver Crystal Sighting

Rare Gold-Silver Crystal Sighting8 Jul 2022

Will Interest Rate Hikes Fix Inflation?

Will Interest Rate Hikes Fix Inflation?19 Jun 2022

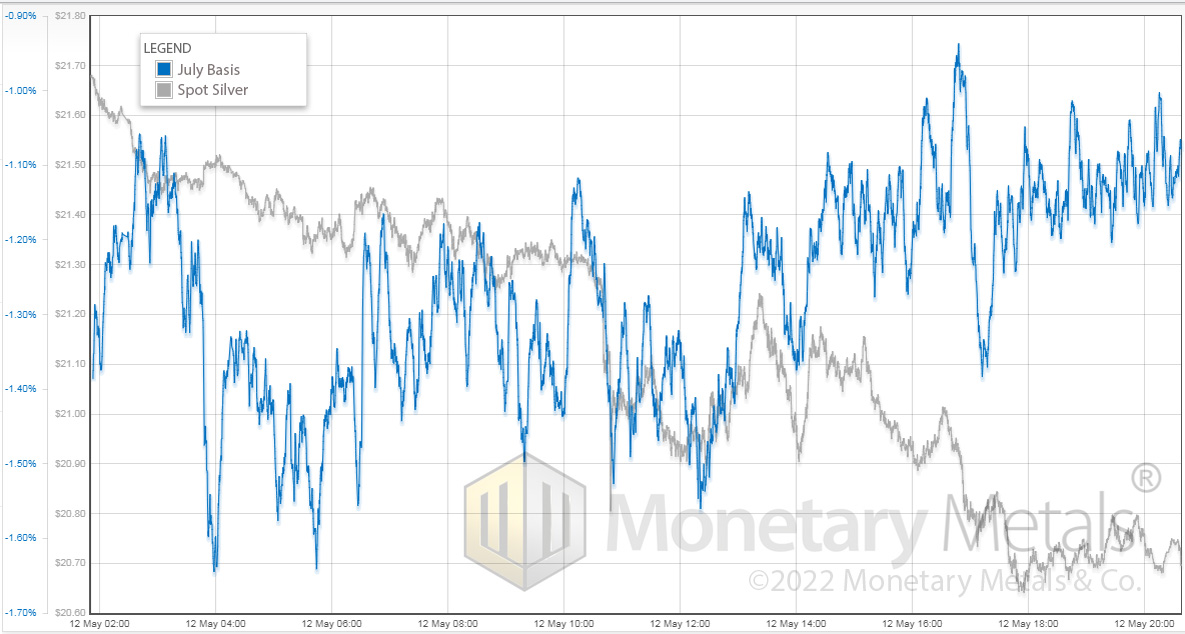

The Silver Chart THEY Don’t Want You to See!

The Silver Chart THEY Don’t Want You to See!16 May 2022

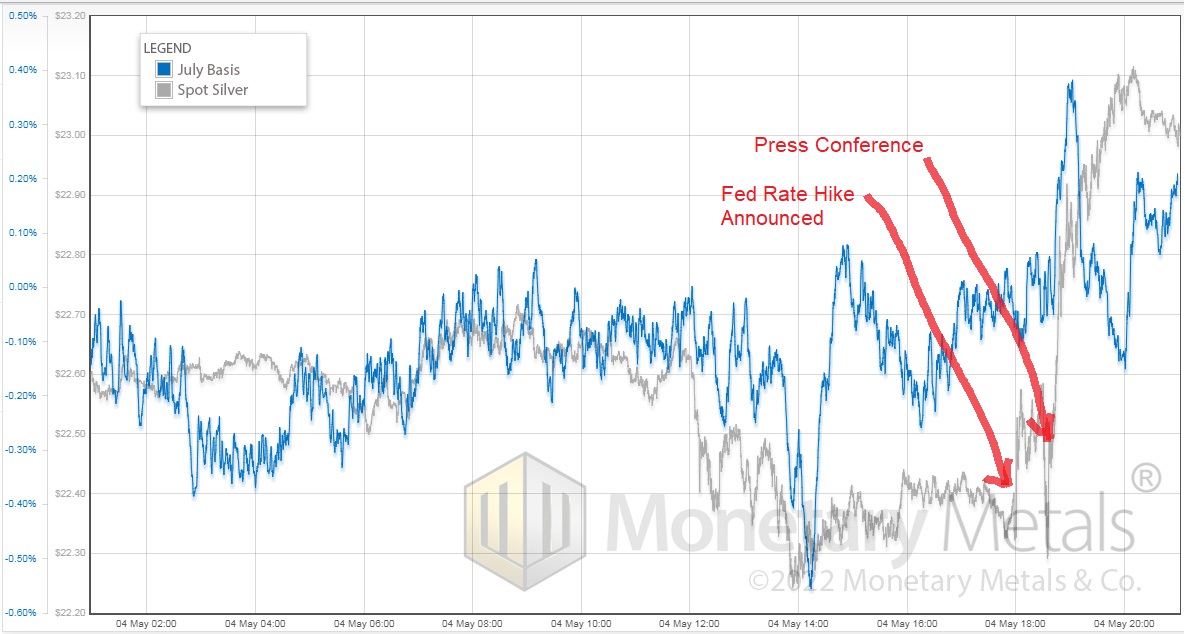

Forensic Analysis of Fed Action on Silver Price

Forensic Analysis of Fed Action on Silver Price9 May 2022

Time for a Silver Trade?

Time for a Silver Trade?4 May 2022

Oil, the Ruble and Gold Walk into a Bar…Part III

Oil, the Ruble and Gold Walk into a Bar…Part III 12 Apr 2022

Oil, the Ruble, and Gold Walk into a Bar…

Oil, the Ruble, and Gold Walk into a Bar… 5 Apr 2022

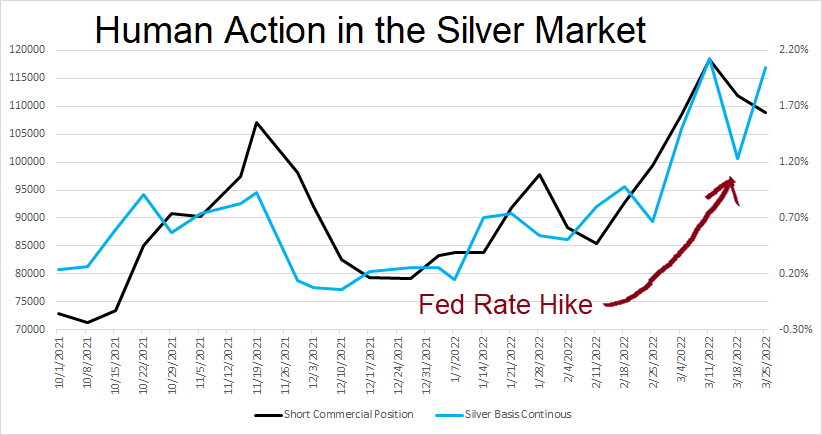

Human Action in the Silver Market

Human Action in the Silver Market29 Mar 2022

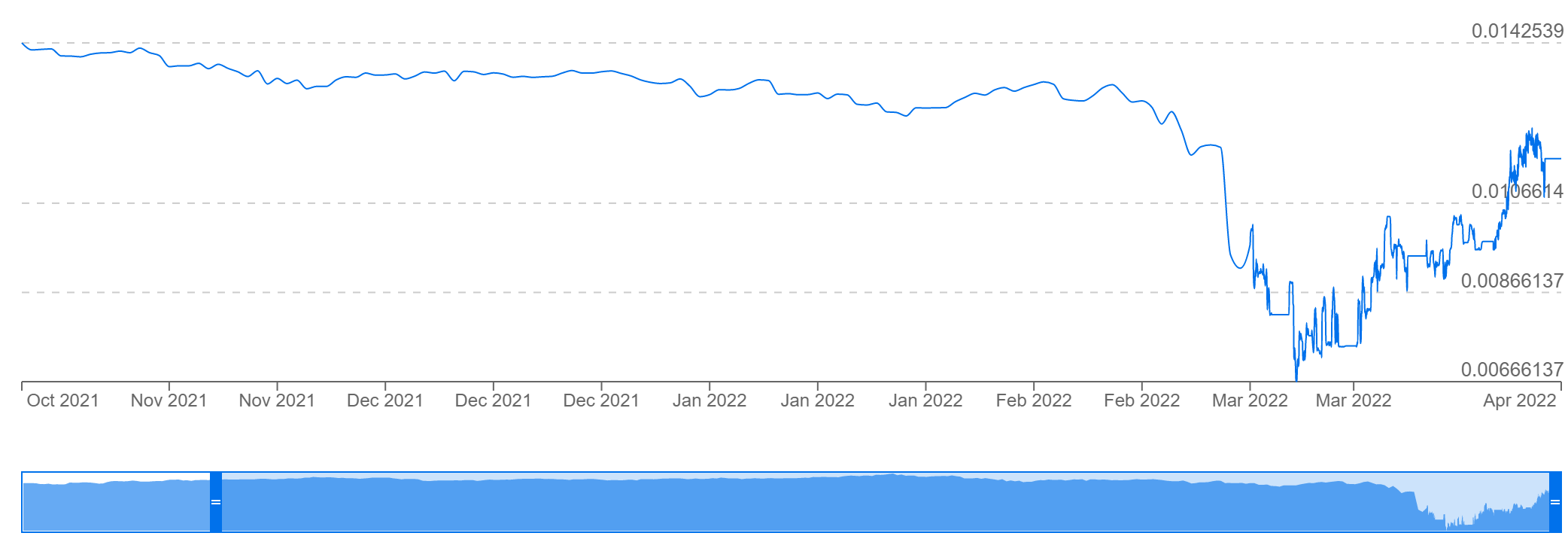

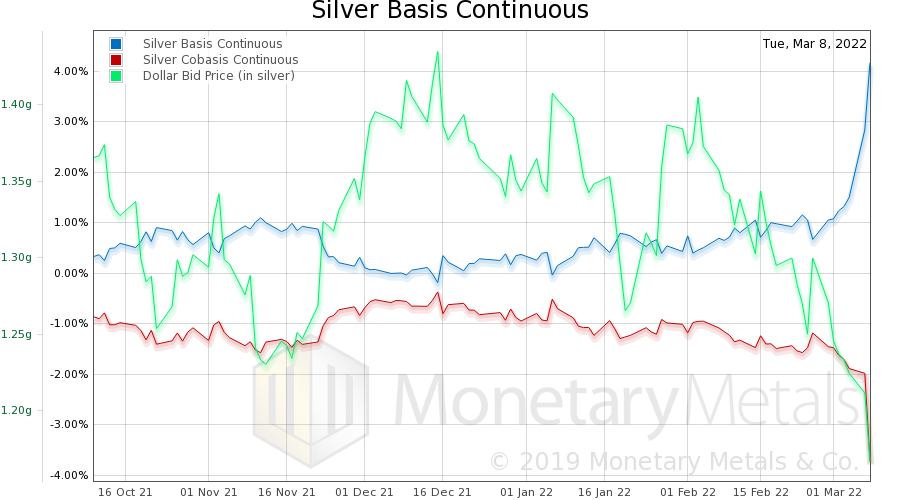

This is Not The Silver Breakout You’re Looking For!

This is Not The Silver Breakout You’re Looking For!10 Mar 2022

Inflation and Gold: What Gives?

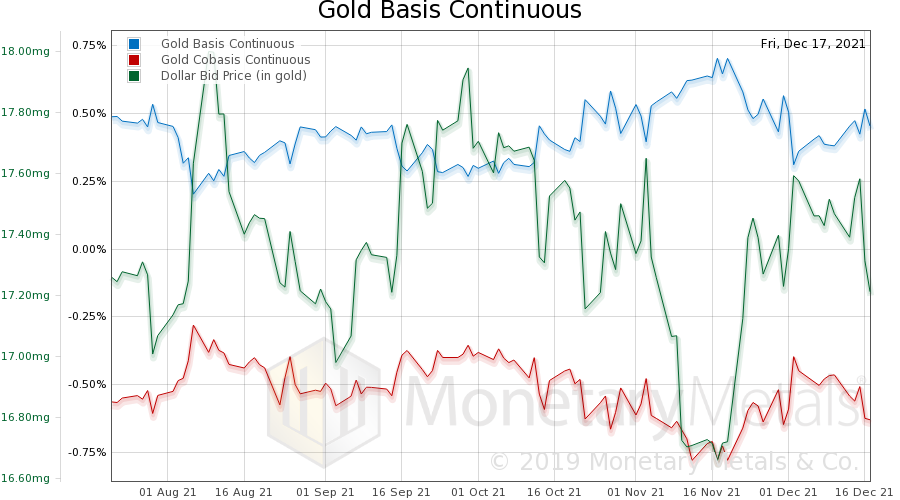

Inflation and Gold: What Gives?21 Dec 2021

What’s In Your Loan?

What’s In Your Loan?23 Nov 2021

Perversity Thy Name is Dollar

Perversity Thy Name is Dollar16 Nov 2021

Rising Fundamentals of Gold and Silver

Rising Fundamentals of Gold and Silver10 Nov 2021

Why a Yield on Gold Matters

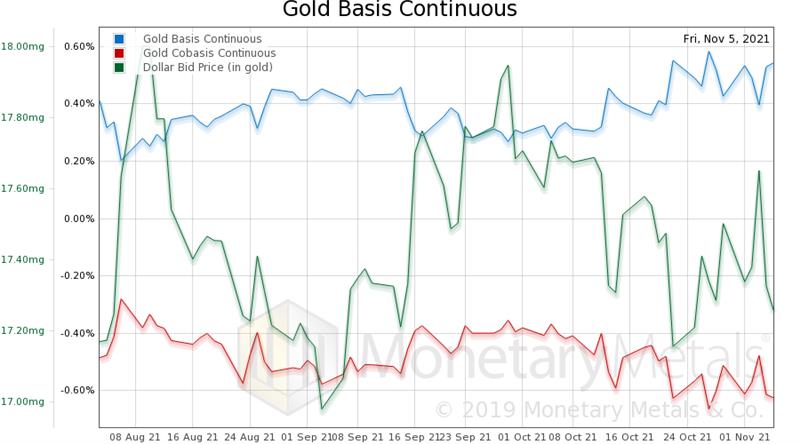

Why a Yield on Gold Matters3 Nov 2021