Tag Archive: Bailout

German constitutional court needs 3 months to decide about the injunction

The German constitutional court will need up to 3 months for the injunction. Weidmann's critic on the ESM in detail. Estimations of German liability between 900 bln. and 2 trillion EUR.

Read More »

Read More »

German constitutional court injunction decision on ESM and the potential referendum

What is the injunction procedure of the German constitutional court exactly about. What are the arguments of the Anti-ESM and the Pro-ESM fractions ?

Read More »

Read More »

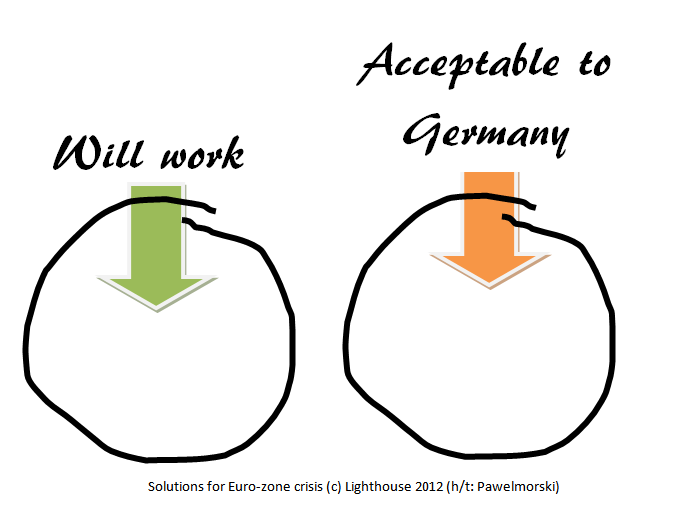

Merkel: ‘No Eurobonds as Long as I Live’, Hollande: ‘Eurobonds will take up to 10 years’

German chancellor Angela Merkel today confirmed the content of our article that Eurobonds are pure utopia. She vows "No Eurobonds as Long as I Live".

Read More »

Read More »

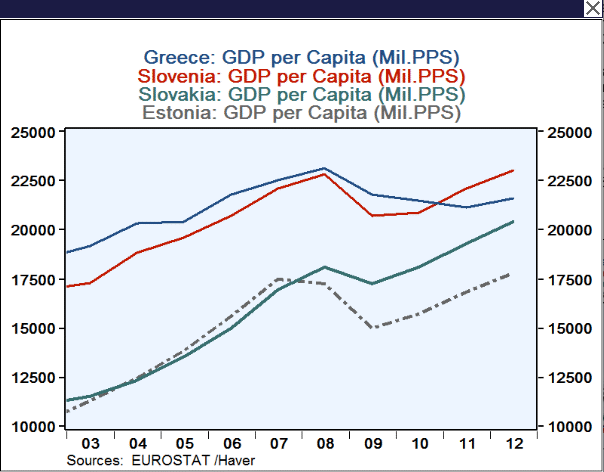

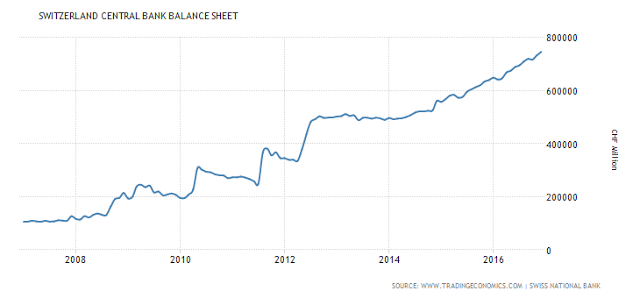

The win of the pro-bailout parties in the Greek elections was no win for the SNB

The win for the pro-bailout parties in the Greek elections was no win for the Swiss National Bank (SNB), even if the fear of an immediate bank-run and extreme money flows into Switzerland are avoided. Also the fact that QE3 is not coming in the next weeks did not help the SNB.

Read More »

Read More »

The German supply-side reforms or will German companies take over the PIIGS ?

Words heart on German street in 2010 during the first Greek bailouts were that Germany should obtain the Greek islands as collateral if Greece is not able to pay back the debt to Germany. But even today German n-tv is reporting about many Greek real estate brokers that are currently delling islands. If it is not that type … Continue...

Read More »

Read More »

SNB meeting on March 15th, 2012: Pure Speculation that SNB raises floor, How to Trade it ?

Between November 2011 and January 2012 mostly left-wing politicians and trade unions wanted the EUR/CHF floor to be risen to 1.30 or 1.40 and uttered their wishes regularly in the Swiss newspapers, triggering many FX traders to speculate on this hike. Recently these demands have become more silent even if some UBS analysts still see the floor to …

Read More »

Read More »

EUR/CHF: One Year of Free Market (07/2010-07/2011): May 2011

May 2011 ForexLive Asian Market Open: Analysis With Fries Just brilliant Jamie Australian GDP this morning and the market is now gearing itself for a poor number after yesterday’s data and weekend comments from the Treasurer. China is selling rallies in AUD/USD and Middle East Sovereigns are buying big dips; sounds like a recipe for medium … Continue reading »

Read More »

Read More »

EUR/CHF: One Year of Free Market (07/2010-07/2011): November 2010

EUR/CHF Continues Lower Presently down at 1.3055 from early 1.3090, having been as low as 1.3037 so far. Earlier I was reading comments made by UBS economist Huenerwadel, who said “At least from a fundamental point of view and aware of the increased long CHF positioning, very little speaks in favour of a materially higher EUR/CHF … Continue reading...

Read More »

Read More »

EUR/CHF, a Year of Free Market (07/2010-07/2011): July 2010

EUR/CHF Hit Again EUR/CHF has been hit again, down at 1.3535 from early 1.3580. Recently there has been talk of the Swiss National Bank selling the cross, something I for one certainly can’t substantiate. Also yesterday there were rumours of a September rate hike in Switzerland. All very murky. The EUR/CHF cross selling has helped pressure EUR/USD, which is … Continue reading »

Read More »

Read More »