Tag Archive: Australian Dollar

FX Weekly Review, October 10-14: Rates Still Key to Dollar’s Outlook

The Swiss Franc index had once again a bad stance against the dollar index. The CHF index was down 1%. The dollar index, however, improved. The US dollar rose against the major currencies last week, except the Australian and Canadian dollars.

Read More »

Read More »

FX Weekly Review, October 03-07: Dollar Profits on Strong ISM Index

The Franc index lost considerably in the last week, in particularly in comparison to the dollar index. Reason was the exceptionally strong U.S. ISM Non-Manufacturing Index.

Read More »

Read More »

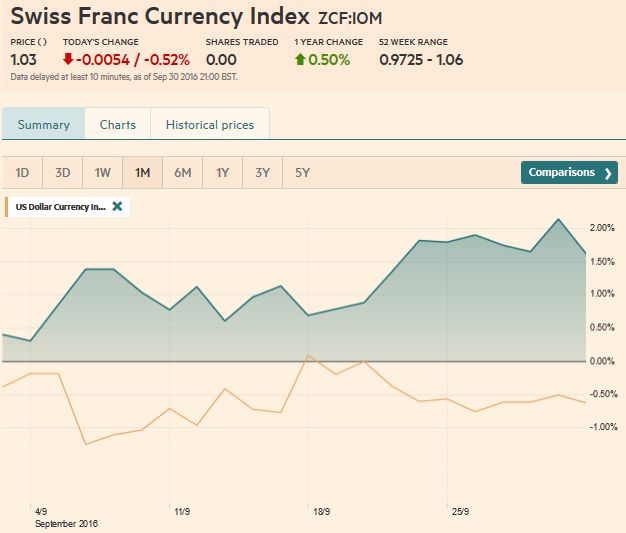

FX Weekly Review, September 26-30: Dollar vulnerable at the Start of Q4, CHF collapses at Quarter End

The US dollar fell against most of the major currencies in Q3. The Norwegian krone was the best performer, gaining 4.4% against the greenback, followed by Aussie and Kiwi. The Swiss Franc collapsed on Friday at quarter end.

Read More »

Read More »

FX Weekly Review, September 12 – 16: U.S. Dollar Resilience Despite Hawkish ECB and bad ISM

The dollar was surprisingly strong this week. This despite a more hawkish ECB, bad U.S. economic data in the ISM surveys.

Read More »

Read More »

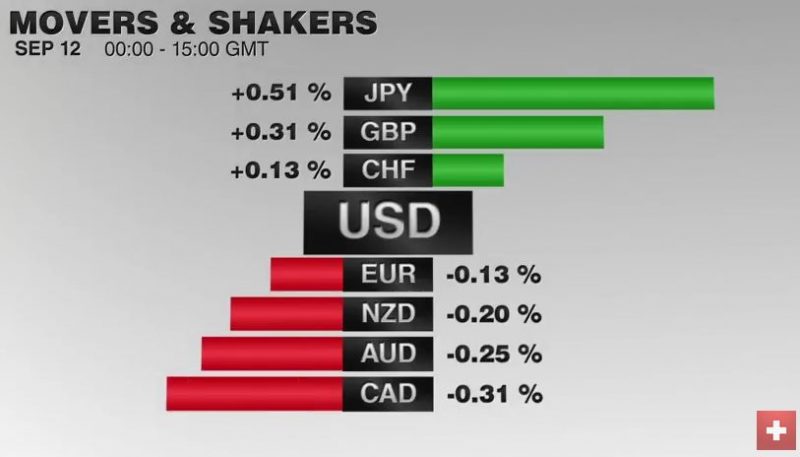

FX Daily, September 12: Markets Off to a Wobbly Start

The EUR/CHF retreated today together with falling stock prices. When investors sell their stocks and move into cash, then the Swiss Franc very often appreciates. This is the safe haven effect: cash in Swiss Franc is perceived as more secure.

Read More »

Read More »

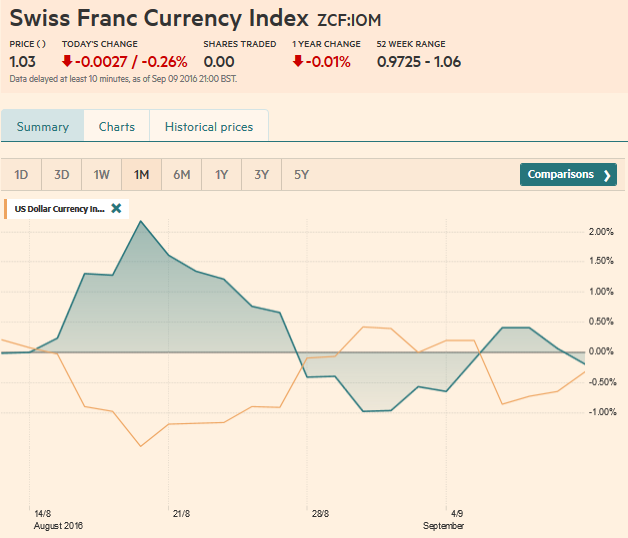

FX Weekly Review, September 05 – September 09: Dollar Proves Resilient as Market Rates Rise

It took the market a few days to overcome the shockingly poor non-manufacturing ISM (51.4 vs. 55.5). However, by the end of the week, the US dollar bulls had regained the upper end.

Read More »

Read More »

FX Weekly Review, August 29 – September 2: Disappointing Jobs Data Doesn’t Break the Buck

During this week the Swiss Franc index lost against both dollar and euro. The CHF index ended one percent down. Despite not convincing US jobs, the dollar index ended in positive territory.

Read More »

Read More »

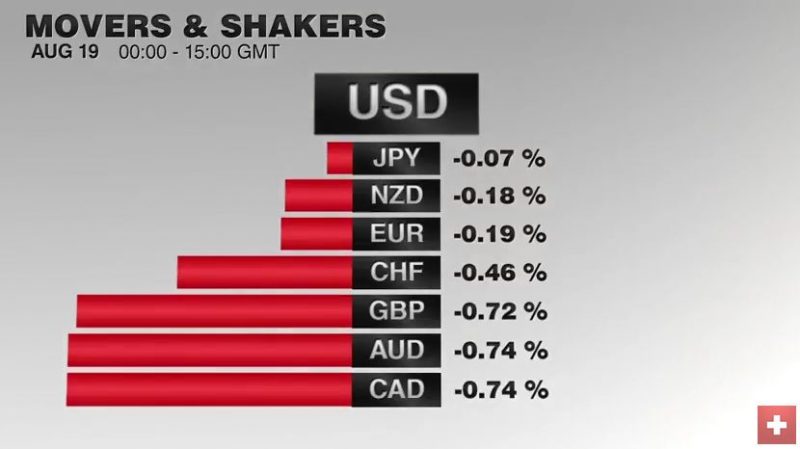

FX Daily, August 19: Dollar Recovers into the Weekend

The US dollar is trading firmly ahead of the weekend as part of this week's losses are recouped. The euro is trading within yesterday's range, holding to a little more than a half-cent above $1.13. However, as we have noted, the Asia and European participants appear more dollar-friendly than Americans

Read More »

Read More »

FX Daily, August 18: US Dollar Pushed Lower, but Do FOMC Minutes Really Trump Dudley?

A bad day for the dollar means a good day for CHF, that appreciates against both euro and dollar. It is not a good day for the US dollar. It is being sold across the board. The seemingly dovish FOMC minutes released late yesterday appears to have gotten the ball rolling. The takeaway for many was that any officials wanted more time to assess the data at the July meeting.

Read More »

Read More »

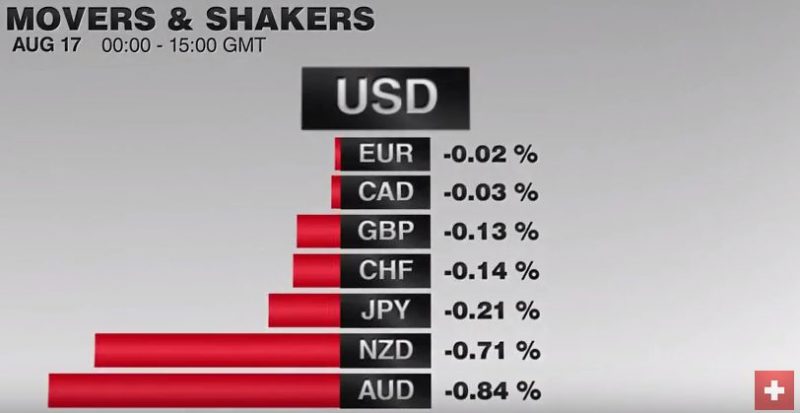

FX Daily, August 17: Dollar Snaps Back

The US dollar is enjoying a mid-week bounce against all the major currencies. It appears that participants in Asia and Europe are giving more credence to NY Fed Dudley's comments yesterday. Although many in the market have given up on a rate hike this year, Dudley reaffirmed his belief that the economy was accelerating in H2 and that the market was being too complacent.

Read More »

Read More »

Great Graphic: Aussie Tests Three-Year Downtrend

The Australian dollar's technical condition has soured. Market sentiment may be changing as the MSCI World Index of developed equities posted a key reversal yesterday. It is not clear yet whether the Aussie is correcting lower or whether there has been a trend change.

Read More »

Read More »

FX Daily, August 15: Dollar Eases to Start the New Week

The US dollar closed the pre-weekend session well off its lows that were seen in response to the disappointing retail sales report. It has been unable to sustain the upside momentum, and as North American dealers prepare to return to their posts, it is trading lower against most of the major currencies. The notable exceptions are the Scandi-bloc, which are consolidating last week's gains, and sterling, which remains pinned near $1.29.

Read More »

Read More »

FX Weekly Preview: Thoughts on the Significance of Ten Developments

The GDP deflator may be just as important as overall growth for BOJ considerations and the possibility of fresh action next month. Falling UK rates and a weaker pound are desirable from a policy point of view.

Dudley's press conference may be more important than FOMC minutes.

Two German state elections that will be held next month comes as Merkel's popularity has waned.

Read More »

Read More »

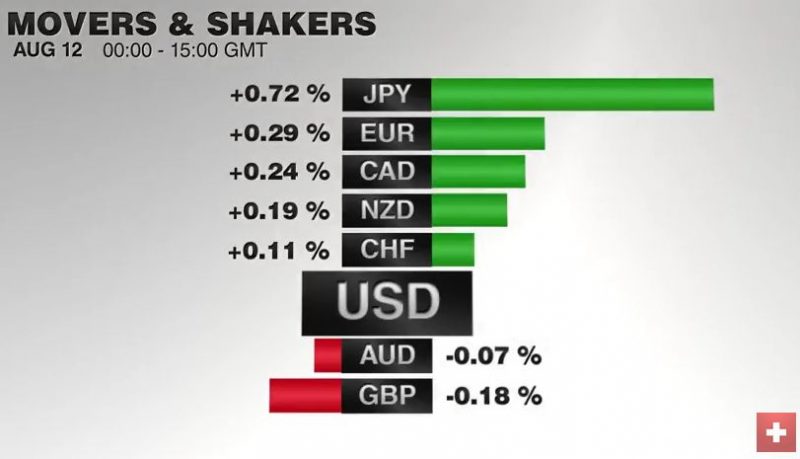

FX Daily, August 12: Summer Markets Grind into the Weekend

There is a general consolidative tone in the capital markets as the week draws to a close. The US retail sales report may offer a brief distraction, but it is unlikely to significantly shift expectations about the trajectory of Fed policy. Indeed, it might not really change investors' information set.

Read More »

Read More »

FX Daily, August 10: FX Consolidation Resolved in Favor of Weaker US Dollar

European bourses are mixed, and this is leaving the Dow Jones Stoxx 600 practically unchanged in late-European morning turnover. Financials are the strongest sector (+0.4%), and within it, the insurance sector is leading with a 0.8% advance and banks are up 0.4%. The FTSE's Italian bank index is up 1.4% to extend its recovery into a fifth session.

Read More »

Read More »

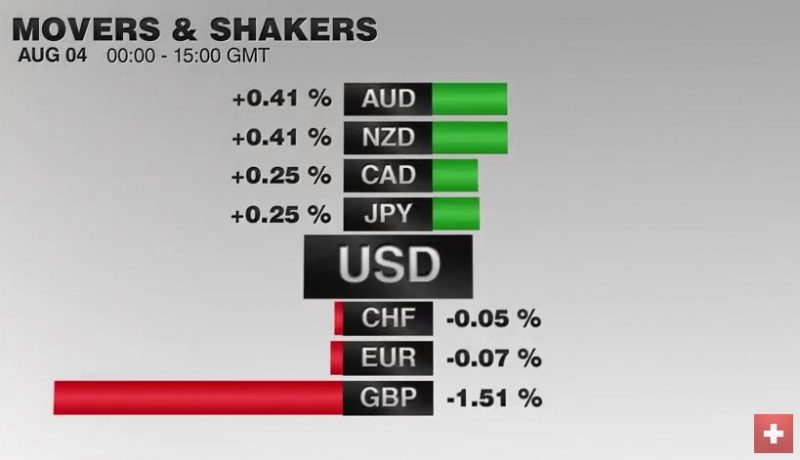

FX Daily, August 04: The BOE Owns Today, but Tomorrow is a Different Story

The Swiss Franc appreciated today against the euro. Given that the Bank of England started monetary easing, this slight appreciation is unexpectedly weak - reason was probably intervention. The SNB intervention level should be around 1 billion francs. Numbers revealed in next week's sight deposits.

Read More »

Read More »

FX Daily, August 03: Consolidation Featured

The US dollar is consolidating yesterday's losses. The greenback's upticks have thus far been shallow and unimpressive, except perhaps against the New Zealand dollar, which is off 0.8% ahead of next week's RBNZ meeting. Softer than expected labor cost increase reinforces the conviction that a 25 bp rate cut will be delivered next week.

Read More »

Read More »

FX Daily, August 02: Greenback Slides Despite RBA Rate Cut and 7-year Low in UK Construction PMI

The US dollar is offered against the major currencies, but appreciating against many emerging market currencies, include the South African rand and Turkish lira. Oil prices are trying to stabilize with Brent near $42 and WTI near $40, but the recent losses continue to weigh on the Malaysian ringgit and the Mexican peso.

Read More »

Read More »

FX Weekly Preview: After this Week, Does August Matter?

RBA meeting is a close call. BOE meeting consensus on rate cut, maybe new QE and lending-for-funding. More details of Japan's fiscal policy. U.S. jobs data. After this week, and outside of RBNZ rate cut, August may be uneventful.

Read More »

Read More »

FX Daily, July 28: Dollar Pulls Back Further Post-FOMC

After reversing lower yesterday after the FOMC statement, the US dollar has continued to move lower against the major currencies, save sterling. While the market is not fully confident of a rate cut by the Reserve Bank of Australia, indicative pricing in the derivative markets suggest a UK rate cut has been fully discounted (and a new asset purchase plan may also be announced).

Read More »

Read More »