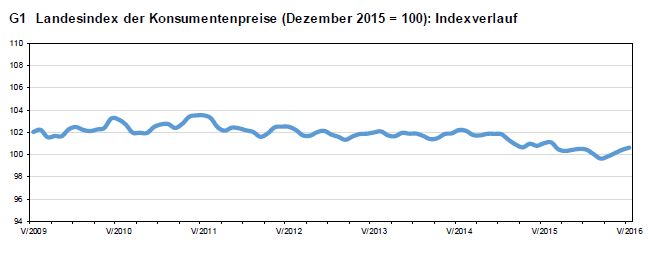

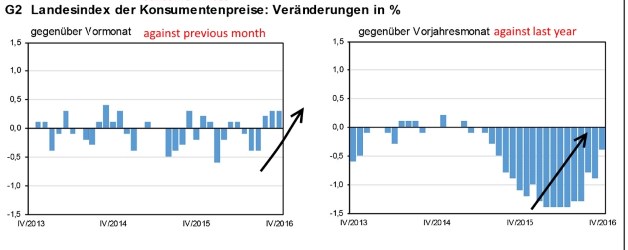

For the third time in a row, prices in Switzerland increased against the previous month. Inflation was -0.4% against last year. Still in 2015 yearly inflation was mostly around -1.5% y/y. Now yearly HCPI inflation is -0.5%. Will this rising price tendency continue?

Read More »

Tag Archive: Asset Price Bubble

Swiss Consumer Price Index in April 2016: -0.4 percent against 2015, +0.3 percent against last month

For the second time in a row prices in Switzerland increased by 0.3% against the previous month. Inflation was -0.4% against last year. Still in 2015 inflation was mostly around -1.5%. Will this rising price tendency continue? It will be a problem for the SNB.

Read More »

Read More »

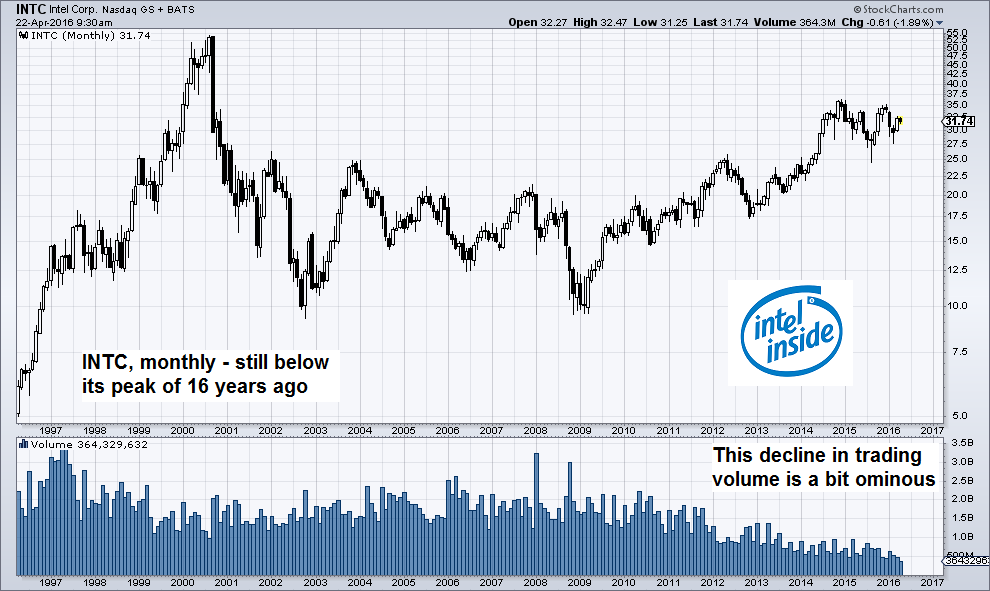

Rational Insanity

Intel Employees Get RIF’d Dark storm clouds gather along the economic horizon. They multiply ominously with each passing day. The recovery, weak as it has been, has run for nearly seven years. Now it appears to be sputtering and stalling out. ...

Read More »

Read More »

(8) Currency Wars: How to Push and Talk Down Your Currency?

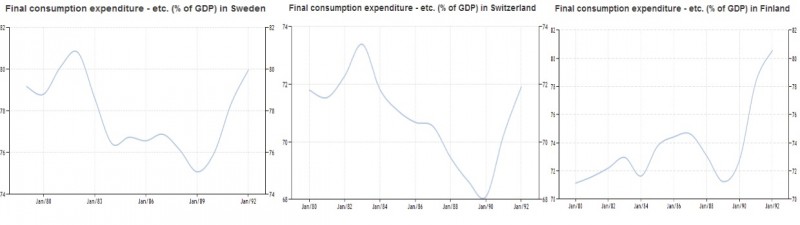

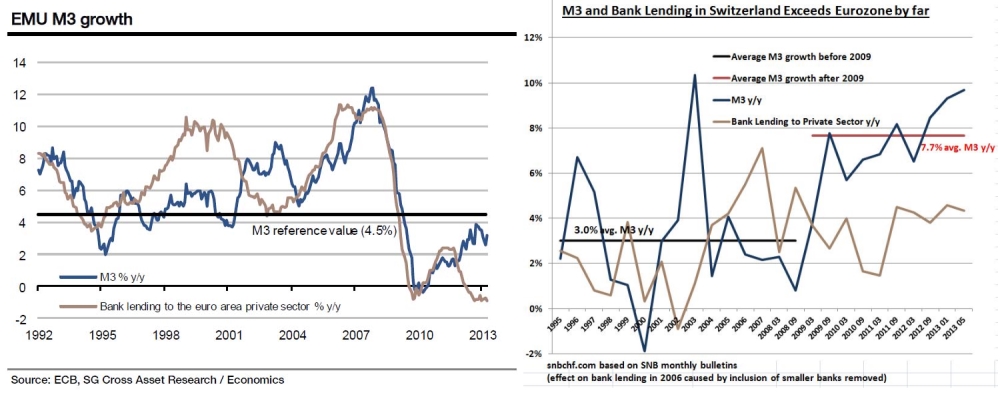

Direct or indirect intervention is credible only in countries where domestic asset prices are undervalued and CPI/asset price inflation are no issues. Otherwise they create medium-term risks.

Read More »

Read More »

Financial Cycles History, 1978-1985: Oil Glut, Strong Dollar and the Lost Decade in Latin America

The next financial cycle takes from 1981 to 1990: The dollar was strong, Latin America lost a decade and the Japanese created their bubble.

Read More »

Read More »

Pros and Cons of the Swiss Countercyclical Capital Buffer

Switzerland is currently living in a big real estate boom. The bubble bursting would imply that banks' collateral in the form of real estate falls in value. Therefore the banks' assets might fall because many home buyers might not be able to repay their mortgage. If a real estate bubble pops, then banks should be better capitalized to absorb such a shock. Therefore the Swiss National Bank introduced macro-prudential measures, like the so-called...

Read More »

Read More »

Our March 2013 Analysis: “Volcker Moment Redux”: Upcoming Weakness of Emerging Markets

The 2010 QE2 is a reason why many emerging markets started to slow considerably in the course of 2012. We reckon that this weakness will continue. Bizarrely QE2 helped to reduce global imbalances.

Read More »

Read More »

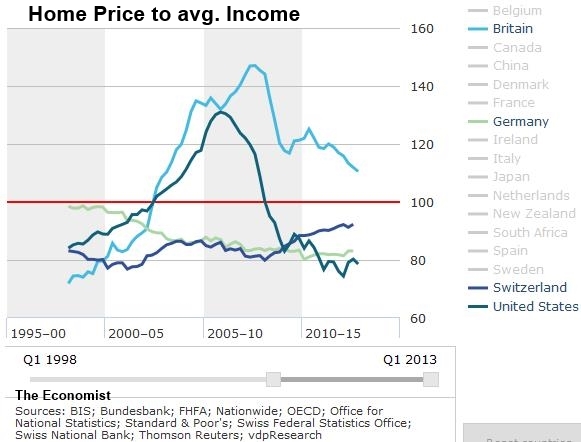

Swiss home price to income ratio small in historic and global comparison

Based on four different data source, we find out that Swiss home price to income ratio is small in global comparison. Therefore we wonder why the SNB must contain home price rises, but the Fed must artificially increase them.

Read More »

Read More »

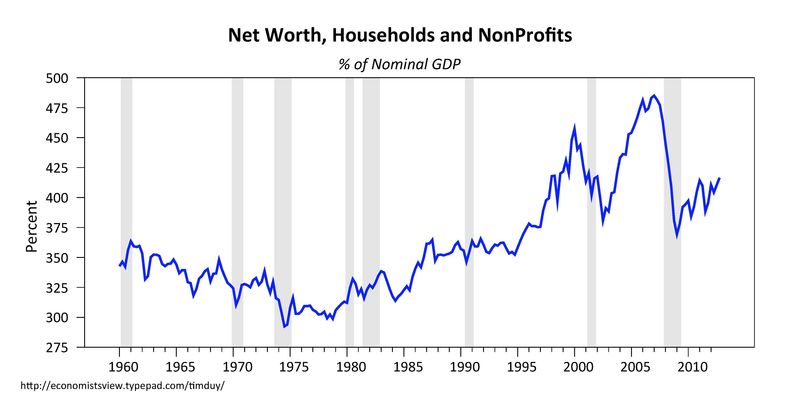

Are Asset Price Bubbles Needed to Make the US Economy Recover?

About the trade-off between economic recovery and financial stability In the recent post on gold prices, we maintained that the Fed will raise interest rates far later than most FOMC members admit. This would imply that the years of financial repression will continue and investors will push up asset prices, incl. gold, instead. Many libertarians …

Read More »

Read More »

IMF (2013): Sees Considerable Risks on SNB Balance Sheet

The International Monetary Fund (IMF) judges "that the SNB’s net revenue is subject to large fluctuations, and sizeable losses could occur if an appreciation of the Swiss franc was to take place before foreign exchange interventions were unwound."

Read More »

Read More »

What Ernst Baltensperger Got Wrong: Why SNB FX Losses Might Not Be Recovered By Income on Reserves

Opposed to Ernst Baltensperger, we think that the risk of losses on the SNB balance sheet and of an asset price bubble might be more important than the dangers of upcoming Swiss inflation.

Read More »

Read More »

Swiss Public Discussion Switched from Floor to Housing Bubble

Why there is no real estate bubble in Switzerland yet and why the SNB will help to create one With the current recovery in the United States the discussion in Switzerland switched from a discussion about the EUR/CHF floor to the Swiss real estate boom, the so-called “housing bubble”. It seems that the Swiss …

Read More »

Read More »

Who Has Got the Problem? Europe or Japan?

A couple of months ago the euro traded close to EUR/USD 1.20 and the whole world was betting on its breakdown. Once the euro downtrend ended thanks to QE3, OMT and euro zone current account surpluses, the common currency did not stop to appreciate against the yen and reached levels of EUR/JPY 104 and above. … Continue reading...

Read More »

Read More »

SNB only major central bank missing at Jackson Hole, are important SNB decisions looming ?

The Jackson Hole Symposium is traditionally a meeting of global central bankers, here the 2010 attendance list. This year it takes place between August 30 and September 1. Central bankers assemble The annual economic symposium for central bankers staged by the Federal Reserve Bank of Kansas City begins in Jackson Hole, Colorado (until September 1). …

Read More »

Read More »