Found 1,869 search results for keyword: label

Abolish the Office of the First Lady

It's almost Christmas time again, and that means its time for White House politicians and staff to spend hundreds of thousands of dollars on Christmas decorations and events for the White House.

Read More »

Read More »

Economics and the Revolt against Reason

The Revolt Against Reason. It is true that some philosophers were ready to overrate the power of human reason. They believed that man can discover by ratiocination the final causes of cosmic events, the inherent ends the prime mover aims at in creating the universe and determining the course of its evolution.

Read More »

Read More »

Switzerland’s high prices – a European comparison

Recently published data shows how prices compare across Europe. The data, collected by Eurostat, compares prices across a number of categories of spending in 2018. Average prices across the EU-28 are used as a base.

Read More »

Read More »

Good Economic Theory Focuses on Explanation, Not Prediction

In order to establish the state of the economy, economists employ various theories. Yet what are the criteria for how they decide whether the theory employed is helpful in ascertaining the facts of reality?

According to the popular way of thinking, our knowledge of the world of economics is elusive — it is not possible to ascertain how the world of economics really works.

Read More »

Read More »

Marx and Left Revolutionary Hegelianism

[This article is excerpted from volume 2, chapter 11 of An Austrian Perspective on the History of Economic Thought (1995).] Hegel's death in 1831 inevitably ushered in a new and very different era in the history of Hegelianism. Hegel was supposed to bring about the end of history, but now Hegel was dead, and history continued to march on. So if Hegel himself was not the final culmination of history, then perhaps the Prussian state of Friedrich...

Read More »

Read More »

Consumer Preferences Are Harder to Measure than the Behavioral Economists Think

A recent paper in the Journal of Consumer Psychology (JCP) has started a debate on the accuracy of "loss aversion," the idea that people are driven by fear of losses more than they are by the potential for gain. Core to behavioral economics, this idea has been rather universally accepted and been part of the awarding of two economics Nobel Prizes, in 2002 to Daniel Kahneman and in 2017 to Richard Thaler.

Read More »

Read More »

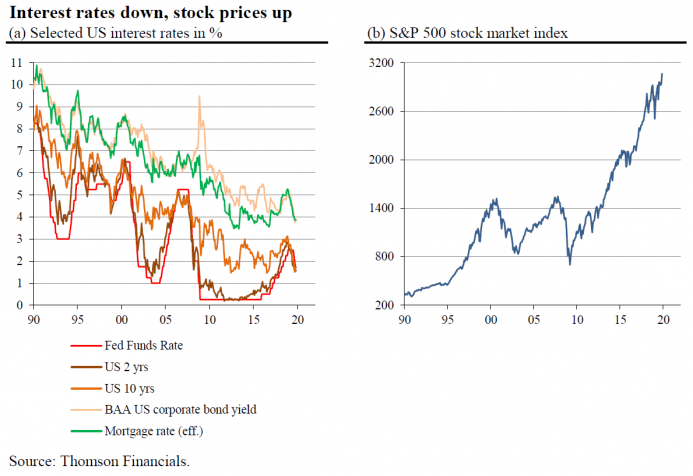

Where’s the Inflation? It’s in Stocks, Real Estate, and Higher Ed

In my days before I worked for the Mises Institute, I had a colleague who knew I associated with Austrian-School economists. In the wake of the bailouts and quantitative easing that followed the 2008 financial crisis, he'd sometimes crack "where's all that inflation you Austrians keep talking about?"

Read More »

Read More »

Hyperinflation, Money Demand, and the Crack-up Boom

In the early 1920s, Ludwig von Mises became a witness to hyperinflation in Austria and Germany — monetary developments that caused irreparable and (in the German case) cataclysmic damage to civilization.

Mises's policy advice was instrumental in helping to stop hyperinflation in Austria in 1922.

Read More »

Read More »

Embrace Unilateral Free Trade with the UK — Right Now

Boris Johnson's Conservatives won an outright majority in yesterday's general election, pushing the Tories to an 80-strong Commons majority in what the Daily Mail called a "staggering election landslide." Given that the Conservatives employed an election slogan of "Get Brexit Done," it appears the election was largely a referendum on Brexit.

Read More »

Read More »

Why the Courts Aren’t All They’re Supposed to Be

In the United States, law courts routinely hand out court order mandating payments to victims. And then do little to enforce them. For example, according to the U.S. Census Bureau, in 2015 only 43.5 percent of custodial parents received the full amount of court-ordered child support payments. 25.8 percent received partial payment while 30.7 percent — a figure which is trending higher — received no payments.

Read More »

Read More »

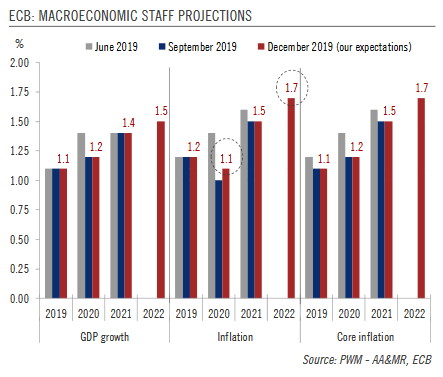

ECB: Preview of the review

We see the ECB remaining on hold throughout next year although we believe it could tweak some of the technical parameters of its toolkit. The first press conference of any new ECB President is an event in itself, and this time will be no different. Christine Lagarde's debut this week will understandably attract a lot of attention as the media and market participants scrutinise both form and substance.

Read More »

Read More »

Can Swiss business and human rights co-exist?

Switzerland performs a delicate dance when it comes to promoting business interests, maintaining neutrality and defending human rights. Daniel Warner looks at recent examples and the stakes at play. Doing business with other countries and promoting human rights can and do go hand in hand, Swiss State Secretary for Foreign Affairs Pascale Baeriswyl recently told swissinfo.ch.

Read More »

Read More »

Money for nothing – Swiss government gets paid to borrow

Imagine borrowing CHF 105,500 but only having to repay CHF 100,000 in 20 years time, including interest. You’d get an interest free loan plus an extra CHF 5,500 to keep. This is what the Swiss federal government will do on 20 December 2019, except it will borrow CHF 196.6 million by issuing zero interest bonds at a price of 105.5%. The government will generate a CHF 10.25 million windfall.

Read More »

Read More »

Central Banks May Be Driving Us Toward More Waste, More Carbon Emissions

Christine Lagarde, the new president of the European Central Bank (ECB), has added a new green dimension to monetary policymaking. The charming Frenchwoman signaled that the ECB could buy green bonds, possibly as part of the reanimated bond purchase program (a form of QE). This could reduce the financing costs of green investment projects.

Read More »

Read More »

Swiss seek compromise amid ‘lack of will’ at climate talks

This year, the signal from the scientific community has been loud and clear on climate change: something needs to be done, and soon. But leadership at the United Nations’ annual climate conference appears less clear-cut, and the head of the Swiss delegation is frustrated by hesitation to move ahead.

Read More »

Read More »

Why this Boom Could Keep Going Well Beyond 2019

The Austrian business cycle theory offers a sound explanation of what happens with the economy if and when the central banks, in close cooperation with commercial banks, create new money balances through credit expansion. Said credit expansion causes the market interest rate to drop below its "natural level," tempting people to save less and consume more.

Read More »

Read More »

How California’s Government Plans to Make Wildfires Even Worse

Not every square inch of the planet earth is suitable for a housing development. Flood plains are not great places to build homes. A grove of trees adjacent to a tinder-dry national forest is not ideal for a dream home. And California's chaparral ecosystems are risky places for neighborhoods.

Read More »

Read More »

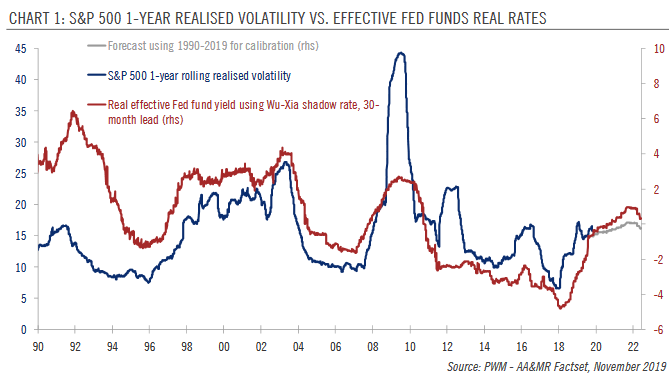

Upward pressure on equity volatility mitigated by fund flows

Whereas inflation is expected to be dormant next year, our expectation of real GDP growth of just 1.3% in the US in 2020 could put upward pressure on equity volatility. Since monetary policy tends to lead volatility by two and a half years, the Fed’s turn toward quantitative tightening in 2017 is also continuing to exert upward pressure on volatility levels for now.

Read More »

Read More »

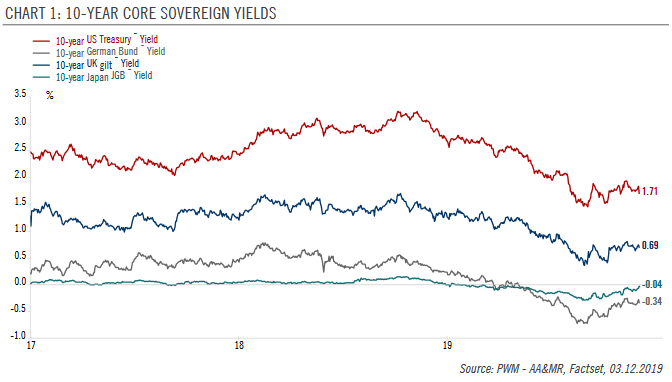

Core sovereign bonds 2020 Outlook

Neutral US Treasuries. We expect the US 10-year yield to fall towards 1.3% in H1 as US growth falters and the US Federal Reserve starts signalling additional rate cuts. However, continued monetary easing and election promises (i.e. fiscal stimulus) could boost inflation expectations in H2, with the 10-year yield ending 2020 at around 1.6% in our central scenario.

Read More »

Read More »

Exports: Currency Devaluation Won’t Grow the Economy

A visible weakness in economic activity in major world economies raises concern among various commentators that world economies have difficulties recovering despite very aggressive loose monetary policies. The yearly growth rate of US industrial production stood at minus 1.1 % in October, against minus 0.1% in September, and 4.1% in October last year.

Read More »

Read More »