Found 1,387 search results for keyword: label

No, Technology Shocks Aren’t Behind Recurring Business Cycles

Economic fluctuations, also known as business cycles, are seen as being driven by mysterious forces that are difficult to identify. Finn Kydland and Edward C. Prescott (KP), the 2004 Nobel laureates in economics, decided to attempt to find out what these forces were.1 They hypothesized that technology shocks are a major factor behind economic fluctuations and demonstrated that a technology-induced shock can explain 70 percent of the fluctuations in...

Read More »

Read More »

Coronavirus catches managers off guard

The coronavirus has laid bare the fragilities and complex dependencies generated by globalisation. American-Swiss professor Suzanne de Treville, a specialist in helping firms relocate their industrial activities to the west, hopes that this crisis will trigger some major soul-searching.

Read More »

Read More »

Financialization: Why the Financial Sector Now Rules the Global Economy

To read or watch the news in today's world is to be confronted with a wide array of stories about financial organization and financial institutions. News about central banks, interest rates, and debt appear to be everywhere.

Read More »

Read More »

SNB-Zinssenkung trotz Virus-Krise wohl kein Thema

Mit zwei Ausnahmen erwarten die 29 von Reuters befragten Finanzmarktteilnehmer und Analysten, dass die Währungshüter der Schweizerischen Nationalbank (SNB) den Leitzins auf dem seit mehr fünf Jahren geltenden Rekordtief von minus 0,75 Prozent belassen. Auch die Sichteinlagen von Banken bei der Notenbank ab einem gewissen Freibetrag dürften weiterhin mit einer Gebühr von 0,75 Prozent belastet werden.

Read More »

Read More »

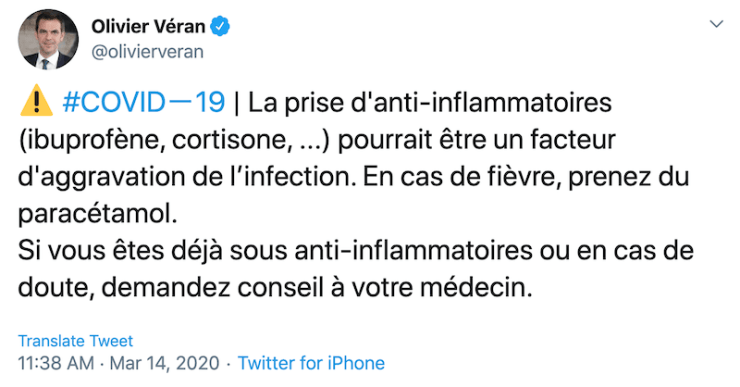

Is Ibuprofen dangerous for those infected with the coronavirus?

Ibuprofen belongs to a family of drugs known as non-steroidal anti-inflammatory drugs. On 14 March 2020, Olivier Véran, France’s health minister Tweeted that taking anti-inflammatory medicine “could be an aggravating factor” for those infected with Covid-19, and recommended paracetamol for those with a fever.

Read More »

Read More »

Swiss industry fears consequences of US travel ban

A United States ban on travellers from Europe has been condemned as “incomprehensible” by leading Swiss manufacturing association, Swissmem. The Swiss-American Chamber of Commerce has also weighed in, saying firms would seriously suffer if borders remain closed for longer than a month.

Read More »

Read More »

Coronavirus: Swiss hospitals have around 750 breathing ventilators

One of the biggest challenges during the coronavirus outbreak will be ensuring there are enough qualified staff and equipment to keep the worst affected patients alive. Thierry Fumeaux, head of the Swiss Society of Intensive Medicine, told RTS there are 82 intensive care units (ICU) across Switzerland. These have a combined 850 places, of which 750 are equipped with breathing equipment. It is not clear how many of these places are currently available.

Read More »

Read More »

Coronavirus: an estimate of the real number of infections in Switzerland

Today, according to the Federal Office of Public Health (FOPH), there were 815 confirmed cases in Switzerland. There are obvious challenges to this figure. Possibly the most important is the time lag between infection and a confirmed case.

Read More »

Read More »

Swiss lawyers seek to keep special ‘advisor’ status in the shadow economy

The Swiss government faces resistance to efforts to tighten anti-money laundering rules that close loopholes for lawyers who act as “advisors” in setting up offshore financial structures. Anti-corruption expert Mark Pieth writes how the lawyer lobby in Switzerland is trying to maintain their special status at the expense of Switzerland’s attempts to improve its reputation as a laundering haven.

Read More »

Read More »

The “Market Monetarists” and NGDP Targeting

[This article is part of the Understanding Money Mechanics series, by Robert P. Murphy. The series will be published as a book in late 2020.] In addition to the Keynesian perspective (covered in chapter 14), a relatively new challenge to the Austrian framework comes from the “market monetarists” and their endorsement of a central bank policy of “level targeting” of nominal gross domestic product (sometimes abbreviated as NGDPLT1).

Read More »

Read More »

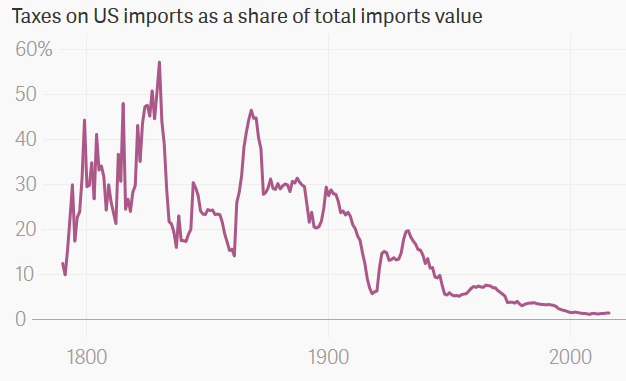

If China Is the Problem, Can’t We At Least Have Free Trade with Everyone Else?

It remains unclear how much the stock market implosion of recent days will affect the larger economy. As David Stockman has noted often, the Wall Street economy is not synonymous with the Main Street economy, contrary to what the advocates of rampant bank bailouts and financialization would have us believe.

Read More »

Read More »

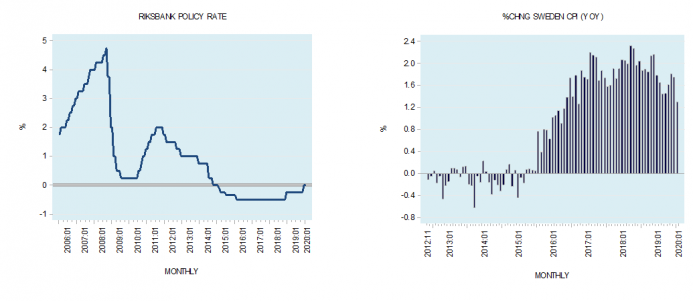

Why Sweden’s Negative Interest Rate Experiment Is a Failure

According to the Financial Times's February 20 article “Why Sweden Ditched Its Negative Rate Experiment,” economists are pondering whether Sweden’s central bank experiment with negative interest rate was a success. Sweden’s Riksbank, the world’s oldest central bank, introduced negative interest rates in early 2015.

Read More »

Read More »

The US Constitution Needs an Expiration Date

A unique feature of the Swiss Federal Constitution is the fact that the central government's power to impose direct taxes on citizens expires every decade or so. In fact, the current taxing authority expires at the end of 2020. Fortunately for the Swiss republic's central government, voters approved an extension (the "New Financial Regime 2021") for another fifteen years in a March 2018 election.

Read More »

Read More »

In die Schweiz auswandern ???

Seit geraumer Zeit haben wir mit unserem Projekt „Auswanderluchs“ gestartet. Christian bloggt und macht Videos zum Thema Auswandern in die Schweiz. Er ist vor 4 Jahren in die Schweiz gezogen, lebt und arbeitet nun hier und gibt seine Erfahrungen und Tipps an die Finanzrudel Community weiter.

Read More »

Read More »

Governments Are Using the Coronavirus to Distract From Their Own Failures

The Johns Hopkins University Coronavirus Global Cases Monitor shows that the mortality rate of the epidemic is very low. At the writing of this article,1 there have been 92,818 cases, 3,195 deaths, and 48,201 recoveries. It is normal for the media to focus on the first two figures, but I think that it is important to remember the last one. The recovered figure is more than ten times the deceased one.

Read More »

Read More »

Potential relief for some Swiss renters

Every three months the rate of interest used to benchmark Swiss rents is reviewed. If it goes down some renters have the right to request a decrease in rent. This time the reference rate fell from 1.50% to 1.25%.

The last time it dropped was 2 June 2017 when it fell to 1.5%. The rate is based on the average Swiss mortgage rate over three months.

Read More »

Read More »

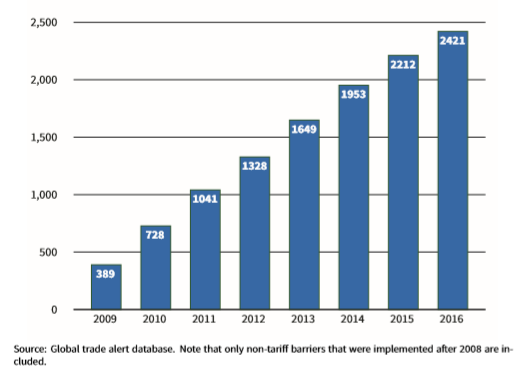

The US’s “Free Trade” Isn’t Very Free

The false notion that the US has eliminated virtually all of its barriers to foreign imports has been repeated more and more in recent years. The claim is made both by advocates for free trade and by critics of free trade. For instance, Patrick Buchanan has claimed only American elites "are beneficiaries to free trade" while implying the US either has free trade, or something close to it.

Read More »

Read More »

The EU’s Latest Screw-You to the UK Shows a Big Problem with Trade Agreements

All too often, discussion over trade deals focuses almost solely on tariffs. It's true that tariffs—i.e., taxes—are always a significant barrier to free exchange at all levels, but there are also plenty of ways to block or lessen trade that are not primarily tariff-based. Recent conflicts over the pending negotiations between the UK and the EU are a reminder of this.

Read More »

Read More »

BLONDHÖRIG | Börsenexpertin Beate Sander erklärt Ihren Weg zum Schotter

BLONDHÖRIG – Folge 01 mit Beate Sander Beater Sander ist eine 82-jährige Selfmade-Börsen-Millionärin, erfolgreiche Autorin und Vortragshalterin. Mit 59 Jahren ging Sie erstmalig, als Realschullehrerin, an die Börse und knackte in diesem Jahr die zweite Million. Spekulationen sind Sachen für Leute wie Uli Höneß und ein Tag startet selten nach 5.00 Uhr. In unserem Gespräch …

Read More »

Read More »

Central Banking since the 2008 Financial Crisis

[This article is part of the Understanding Money Mechanics series, by Robert P. Murphy. The series will be published as a book in late 2020.] In chapter 5 we reviewed the textbook analysis of how a central bank buys government debt in “open market operations” to add reserves to the banking system, with which commercial banks can then advance loans to their own customers.

Read More »

Read More »