This article is part of the Understanding Money Mechanics series, by Robert P. Murphy. The series will be published as a book in late 2020.

In chapter 5 we reviewed the textbook analysis of how a central bank buys government debt in “open market operations” to add reserves to the banking system, with which commercial banks can then advance loans to their own customers. However, in the wake of the financial crisis of 2008, the Federal Reserve and other central banks around the world adopted new “tools” (the term often used) to influence economic activity.

In this chapter we will first elaborate on conventional monetary policy, and then explain why it had apparently “lost traction” after the fall of 2008. We will then summarize some of the major changes to the practice of central banking since the financial crisis. Although we will focus on the Federal Reserve, much of our commentary is applicable to other central banks.

Before proceeding, we should clarify for the reader that most of the discussion in this chapter will be standard, with many of the details coming from Federal Reserve publications. However, even though it is legitimate to rely on establishment sources to document what they did, it is more dubious to take at face value their explanations for why they did it. Some cynics, for example, might argue that particular changes in Fed policy—such as buying not just Treasurys but also mortgage-backed securities, or initiating the payment of interest on bank reserves—were implemented in order to benefit particular firms and coalitions with political influence, rather than out of concern for the general welfare. However, it lies outside the scope of the present volume to address the motivations behind the changes described in this chapter.

Federal Reserve Monetary Policy before the 2007–08 Crisis

In chapter 5 we introduced the mechanics through which a central bank that wished to engage in “looser” or “easier” monetary policy could (1) buy assets in so-called open market operations and thereby (2) increase commercial bank reserves that would normally (3) result in more commercial bank lending and thus (4) push down market interest rates. However, in actual practice, the Federal Reserve has historically adopted different targets that are the immediate object of its use of this conventional mechanism. Another way of stating this is that the Fed’s policy regime has changed over time.

For example, economists believe that it was sometime in the 1980s that the Fed moved away from targeting the total amount of money and/or bank reserves, and instead began to use its powers to target interest rates.1 Specifically, from the 1980s until the eve of the 2008 financial crisis, the Fed’s official announcements of policy decisions concerned its target for the so-called federal funds rate.

The federal funds rate is the interest rate that commercial banks charge each other for overnight loans of reserves. Because of legal reserve requirements, commercial banks must hold a certain quantity of reserves—which, recall, consist of either paper currency in the bank vault or electronic deposit balances with the Fed itself—to “back up” the outstanding demand deposits held with the bank by its own customers. For example, with a 10 percent reserve requirement, if Citibank’s customers collectively hold $1 billion in their checking accounts, then Citibank must hold $100 million in reserves—perhaps $30 million in actual paper currency in Citibank’s vaults and the remaining $70 million in Citibank’s electronic account balance in the Fed’s computer system.

Now because commercial banks have a reserve requirement (which is enforced at the end of each business day), if they make new loans, they might need to obtain more reserves in order to satisfy the requirement. To continue our example from above, if Citibank lent out $10 million from its vault cash to new borrowers, then its new position would be: $1.01 billion in outstanding customer checking account balances, with $20 million left in the vault and $70 million still on deposit with the Fed. At the end of the business day, to avoid being assessed a penalty, Citibank would now need to have $101 million in reserves ($1.01 billion x 10% = $1.01 billion). But at the moment it only has $90 million ($20 million + $70 million = $90 million). Being short $11 million in reserves, Citibank would go out into the federal funds market and borrow (overnight) $11 million in excess reserves from other commercial banks that have more reserves at that moment than they need to satisfy their own legal reserve requirements. The market-determined rate of interest (quoted on an annualized basis, even though the loan would only be for one day) on this overnight loan of $11 million would be the federal funds rate.

To reiterate, during the period from the 1980s up until the brewing crisis in 2007–08, when the Federal Reserve made an announcement, it would typically tell the world what it was doing regarding its target for the federal funds rate. When the actual federal funds rate in the market was higher than the Fed’s target, the Fed would buy more assets, injecting new bank reserves into the system and thus push down the fed funds rate. On the other hand, when the Fed raised its target and wanted to push up the actual fed funds rate, it would do the opposite: it would sell off some of its assets, thereby draining bank reserves from the system and (since the quantity was now smaller) pushing up the interest rate that bankers themselves had to pay to other bankers in order to borrow reserves.

Another Old-School “Tool”: The Discount Window

Although the use of open market operations to achieve its desired federal funds rate target was the primary “tool” that the Fed used from the 1980s up through 2008, another power that the Fed has held from its very inception is the ability to directly lend to financial institutions through the so-called discount window. As the Fed’s website explains:

When the Federal Reserve System was established in 1913, lending reserve funds through the Discount Window was intended as the principal instrument of central banking operations. Although the Window was long ago superseded by open market operations as the most important tool of monetary policy, it still plays a complementary role. The Discount Window functions as a safety valve in relieving pressures in reserve markets; extensions of credit can help relieve liquidity strains in a depository institution and in the banking system as a whole.2

For the purposes of an introductory text, the important thing to note is that when the Fed (tries to) push down interest rates through open market operations, the Fed is NOT directly lending new reserves to the banks. Instead, it is paying newly created reserves over to the sellers of financial assets in exchange for their property. When those new reserves are deposited into the banking system, the recipient banks lend them out to other banks and thereby (tend to) push down the fed funds rate.

In contrast, when a depository institution uses the discount window, it is directly borrowing newly created reserves from the Federal Reserve itself. In order to keep the discount window as a fallback option, the Fed typically sets the interest rate on its discount window lending—called the discount rate—above the federal funds rate.3

Out with Fed Funds Rate Targets, In with “QE”

The most obvious change in the conduct of monetary policy since 2008 was the de-emphasis on interest rates and the focus on the size (and composition) of asset purchases. Specifically, investors and the public at large began fretting over what the Fed would do with its various rounds of “quantitative easing” or simply “QE.” (Note that the Federal Reserve itself has never officially used this popular term to describe its operations.)

Prior to the financial crisis most people probably never thought about—and the Fed itself certainly didn’t emphasize—the fact that when the Fed cut or raised interest rates it didn’t simply turn a dial but instead had to buy or sell assets, and thereby create or destroy dollar reserves in the financial system. But when the federal funds rate collapsed from 4 percent in late 2007 to just about zero percent by the end of 2008, it was clear that Fed officials could no longer announce additional rate cuts to show the world they were “helping.” (To be clear, many Austrian economists would disagree that easier money is the solution to an ailing economy, as we explain in chapter 8.)

In this context, soon after the financial crisis struck, the Fed began announcing not merely its plans for the future path of the federal funds rate, but also its intentions for the scale, pace, and composition of its asset purchases. For example, in November 2010 the Federal Open Market Committee (FOMC) announced its plans for what the financial press would soon dub “QE2”:

To promote a stronger pace of economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate, the Committee decided today to expand its holdings of securities. The Committee will maintain its existing policy of reinvesting principal payments from its securities holdings. In addition, the Committee intends to purchase a further $600 billion of longer-term Treasury securities by the end of the second quarter of 2011, a pace of about $75 billion per month.4

When this second round of quantitative easing didn’t do the trick, the Fed in September 2012 announced what would be dubbed “QE3,” in which it would buy $40 billion in additional mortgage-backed securities per month.5 (Because there was not a set dollar-limit on the total plan, this program was also dubbed “QE-infinity” by some cynics.) A few months later, in December 2012, the Fed announced that it would also begin buying an additional $45 billion per month in (longer-term) Treasury securities, meaning that QE3 at that point consisted of adding $85 billion in new assets monthly to the Fed’s balance sheet.6 And thus, what were once mechanical considerations kept behind the scenes now became front and center: the Fed no longer relied merely on interest rate targets to communicate its intentions to the public, but now announced detailed descriptions of its planned asset purchases. Since the federal funds rate had hit rock-bottom by late 2008, the subsequent rounds of quantitative easing allowed the Fed to show that it hadn’t “run out of ammunition” and could continue to inject money in an attempt to boost spending through a “wealth effect” and reduced longer-term interest rates.

Another Major Innovation: Fed Begins Paying Interest on Reserves

Another significant change in Fed policy was its announcement in September 2008 that in October it would begin paying interest to commercial banks on the reserve balances that they kept on deposit (or “parked”) with the Fed.

Because many commentators argue that this new policy was at least partially responsible for the failure of the Fed’s extraordinary injections of new reserves to lead to a comparable increase in bank lending and consumer price inflation, we will cover this topic in detail in chapter 13.

For our purposes in the present chapter, it is enough to note that the new policy of paying interest on reserves allowed the Fed to decouple its asset purchases from its target for the federal funds rate. Specifically, in October of 2008 the Fed wanted to (among other things) calm the panic in the financial sector by buying large quantities of mortgage-backed securities (which were then considered “toxic assets”). Normally, such large asset purchases would flood the system with new reserves and push down the federal funds rate. But since the Fed had not yet wanted the fed funds rate to sink to zero percent, it established a “floor” under the fed funds rate by paying commercial banks interest on the reserves that they kept on deposit with the Fed. The intuition here is that a commercial bank could always earn a guaranteed return from the Fed by keeping its excess reserves parked at the Fed rather than lending them to other commercial banks. Therefore, if a commercial bank needed to borrow excess reserves in order to satisfy its reserve requirements, it would have to offer at least as much as the prevailing rate that the Fed itself was paying on reserve balances.

At the other end of the cycle, when the Fed began “normalizing” its policy stance and finally began raising its target for the federal funds rate in December 2015, it did not do so by selling off some of its assets (and thereby draining reserves out of the banking system), as the textbook description of monetary policy would have it. Instead, the Fed maintained its outstanding stock of assets and caused the fed funds rate to increase by raising the interest rate that it paid to banks on their reserves kept at the Fed. In this way, the Fed could raise interest rates without selling off its large holdings of Treasury bonds and mortgage-backed securities, actions that may have jeopardized the still fragile recovery in financial markets.

To sum up, among other implications,7 the new policy begun in October 2008 of paying interest on reserves allowed the Fed to decouple its asset purchases from its desired target for the market-clearing federal funds rate.

A Timeline of Additional “Tools” Added to the Fed’s Kit

Drawing on the Federal Reserve’s timeline, the following table summarizes some of the innovations in Fed policy introduced as the housing and credit markets began deteriorating in late 2007. (The descriptions in the second column are direct quotations from the St. Louis Fed timeline, with bold added by the present author.)

| Date | Action |

| 12/12/07 | The Federal Reserve Board announces the creation of a Term Auction Facility (TAF) in which fixed amounts of term funds will be auctioned to depository institutions against a wide variety of collateral. The FOMC authorizes temporary reciprocal currency arrangements (swap lines) with the European Central Bank (ECB) and the Swiss National Bank (SNB). |

| 3/11/08 | The Federal Reserve Board announces the creation of the Term Securities Lending Facility (TSLF), which will lend up to $200 billion of Treasury securities for 28-day terms against federal agency debt, federal agency residential mortgage-backed securities (MBS), non-agency AAA/Aaa private label residential MBS, and other securities. |

| 3/16/08 | The Federal Reserve Board establishes the Primary Dealer Credit Facility (PDCF), extending credit to primary dealers at the primary credit rate against a broad range of investment grade securities. |

| 3/24/08 | The Federal Reserve Bank of New York announces that it will provide term financing to facilitate JPMorgan Chase & Co.’s acquisition of The Bear Stearns Companies Inc. A limited liability company (Maiden Lane) is formed to control $30 billion of Bear Stearns assets that are pledged as security for $29 billion in term financing from the New York Fed at its primary credit rate. |

| 6/13/08 | The Federal Reserve Board authorizes the Federal Reserve Bank of New York to lend to the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac), should such lending prove necessary. |

| 9/16/08 | The Federal Reserve Board authorizes the Federal Reserve Bank of New York to lend up to $85 billion to the American International Group (AIG) under Section 13(3) of the Federal Reserve Act. |

| 9/18/08 | The FOMC expands existing swap lines by $180 billion and authorizes new swap lines with the Bank of Japan, Bank of England, and Bank of Canada. |

| 9/19/08 | The Federal Reserve Board announces the creation of the Asset-Backed Commercial Paper Money Market Mutual Fund Liquidity Facility (AMLF) to extend non-recourse loans at the primary credit rate to U.S. depository institutions and bank holding companies to finance their purchase of high-quality asset-backed commercial paper from money market mutual funds. The Federal Reserve Board also announces plans to purchase federal agency discount notes (short-term debt obligations issued by Fannie Mae, Freddie Mac, and Federal Home Loan Banks) from primary dealers. |

| 9/21/08 | The Federal Reserve Board approves applications of investment banking companies Goldman Sachs and Morgan Stanley to become bank holding companies. |

| 9/29/08 | The FOMC authorizes a $330 billion expansion of swap lines with Bank of Canada, Bank of England, Bank of Japan, Danmarks Nationalbank, ECB, Norges Bank, Reserve Bank of Australia, Sveriges Riksbank, and Swiss National Bank. Swap lines outstanding now total $620 billion. |

| 9/26/08 | The Federal Reserve Board announces that the Fed will pay interest on depository institutions’ required and excess reserve balances at an average of the federal funds target rate less 10 basis points on required reserves and less 75 basis points on excess reserves. |

| 10/7/08 | The Federal Reserve Board announces the creation of the Commercial Paper Funding Facility (CPFF), which will provide a liquidity backstop to U.S. issuers of commercial paper through a special purpose vehicle that will purchase three-month unsecured and asset-backed commercial paper directly from eligible issuers. |

| 10/8/08 | The Federal Reserve Board authorizes the Federal Reserve Bank of New York to borrow up to $37.8 billion in investment-grade, fixed-income securities from American International Group (AIG) in return for cash collateral. |

| 10/21/08 | The Federal Reserve Board announces creation of the Money Market Investor Funding Facility (MMIFF). Under the facility, the Federal Reserve Bank of New York provides senior secured funding to a series of special purpose vehicles to facilitate the purchase of assets from eligible investors, such as U.S. money market mutual funds. Among the assets the facility will purchase are U.S. dollar-denominated certificates of deposit and commercial paper issued by highly rated financial institutions with a maturity of 90 days or less. |

| 10/29/08 | The FOMC also establishes swap lines with the Banco Central do Brasil, Banco de Mexico, Bank of Korea, and the Monetary Authority of Singapore for up to $30 billion each. |

| 10/10/08 | The Federal Reserve Board and the U.S. Treasury Department announce a restructuring of the government’s financial support of AIG….The Federal Reserve Board also authorizes the Federal Reserve Bank of New York to establish two new lending facilities for AIG: The Residential Mortgage-Backed Securities Facility will lend up to $22.5 billion to a newly formed limited liability company (LLC) to purchase residential MBS from AIG; the Collateralized Debt Obligations Facility will lend up to $30 billion to a newly formed LLC to purchase CDOs from AIG (Maiden Lane III LLC). |

| 10/23/08 | The U.S. Treasury Department, Federal Reserve Board, and FDIC [Federal Deposit Insurance Corporation] jointly announce an agreement with Citigroup to provide a package of guarantees, liquidity access, and capital. Citigroup will issue preferred shares to the Treasury and FDIC in exchange for protection against losses on a $306 billion pool of commercial and residential securities held by Citigroup. The Federal Reserve will backstop residual risk in the asset pool through a non-recourse loan. |

| 11/25/08 | The Federal Reserve Board announces the creation of the Term Asset-Backed Securities Lending Facility (TALF), under which the Federal Reserve Bank of New York will lend up to $200 billion on a non-recourse basis to holders of AAA-rated asset-backed securities and recently originated consumer and small business loans. |

| 11/25/08 | The Federal Reserve Board announces a new program to purchase direct obligations of housing related government-sponsored enterprises (GSEs)—Fannie Mae, Freddie Mac and Federal Home Loan Banks—and MBS backed by the GSEs. Purchases of up to $100 billion in GSE direct obligations will be conducted as auctions among Federal Reserve primary dealers. Purchases of up to $500 billion in MBS will be conducted by asset managers. |

| 12/22/08 | The Federal Reserve Board approves the application of CIT Group Inc., an $81 billion financing company, to become a bank holding company. |

| 1/16/09 | The U.S. Treasury Department, Federal Reserve, and FDIC announce a package of guarantees, liquidity access, and capital for Bank of America. The U.S. Treasury and the FDIC will enter a loss-sharing arrangement with Bank of America on a $118 billion portfolio of loans, securities, and other assets in exchange for preferred shares. In addition, and if necessary, the Federal Reserve will provide a non-recourse loan to back-stop residual risk in the portfolio. |

| 2/10/09 | The Federal Reserve Board announces that is prepared to expand the Term Asset-Backed Securities Loan Facility (TALF) to as much as $1 trillion and broaden the eligible collateral to include AAA-rated commercial mortgage-backed securities, private-label residential mortgage-backed securities, and other asset-backed securities. |

| 3/18/09 | The FOMC decides to increase the size of the Federal Reserve’s balance sheet by purchasing up to an additional $750 billion of agency mortgage-backed securities, bringing its total purchases of these securities to up to $1.25 trillion this year, and to increase its purchases of agency debt this year by up to $100 billion to a total of up to $200 billion. The FOMC also decides to purchase up to $300 billion of longer-term Treasury securities over the next six months to help improve conditions in private credit markets. Finally, the FOMC announces that it anticipates expanding the range of eligible collateral for the TALF (Term Asset-Backed Securities Loan Facility). |

| 3/19/09 | The Federal Reserve Board announces an expansion of the eligible collateral for loans extended by the Term Asset-Backed Securities Loan Facility (TALF) to include asset-backed securities backed by mortgage servicing advances, loans or leases related to business equipment, leases of vehicle fleets, and floorplan loans. |

Source: St. Louis Federal Reserve.8

| As the table above makes clear, the brewing crisis in the housing and credit markets in 2007–08 allowed for an extraordinary increase in the power of the Federal Reserve. This development led the present author to describe then chair of the Fed Ben Bernanke as “the FDR of central bankers.”9 | |

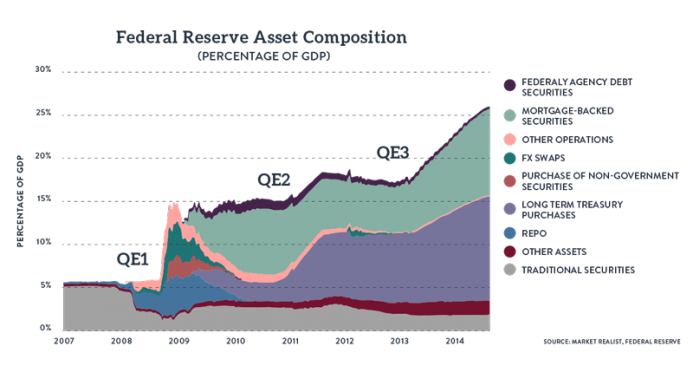

Were the Fed’s Post-Crisis Asset Purchases Legal?As explained in the previous section, since the advent of the financial crisis the Federal Reserve has drastically increased not merely the amount of assets that it purchases but also the types of assets. The figure below illustrates the dramatic expansion and change in composition of the Fed’s balance sheet: In addition to the profound questions concerning the efficacy and wisdom of the Fed’s dramatic new role in the economy, there is also the stark issue of whether the Fed’s post-crisis actions were legal. In order to avoid the obvious invitation to corruption, the legislation authorizing the Federal Reserve put limits on what the U.S. central bank could buy. After all, if the people running the New York Federal Reserve Bank could create money electronically with which to buy specific shares of Wall Street stock, there would be vast opportunities for abuse. |

Federal Reserve Asset Composition, 2007-2014 |

| When justifying the new powers that it took after the financial crisis struck, Fed officials typically appealed to the section of the Federal Reserve Act giving it liberal powers to lend money to financial institutions. In practice, the Fed lent money to newly created Limited Liability Corporations (LLCs) named “Maiden Lane”—referring to the street in New York’s financial district—that would then use the money borrowed from the Fed to purchase the desired assets. (See the endnote for an article discussing the dubious legality of this arrangement.10 |

- 1. It’s actually difficult to pinpoint precisely when the Fed changed its approach, because it made no formal announcement, but an analysis of the transcripts of Fed meetings suggests that it was in 1982. See Daniel L. Thornton, “When Did the FOMC Begin Targeting the Federal Funds Rate? What the Verbatim Transcripts Tell Us” (Federal Reserve Bank of St. Louis Working Paper no. 2004–015B, Federal Reserve Bank of St. Louis, St. Louis, Mo., Aug. 2004, rev. May 2005), available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=760518.

- 2. See “The Federal Reserve Discount Window,” Federal Reserve Discount Window and Payment Risk (website), last modified June 22, 2015, https://www.frbdiscountwindow.org/pages/general-information/the-discount-window.

- 3. Note that there are different rates the Fed charges based on the length of the loan and the creditworthiness of the borrower, and for all such discount lending the borrower must pledge collateral of adequate quality.

- 4. See “FOMC Statement,” Press Releases, Board of Governors of the Federal Reserve System, Nov. 3, 2010, https://www.federalreserve.gov/newsevents/pressreleases/monetary20101103a.htm.

- 5. See “Federal Reserve Issues FOMC Statement,” Press Releases, Board of Governors of the Federal Reserve System, Sept. 13, 2012, https://www.federalreserve.gov/newsevents/pressreleases/monetary20120913a.htm.

- 6. See “Federal Reserve Issues FOMC Statement,” Press Releases, Board of Governors of the Federal Reserve System, Dec. 12, 2012, https://www.federalreserve.gov/newsevents/pressreleases/monetary20121212a.htm.

- 7. George Selgin has devoted an entire monograph to the (perhaps unintended) consequences of the Fed’s decision to begin paying interest on reserves: “Floored! How a Misguided Fed Experiment Deepened and Prolonged the Great Recession” (Cato Working Paper, no. 50/CMFA no. 11, Center for Monetary and Financial Alternatives, Cato Institute, Washington, DC, Mar. 1, 2018, rev. Mar. 13, 2018), available at https://www.cato.org/sites/cato.org/files/pubs/pdf/working-paper-50-updated-3.pdf, published as Floored! How a Misguided Fed Experiment Deepened and Prolonged the Great Recession (Washington, DC: Cato Institute, 2018).

- 8.

Table excerpted from “The Financial Crisis: A Timeline of Events and Policy Actions,” Federal Reserve Bank of St. Louis, http://timeline.stlouisfed.org/index.cfm?p=timeline. This page is no longer live, but the Federal Reserve Archival System for Economic Research (FRASER) has preserved the timeline. See “Federal Reserve of St. Louis’ Financial Crisis Timeline,” FRASER, Federal Reserve Bank of St. Louis, accessed Feb. 24, 2020, https://fraser.stlouisfed.org/timeline/financial-crisis.

- 9. Robert P. Murphy, “Ben Bernanke, The FDR of Central Bankers,” in The Fed at One Hundred: A Critical View on the Federal Reserve System, ed. David Howden and Joseph T. Salerno (London and New York: Springer, 2014), pp. 31–41.

- 10. Alexander Mehra, “Legal Authority in Unusual and Exigent Circumstances: The Federal Reserve and the Financial Crisis,” University of Pennsylvania Journal of Business Law 13, no. 1 (2010): 221–73, https://www.law.upenn.edu/journals/jbl/articles/volume13/issue1/Mehra13U.Pa.J.Bus.L.221(2010).pdf.

Tags: newsletter