Found 1,381 search results for keyword: label

Everything You Wanted to Know about Money, but Were Afraid to Ask

Introduction. With my talk, I would like to accomplish three goals:

First, I want to explain some sound and time-tested basics of monetary theory.

Second, I would like to point out why it is important to have a free market in money; that the battlefront of our time is not between, say, bitcoin, stable coins, gold, and silver, but between government-monopolized fiat monies and a free market in money.

Read More »

Read More »

Weekly Market Pulse: The More Things Change…

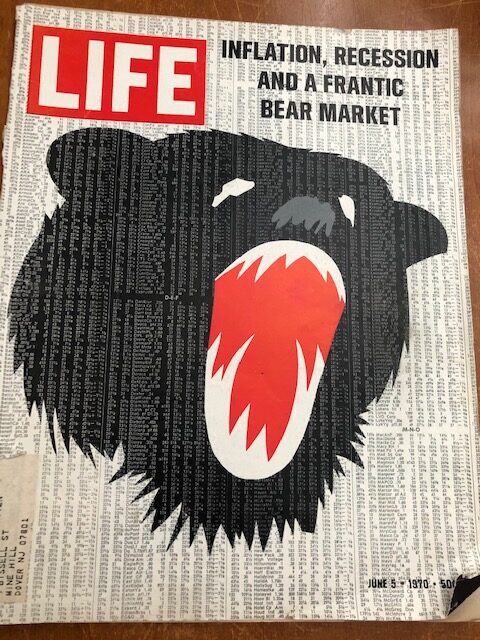

I stopped in a local antique shop over the weekend. The owner is retiring and trying to clear out as much as she can before they close the doors so I paid a mere $3 for the Life magazine above. I think it might be worth many multiples of that price for investors who think our situation today is somehow uniquely bad. The cover headline could just as easily be describing today as 1970.

Read More »

Read More »

Börse – Zinsen, Dividenden, Wachstum: Diese Schweizer Bank-Aktien ziehen starkes Interesse auf sich

Die Chefs von Schweizer Banken dürften am 16. Juni aufgeatmet haben. Was auch immer über die Pros und Cons von Zinserhöhungen gesagt wird, der Zinsschritt der Schweizerischen Nationalbank (SNB) hilft der Branche. Wie eine Auswertung von cash.ch zeigt, liegen in der Jahres-Performance 12 der 16 besonders zinssensitiven Kantonal- und Regionalbanken in der Schweiz und Liechtenstein im Puls (siehe Tabelle).

Read More »

Read More »

Review: Progressive Conservatism: How Republicans Will Become America’s Natural Governing Party

Frank Buckley is always a thoughtful and provocative author, but I disagree with what he has to say in Progressive Conservatism more than with other books of his I’ve reviewed, such as his outstanding American Secession and Curiosity.

Read More »

Read More »

Droht mit Taiwan das nächste Risiko für die Börsen? Podcast mit Dr. Ulrich Kaffarnik

Als wäre die geopolitische Lage nicht schon angespannt genug, heizt sich die Lage auch in Asien zunehmend auf. Der schwelende Konflikt zwischen China und Taiwan bekam durch den jüngsten Besuch einer hochrangigen US-Politikerin neue Brisanz.

Read More »

Read More »

Adipositas – Eine Volkskrankheit aus Investorensicht – Podcast mit Maximilian-Benedikt Köhn

In der industrialisierten Welt spielen Zivilisationskrankheiten eine zunehmend bedeutsame Rolle. Insbesondere Adipositas ist auf dem Vormarsch. Wohin zeigen die Trends? Welche Therapien gibt es? Woran arbeitet die Forschung und welche neuen Entwicklungen könnten nicht nur für die Betroffenen, sondern auch aus Sicht von Investoren spannend sein?

Darüber sprechen wir heute mit dem Healthcare-Spezialisten im DJE Research Team: Maximilian-Benedikt...

Read More »

Read More »

The Sphere of Economic Calculation

Economic calculation can comprehend everything that is exchanged against money. The prices of goods and services are either historical data describing past events or anticipations of probable future events. Information about a past price conveys the knowledge that one or several acts of interpersonal exchange were effected according to this ratio. It does not convey directly any knowledge about future prices.

Read More »

Read More »

Poll finds early support for pension reform and eco-friendly farming

Despite leading in latest polls, a proposed ban on factory farming in Switzerland has limited chances of success at the ballot box next month, pollsters say. A reform of the old age pension scheme enjoys more solid backing.

Read More »

Read More »

If Mauritius is a Tax H(e)aven, Other African Countries Must be Tax Hells

It is common for commentator to point to corruption, incompetence, malicious Western meddling, and other factors as the source of Africa’s continued economic woes. One seldom hears so-called experts point to taxes as a major impediment to economic development. Even “development economists” do not repudiate Africa’s paradoxically onerous tax regimes.

Read More »

Read More »

Freundliche Welt-Börsentendenz sollte bald enden – DJE plus News August 2022 (Marketing-Anzeige)

In dieser Ausgabe der monatlichen plusNews hat Mario Künzel René Kerkhoff zu Gast, Fondsmanager des DJE - Mittelstand und Innovation. Neben dem Rückblick auf die letzten Wochen und dem Ausblick auf die nächsten sprechen Mario Künzel und René Kerkhoff insbesondere über die Marktlage in Deutschland und Europa.

Das nächste DJE plusNews findet am 14. September 2022 statt.

Hier können Sie sich dazu anmelden: https://web.dje.de/djeplusnews

►...

Read More »

Read More »

US Dollar Soft while Consolidating Yesterday’s Drop

Overview: The US dollar is consolidating yesterday’s losses but is still trading with a heavier bias against the major currencies and most emerging market currencies. The US 10-year yield is soft below 2.77%, while European yields are mostly 2-4 bp higher.

Read More »

Read More »

The Origin of the Income Tax

The freedoms won by Americans in 1776 were lost in the revolution of 1913, wrote Frank Chodorov. Indeed, a man's home used to be his castle. The income tax, however, gave the government the keys to every door and the sole right to change the locks.

Read More »

Read More »

Garet Garrett: Far Forward of the Trenches

Joseph Sobran discovered these Garet Garrett essays "one night, long ago, at the office of National Review, where I then worked." As the flagship of modern conservatism, National Review supported the Cold War and the hot war then raging in Vietnam.

Read More »

Read More »

Sommerfrische an den Börsen: DJE-Marktausblick August 2022

Ein Damoklesschwert hängt über der deutschen und zum Teil auch europäischen Industrieproduktion. Sollte kein russisches Gas mehr geliefert werden, besteht die Gefahr weiterer Kursverluste. Ein besseres Chance-Risiko-Verhältnis bietet zurzeit der US-Aktienmarkt. Zudem bieten ausgewählte Anleihen Chancen bei überschaubaren Laufzeiten.

Erfahren Sie mehr im VIDEO-INTERVIEW mit Stefan Breintner, Leiter Research bei DJE, und dem Wallstreet - Experten...

Read More »

Read More »

“Whatever it takes” – Part II of II

The Fascist Boogeyman awakes again

The threat of a far-right takeover has been around for at least three decades in Europe and Italy has been one of the best “candidates” for the “beginning of the end” since the last European crisis ten years ago. Back then it was the Lega, led by Salvini, that fueled the scaremongering campaigns of the mainstream press, labeling every conservative policy point as basically pure fascism. Of course, none of those...

Read More »

Read More »

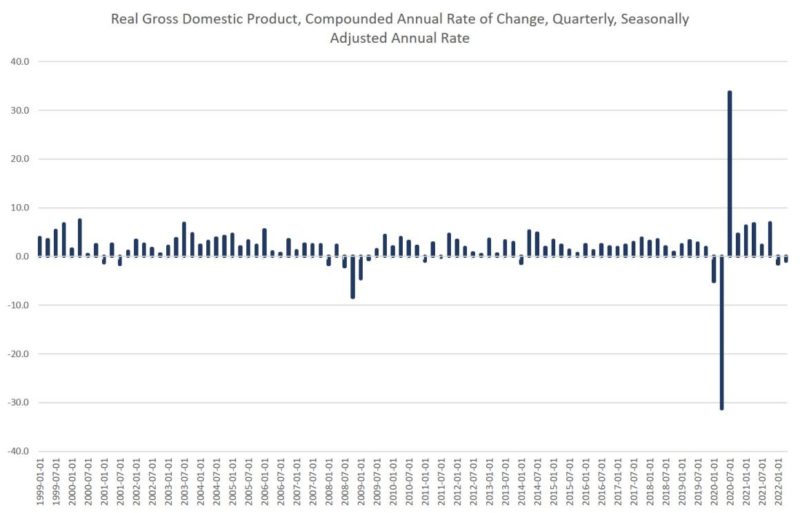

GDP Shrinks Again as Biden Quibbles over the Definition of “Recession”

The U.S. economy contracted for the second straight quarter during the second quarter this year, the Bureau of Economic Analysis reported Thursday. With that, economic growth has hit a widely accepted benchmark for defining an economy as being in recession: two consecutive quarters of negative economic growth.

Read More »

Read More »

Emil Kauder as an Austrian Dehomogenizer

Rothbard's two-volume An Austrian Perspective on the History of Economic Thought contains a lengthy reference list, but a close look at the books reveals that Rothbard continually cited certain authors and borrowed his theses from them.

Read More »

Read More »

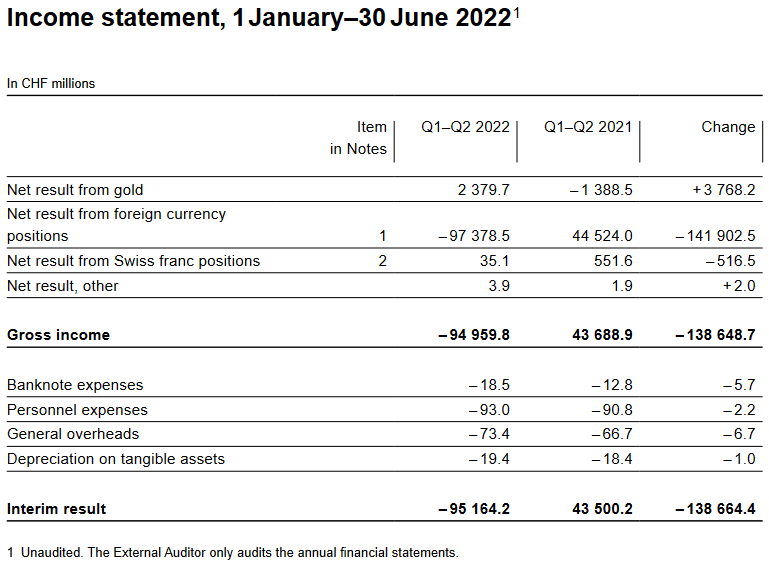

SNB Results Q2/2022: 95 Billion Loss, Close to my Predictions

I was predicting for many years that the SNB will suffer a big loss when inflation comes. The time of reckoning has come. I expected some 150 billion loss in one year: at half time we are 95 billion CHF.

Read More »

Read More »

Ist der Höhepunkt der Inflation erreicht? Podcast mit Dr. Ulrich Kaffarnik

Der Pessimismus im Markt ist weiterhin hoch. Kein Wunder, sind die Belastungsfaktoren doch weiterhin präsent: Inflation, Notenbanken, Geopolitik. Erste Anzeichen signalisieren nun immerhin eine Abkühlung der Inflation. Doch wann ist damit zu rechnen?

Read More »

Read More »