Found 1,377 search results for keyword: label

Aktienrisiken reduzieren – DJE-Marktausblick Oktober 2022 (Marketing-Anzeige)

Inflation, steigende Zinsen, falkenhafte Zentralbanken und anhaltende Energiekrise in Europa schickten die Börsen im September in den Keller. Im Oktober rechnen wir mit einer kurzfristigen Erholung an den Märkten.

Erfahren Sie mehr im VIDEO-INTERVIEW mit Stefan Breintner, Leiter Research bei DJE, und dem Wallstreet - Experten Markus Koch über das, was die Anleger in den nächsten Wochen erwartet.

► Webseite: https://www.dje.de

► Podcast:...

Read More »

Read More »

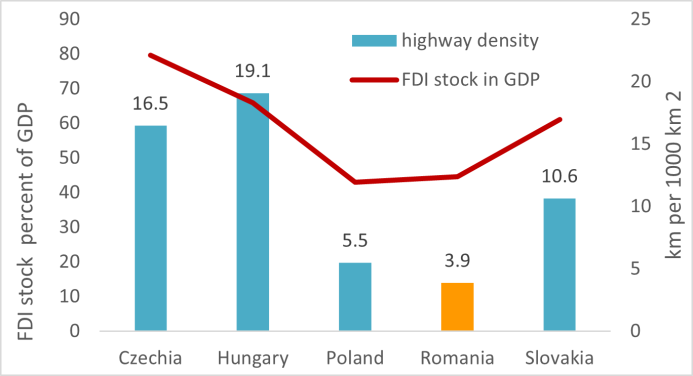

Government Malinvestment Is Endemic and Ceaușescu’s Socialist Romania Excelled in It

Today’s intellectual framework considers government spending to be the solution to any economic and social problem. Be it helicopter money to households and businesses during the pandemic, subsidies for electric cars, or debt forgiveness to students, the government generosity must be growth and welfare enhancing by definition.

Read More »

Read More »

NVDA technical analysis

The next technical analysis video for Nvidia Corp. stock shows that bulls can plan a series of buys and set buy orders at lower prices to target a reversal.

I created a new approach. The 'Fibonacci Entry' Why?

As the price falls, Fibonnaci orders are placed.

1 NVDA is purchased

Then 2 NVDA stocks are bought at a lower price

Then 3 NVDA stocks are bought at a lower price

5, 8, 11, etc.

You decide the series' length. So are entry prices (which...

Read More »

Read More »

Zeitenwende in Politik und Wirtschaft: Dr. Jens Ehrhardt und Alexander Graf Lambsdorff im Gespräch

Politische Spannungen, Inflation, Rezession, globale Lieferketten und was ist heute „der Westen“: Vermögensverwalter Dr. Jens Ehrhardt und Alexander Graf Lambsdorff, stellv. FDP-Fraktionsvorsitzender im Deutschen Bundestag im Gespräch mit Markus Koch anlässlich des DJE-Gesprächskreises 2022 auf Schloss Hohenkammer. Mit breiter Politik- und Marktexpertise ordnen die beiden Interviewpartner die aktuelle Lage in Sachen Weltpolitik und deren...

Read More »

Read More »

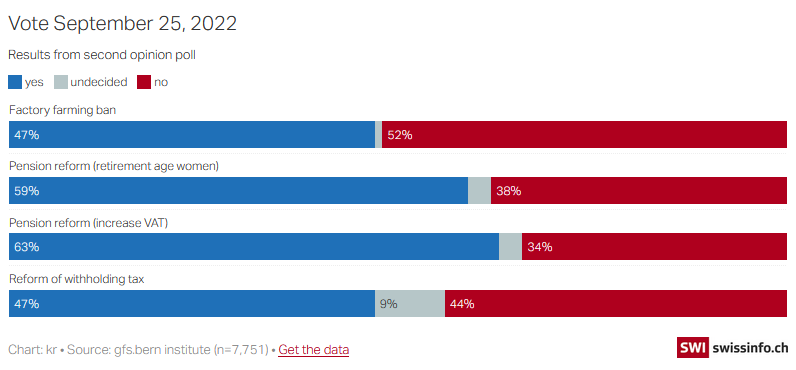

Reform of withholding tax flops in Swiss ballot

Voters have thrown out a decision by parliament to scrap withholding tax on interest from Swiss bonds. Final results show 52% of voters coming out against the reform, which was aimed at boosting investment in Switzerland as well as strengthening the country’s competitiveness and its finance industry.

Read More »

Read More »

The Idea of Liberty Is Western

[This article is excerpted from chapter 21 of Money, Method, and the Market Process, a collection of essays selected and edited by Margit von Mises and with an introduction by Richard M. Ebeling.]

Read More »

Read More »

Does Capitalism Itself Create Economic Instability or Is Central Banking the Culprit?

Instability in financial markets has brought back the ideas of post-Keynesian school of economics (PK) economist Hyman Minsky. Minsky held that the capitalist economy inherently is unstable, culminating in severe economic crisis, accumulation of debt being the key mechanism pushing the economy toward a crisis.

Read More »

Read More »

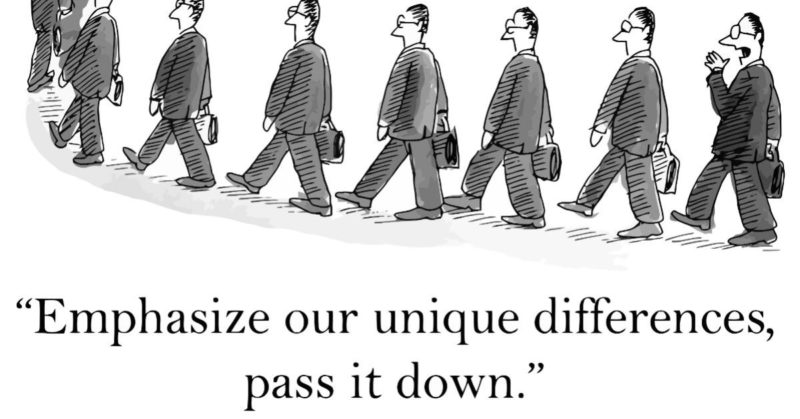

Socialism Is Not Groupthink, but Statethink: A Brief Comment on Jordan Peterson

According to Jordan Peterson, left-wing totalitarians are characterized by an ideology in which group identity is paramount. I will demonstrate that this is a misconception. Historically, socialists have fought against feudalism and capitalism in the name of emancipating the individual from any kind of group or class identity.

Read More »

Read More »

Der strukturelle Wachstumstrend: Podcast mit René Kerkhoff (Marketing-Anzeige)

E-Commerce und Payment ist intakt

Obwohl der E-Commerce Sektor in der Corona Hochzeit zu den größten Gewinnern zählte, hat sich die euphorische Stimmung heute ein Stück weit normalisiert – weniger Wachstum und ein zunehmend unsicheres wirtschaftliches Umfeld verlangsamen die Entwicklung. Was bedeutet das für Sektor und Anleger? Bieten sich trotzdem noch spannende Optionen? Darüber sprechen wir heute mit DJE Analyst und Fondsmanager René Kerkhoff....

Read More »

Read More »

The Fed Is Wrong to Make Policies Based upon the Phillips Curve

Speaking at Jackson Hole, Wyoming, on August 26, 2022, the chair of the Federal Reserve, Jerome Powell, said the Fed must continue to raise interest rates—and keep them elevated for a while—to bring the fastest inflation in decades back under control.

Read More »

Read More »

Support drops for pension reform and factory farming ban

A reform of the Swiss old age pension system has lost ground but is still likely to win a majority in a nationwide vote later this month, pollsters say.

Read More »

Read More »

Elefantenrennen – DJE plusNews September 2022 (Marketing-Anzeige)

In dem monatlich stattfindendem DJE plus News reflektiert Mario Künzel, Referent Investmentstrategie, die Marktgeschehnisse der vergangenen vier Kalenderwochen und gibt Ihnen einen Ausblick auf die kommenden Wochen.

Read More »

Read More »

Agieren aus der Defensive: DJE-Marktausblick September 2022 (Marketing-Anzeige)

Die zweite Augusthälfte war für die Börsen schwierig. Das lag v.a. an der Verschärfung der Energiekrise und dem Vorrang für Inflationsbekämpfung vor Wachstum und Arbeitsmarkt für die Zentralbanken. Wir rechnen damit, dass auch der September ein eher schwieriger Monat – v.a. für europäische Aktienwerte und deutsche Staatsanleihen – werden wird.

Read More »

Read More »

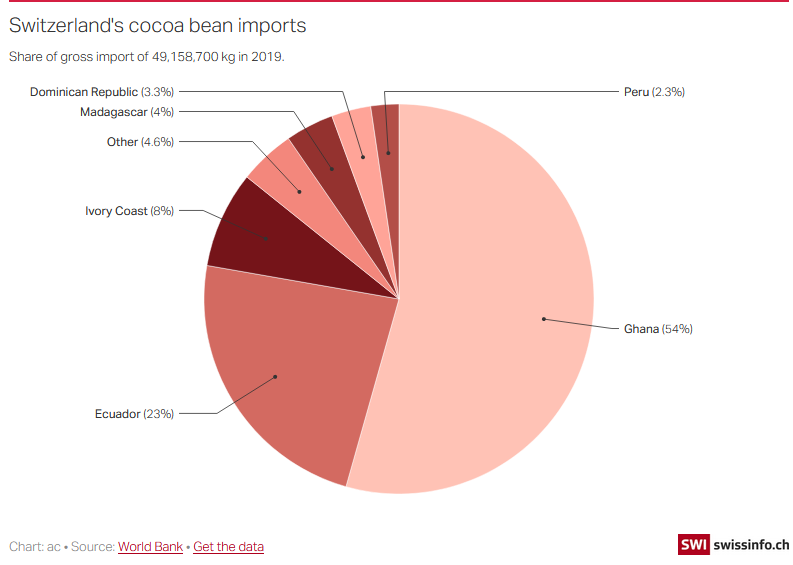

How gold mining in Ghana is threatening Swiss chocolate

As the world’s second-largest cocoa producer continues to lose swathes of farmland to illegal gold mining, Switzerland's chocolate makers are waking up to the threat to their raw material supply.

Read More »

Read More »

We Cannot Interpret Economic Data Unless We Know Economic Theory

Most economic commentators believe that historical data is the key in assessing the state of the economy. Thus, if a statistic such as real gross domestic product or industrial production displays a visible increase, then the economy is stronger. Conversely, a decline in the growth rate says the economy is weakening.

Read More »

Read More »

Social security

Switzerland has a social security network that covers risks in many areas – work, health, family and old age.

Read More »

Read More »

Everything You Wanted to Know about Money, but Were Afraid to Ask

Introduction. With my talk, I would like to accomplish three goals:

First, I want to explain some sound and time-tested basics of monetary theory.

Second, I would like to point out why it is important to have a free market in money; that the battlefront of our time is not between, say, bitcoin, stable coins, gold, and silver, but between government-monopolized fiat monies and a free market in money.

Read More »

Read More »

Weekly Market Pulse: The More Things Change…

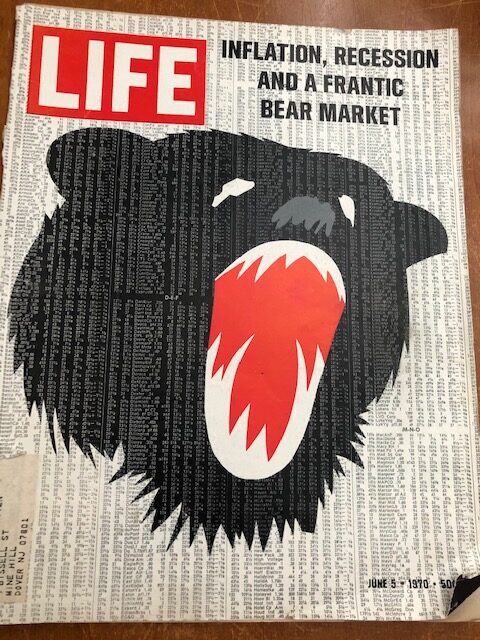

I stopped in a local antique shop over the weekend. The owner is retiring and trying to clear out as much as she can before they close the doors so I paid a mere $3 for the Life magazine above. I think it might be worth many multiples of that price for investors who think our situation today is somehow uniquely bad. The cover headline could just as easily be describing today as 1970.

Read More »

Read More »

Börse – Zinsen, Dividenden, Wachstum: Diese Schweizer Bank-Aktien ziehen starkes Interesse auf sich

Die Chefs von Schweizer Banken dürften am 16. Juni aufgeatmet haben. Was auch immer über die Pros und Cons von Zinserhöhungen gesagt wird, der Zinsschritt der Schweizerischen Nationalbank (SNB) hilft der Branche. Wie eine Auswertung von cash.ch zeigt, liegen in der Jahres-Performance 12 der 16 besonders zinssensitiven Kantonal- und Regionalbanken in der Schweiz und Liechtenstein im Puls (siehe Tabelle).

Read More »

Read More »

Review: Progressive Conservatism: How Republicans Will Become America’s Natural Governing Party

Frank Buckley is always a thoughtful and provocative author, but I disagree with what he has to say in Progressive Conservatism more than with other books of his I’ve reviewed, such as his outstanding American Secession and Curiosity.

Read More »

Read More »