At the end of May, SNB president Jordan admitted that the EUR/CHF floor will not raised (here also cited by Bloomberg):

We cannot arbitrarily manipulate our currency. In an even worse crisis situation this would be disastrous and counterproductive. The floor must be legitimized. The current minimum exchange rate is realistic and has helped the Swiss economy.

This stance was surprisingly different to the strong commitment about the floor he uttered previously: for months the SNB continued to vow that it might take further measures to weaken the franc, even if the wording changed from the “massively overvalued franc” in August 2011 over to “significantly overvalued franc” in January 2012 to “very very strong franc” in April.

Based on the IMF Code of Good Practices on Transparency in Monetary and Financial Policies, Jordan gave such a clear and transparent message, which we translated into: The SNB will not raise the floor. Long-term investors can be sure not to lose money.

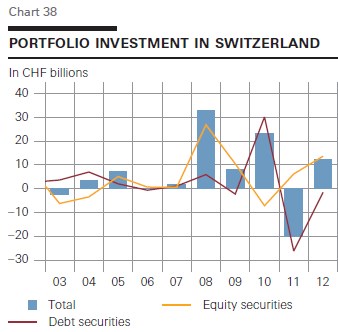

| During that period strong interventions started again. Foreigners mostly bought Swiss equities – and not Swiss safety aka bonds or cash. (source Swiss Balance of Payments). The SNB reacted increasing strongly the equity share in its foreign currency portfolio.

In November, Swiss inflation had picked up only a little. Jordan has in the meantime weakened his language again: Tthe franc is now only “very strong”.

|

SNB Inflation Forecasts |

| Our Comment

In September 2011, the EUR/CHF floor was born based on the wrong assumption that Switzerland could go for longer lasting deflation and the global economy into a recession. The SNB continued to sustain and to incite bank research that published two misleading ideas: 1) “The Swiss franc is overvalued at real effective exchange rate REER values of 110%.” 2) “The Swiss franc is a safe-haven. Once the crisis is finished, it will devalue.” In May 2012 Swiss Q1 GDP was released and, thanks to US, Chinese and global growth, Swiss GDP clearly outpaced expectations. At that moment the two wrong assumptions above turned into a blunt lie. The SNB bluff was quickly called by former UBS chairman Oswald Gruebel. Investors piled massively into the Swiss franc. Balance of Payments data published by the SNB itself showed that a big part of foreign inflows were risk-on investments (see graph). In 2011 and 2012, foreigners sold Swiss bonds. |

Portfolio Investments in Switzerland Source: SNB - Click to enlarge |

Equity investors are very sensitive to exchange rates that make stocks of overvalued currencies relatively expensive and they sell them.

Hence, If the minimum rate had been defined at (for CHF) overvalued levels of 1.10, then the SNB balance sheet would be 30-50% smaller. If the EUR/CHF floor had been established at parity, then the SNB would have sold off nearly all reserves and the EUR/CHF might be back at 1.05 or 1.10. The choice of 1.20 as the floor was wrong. Together with excessively cheap money, this will turn into a boom with wrong investments.

See more for