Category Archive: 2.) Pictet Macro Analysis

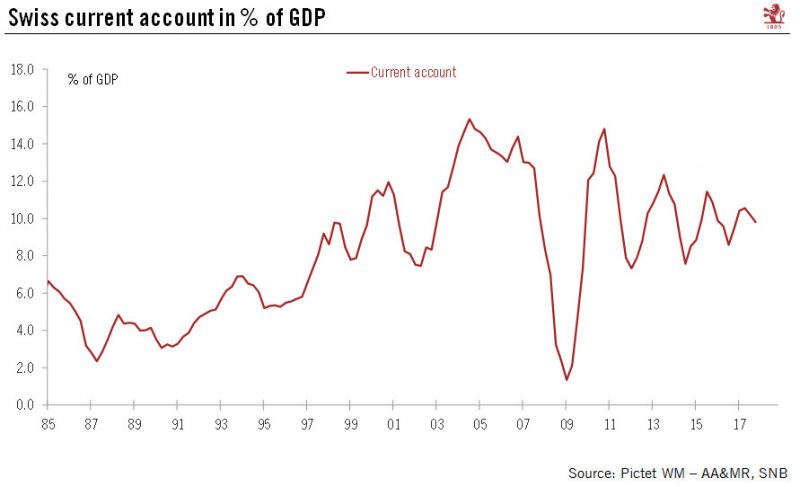

Disentangling the Swiss current account

Following the Swiss National Bank’s (SNB) publication of Switzerland’s balance of payments data for Q4 2017, in this note we look deeper into the Swiss current account to try to find out why Switzerland persistently runs a surplus and whether or not the current account balance can be used to assess the fair value of the Swiss franc.

Read More »

Read More »

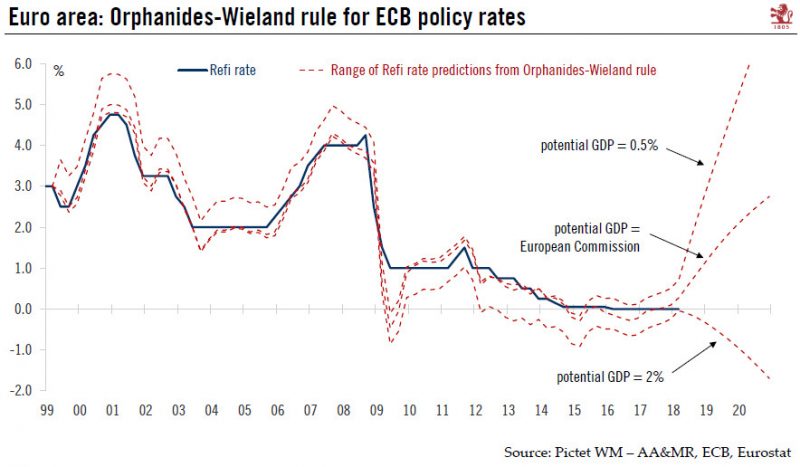

Europe chart of the week – monetary policy

Much of recent ECB dovish rhetoric has been building around the (not-sonew) idea that potential growth might be higher than previously thought, implying a larger output gap and lower inflationary pressure, all else equal. The argument is both market-friendly and politically welcome – what we are seeing is the early effects of those painful structural reforms implemented during the crisis. Inflation would be low for good reasons.

Read More »

Read More »

Pictet Perspectives – What happens when rates rise?

After years of low interest rates, investors need to prepare for a rise in the cost of credit.

Since the financial crisis, investors have benefitted from rising bond price, while companies have seen their funding costs decline to the lowest point in decades. But with central banks scaling back their support in response to good economic growth, the years ahead will be very different. Investors need to prepare for a rise in the cost of debt, says...

Read More »

Read More »

Pictet Perspectives – What happens when rates rise?

After years of low interest rates, investors need to prepare for a rise in the cost of credit. Since the financial crisis, investors have benefitted from rising bond price, while companies have seen their funding costs decline to the lowest point in decades. But with central banks scaling back their support in response to good …

Read More »

Read More »

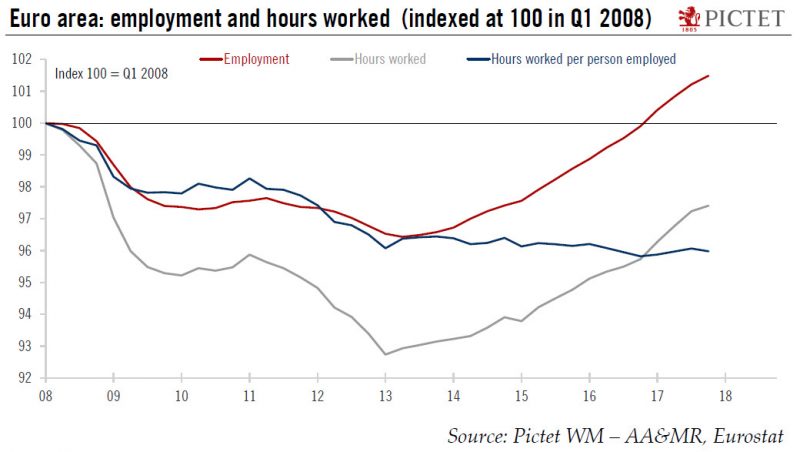

Europe chart of the week – Employment

Euro area employment grew for the 18th consecutive quarter in Q4 2017 (+0.3% q-o-q), and is now 1.5% above its pre-crisis (2008) level. By contrast, hours worked per person employed decreased during the same period, remaining 4% below their pre-crisis level. The two data series have followed divergent trends since the start of the economic recovery. Between Q1 2008 and Q2 2013, the total amount of labour input used by firms decreased massively.

Read More »

Read More »

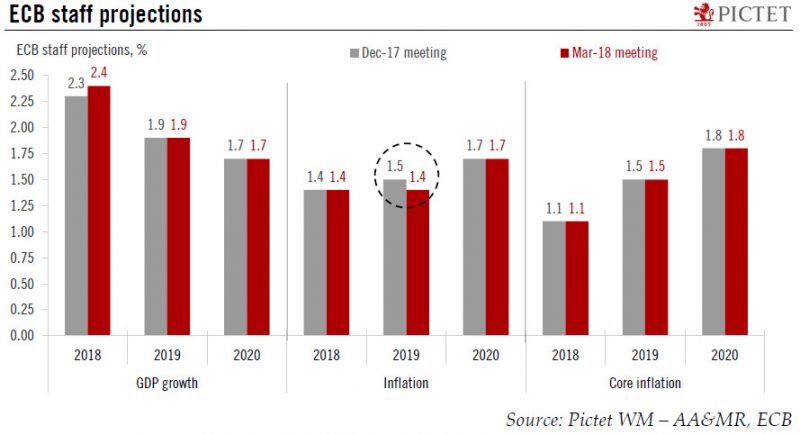

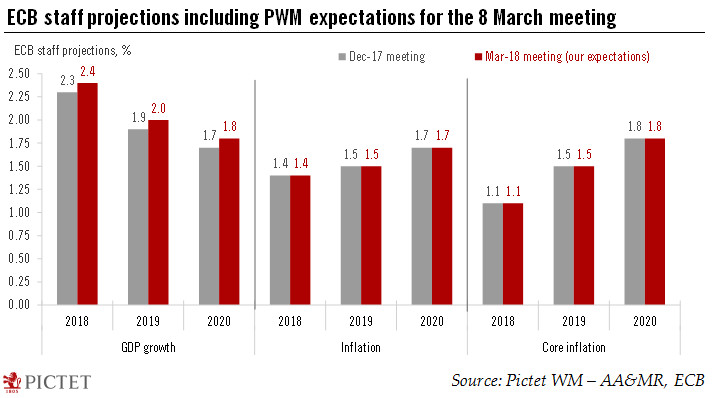

ECB begins to rotate forward guidance

The ECB made one small change to its communication in March consistent with a normalisation process that is likely to remain very gradual. In line with our expectations, today the Governing Council (unanimously) decided to drop its commitment to increase asset purchases “in terms of size and/or duration” if needed, which had steadily become more difficult to justify and less credible anyway.

Read More »

Read More »

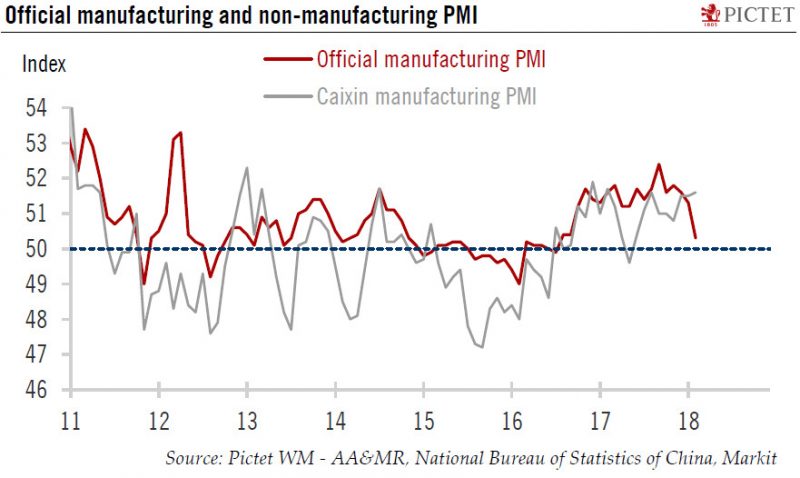

China: February PMIs point to deceleration in industrial activity

China’s official manufacturing Purchasing Manager Index (PMI) for February, compiled by the National Bureau of Statistics of China and the China Federation of Logistics and Purchasing, came in at 50.3, down from 51.3 in January and 51.6 in December 2017. This is the lowest reading of this gauge since October 2016. The Markit PMI (also known as the Caixin PMI), however, edged up slightly to 51.6 in February from 51.5 in the previous month

Read More »

Read More »

Europe – ECB preview

Market participants have enjoyed a protracted period of very low volatility, but it may well have come to an end in 2018. Central banks are often said to be responsible for the disappearance of volatility, for example through their large-scale asset purchases, which have compressed the term premium. But, now that the same central banks are heading for the exit from unconventional policies, they, too, need to relearn how to live with volatility.

Read More »

Read More »

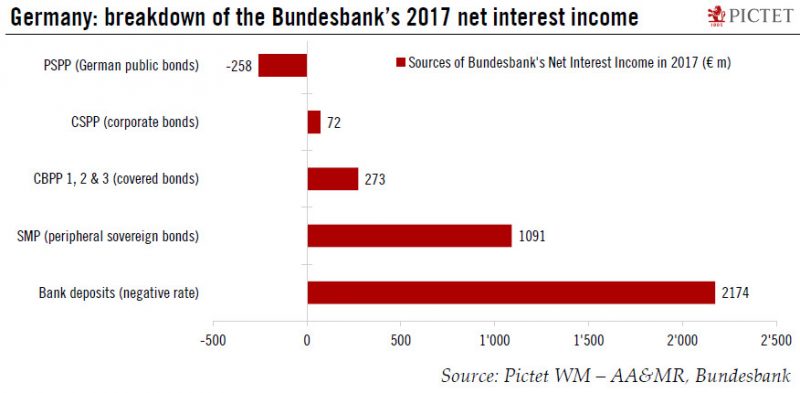

ECB policy is boosting the Bundesbank’s profits

This week the German Bundesbank published its 2017 annual report, which includes a number of interesting figures that are relevant to the broader (monetary) policy debate in the euro area. In particular, the Bundesbank provided details of the amount of securities held on its balance sheet for policy purposes, including QE, at the end of 2017, and the corresponding flows of income stemming from its asset purchases. Remember that QE is largely...

Read More »

Read More »

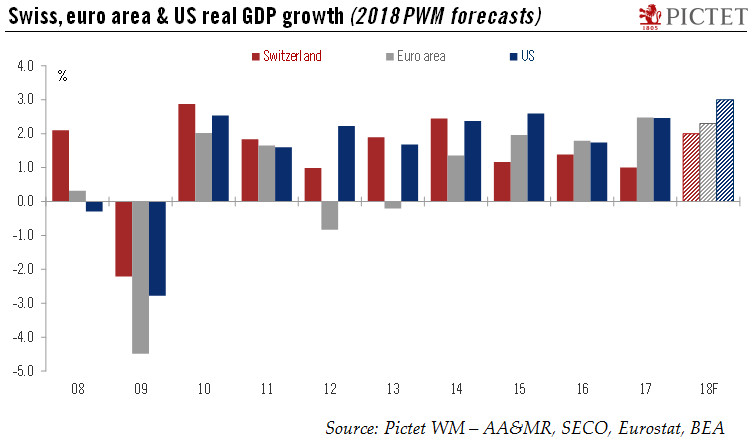

Switzerland: So far so good

According to the State Secretariat for Economic Affairs (SECO)’s quarterly estimates, Swiss real GDP rose by 0.6% q-o-q in Q4 (2.4% q-o-q annualised; 1.9% y-o-y), above consensus expectations (0.5%). The Swiss economy expanded by 1.0% in 2017 overall, in line with our own forecast. This comes after GDP growth of 1.4% in 2016 and 1.2% in 2015.

Read More »

Read More »

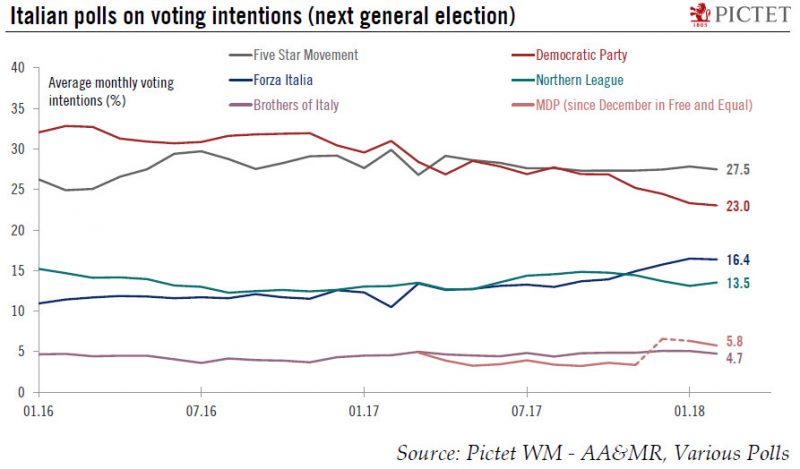

Who will tackle Italy’s root problems?

The Italian general election campaign is in its final stretch before voting on 4 March. The election will take place under the new electoral law (Rosatellum bis), which allocates 37% of parliamentary seats via the principle of "first-past-the-post" and 61% via proportional representation, with the remaining 2% reserved for overseas constituencies (see our previous Flash Note for further details).

Read More »

Read More »

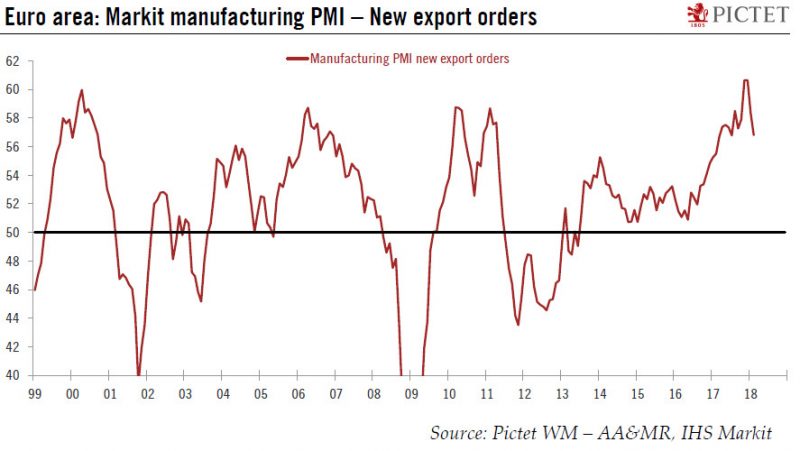

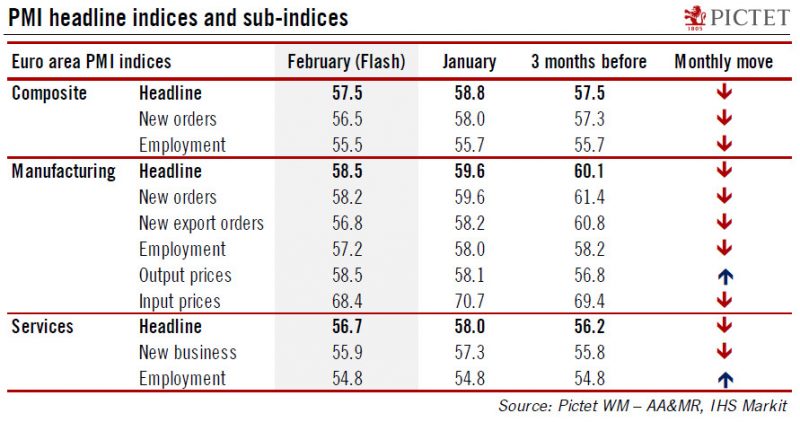

Europe chart of the week – Business surveys

There was a broad-based setback in euro area business surveys in February, whether in terms of country or of sector. The Flash composite PMI slipped to 57.5 in February from 58.8 in January. The month-to-month dip was the biggest since 2014. National business surveys painted a similar picture.

Read More »

Read More »

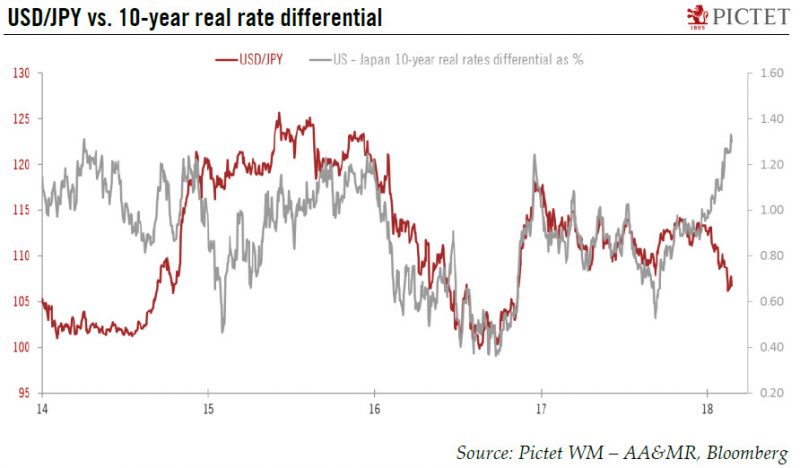

Less scope for yen and Swiss franc depreciation

The start of the year has seen the Japanese yen and Swiss franc appreciate strongly against the US dollar (they rose by 5.6% and 4.4% respectively between 1 January and 22 February) despite higher US yields. However, this rise in US yields came with heightened market volatility, favouring safe haven currencies such as the yen and franc.

Read More »

Read More »

Euro area: Flash PMI surveys pass their peak

The IHS Markit flash composite purchasing managers’ index (PMI) for the euro area eased to 57.5 in February from 58.8 in January, below consensus expectations (58.4). The index marked its the largest monthly decrease since August 2014. Activity in both services PMI (-1.3 points to 56.7) and manufacturing (-1.1 points to 58.5) cooled in February. But while the breakdown by sub-indices showed that the pace of growth in new orders and output slowed...

Read More »

Read More »

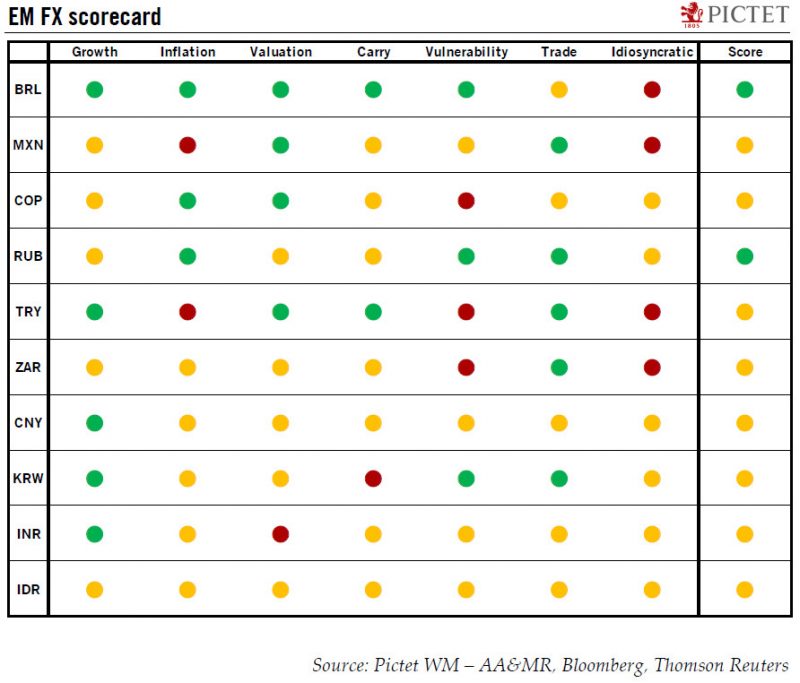

Our emerging market currencies scorecard gives good marks to real and rouble

The scope of this note is to present a score card for Emerging Market (EM)currencies, designed to assess the attractiveness of a given currency over the coming 12 months. The scorecard (see chart), constructed using a rules - based methodology, suggests that the Russian rubble and the Brazilian real are currently among the most attractive EM currencies.

Read More »

Read More »

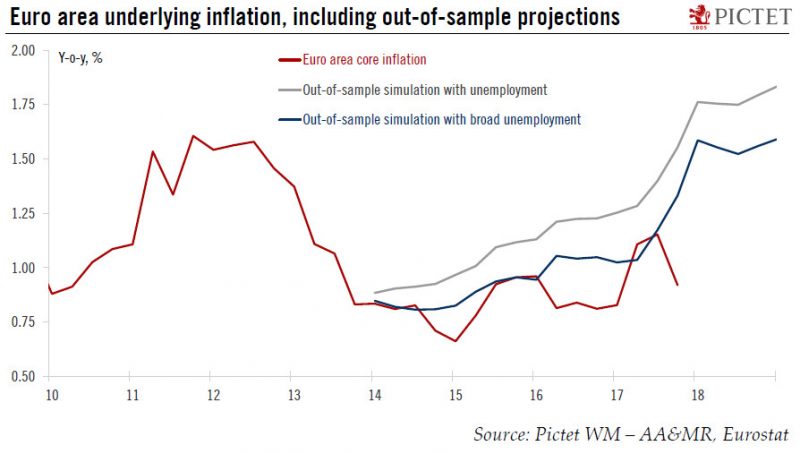

Euro area inflation: the Phillips curve and the ‘broad unemployment’ hypothesis

Monetary policy in 2018 is all about the Phillips curve. The extent to which wage growth and inflation respond to falling unemployment will shape the monetary tightening cycle. If recent price action is any guide, any surprise on that front could result in market overreaction and volatility spikes. The most elegant description of the current state of research was provided by ECB Executive Board member Benoît Coeuré last year, who described the...

Read More »

Read More »

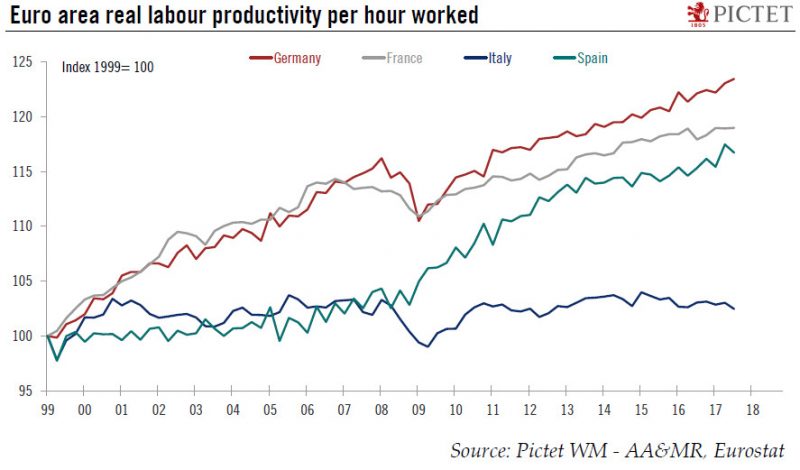

Europe chart of the week – Italian productivity

With less than 30 days to go, the Italian general election remains highly unpredictable. The new electoral system and the fact that 37% of seats are to be allocated on a ‘first-past-the-post’ system make projecting seats from voting intentions particularly hard. Importantly, Italy is going into this election with an economy that is performing relatively strongly relative to recent history. However, cyclical strength is masking structural...

Read More »

Read More »

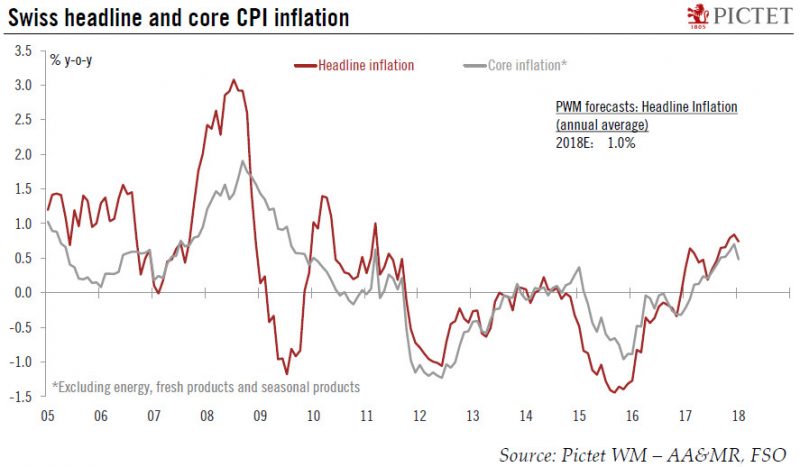

Switzerland: inflation edged lower in January

According to the Swiss Federal Statistical Office (FSO), the headline consumer price index (CPI) inflation eased to 0.7% y-o-y in January from 0.8% y-o-y in December, in line with consensus and our own expectations. Core inflation (CPI excluding food, beverages, tobacco, seasonal products, energy and fuels) also eased, from 0.7 % y-o-y in December to 0.5% y-o-y in January (see Chart 1), back to the level of October 2017.

Read More »

Read More »

Pictet Perspectives – Volatility presents opportunities

A pick-up in inflation fears contributed to the recent spike in bond yields that spilled over into equities. But while inflation remains a risk, Cesar Perez Ruiz, CIO at Pictet Wealth Management, remains sanguine about the global economy and risk assets and sees volatility as an opportunity for tactical positioning.

More on http://perspectives.pictet.com/

https://www.group.pictet/wealth-management

Read More »

Read More »

Pictet Perspectives – Volatility presents opportunities

A pick-up in inflation fears contributed to the recent spike in bond yields that spilled over into equities. But while inflation remains a risk, Cesar Perez Ruiz, CIO at Pictet Wealth Management, remains sanguine about the global economy and risk assets and sees volatility as an opportunity for tactical positioning. More on http://perspectives.pictet.com/ https://www.group.pictet/wealth-management

Read More »

Read More »