Category Archive: 2) Swiss and European Macro

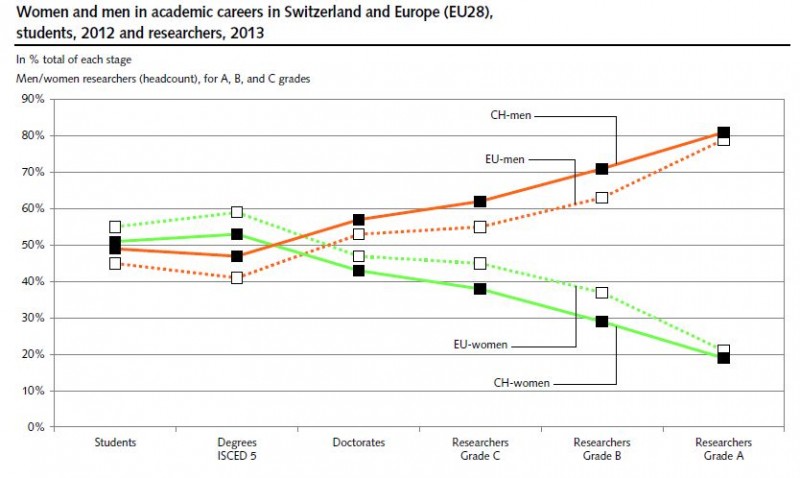

Women and Science 2015: Under-representation of women in science greater in Switzerland than in Europe

14.03.2016 09:15 - FSO, Economic structure and analyses (0353-1600-90) Women and Science 2015 Neuchâtel, 14.03.2016 (FSO) – In Switzerland, women are outnumbered by men in the field of science and research, especially in academic careers. Only 18% o...

Read More »

Read More »

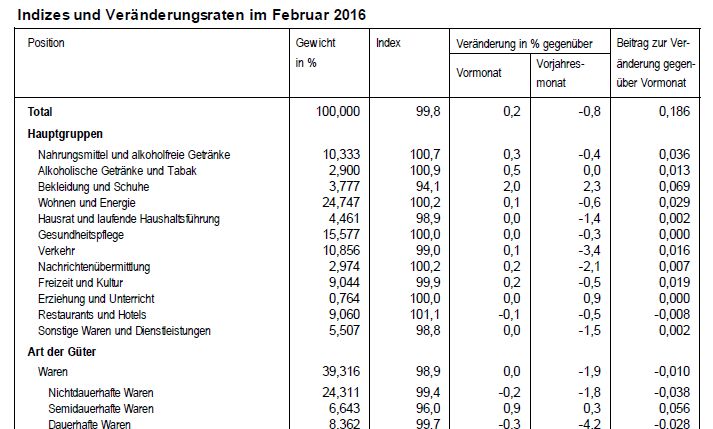

Swiss Consumer Price Index in February 2016: -0.8 percent against 2015, +0.2 percent against last month

08.03.2016 09:15 - FSO, Prices (0353-1602-40) Swiss Consumer Price Index in February 2016 Neuchâtel, 08.03.2016 (FSO) – The Swiss Consumer Price Index (CPI) increased by 0.2% in February 2016 compared with the previous month, reaching 99.8 points

Read More »

Read More »

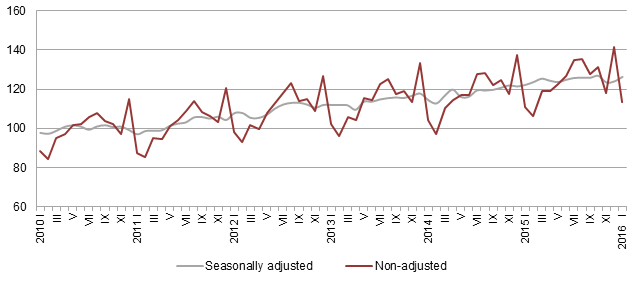

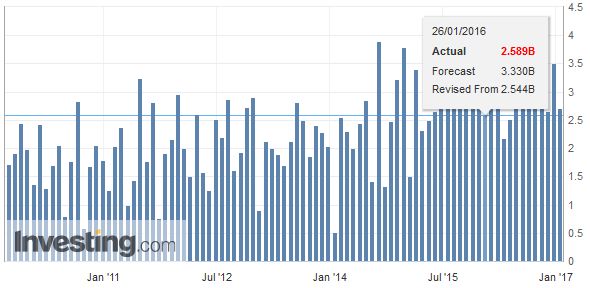

Statistics on tourist accommodation in January 2016: Marked decline in overnight stays in January

07.03.2016 09:15 - FSO, Tourism (0353-1602-30) Statistics on tourist accommodation in January 2016 Neuchâtel, 07.03.2016 (FSO) – The Swiss hotel industry registered 2.6 million overnight stays in January 2016, which corresponds to a decrease of 6.8%...

Read More »

Read More »

Equities: Renewing the bull market?

Equity markets have picked up since early February. Christophe Donay, Chief Strategist at Pictet Wealth Management, discusses whether this is a new bull market or just a tactical rebound.

Read More »

Read More »

January Retail Sales: Real YoY +0.2 percent, Nominal -1.3 percent YoY

01.03.2016 09:15 - FSO, Economic Surveys (0353-1602-20) Retail trade turnover in January 2016 Neuchâtel, 01.03.2016 (FSO) – Turnover in the retail sector fell by 1.3% in nominal terms in January 2016 compared with the previous year. Seasonally adjus...

Read More »

Read More »

Statistical Yearbook of Switzerland 2016 / Statistical Data on Switzerland 2016: Where numbers are more than just data

26.02.2016 09:15 - FSO, Dissemination and Publications (0353-1602-10) Statistical Yearbook of Switzerland 2016 / Statistical Data on Switzerland 2016 Neuchâtel, 26.02.2016 (FSO) – The 2016 editions of the “Statistical Yearbook of Switzerland” and “S...

Read More »

Read More »

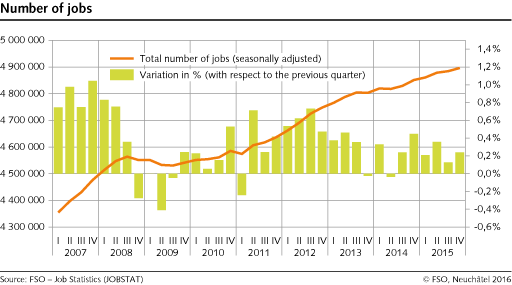

The employment barometer in the 4th quarter 2015: Increase in total employment, decline in secondary sector

26.02.2016 09:15 - FSO, Economic Surveys (0353-1602-00) The employment barometer in the 4th quarter 2015 Neuchâtel, 26.02.2016 (FSO) – Employment grew by 0.9% in the 4th quarter 2015 compared with the same quarter of the previous year. However, the ...

Read More »

Read More »

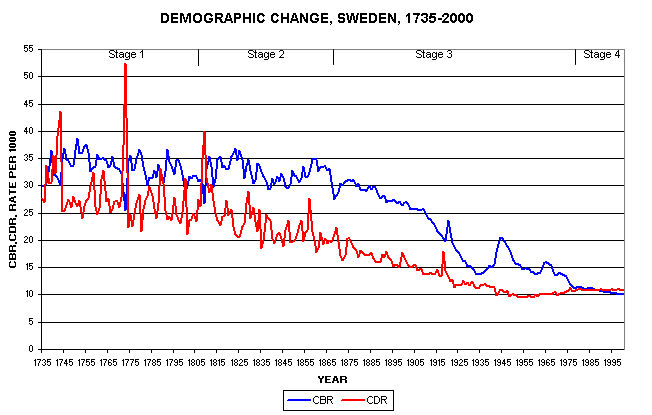

Vital Statistics 2015: provisional results: Highest number of deaths since 1918

25.02.2016 09:15 - FSO, Demography and Migration (0353-1601-80) Vital Statistics 2015: provisional results Neuchâtel, 25.02.2016 (FSO) – 2015 was characterised by a sharp increase in the number of deaths, and a fall in the number of births, marriage...

Read More »

Read More »

Construction Industry Production, Orders and Turnover Statistics in 4th quarter 2015: Secondary sector production in Switzerland still falling

25.02.2016 09:15 - FSO, Economic Surveys (0353-1601-90) Construction Industry Production, Orders and Turnover Statistics in 4th quarter 2015 Neuchâtel, 25.02.2016 (FSO) – Secondary sector production fell by 4.5% in 4th quarter 2015 compared with the...

Read More »

Read More »

Statistics on tourist accommodation in December and year 2015: Overnight stays declined by 0.8 percent in 2015

23.02.2016 10:30 - FSO, Tourism (0353-1601-70) Statistics on tourist accommodation in December and year 2015 Neuchâtel, 23.02.2016 (FSO) – The hotel sector registered 35.6 million overnight stays in Switzerland in 2015, representing a decline of 0.8...

Read More »

Read More »

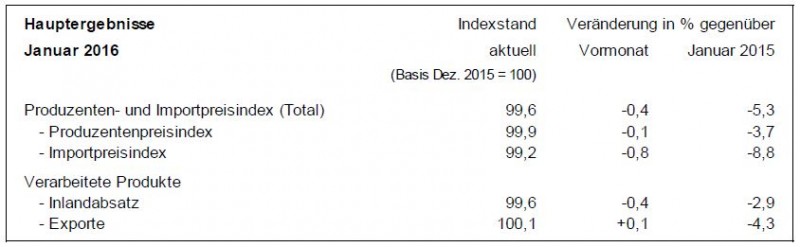

Swiss Producer and Import Price Index in January 2016: Minus 5.3 percent YoY

The Producer and Import Price Index fell in January 2016 by 0.4% compared with the previous month, reaching 99.6 points (base December 2015 = 100). Whereas the Producer Price Index declined by 0.1%, the Import Price Index fell by 0.8%. The decline is due largely to falling prices for petroleum products. Compared with January 2015, the price level of the whole range of domestic and imported products fell by 5.3%. These are the findings of the...

Read More »

Read More »

Swiss Labour Force Survey in 4th quarter 2015: labour supply: 0.5 percent increase in the number of employed persons; unemployment rate based on ILO rises to 4.7 percent

18.02.2016 09:15 - FSO, Labour Force (0353-1601-40) Swiss Labour Force Survey in 4th quarter 2015: labour supply Neuchâtel, 18.02.2016 (FSO) – The number of employed persons in Switzerland rose by 0.5% between the 4th quarter 2014 and the 4th quarte...

Read More »

Read More »

Swiss Consumer Price Index in January 2016: Consumer prices fall by 0.4 percent

11.02.2016 09:15 - FSO, Prices (0353-1601-30) Swiss Consumer Price Index in January 2016 Neuchâtel, 11.02.2016 (FSO) – The Swiss Consumer Price Index (CPI) fell by 0.4% in January 2016 compared with the previous month. The decline is due largely to ...

Read More »

Read More »

The Economist – Δαμηλάκης Ευτύχιος, ερώτηση στον Dr. Peter Bofinger

Ερώτηση, Δαμηλάκη Ευτυχίου. The Economist στον Κ.Professor Dr Peter Bofinger,German Council of Economic Experts/ University of Würtzburg,την 09 Ιουλίου 2015, για την περικοπή των αμυντικών δαπανών, την ασφάλεια της Ελλάδος,της Ευρώπης, και τον Ισλαμικό φονταμενταλισμό.

Read More »

Read More »

Equities: A change of regime

Equities markets had an unusually turbulent start to the year. Christophe Donay, Chief Strategist at Pictet Wealth Management, explains what investors should expect next, on both tactical and strategic horizons.

Read More »

Read More »

Euro area: Oil, inflation and the ECB’s likely response

The new fall in oil prices in recent weeks will add to deflationary pressures in the euro area. Frederik Ducrozet, Senior European Economist at Pictet Wealth Management, discusses the size of the impact and the likely policy response from the ECB.

Read More »

Read More »

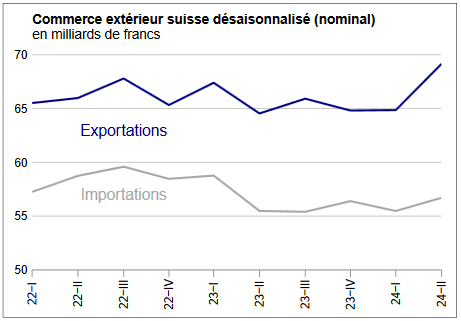

2015 Swiss Exports and Swiss Trade Balance: Decline at a High Level

After several years of moderate growth, exports (-2.6%) and imports (-6.9%) fell in nominal terms in 2015. Nevertheless, exports were at their third-highest level ever at CHF 202.9 billion. Prices clearly declined, particularly for imports, against the backdrop of the strong Swiss franc.

Read More »

Read More »