Category Archive: 2) Swiss and European Macro

Insider kauft diese Aktie!

► TIPP: Sichere Dir wöchentlich meine Tipps zu Gold, Aktien, ETFs & Co. – 100% gratis: http://lars-erichsen.de/ In diesem Video werden ich euch zeigen, wo und wie die Insider gerade kaufen. Außerdem werde ich euch sagen, wie ihr an die Daten der so genannten Directors´ Dealings herankommt und zu guter letzt bekommt ihr von mir … Continue...

Read More »

Read More »

Zeit für Gold | Robert Vitye bei Mission Money mit Florian Homm, Horst Lüning & Dr. Markus Elsässer

Im Rahmen des Börsianischen Quartetts, welches von Mission Money, dem YouTube-Kanal von Focus Money ausgerichtet wird, nahm Robert Vitye – Geschäftsführer der SOLIT Gruppe – an einer Live-Diskussion ? mit Florian Homm, Dr. Markus Elsässer und Horst Lüning teil. Das Thema der Diskussionsrunde: Wie viel Diversifikation im Depot macht Sinn und welche Rolle spielt Gold …

Read More »

Read More »

Deutsche Autos als Gefahr für die nationale Sicherheit der USA?

Mercedes, BMW, VW, Audi und Porsche werden von der Trump-Administration als Gefahr für die nationale Sicherheit ihres Landes gebrandmarkt. Über so viel Unsinn kann man als Deutscher zunächst nur den Kopf schütteln. Bei genauerer Betrachtung der Gemengelage erkennt man jedoch die eigentlichen Beweggründe Amerikas, die mit nationaler Gefahr wenig bis nichts mehr zu tun haben. …

Read More »

Read More »

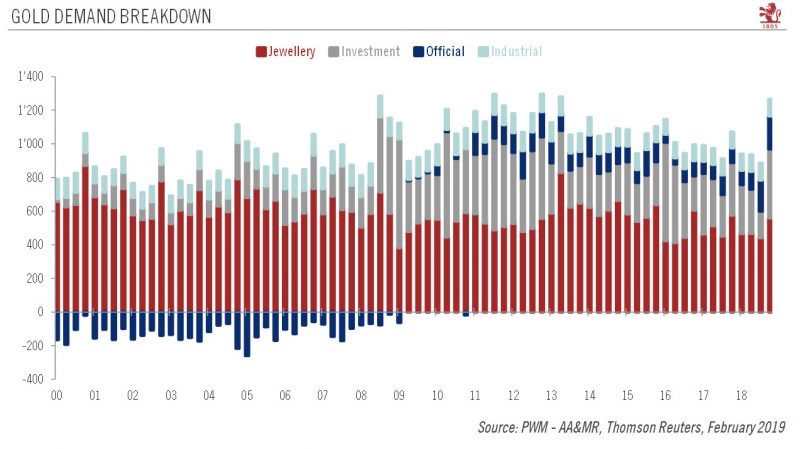

Gold to consolidate before further leg up

Some recent factors supporting gold are fading. However, while gold could sag in the short term, medium-term prospects look better.Last year ended on a very strong note for gold demand, with a significant increase in jewellery and investment demand in the fourth quarter (see chart), leading to strong price performance (7.7% in US dollar terms in Q4).

Read More »

Read More »

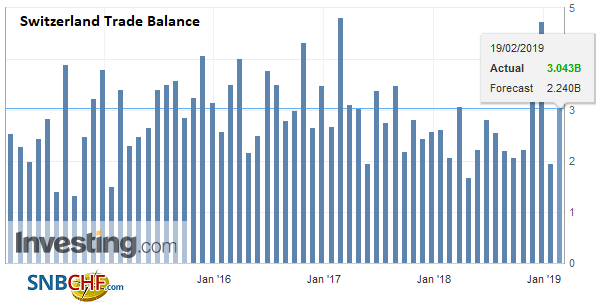

Swiss Trade Balance January 2019: Start of a Positive year

Swiss foreign trade started the year 2019 in a positive way. Seasonally adjusted exports rose by 1.1% to 18.9 billion francs and imports by 3.4% to 17.5 billion. The trade balance closed with a surplus of 1.4 billion francs.

Read More »

Read More »

YANIS VAROUFAKIS : POUR UNE EUROPE VRAIMENT DÉMOCRATIQUE

Ce soir, Le Media vous propose un Entretien Libre extraordinaire. Dans le cadre de la soirée de clôture du festival Nos Disques Sont Rayés, avec Yanis Varoufakis au théâtre du rond point, nous évoquerons, pendant près d’une heure, sa vision de l’Europe, son projet politique pour les élections européennes et la crise des Gilets Jaunes. …

Read More »

Read More »

Dividenden-Schock bei Daimler! Diese 3 Aktien sind besser!

► TIPP: Sichere Dir wöchentlich meine Tipps zu Gold, Aktien, ETFs & Co. – 100% gratis: http://lars-erichsen.de/ Nicht erst seit der letzten Dividendenkürzung haben Daimleraktionäre herzlich wenig zu lachen. In diesem Video möchte ich euch schlicht und einfach drei – aus meiner Sicht – deutlich bessere Alternativen vorstellen. Los geht´s! ——– ➤ Mein YouTube-Kanal zum …

Read More »

Read More »

Pictet Perspectives – What to expect from central banks this year

Following the Fed’s recent dovish turn, we could expect other central banks to follow suit. However, according to Frederik Ducrozet, Strategist at Pictet Wealth Management, the ongoing trade tensions and idiosyncratic constraints facing central banks today could limit their room to manoeuvre. We expect the European, Japanese and Chinese central banks to contribute to rising global liquidity this year, more than offsetting any quantitative...

Read More »

Read More »

Pictet Perspectives – What to expect from central banks this year

Following the Fed’s recent dovish turn, we could expect other central banks to follow suit. However, according to Frederik Ducrozet, Strategist at Pictet Wealth Management, the ongoing trade tensions and idiosyncratic constraints facing central banks today could limit their room to manoeuvre. We expect the European, Japanese and Chinese central banks to contribute to rising …

Read More »

Read More »

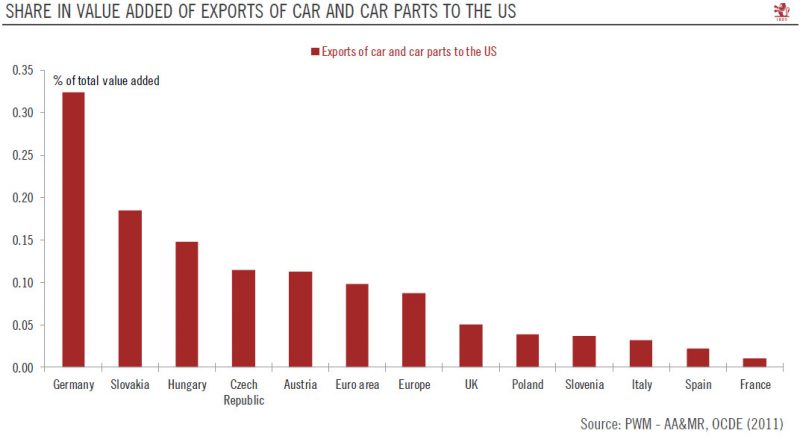

Euro area : What if car tariffs lie ahead ?

New US auto tariffs may impact the economy significantly more than the previous tariffs on steel and aluminium.Among the key risks for our euro area outlook, the threat of US auto tariffs is of major importance.The US Commerce Department’s investigation on national security threats posed by auto imports is due to be concluded on 17 February.

Read More »

Read More »

Yanis Varoufakis: sogno un’Europa che sia la soluzione, non il problema

Intervista con l’ex-ministro delle finanze greco, candiato alle elezioni parlamentari europee in Germania. … ALTRE INFORMAZIONI : https://it.euronews.com/2019/02/15/yanis-varoufakis-sogno-un-europa-che-sia-la-soluzione-non-il-problema euronews: il canale di informazione più seguito in Europa. Abbonati ! http://www.youtube.com/subscription_center?add_user=euronewsit euronews è disponibile in 13 lingue:...

Read More »

Read More »

YANIS VAROUFAKIS EN DIRECT SUR LE MEDIA

YANIS VAROUFAKIS EN DIRECT SUR LE MEDIA Lundi à 20H, Aude Lancelin recevra Yanis Varoufakis en direct du théâtre du rond point. Un entretien libre en direct exceptionnel, où l’ancien ministre des finances grec du gouvernement Syriza reviendra sur ses années au pouvoir où il s’est confronté au mur de l’administration européenne, le lancement de …

Read More »

Read More »

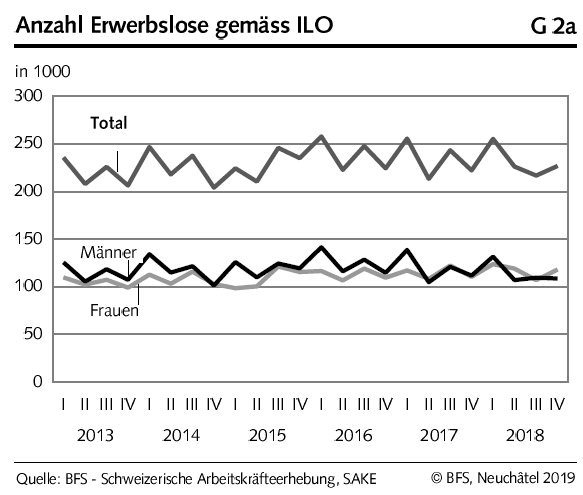

Swiss Labour Force Survey in 4th quarter 2018: 0.8percent increase in number of employed persons; unemployment rate based on ILO definition at 4.6percent

14.02.2019 - The number of employed persons in Switzerland rose by 0.8% between the 4th quarter 2017 and the 4th quarter 2018. During the same period, the unemployment rate as defined by the International Labour Organisation (ILO) increased slightly by 0.1 percentage points to 4.6%. The EU's unemployment rate decreased from 7.3% to 6.6%.

Read More »

Read More »

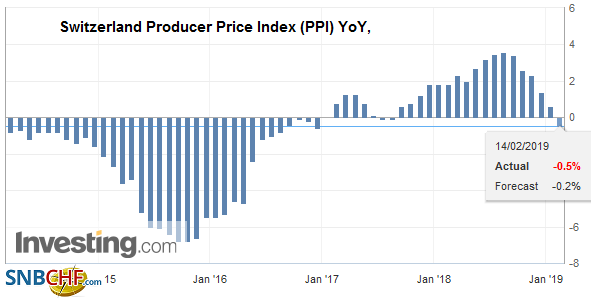

Swiss Producer and Import Price Index in January 2019: -0.5 percent YoY, -0.7 percent MoM

14.02.2019 - The Producer and Import Price Index fell in January 2019 by 0.7% compared with the previous month, reaching 101.7 points (December 2015 = 100). This decline is due in particular to lower prices for petroleum products. Compared with January 2018, the price level of the whole range of domestic and imported products fell by 0.5%.

Read More »

Read More »

Schluss mit Aktien! Wann?

► TIPP: Sichere Dir wöchentlich meine Tipps zu Gold, Aktien, ETFs & Co. – 100% gratis: http://lars-erichsen.de/ Ich habe es auf diesem Kanal mehrfach besprochen: Aktien sind nicht nur ein sehr rentabler, sondern auch ein sehr flexibler Sachwert und deswegen aus meiner Sicht für den langfristigen Vermögensaufbau bestens geeignet. Das sollte allerdings nicht darüber hinweg …

Read More »

Read More »

Können sich die Anleger nur noch auf die Geldpolitik verlassen?

Die real existierende Außen-, Wirtschafts- und Finanzpolitik vieler Länder zeigt häufig eine unberechenbare, ja sogar zerstörerische Kraft auf Konjunktur und Börsen. Dagegen scheint die internationale Geldpolitik eine sehr berechenbare, geradezu heilende Kraft zu sein. Mit welchen weiteren Entwicklungen der Zins- und Liquiditätspolitik ist zukünftig zu rechnen? Hat die Geldpolitik ihr Pulver nicht längst verschossen? Robert …

Read More »

Read More »

China: Gefahr für die Weltwirtschaft?

► TIPP: Sichere Dir wöchentlich meine Tipps zu Gold, Aktien, ETFs & Co. – 100% gratis: http://lars-erichsen.de/ Bedeutet Chinas Verschuldung eine Gefahr für die Weltwirtschaft? Wird China also möglicherweise der Auslöser für die nächste ganz große Krise? Das halte ich tatsächlich für möglich und ich werde in diesem Video auch erläutern, warum man um chinesische …

Read More »

Read More »

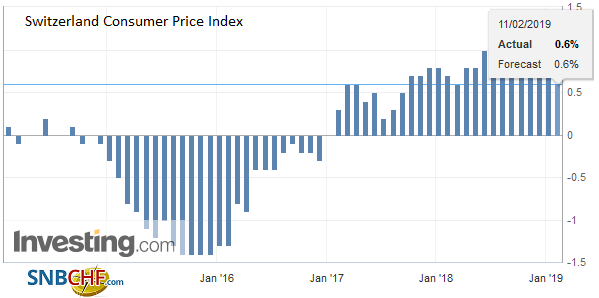

Swiss Consumer Price Index in January 2019: +0.6 percent YoY, -0.3 percent MoM

The consumer price index (CPI) fell by 0.3% in January 2019 compared with the previous month, reach-ing 101.3 points (December 2015 = 100). Inflation was 0.6% compared with the same month of the pre-vious year. These are the results of the Federal Statistical Office (FSO).

Read More »

Read More »

Yanis Varoufakis | Europe Lecture 2013

Athens Professor of Economics Yanis Varoufakis gives the WSU inaugural Europe lecture in 2013. The Lecture series is an initiative led by WSU historian, Dr Margarite Poulos.

Read More »

Read More »