Category Archive: 2.) Europe and Euro Crisis

Italy: A Sustained US Recovery Will Make a Eurozone Split Up Possible

We reckon that a sustained US recovery will make it possible that the eurozone splits up. Today's Italian elections are maybe the start of an upcoming Italian euro exit.

Read More »

Read More »

Deflationary Risks? Comparing Swiss, Swedish and Norwegian Inflation and Exchange Rates

When the Swiss National Bank introduced the 1.20 lower limit, it wanted to eliminate the deflationary risks for Switzerland. For a certain period, namely when a global recession was looming in Autumn 2011, and the Swiss franc was hovering around 1.10, this risk was really present. In this post we would like to know if …

Read More »

Read More »

Ways to the Northern Euro

Two ways for building the Northern euro, exit of Southern members or slow creation of Northern euro with currency interventions of central banks.

Read More »

Read More »

2012 Posts on Euro Crisis and Euro Macro

Who Says No to Austerity and Global Imbalances, Must Say Yes to the Northern Euro

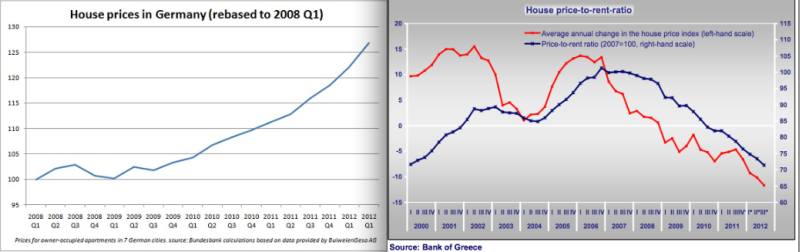

Eventually the euro will be abolished, a Northern Euro introduced: politicians and their economic advisors might just be waiting for a calm moment, especially with upcoming German inflation.

Read More »

Read More »

The Upcoming Spanish Lost Decade(s)

To us, the big theatre surrounding Greece was just a preview of a much bigger crisis that will happen in the coming years in Spain, the upcoming Spanish lost decade(s). Greece was an absolutely desperate case; therefore, everything was quick. It took just two years till we arrived at the official sector participation and yearly German transfer …

Read More »

Read More »

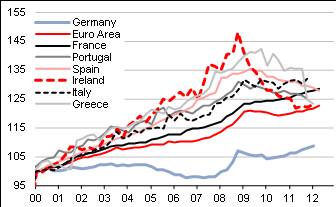

The Fairy Tale of Rising Competitiveness in the European Periphery

In our post we look on two questions concerning competitiveness for the European periphery: When will local production be cheaper than imported products? Do people have the money to buy these local products? It does not help reducing labor costs if local production costs still more than imported products. The second aspect is: even if …

Read More »

Read More »

Who is the Biggest Debt Time Bomb: Japan, France, the UK or the United States?

Some must reads: According to the Economist the biggest time bomb in the euro zone crisis is France.

We wonder why the United States and Britain, that have same weak trade balances, the same weak competitiveness and a debt overhang, shouldn't have a problem?

Just because France must do austerity according to the German Fiscal Compact wish, and the US and Britain do not need to do this?

Or like Ray Dalio called it, are the US and Britain...

Read More »

Read More »

4 Different Solutions for the Euro Crisis: Can it Be the Northern Euro? A Discussion

The discussion about the future of the Euro: Among a Post-Keynesian, a European Etatist, an Austrian economist and an advocate of a Northern Euro on the French website www.atlantico.fr. The French paper is asking: “Sommet européen : créer un euro du Nord est-il le seul moyen de sauver l’Europe de l’austérité ?” Is the creation of …

Read More »

Read More »

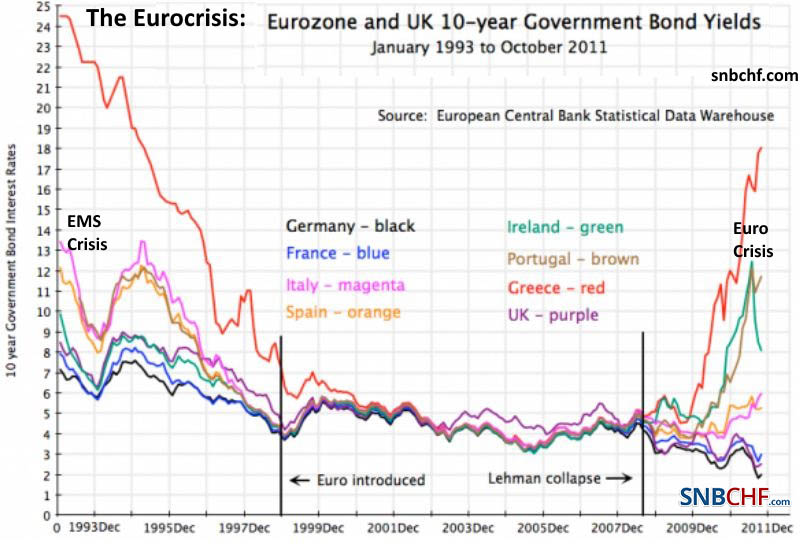

Viva la Democrazia! The Reign of the Spread is Finished!

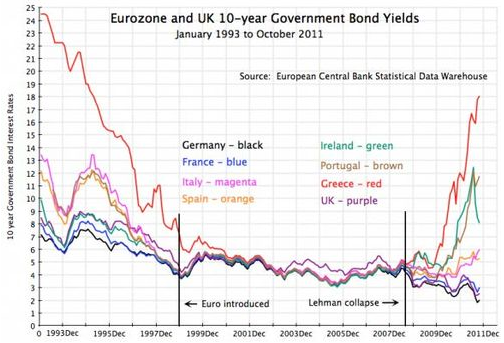

Claudio Messora, one of most well known critics during the "Reign of the spread" between Italian and German bonds.He happy about the return of democracy.

Read More »

Read More »

The Full List of Monti Reforms: Which Have Been Really Implemented?

Italian Prime Minister Mario Monti passed 30 billion euros ($40.3 billion) in tax hikes (17 billion), pension and spending cuts (13 billion).

Read More »

Read More »

German Economists and Merkel, the Implicit Followers of the Gold Standard

With ECB's OMT & "conditionality", that requires austerity and implicitly reduction of salaries in European periphery, Merkel & German economists have created consequences similar to a gold-standard.

Read More »

Read More »

The Euro Crisis: Details and chronology and the German Perspective on it

The history of EU reforms, bailouts during the euro crisis and the German perspective on them

Read More »

Read More »

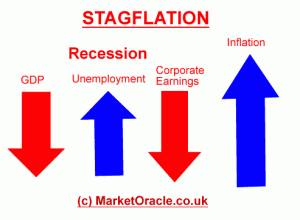

Euro Morons: Hyperinflation Successfully Avoided, Stagflation Successfully Created

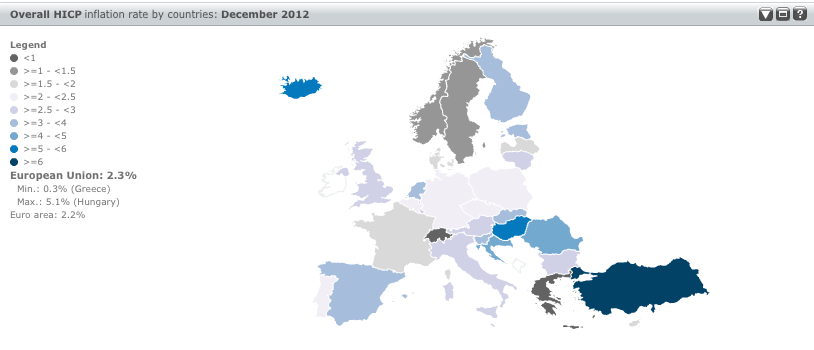

Keeping Greece in euro zone, eurocrats or better “euro morons” have successfully avoided a weak drachma and a following Greek hyperinflation. Instead they successfully created stagflation. Currently European HICP inflation is at 2.5%, far above the max. 2.0% official ECB mandate, but the euro is becoming weaker and weaker. German salaries are rising with 2.6% …

Read More »

Read More »

Das Beste von Ludwig Poullain: Das Ende des Euros, der Beginn des Nordeuros

Ludwig Poullain: Das Ende des Euro rückt näher. Er treibt Völker wieder auseinander. Neid, Missgunst, Verachtung, selbst Hass sind wieder lebendig geworden.

Read More »

Read More »

Who’s the Next Downgrade Domino to Fall?…The UK?

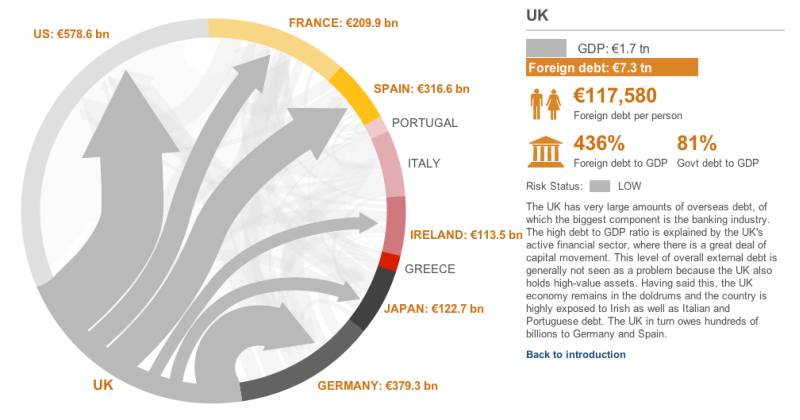

Who Downgrades France MUST downgrade the UK, too After Moody’s downgraded France, we are waiting the next major sovereign to suffer the same fate. According to the must-read interactive graph on the BBC, France now has a medium risk of default, but the UK is still in risk status “low”. According to the BBC, each citizen …

Read More »

Read More »

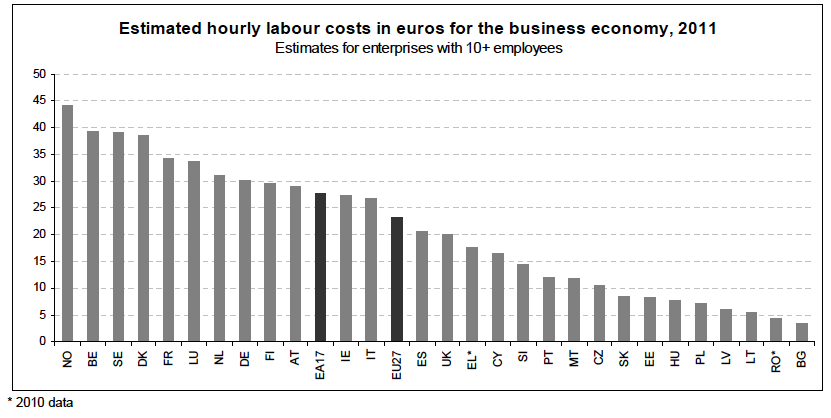

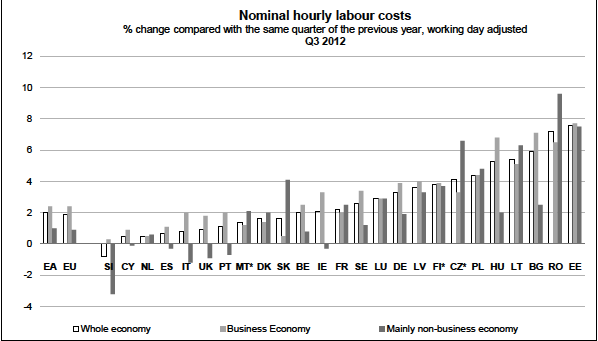

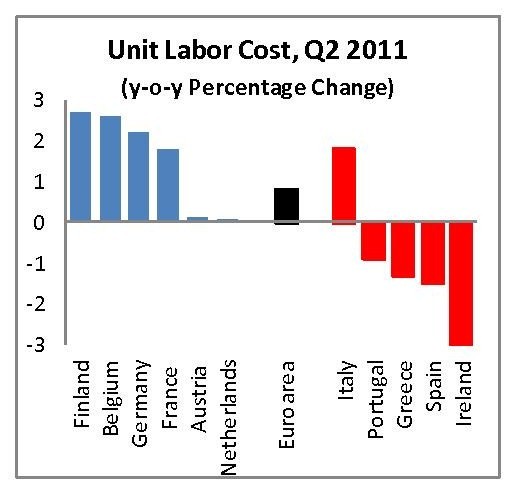

Falling Unit Labour Costs, but Rising Production Prices in the Periphery. Is this Competitiveness?

Currently European HICP inflation is at 2.5%, far above the 2.0% official ECB mandate, but the euro is becoming weaker and weaker. German salaries are rising with 2.6% per year. At the same time, the ECB cannot hike interest rates, because it wants to provide cheap money to the periphery. The periphery continues to buy German products, even …

Read More »

Read More »