Category Archive: 2.) Europe and Euro Crisis

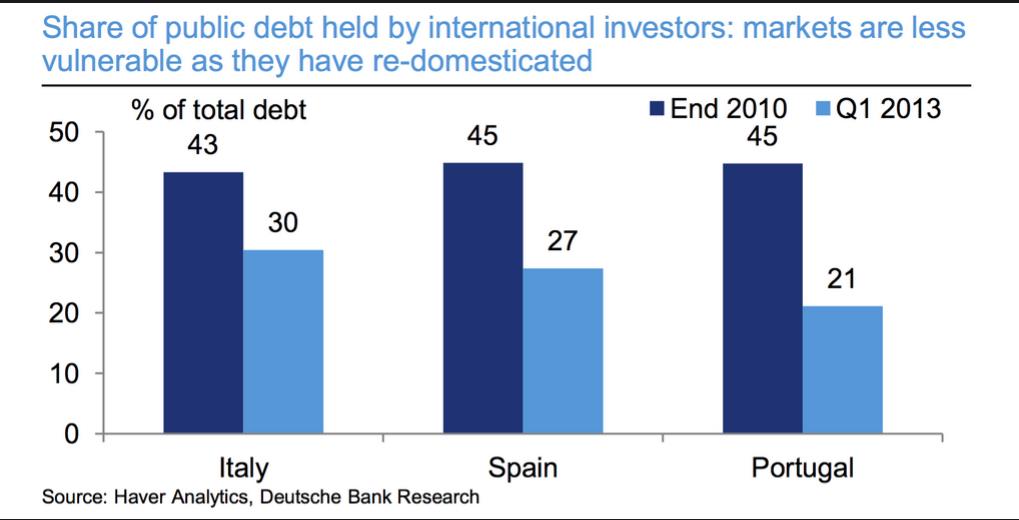

The New Widow-Maker Trade: Short Italian Government Bonds

We think that, similarly as Japanese JGBs, Spanish and Italian Government Bond Yields will continue its race to the bottom, Short Italian Bonds is the new Widow-Maker Trade.

Read More »

Read More »

2013 Posts on Euro Crisis and Euro Macro

An Upcoming Italian Success Story?

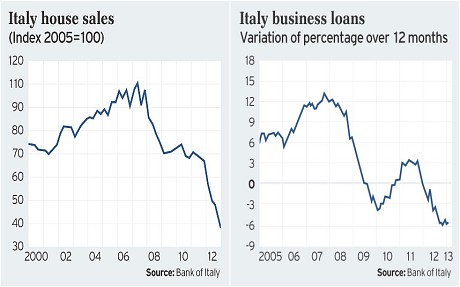

While the mainstream is still talking about potential riots in Italian streets, we rather see positive adjustments in the Italian economy.

Read More »

Read More »

An Upcoming Italian Success Story?

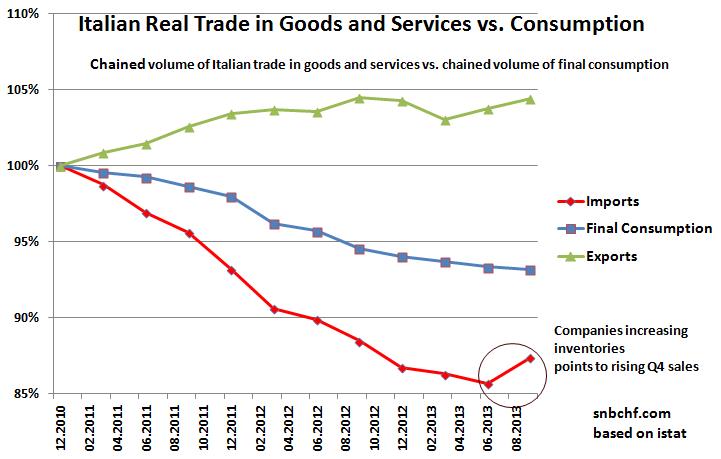

Higher exports show that Italy's economy is trying to become a new German Companies seem to hide their competitiveness. A question remains: Will Italian companies really invest in Italy and create jobs?

Read More »

Read More »

8a) Italy and the Euro Exit

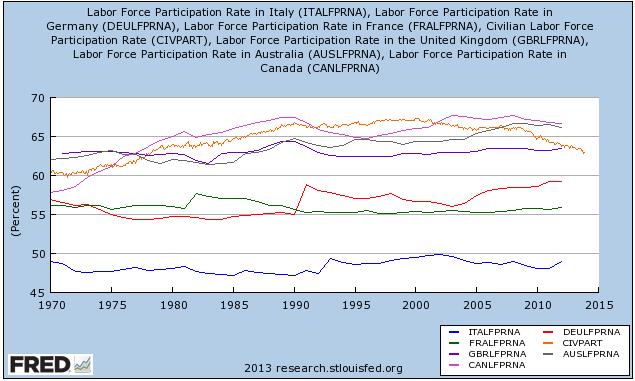

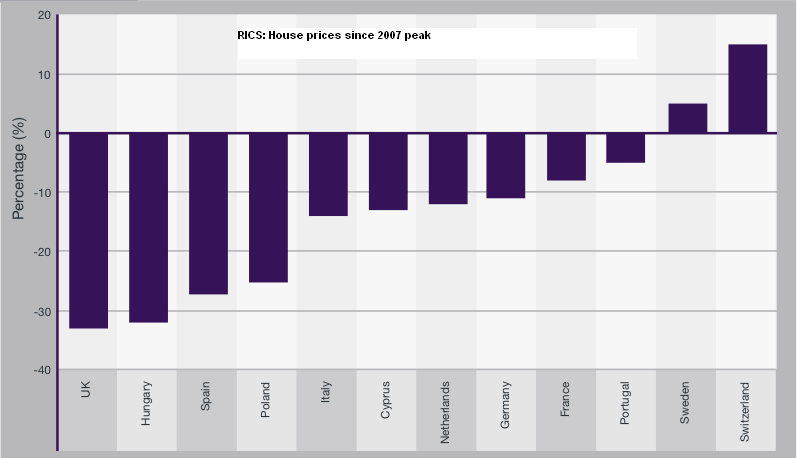

Italy, other peripheral economies and later France will follow Japan for a decade or more of balance sheet recession: stagnant wages, falling real estate prices and a reduction of private debt.

Read More »

Read More »

European Banking Assets and Debt

Still in summer 2013, too much debt was an issue. By 2014 things have changed: Europeans have too many savings.

Read More »

Read More »

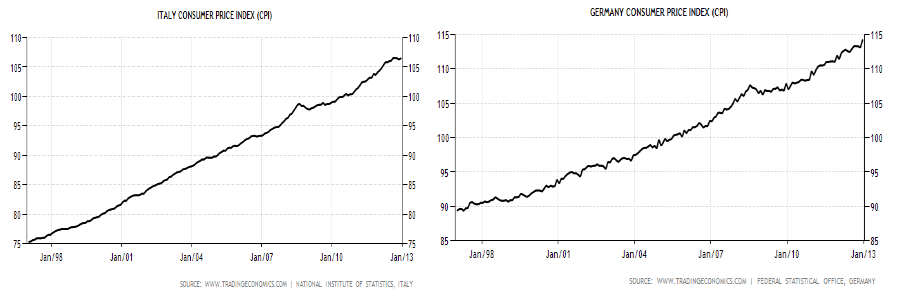

Italian Retail Prices Remain close to Switzerland, Germany Far Cheaper

Disinflation Finally Starting in Italy The Swiss site preisbarometer.ch is run by the Swiss Consumer Association. Their price data shows that a food basket is 46% more expensive when compared between the German “Kaufland” shop and the Swiss “Coop”. Going to France into “Leclerc” gives you an advantage of 38% against Coop. However, for a …

Read More »

Read More »

Why it Makes Sense to Exit the Euro Zone in Times of Balance Sheet Recessions

Italy will follow Japan for decade(s) of balance sheet recession. There is one mean to avoid it. The periphery should use current positive market sentiments and low inflation to exit the euro zone.

Read More »

Read More »

The European Transfer Union From North To South and from Poor to Rich between 1999 and 2007

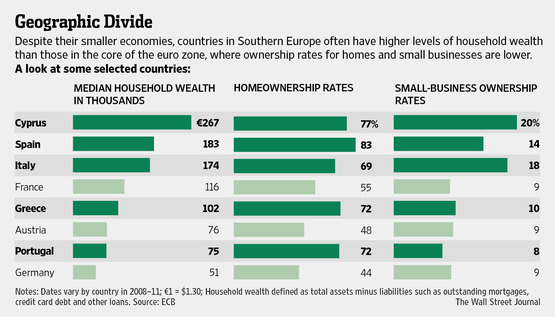

Cheap ECB rates and rising home prices helped to enrich Southern Europeans between 1999 and 2007. Germany's middle-class and poor, most of them not owning a home, were the ones that financed it.

Read More »

Read More »

The Transfer Union from South to North since 2008: Wolfgang Schäuble, the Evil Genius of the Euro Crisis

Wolfgang Schäuble has become the evil genius of the euro crisis. He has understood that the Cyprus crisis won't lead to a bank-run and collapse of capital markets. We all know that the US is now recovering.

Read More »

Read More »

European Wealth Reports: Why “Median” Italians are Far Richer than Germans

We explain why according to the European wealth reports "median" Italians are more wealthy than Germans. The main reasons are high savings and accumulation of wealth for the average family until the 1990s, often invested in homes and real estate. Low ECB interest rates finally let the value of the home rise strongly.

Read More »

Read More »

Dijsselbloem: The End of the Bankers’ and Bond Holders’ Moral Hazard

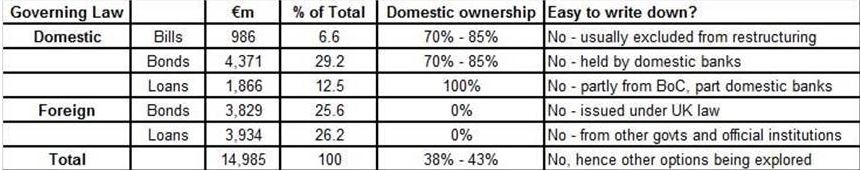

We have insisted in several posts that the northern euro zone is very reluctant to continuously bail out the periphery and in particular its banks. The euro group chief Dijsselbloem has confirmed this now.

Read More »

Read More »

Cyprus, the Final Compromise: The Winners and the Losers

UPDATE March 25 The final compromise: via Reuters TOP NEWS Detail of EU/IMF bailout agreement with Cyprus Sun, Mar 24 22:19 PM EDT BRUSSELS (Reuters) – Cyprus clinched a last-ditch deal with international lenders on Monday for a 10 billion euro ($13 billion) bailout that will shut down its second largest bank and inflict heavy …

Read More »

Read More »

Cyprus: The initial compromise and reactions

The initial compromise The Cyprus compromise combines a 10 billion € bailout with European, basically German tax-payers money, that also obliges rich account owners (9.9% levy) – rich Russians and Brits – and poorer account owners (6.75% levy) – Cypriot tax-payers money – to take part in the deal. Initial reactions from Zerohedge over Keynesian mainstream …

Read More »

Read More »

Cyprus Levy on Deposits: New Escalation or Final Stage of Euro Crisis?

Nicosia will impose a 9.9 percent one-off levy on deposits above 100,000 euros in Cypriot banks. This constitutes maybe the final stage of the euro crisis, with the very last country to be rescued. Or will it be a new escalation and may be the most dangerous one, a bank-run? How many Cyprus clients managed …

Read More »

Read More »

A Century Of French And Italian Economic Decline

Italy overtook Japan with the worst real GDP growth of all advanced economies since 1991 (0.79% per year, an amazing and sad distinction). Italians and French are clearly getting tired of austerity.

Read More »

Read More »

Das beeindruckende Comeback Berlusconis.

Wir sind beeindruckt von dem Leitartikel der Weltwoche, der doch ganz unserem Gedankengut entsprochen hat. Der deutsche Kanzlerkandidat Steinbrück hat der deutschen Demokratieverachtung und EU-treuen Überheblichkeit dann noch das i-Tüpfelchen hinzugefügt. “Zwei Clowns haben gewonnen.“ Von Roger Köppel, Die Weltwoche Demokratie ist, wenn es anders herauskommt, als Meinungsführer, Journalisten und tonangebende Politiker gedacht...

Read More »

Read More »

Über die Arroganz und Demokratiefeindlichkeit der deutschen und Schweizer Medien

Deutsche und Schweizer Medien sind oft vereint mit den Europäischen Leadern, Deutschen Exporteuren und den Finanzmärkten im Kampf gegen den gemeinsamen Feind, Silvio Berlusconi, das Enfant Terrible, das Gegenteil der Schweizer Bescheidenheit- und “Bloss nicht zu laut”-Etikette. Berlusconi soll Schuld sein am Abstieg Italiens seit den 90igern, obwohl auch die Linke mit Romani Prodi zweimal …

Read More »

Read More »