Category Archive: 1.) SNB Press Releases

Monetary Assessment Meeting, Introduction

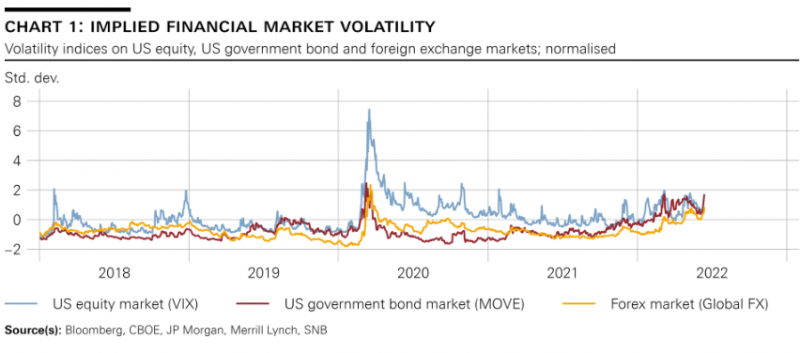

I will begin my remarks with a review of developments on the financial markets over the past half-year. I would then like to discuss the lowering of the threshold factor mentioned by Thomas Jordan.

Read More »

Read More »

Fritz Zurbrügg: Introductory remarks, news conference

In my remarks today, I will present the key findings from the new Financial Stability Report, published this morning by the Swiss National Bank.

Read More »

Read More »

Тhomas Jordan: Introductory remarks, news conference

It is my pleasure to welcome you to the Swiss National Bank’s news conference. In my remarks, I will begin by explaining our monetary policy decision and our assessment of the

economic situation. After that, Fritz Zurbrügg will present the key messages from this year’s Financial Stability Report. Andréa Maechler will then comment on the situation on the

financial markets and the implementation of monetary policy. We will – as ever – be pleased to...

Read More »

Read More »

SNB Governing Board: Federal Council appoints Martin Schlegel as Vice Chairman of the Governing Board

Petra Gerlach and Attilio Zanetti become Alternate Members of the Governing Board. At its meeting of 4 May 2022, the Federal Council appointed Martin Schlegel as Vice Chairman of the Governing Board of the Swiss National Bank with effect from 1 August 2022. He will succeed Fritz Zurbrügg on the Governing Board when the latter steps down at the end of July 2022.

Read More »

Read More »

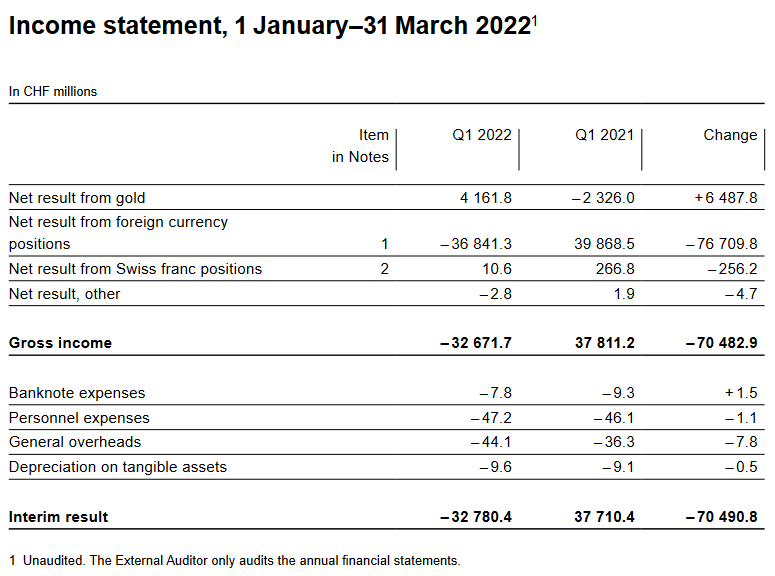

Interim results of the Swiss National Bank as at 31 March 2022

The Swiss National Bank reports a loss of CHF 32.8 billion for the first quarter of 2022. The loss on foreign currency positions amounted to CHF 36.8 billion. A valuation gain of CHF 4.2 billion was recorded on gold holdings. The profit on Swiss franc positions was CHF 10.6 million.

Read More »

Read More »

Macro Week 2022: Thomas Jordan

At this critical juncture for the global economy and monetary policy, the Peterson Institute for International Economics is convening central bankers and finance officials from around the world for our annual Macro Week—a series of speeches and onstage discussions moderated by PIIE President Adam S. Posen.

Thomas Jordan (Chairman, Swiss National Bank) speaks on April 19, 2022.

For more information, visit:...

Read More »

Read More »

What are the consequences of the war in Ukraine for the SNB’s monetary policy?

Russia's attack on Ukraine has fundamentally changed the geopolitical situation. However, it also has far-reaching economic consequences and poses the question as to whether the integration of the global economy will decrease again.

Read More »

Read More »

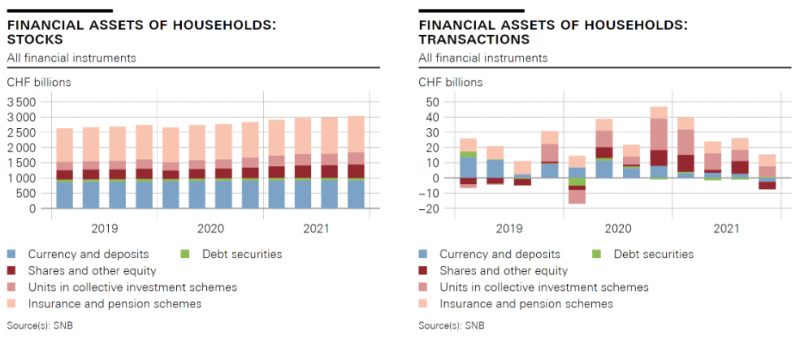

Swiss Financial Accounts: Household wealth in 2021

The Swiss National Bank is today publishing financial accounts data for Q4 2021. Data on household wealth are thus available for the whole of 2021; a commentary is provided below. This is followed by a detailed look at the development of the financial net worth of the Swiss economy’s institutional sectors since the onset of the coronavirus pandemic.

Read More »

Read More »

Macro Week 2022: Thomas Jordan

At this critical juncture for the global economy and monetary policy, the Peterson Institute for International Economics is convening central bankers and finance officials from around the world for our annual Macro Week—a series of speeches and onstage discussions moderated by PIIE President Adam S. Posen.

Read More »

Read More »

Andréa M. Maechler / Thomas Moser: Life after Libor: A new era of reference interest rates

A new era of reference interest rates began at the start of this year. Libor, which had been the key reference rate for several decades and several currencies, including the Swiss franc, ceased to exist in many currencies at the end of 2021. SARON has now fully replaced Swiss franc Libor.

Read More »

Read More »

Fritz Zurbrügg: Macroprudential policy beyond the pandemic: Taking stock and looking ahead

In the aftermath of the Global Financial Crisis (GFC), national regulators and international institutions joined forces to build the foundations of our current macroprudential frameworks. These comprise policies aimed at containing the build-up of vulnerabilities to which the banking sector is exposed, and at strengthening banking sector resilience.

Read More »

Read More »

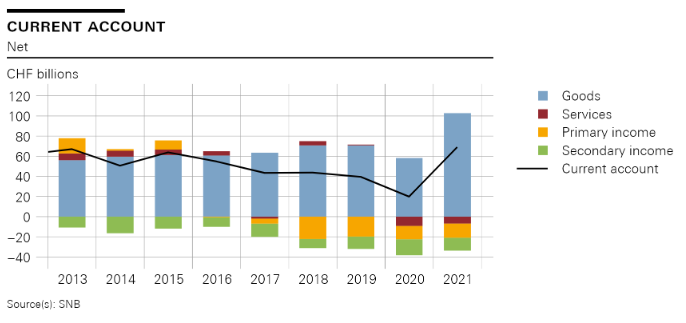

Swiss balance of payments and international investment position: 2021 and Q4 2021

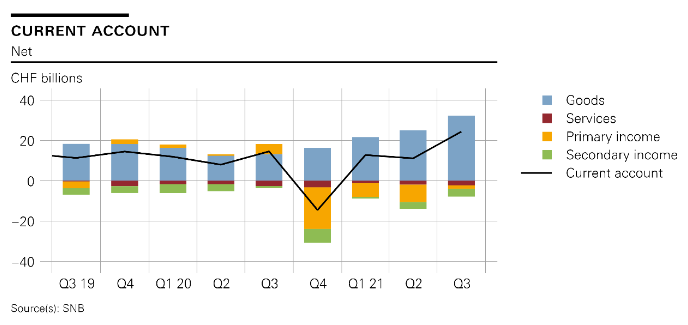

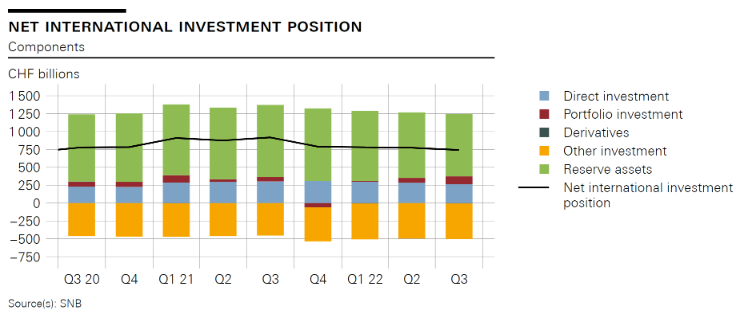

The current account surplus in 2021 was CHF 69 billion, up CHF 49 billion on the previous year, which was heavily influenced by the coronavirus pandemic. The increase in the current account surplus was almost entirely due to the higher receipts surplus in goods trade (up CHF 45 billion). Here a significantly higher receipts surplus was recorded in both traditional goods trade (foreign trade total 1) and merchanting than in the previous year....

Read More »

Read More »

„Jetzt hilft uns, dass Thomas Jordan ein Falke ist“

Der SNB-Chef wurde wegen seiner harten Anti-Inflations-Haltung gescholten, sagt Fabio Canetg, Journalist mit "Geldcast"-Sendung. Nun profitiere die Schweiz davon, weil hier die Preise mit plus 2 Prozent im Vergleich zum Euro-Raum und den USA moderat stiegen. Das wiederum ziehe Vermögen aus dem Ausland an, was den Franken stärke und die Inflation zusätzlich dämpfe.

Read More »

Read More »

Swiss National Bank renews its commitment to adhere to the FX Global Code

The Swiss National Bank (SNB) has renewed the Statement of Commitment to the FX Global Code based on the revised version of the Code dated July 2021. By signing this Statement, the SNB attests that its internal processes are consistent with the principles of the FX Global Code. The SNB also expects its regular counterparties to comply with the agreed rules of conduct.

Read More »

Read More »

Swiss National Bank proposes reactivation of sectoral countercyclical capital buffer at 2.5%

After consultation with the Swiss Financial Market Supervisory Authority (FINMA), the Swiss National Bank has submitted a proposal to the Federal Council requesting that the sectoral countercyclical capital buffer (CCyB) be reactivated. The buffer is to be set at 2.5% of risk-weighted exposures secured by residential property in Switzerland (cf. appendix).

Read More »

Read More »

BIS, SNB and SIX successfully test integration of wholesale CBDC settlement with commercial banks

Project Helvetia looks toward a future with more tokenised financial assets based on distributed ledger technology coexisting with today’s systems.

Read More »

Read More »

Swiss National Bank expects annual profit of around CHF 26 billion for 2021

According to provisional calculations, the Swiss National Bank will report a profit in the order of around CHF 26 billion for the 2021 financial year. The profit on foreign currency positions amounted to just under CHF 26 billion. A valuation loss of CHF 0.1 billion was recorded on gold holdings. The net result on Swiss franc positions amounted to over CHF 1 billion.

Read More »

Read More »

Swiss balance of payments and international investment position: Q3 2021

In the third quarter of 2021, the current account surplus amounted to CHF 24 billion, CHF 10 billion more than in the same quarter of 2020. The increase was mainly attributable to the significantly higher receipts surplus in goods trade. This surplus was due to traditional goods trade (foreign trade total 1), non-monetary gold trading, as well as to merchanting.

Read More »

Read More »

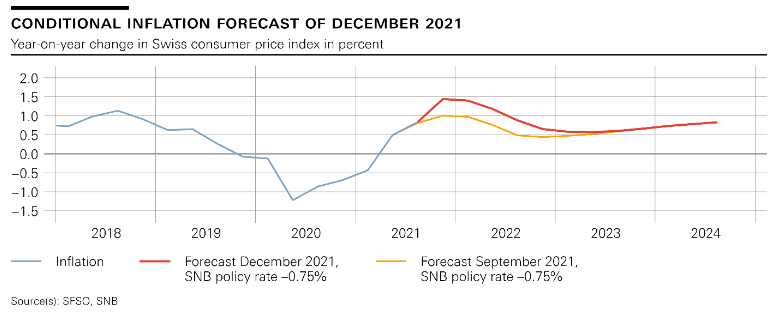

Monetary policy assessment of 16 December 2021: Swiss National Bank maintains expansionary monetary policy

The SNB is maintaining its expansionary monetary policy. It is thus ensuring price stability and supporting the Swiss economy in its recovery from the impact of the coronavirus pandemic. It is keeping the SNB policy rate and interest on sight deposits at the SNB at −0.75%, and remains willing to intervene in the foreign exchange market as necessary, in order to counter upward pressure on the Swiss franc.

Read More »

Read More »

Swiss National Bank, Banque de France and BIS conclude successful cross-border wholesale CBDC experiment

Central bank digital currencies (CBDCs) can be used effectively for international settlements between financial institutions, as shown in the newest wholesale CBDC experiment concluded by the Swiss National Bank (SNB), the Banque de France (BdF) and the Bank for International Settlements (BIS).

Read More »

Read More »