Category Archive: 1) SNB and CHF

1000-Franc Note Enters Circulation Today

Issuance of the new 1000-franc note presented a week ago begins today, 13 March. The Swiss National Bank’s ‘Swiss Banknotes’ app has now been updated to include the new note. The app, which has been downloaded some 110,000 times, can be obtained free of charge from the Apple (itunes.apple.com) and Google Play (play.google.com) app stores.

Read More »

Read More »

Swiss National Bank releases new 1000-franc note

The Swiss National Bank (SNB) will begin issuing the new 1000-franc note on 13 March 2019. Following the 50, 20, 10 and 200-franc notes, this is the fifth of six denominations in the new banknote series to be released. The current eighth-series banknotes remain legal tender until further notice.

Read More »

Read More »

Die neue 1000-Franken-Note: Präsentation – Le nouveau billet de 1000 francs: présentation

Dieser Film zeigt Impressionen von der Präsentation der neuen Schweizer 1000-Franken-Note am 5. März 2019 in Zürich. Fritz Zurbrügg, Vizepräsident des Direktoriums der Schweizerischen Nationalbank, stellt die wichtigsten Gestaltungsmerkmale und Sicherheitselemente der neuen Banknote vor. - Ce film donne quelques impressions de la présentation du nouveau billet de 1000 francs qui a eu lieu le 5 mars 2019. Fritz Zurbrügg, vice-président de la...

Read More »

Read More »

Die neue 1000-Franken-Note: Präsentation – Le nouveau billet de 1000 francs: présentation

Dieser Film zeigt Impressionen von der Präsentation der neuen Schweizer 1000-Franken-Note am 5. März 2019 in Zürich. Fritz Zurbrügg, Vizepräsident des Direktoriums der Schweizerischen Nationalbank, stellt die wichtigsten Gestaltungsmerkmale und Sicherheitselemente der neuen Banknote vor. – Ce film donne quelques impressions de la présentation du nouveau billet de 1000 francs qui a eu lieu le …

Read More »

Read More »

GBP/CHF exchange rates: A good start to the year, but what next for Brexit?

Since the start of the year GBP/CHF exchange rates have increased from 1.2377 to 1.3212 at the time of writing this report. To put this into monetary value, a client that converts £200,000 into CHF could now achieve an additional 16,700 Swiss Francs.

Read More »

Read More »

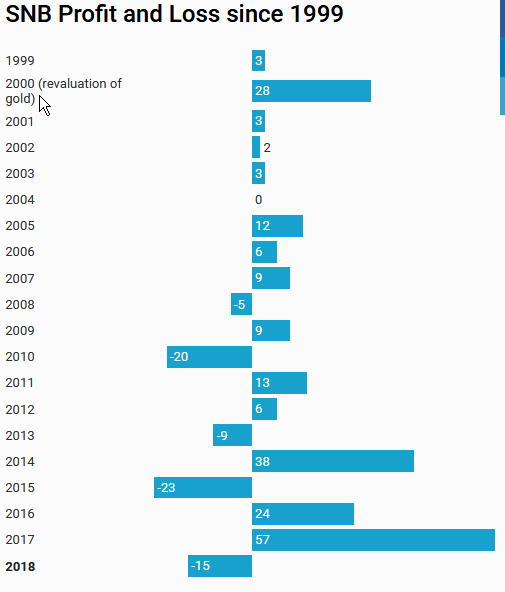

SNB loses 15 billion in 2018

The SNB earned 2 billion on negative interest rates (Swiss franc positions below), but lost nearly 17 billion CHF on FX investments, of which 5 bn on bonds and 12 bn on stocks. Gold was nearly unchanged.

Read More »

Read More »

Mit Negativzinsen die Wirtschaft ankurbeln? Nächste Irrlehre der SNB

Seit Jahrzehnten geistert die Illusion in den Köpfen der Oekonomen herum, man könne mit Zinssenkungen eine Wirtschaft ankurbeln. Den Vogel schiesst der vermeintliche „Starökonom“ von der Harvard University, Kenneth Rogoff, ab. Er prophezeit, dass künftige Wirtschaftskrisen mit Negativzinsen von bis zu minus 6 Prozent bekämpft würden.

Read More »

Read More »

GBP to CHF rate hovers over 1.32 awaiting new Brexit Developments

The pound has rallied higher against the Swiss Franc with rates for the GBP/CHF pair now sitting over 1.32. Pound to Swiss Franc exchange rates have been lifted on the back of some optimism over Brexit, that a deal will be reached between Britain and the EU. The markets are awaiting developments over the contentious Irish backstop which could pave the way forward for a deal.

Read More »

Read More »

XXIX. Atelier de la Concurrence: Strafrechtliche Verfahrensgarantien vor WEKO und FINMA

Im klassischen Verwaltungsverfahren sind Parteien zu Mitwirkung und Auskunft verpflichtet. Im Strafverfahren hat demgegenüber der Beschuldigte das Recht, Aussage und Mitwirkung zu verweigern. Das Recht, sich selbst nicht belasten zu müssen, kollidiert somit mit der Mitwirkungspflicht im WEKO- und FINMA-Verfahren. Es stellt sich deshalb die Frage nach sachgerechten Lösungen. Zu diesem Thema fand Anfangs Oktober …

Read More »

Read More »

Strong Trade Balance Data Supports the Franc

The Swiss Franc has been boosted during early morning trading as investors find the latest Trade Balance data supportive of the economy, with the Trade Balance data coming in showing a surplus of CHF3bn. The strength of the Swiss economy is its exports; in watches, chocolate and specialized industrial engineering.

Read More »

Read More »

La Dépossession façon BNS. Entretien ORBIS TERRAE

L’ouvrage de Vincent Held aborde une série de sujets brûlants : la politique d’affaiblissement du francs suisse menée par la Banque nationale suisse (BNS), l’imbrication de cette politique avec celles des banques privées suisses, la politique d’acquisition d’obligations d’Etat en dollars et en euros au détriment de la constitution d’un véritable fonds souverain… Le livre de M. Held touche au cœur nucléaire de la prospérité helvétique. Et ce qu’il...

Read More »

Read More »

The SNB’s Karl Brunner Distinguished Lecture Series: Raghuram Rajan announced as next speaker

The Swiss National Bank (SNB) has named Raghuram Rajan as this year’s speaker for its Karl Brunner Distinguished Lecture Series. Professor Rajan has made outstanding contributions to both economic practice and economic research on the global stage. His roles have included Governor of the Reserve Bank of India from 2013 until 2016 and Chief Economist at the IMF between 2003 and 2006.

Read More »

Read More »

Scam Alert! #Swiss-Finma is no more paying! Withdrawal pending – Hyips daily

Scam Alert! #Swiss-Finma is no more paying! Withdrawal pending – #Hyipsdaily Avoid investing in Swiss-finma.Com #Scam Now More alarm join: https://t.me/hyipsdaily Join WhatsApp group: https://chat.whatsapp.com/HOVV2TLAX0B23i7DSeC2PE #hyipsdaily #paying #paying_hyip #hyip #cryptocurrency #hyip_investor #hyip_review #hyip_monitor #hyip_news #Scam_Alert #Scam

Read More »

Read More »

Mark Carney Steadies GBP/CHF Rates on Global Viewpoint

The pound to Swiss franc exchange rate has been steadied following comments from Mark Carney during a briefing on the global economy at the Barbican centre in London yesterday. I was fortunate to be in attendance and was struck by Carney’s confident manner, although he highlighted some major risks ahead which would be key for GBP/CHF rates.

Read More »

Read More »

Chaos-Politik der SNB mobilisiert SVP und SP: Milliarden für Vorsorge

Mit „links und rechts“ hat unsere Schweizerischen Nationalbank (SNB) ihre grosse Mühe. Da ist zunächst ihre Bilanz, bei der sie unfähig ist, „links und rechts“ voneinander zu unterscheiden. Unverstanden gerät sie nun folgerichtig auch politisch immer mehr unter Druck: konsequenterweisee von „links und rechts“.

Read More »

Read More »

Lohngleichheit @FINMA

“Lohngleichheit ist eigentlich eine Selbstverständlichkeit. Keine Organisation kann es sich leisten, per se eine diskriminierende Kultur zu haben.” Interview mit Mark Branson, Direktor der FINMA: – Warum ist Lohngleichheit wichtig für Ihre Behörde? – Wie fördern Sie die Lohngleichheit in Ihrer Behörde? – Was nehmen Sie mit aus der Lohngleichheitsanalyse mit Logib? www.finma.ch www.logib.ch...

Read More »

Read More »

GBPCHF rates hit near 3-month highs

The Pound to Swiss Franc exchange rate has soared dramatically following a series of revelations in the currency markets and global economy. A big factor is of course Sterling strength, which has arisen on the back of increased feelings that the UK will avoid a no-deal Brexit. This could manifest next week in a Parliamentary vote on whether or not to rule out a no-deal Brexit.

Read More »

Read More »

Folgt nun der umgekehrte Frankenschock?

An ihrer ersten Sitzung im neuen Jahr hat die Europäische Zentralbank (EZB) ihren Kurs bestätigt. Das Wertschriftenkaufprogramm ist definitiv beendet. Fortan kauft sie netto keine zusätzlichen Anleihen mehr zu. Sondern sie ersetzt nur noch die bestehenden Papiere, die sie in ihrem Portefeuille hält.

Read More »

Read More »

SNB Grants Fintechs Access to SIC

In a press release the Swiss National Bank explains that it: "grants access to … [fintechs] that make a significant contribution to the fulfilment of the SNB’s statutory tasks, and whose admission does not pose any major risks.

Read More »

Read More »