Category Archive: 1) SNB and CHF

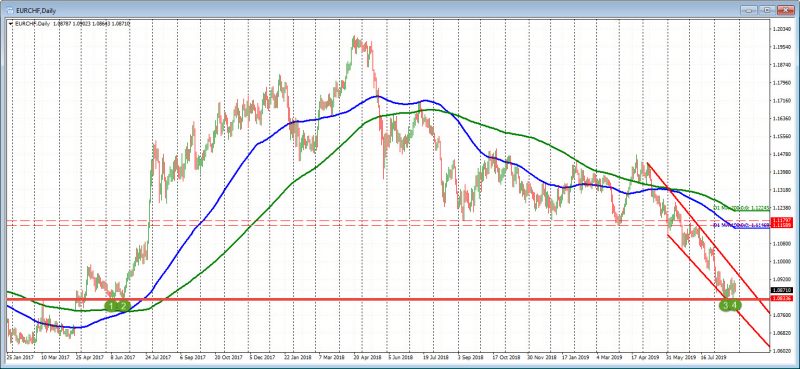

EUR/CHF technical analysis: Break out or fake out?

The cross needs to hold above the 1.0970s and beyond the 25th July swing lows. To the downside, a break back below the prior descending resistance will spell bad news for the bulls. EUR/CHF has been running higher of late, despite the onset of the European Central Bank - a possible buy the rumour sell the fact scenario as the less committed euro shorts are squeezed.

Read More »

Read More »

Jerome Powell, Chair of the Board of Governors of the Federal Reserve System, SIAF, UZH, 06.09.2019

Jerome Powell, Chair of the Board of Governors of the Federal Reserve System, Swiss Institute of International Studies (SIAF), University of Zurich, 06.09.2019

00:00 Introduction by Martin Meyer, President of the Board, SIAF

08:25 Discussion with Jerome Powell, Fed Chair, and Thomas Jordan, SNB Governor

40:55 Questions and answers

Read More »

Read More »

Jerome Powell, Chair of the Board of Governors of the Federal Reserve System, SIAF, UZH, 06.09.2019

Jerome Powell, Chair of the Board of Governors of the Federal Reserve System, Swiss Institute of International Studies (SIAF), University of Zurich, 06.09.2019 00:00 Introduction by Martin Meyer, President of the Board, SIAF 08:25 Discussion with Jerome Powell, Fed Chair, and Thomas Jordan, SNB Governor 40:55 Questions and answers

Read More »

Read More »

SNB Jordan: Cannot say how long negative interest rates will last

SNBs Jordan on the wiresThe Swiss national banks Jordan is on the wires saying:He cannot say how long negative interest rates will lastNegative rates are necessary for nowInterest rate spreads like important role for exchange ratesThe USDCHF is trading higher today. It currently trades at 0.9861.

Read More »

Read More »

Swiss Regulator FINMA Licenses Two New Blockchain Companies, Reaffirming Strict Approach to AML Law

FNMA, the Swiss Financial Market Supervisory Authority, bolsters its fight against money laundering by employing two new blockchain companies on their side. Here are the latest news regarding its new partners, updates and other info. Tune in for today’s Cryptocurrency and Blockchain news, updates, and more! »Check in for daily news, updates, and stories on …

Read More »

Read More »

New 100 Swiss Franc Note Coming Soon

The note’s design is inspired by Switzerland’s tradition of humanitarianism, represented on the note by water. The note remains blue but is much smaller than the existing one, making it easier to fit into wallets.

Read More »

Read More »

Die neue 100-Franken-Note: Präsentation – Le nouveau billet de 100 francs : présentation

Dieser Film zeigt Impressionen von der Präsentation der neuen Schweizer 100-Franken-Note am 3. September 2019 in Bern. Thomas Jordan, Präsident des Direktoriums der Schweizerischen Nationalbank, und Fritz Zurbrügg, Vizepräsident des Direktoriums der Schweizerischen Nationalbank, stellen die wichtigsten Gestaltungsmerkmale und Sicherheitselemente der neuen Banknote vor. - Ce film donne quelques impressions de la présentation du nouveau billet de 100...

Read More »

Read More »

Die neue 100-Franken-Note: Präsentation – Le nouveau billet de 100 francs : présentation

Dieser Film zeigt Impressionen von der Präsentation der neuen Schweizer 100-Franken-Note am 3. September 2019 in Bern. Thomas Jordan, Präsident des Direktoriums der Schweizerischen Nationalbank, und Fritz Zurbrügg, Vizepräsident des Direktoriums der Schweizerischen Nationalbank, stellen die wichtigsten Gestaltungsmerkmale und Sicherheitselemente der neuen Banknote vor. – Ce film donne quelques impressions de la présentation du nouveau...

Read More »

Read More »

Nationalbank – SNB-Präsident Jordan: Libra könnte Geldpolitik gefährden

Die Schweizerische Nationalbank (SNB) misst Kryptowährungen wie Bitcoin wenig Potenzial zu. Die Chancen darauf, als Zahlungsmittel akzeptiert zu werden, sind aus Sicht der Zentralbank gering. Kryptowährungen hätten "eher den Charakter von spekulativen Anlageinstrumenten als von 'gutem' Geld", sagte der SNB-Präsident in einer Rede an der Universität Basel.

Read More »

Read More »

USD/CHF bounces from trend-line support on trade news

US/Sino trade teams will consult in mid-September with a view for a meeting in Washington in early October. USD/CHF is currently trading 0.26% higher and bouning of trend-line support.

Read More »

Read More »

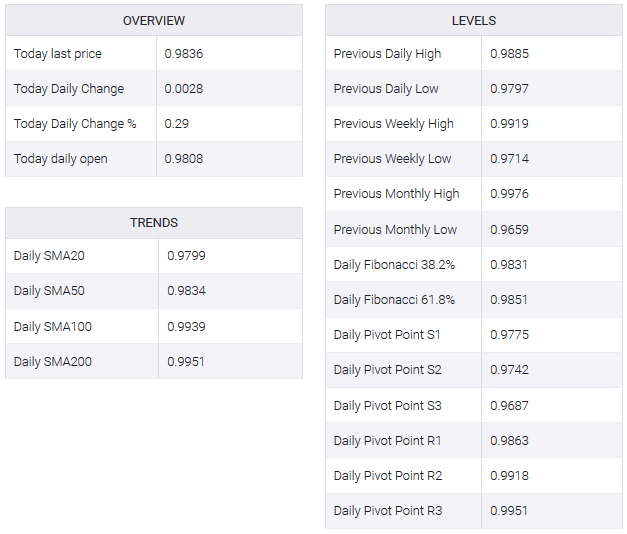

USD/CHF Technical Analysis: The ongoing corrective slide challenges 200-hour SMA support, around mid-0.9800s

Extends overnight retracement slide from an ascending trend-channel resistance. A follow-through selling has the potential to drag the pair towards channel support. The USD/CHF pair remained under some selling pressure for the second consecutive session on Wednesday and retreated farther from over one-month tops set in the previous session.

Read More »

Read More »

Medienkonferenz – Conférence de presse – News conference – Conferenza stampa, 03.09.2019

Medienkonferenz - Conférence de presse - News conference - Conferenza stampa, 03.09.2019

00:00 Einleitende Bemerkungen von Fritz Zurbrügg, Vizepräsident des Direktoriums der Schweizerischen Nationalbank - Remarques introductives de Fritz Zurbrügg, vice-président de la Direction générale de la Banque nationale suisse - Introductory remarks by Fritz Zurbrügg, Vice Chairman of the Governing Board of the Swiss National Bank - Osservazioni introduttive...

Read More »

Read More »

Medienkonferenz – Conférence de presse – News conference – Conferenza stampa, 03.09.2019

Medienkonferenz – Conférence de presse – News conference – Conferenza stampa, 03.09.2019 00:00 Einleitende Bemerkungen von Fritz Zurbrügg, Vizepräsident des Direktoriums der Schweizerischen Nationalbank – Remarques introductives de Fritz Zurbrügg, vice-président de la Direction générale de la Banque nationale suisse – Introductory remarks by Fritz Zurbrügg, Vice Chairman of the Governing Board of the Swiss …...

Read More »

Read More »

Swiss National Bank Presents New 100-Franc Note

The Swiss National Bank (SNB) will begin releasing the new 100-franc note on 12 September 2019, bringing the issuance of the ninth banknote series to a close. The first denomination in the new series, the 50-franc note, entered circulation on 13 April 2016. This was followed by the 20, 10, 200 and 1000-franc notes, which were released at six or twelve-month intervals.

Read More »

Read More »

“Die Finma sagt Facebook: Hey Guys, Euren Libra könnt Ihr vergessen”

Das sei die wahre Botschaft hinter der Bewilligung zweier Schweizer Krypto-Banken, sagt Hans Geiger. Die Aufsicht lasse wegen Geldwäscherei so wenig zu, dass Libra gestorben sei.

Read More »

Read More »

SNB’s Maechler: Reaffirms Pledges on FX and Intervention, Negative Rates

SNB jawboning CHF lower as concerns mount over global growth fears and a flight to safety. EUR/CHF is already trading close to the lows of the year. The Swiss National Bank's Andréa M Maechler, Member of the Governing Board, has crossed the wires saying that ‘any intervention’ requires an analysis of cost/benefits - plenty of jawboning going on here.

Read More »

Read More »

More SNB Maechler: Right now we still have plenty of room for forex intervention

Right now is still plenty of room for forex intervention. As to negative rates are working, SNB's Maechler says "absolutely". Looking at the EURCHF, the pair is trading near the lowest levels since June 2017. The lows this month tested the lows from back then. The test has stalled the fall.

Read More »

Read More »

USD/CHF technical analysis: Manages to hold above 0.9800 handle, 200-hour SMA

The USD/CHF pair struggled to sustain above 61.8% Fibo. level of the 0.9879-0.9714 recent slump and seems to have stalled this week's recovery move from the 0.9700 neighbourhood. The intraday downtick remained cushioned near the 0.9800 handle, which coincides with 100/200-hour SMA confluence region and should act as a key pivotal point for intraday traders.

Read More »

Read More »

USD/CHF: Value of CHF calls hits highest since March 2018

Risk reversals on Swiss Franc (CHF1MRR), a gauge of calls to puts, dropped to the lowest level in 17-months, indicating the investors are adding bets to position for a rise in the Swiss currency. The USD/CHF one-month 25 delta risk reversals fell to -1.41 – a level last seen in March 2018.

Read More »

Read More »

Die Nationalbank riskiert Ärger mit Donald Trump

Die Deviseninterventionen der Schweizerischen Nationalbank sorgen für Spannungen. Die Schweiz läuft Gefahr, von den USA als Währungsmanipulatorin gebrandmarkt zu werden. (K)ein Grund zur Sorge?

In den vergangenen Wochen hat die Schweizerische Nationalbank (SNB) wiederholt am Devisenmarkt interveniert, um den Franken davor zu bewahren, noch stärker gegen die wichtigsten Handelswährungen wie Euro und Dollar zu steigen.

Read More »

Read More »

-637031895419073883-800x353.png)

-637025933982178300-800x353.png)