Category Archive: 1) SNB and CHF

The new banknotes – design and security features

The film shows a variety of design elements and security features that can be found on the new Swiss banknotes. It invites the viewer to discover the note’s many facets. The new banknotes have numerous security features – some new, some tried and tested – offering a range of different ways to check if a …

Read More »

Read More »

Le nuove banconote – Le caratteristiche grafiche e di sicurezza

Questo film mostra le molteplici caratteristiche grafiche e di sicurezza delle nuove banconote svizzere. Esso invita a scoprire la banconota in tutte le sue sfaccettature. Le nuove banconote contengono una combinazione di elementi di sicurezza sia di comprovata efficacia sia di nuova concezione, che permettono un’esauriente verifica della loro autenticità. Accanto a caratteristiche visive e …

Read More »

Read More »

Die neuen Noten – die Gestaltungs- und die Sicherheitsmerkmale (Version für Hörbehinderte)

Dieser Film zeigt die Vielfalt der Gestaltungs- und Sicherheitsmerkmale der neuen Schweizer Banknoten. Er lädt die Betrachter ein, die Note in allen ihren Facetten zu entdecken. Die neuen Banknoten enthalten eine Kombination aus bewährten und neuartigen Sicherheitselementen, die eine umfassende Echtheitsprüfung der Note erlauben. Dabei wird zwischen visuellen und taktilen Merkmalen für das Publikum und …

Read More »

Read More »

Les nouveaux billets – Les éléments graphiques et de sécurité (version pour malentendants)

Ce film présente les différents éléments graphiques et de sécurité dont sont dotés les nouveaux billets de banque suisses, et nous invite à découvrir ces derniers sous toutes leurs facettes. Les nouveaux billets de banque allient certains éléments de sécurité ayant déjà fait leurs preuves et d’autres, novateurs, qui permettent une vérification complète de l’authenticité …

Read More »

Read More »

SNB entbindet zwei Bilanzpositionen der Unterlegungspflicht

Die Schweizerische Nationalbank (SNB) passt die Nationalbankverordnung (NBV) mit Wirkung per Anfang 2020 leicht an. Neben der Anpassung diverser in der NBV verwendeter Begriffe und Anpassungen bei den statistischen Erhebungen im Anhang der NBV sind neu zwei Positionen bei der Berechnung der Mindestreserve nicht mehr massgeblich.

Read More »

Read More »

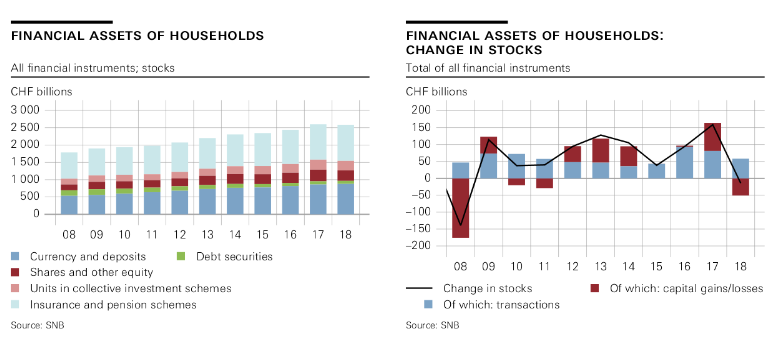

Verpflichtungen der Anlagefonds sinken erstmals seit 2008

Sinkende Aktienkurse führten 2018 zu hohen Kapitalverlusten. (Bild: Shutterstock/Phongpan)Zwei Faktoren prägten 2018 die finanziellen Forderungen der privaten Haushalte: Einerseits führten sinkende Aktienkurse zu hohen Kapitalverlusten, andererseits erhöhten die privaten Haushalte ihr Finanzvermögen durch Transaktionen.

Read More »

Read More »

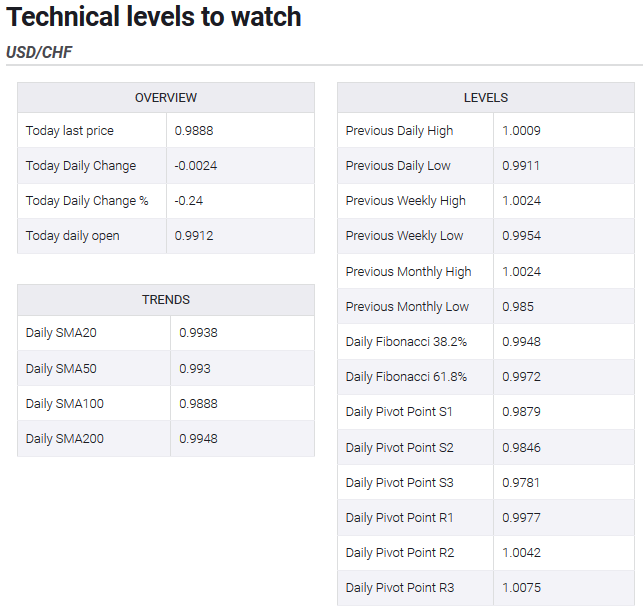

USD/CHF hammered down to sub-0.9900 levels, 2-week lows

USD/CHF lost some additional ground for the second straight session on Tuesday. A subdued USD demand, stability in equity markets did little to provide any respite. Trump’s latest remarks opened the room for a further intraday depreciating move. The USD/CHF pair witnessed some follow-through selling on Tuesday and dropped to near two-week lows, below the 0.9900 handle in the last hour.

Read More »

Read More »

2019-12-03 – Amendment of National Bank Ordinance

Changes due to entry into force of FinSA/FinIA andadjustments to minimum reserve requirements. The Swiss National Bank is amending the National Bank Ordinance (NBO). Various terms used in the NBO will be revised in connection with the entry into force of the Financial Services Act (FinSA) and the Financial Institutions Act (FinIA) as of 1 January 2020.

Read More »

Read More »

Swiss Financial Accounts, 2018 edition

The financial assets of households were influenced by two factors in 2018: First, falling share prices led to high capital losses and, second, households grew their financial wealth through transactions. They increased their insurance and pension scheme entitlements, expanded their bank deposits and invested in securities. Overall, household financial assets fell slightly by CHF 14 billion to CHF 2,586 billion (down 0.6%) – the first decline in ten...

Read More »

Read More »

Österreichs Notenbankchef: Geldpolitische EZB-Ziele auf den Prüfstand

Die Europäische Zentralbank (EZB) wird nach Aussagen des Gouverneurs der Oesterreichischen Nationalbank (OeNB) und EZB-Rats Robert Holzmann die geldpolitischen Ziele in den kommenden Monaten auf den Prüfstand stellen. "Alles steht zur Diskussion", sagte Holzmann am Montagnachmittag vor Journalisten in Wien.

Read More »

Read More »

Richard H. Clarida, Vice Chairman, Board of Governors of the Federal Reserve System, 12.11.2019

SNB-FRB-BIS High-Level Conference - keynote speech by Richard H. Clarida, Vice Chairman, Board of Governors of the Federal Reserve System, 12.11.2019

Read More »

Read More »

Richard H. Clarida, Vice Chairman, Board of Governors of the Federal Reserve System, 12.11.2019

SNB-FRB-BIS High-Level Conference – keynote speech by Richard H. Clarida, Vice Chairman, Board of Governors of the Federal Reserve System, 12.11.2019

Read More »

Read More »

OECD rechnet für 2020 mit höherem Wachstum in der Schweiz

Vor allem der Einfluss internationaler Sportereignisse wird das Wachstum des Bruttoinlandprodukts (BIP) im kommenden Jahr ankurbeln, erklärte die OECD. Entsprechend werde es 2021 wieder auf 1,0 Prozent zurückfallen. Für das laufende Jahr erwartet die OECD eine Zunahme des BIP um 0,8 Prozent.

Read More »

Read More »

Negativzinsen für Kunden bei Raiffeisen vorerst vom Tisch

Auf die Frage, ob auch die Raiffeisen-Gruppe künftig Strafzinsen verrechnen will, erklärte der 58-jährige Lachappelle: "Ich kann mir das nicht vorstellen." Wenn bei Sparkonti Negativzinsen eingeführt würden, sei die Gefahr gross, dass es zu einem "Bank Run" komme - also dass die Sparer ihr Geld von den Banken abziehen.

Read More »

Read More »

Negativzinsen, unser notwendiges Übel

Warum die Schweizer Negativzinspolitik trotz aller leidigen Nebenwirkungen bis auf weiteres unumgänglich ist. Negativzinsen in der Schweiz sind ein Sonderfall. Denn die Schweiz hat keine Negativzinsen, um das Wirtschaftswachstum anzukurbeln oder um bedrohte Schuldner vor dem Zusammenbruch zu retten. Die Negativzinsen hierzulande haben nur einen einzigen Grund: Ein weiteres Erstarken des Schweizer Frankens soll verhindert werden.

Read More »

Read More »

‘We’re green enough’ says Swiss central bank

The Swiss National Bank (SNB) is doing enough to mitigate climate damage with its investment policy, senior directors have stated. Switzerland’s central bank does not have the mandate to impose environmental conditions on the commercial banking sector.

Read More »

Read More »

USD/CHF technical analysis: Bulls struggle to extend the recovery beyond 0.9900 handle

Renewed US-China trade optimism helped regain some traction. The uptick lacked bullish conviction and warrants some caution. The USD/CHF pair stalled its recent pullback from levels beyond 200-day SMA and regained some traction on the last trading day of the week. Renewed trade optimism weighed on the Swiss franc's safe-haven status and led to a modest recovery, though bulls struggled to extend the momentum beyond the 0.9900 handle.

Read More »

Read More »

Andréa Maechler – SNB: Klimarisiken für die Stabilität der Wirtschaft sind «mässig»

Aufgabe der Nationalbank sei die Gewährleistung der Preisstabilität, sagte SNB-Direktorin Andréa Maechler. Es sei nicht wünschenswert, dass die SNB "spezifische struktur- oder gesellschaftspolitische Ziele anstrebe".

Read More »

Read More »

-637094243479377368-800x391.png)