Category Archive: 1) SNB and CHF

Swiss National Bank profits cut in half by Covid

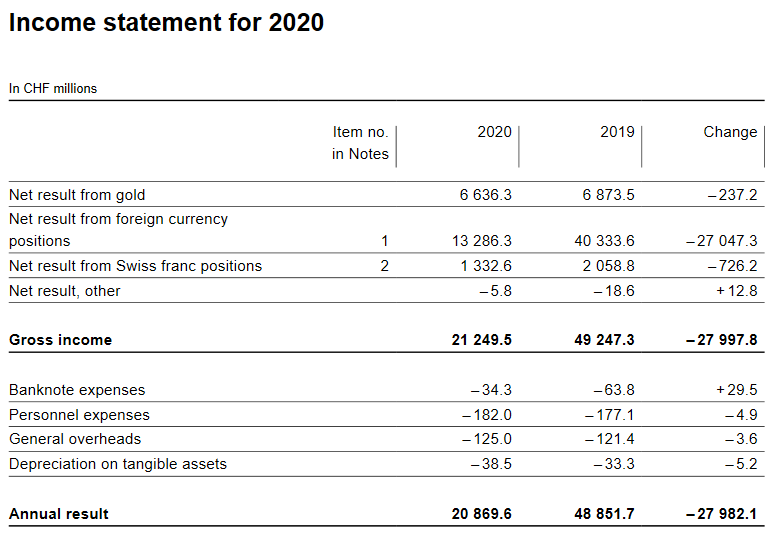

The Swiss National Bank (SNB) recorded a profit of CHF20.9 billion (almost $23 billion) in 2020, less than half of the CHF48.9 billion it made in 2019.

Read More »

Read More »

The Swiss National Bank reports a profit of CHF 20.9 billion for 2020 (2019: CHF 48.9 billion).

The Swiss National Bank reports a profit of CHF 20.9 billion for 2020 (2019: CHF 48.9 billion). The profit on foreign currency positions amounted to CHF 13.3 billion. A valuation gain of CHF 6.6 billion was recorded on gold holdings. The profit on Swiss franc positions was CHF 1.3 billion.

Read More »

Read More »

Devisen – Euro kostet erstmals seit Ende 2019 mehr als 1,10 Franken

Dieses Niveau hatte es letztmals Ende 2019 gegeben. Auch der US-Dollar hat in den letzten Wochen weiter Boden gut gemacht und nähert sich mittlerweile der 0,91er Marke an. Der Franken habe derzeit keinen leichten Stand bei den Anlegern, hiess es am Markt.

Read More »

Read More »

Understanding Minimum Wage Mandates: Empirical Studies Aren’t Enough

It is only through the increase in capital goods, i.e., through the enhancement and the expansion of the infrastructure, that labor can become more productive and earn a higher hourly wage.

Read More »

Read More »

Gold Could Offer A Way Out Of Switzerland’s Failing Inflationist Experiment

Authored by Brendan Brown via The Mises Institute,Never mind that the US Treasury’s indictment late last year of Switzerland as a currency manipulator rested on some flawed evidence and does not identify the crime.

Read More »

Read More »

Devisenreserven der SNB steigen im Januar um 3,90 Mrd Fr.

Die Devisenreserven der Schweizerischen Nationalbank (SNB) sind im Januar um 3,90 Milliarden Franken gestiegen. Per Ende des Berichtsmonats lag der Wert bei 896,15 Milliarden Franken, nachdem es Ende Dezember noch 892,25 Milliarden Franken gewesen waren.

Read More »

Read More »

SNB-Jordan: Haben gute Lösung zu höheren Gewinnausschüttungen getroffen

"Wenn es der Nationalbank über die Jahre gut geht, kann sie viel ausschütten. Wenn es aber schlechter geht, werden wir die Ausschüttungen wieder reduzieren", sagte Jordan weiter. Dabei stütze sich die neue, am vergangenen Freitag kommunizierte Vereinbarung auf die alten Abmachungen zur Ausschüttung an Bund und Kantone, nur dass die Bilanz und die Ausschüttungs-Reserve heute deutlich höher seien als vorher.

Read More »

Read More »

6 billion franc Swiss National Bank payment after new agreement

Switzerland’s Federal Department of Finance (FDF) and the Swiss National Bank (SNB), Switzerland’s central bank, have signed a new agreement on how SNB profits can be distributed.

Read More »

Read More »

2021-01-08 – Swiss National Bank expects annual profit of around CHF 21 billion for 2020

According to provisional calculations, the Swiss National Ban k will report a profit in the order of CHF 21 billion for the 2020 financial year. The profit on foreign currency posi ti ons amounted to CHF 13 billion. A valuation gain of CHF 7 billion was recorded on gold holdings. The net r esult on Swiss franc posit ions amounted to over CHF 1 billion.

Read More »

Read More »

Swiss franc shrugs off being put on the naughty step by US

For many foreign exchange traders, the US Treasury’s decision to designate Switzerland as a currency manipulator last month comes nearly six years too late and with a good dose of irony.

Read More »

Read More »

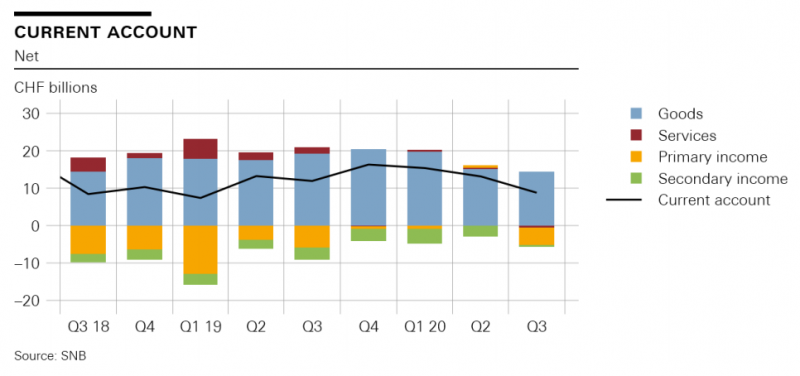

Swiss balance of payments and international investment position: Q3 2020

In the third quarter of 2020, the current account surplus amounted to CHF 9 billion, CHF 3 billion less than in the same quarter of 2019. This decline was particularly due to the lower receipts surplus in trade in goods and services. In the case of the goods trade, the decline was attributable to gold trading. This decrease was curbed by the expenses surplus for primary and secondary income, which decreased compared to Q3 2019.

Read More »

Read More »

Krankenzusatzversicherer: FINMA sieht umfassenden Handlungsbedarf bei Leistungsabrechnungen

Die Eidgenössische Finanzmarktaufsicht FINMA stellt aufgrund ihrer jüngsten Analysen fest, dass Rechnungen im Bereich der Krankenzusatzversicherung häufig intransparent sind und zum Teil unbegründet hoch oder ungerechtfertigt scheinen.

Read More »

Read More »

Monetary policy assessment of 17 December 2020

The coronavirus pandemic is continuing to have a strong adverse effect on the economy. Against this difficult backdrop, the SNB is maintaining its expansionary monetary policy with a view to stabilising economic activity and price developments.

Read More »

Read More »

“Dirk Niepelt im swissinfo.ch-Gespräch (Interview with Dirk Niepelt),” swissinfo, 2020

Swissinfo, December 14, 2020. HTML, podcast.

We talk about CBDC, the Swiss National Bank, whether CBDC would render it easier to implement helicopter drops, and how central bank profits should be distributed.

Read More »

Read More »

Swiss National Bank accused of lagging behind in green investment

Swiss banks and retirement funds are still investing enormous sums in fossil fuel companies and thereby contributing to global warming. This is the conclusion of a government climate compatibility test. The Swiss National Bank (SNB) didn’t even take part in the test – and is lagging far behind foreign institutions in climate protection.

Read More »

Read More »

BIS, Swiss National Bank and SIX announce successful wholesale CBDC experiment

Project Helvetia shows the feasibility of two proofs of concept (PoCs), using “near-live” systems to settle digital assets on a distributed ledger with central bank money.

Read More »

Read More »

Issuance calendar for Confederation bonds and money market debt register claims in 2021

The Swiss National Bank (SNB) and the Federal Finance Administration (FFA) advise as follows:

Read More »

Read More »

SUERF Webinar Baffi Bocconi Libra 2 0 20200831

This SUERF Baffi Bocconi e-lecture hosted Katrin Assenmacher, ECB, and Dirk Niepelt, University of Bern, to discuss Libra 2.0 from a monetary policy and financial stability perspective and to set Libra 2.0 in relation to the concept of Central Bank Digital Currencies (CBDC).

Read More »

Read More »

Strategische Ziele 2021 bis 2024

Die Eidgenössische Finanzmarktaufsicht FINMA veröffentlicht ihre strategischen Ziele für die Periode von 2021 bis 2024. Diese wurden heute vom Bundesrat genehmigt. Die insgesamt zehn Ziele zeigen auf, wie die FINMA ihr gesetzliches Mandat erfüllen will und welche Schwerpunkte sie dabei setzt. Die Ziele betreffen verschiedene Bereiche des Kunden- und Systemschutzes, aber auch betriebliche Themen.

Read More »

Read More »

FINMA veröffentlicht Risikomonitor 2020

Die Eidgenössische Finanzmarktaufsicht FINMA veröffentlicht den Risikomonitor 2020. Sie gibt damit einen Überblick über die aus ihrer Sicht aktuell bedeutendsten Risiken für die Beaufsichtigten und beschreibt den daraus abgeleiteten Fokus der Aufsichtstätigkeit. Die FINMA identifizierte im Corona-Jahr sieben Hauptrisiken. Neu auf der Liste sieht die FINMA drohende Ausfälle oder Korrekturen bei Unternehmenskrediten und -anleihen im Ausland.

Read More »

Read More »