Category Archive: 1.) Monetary Data

2025-06-25 – Quarterly Bulletin 2/2025

Report for the attention of the Governing Board of the Swiss National Bank for its quarterly monetary policy assessment of June 2025

Read More »

Read More »

2/2025 – Business cycle signals: SNB regional network

Report submitted to the Governing Board of the Swiss National Bank for its quarterly monetary policy assessment

Read More »

Read More »

2023-12-20 – 4/2023 – Business cycle signals: SNB regional network

Report submitted to the Governing Board of the Swiss National Bank for its quarterly monetary policy assessment The appraisals presented here are based on discussions between the SNB’s delegates for regional economic relations and members of management at companies throughout Switzerland. In its evaluation, the SNB aggregates and interprets the information received. A total of 239 company talks were conducted between 10 October and 28 November.

Read More »

Read More »

Quarterly Bulletin Q4/2022

Report for the attention of the Governing Board of the Swiss National Bank for its quarterly assessment of December 2022. The report describes economic and monetary developments in Switzerland and explains the inflation forecast. It shows how the SNB views the economic situation and the implications for monetary policy it draws from this assessment.

Read More »

Read More »

Monetary policy report Quarterly Bulletin 3/2022

Report for the attention of the Governing Board of the Swiss National Bank for its quarterly assessment of September 2022. The report describes economic and monetary developments in Switzerland and explains the inflation forecast. It shows how the SNB views the economic situation and the implications for monetary policy it draws from this assessment. The first section (‘Monetary policy decision of 22 September 2022’) is an excerpt from the press...

Read More »

Read More »

Business cycle signals: SNB regional network – Q3/2022

Report submitted to the Governing Board of the Swiss National Bank for its quarterly monetary policy assessment. The appraisals presented here are based on discussions between the SNB’s delegates for regional economic relations and company managers throughout Switzerland. In its evaluation, the SNB aggregates and interprets the information received. A total of 209 company talks were conducted between 19 July and 6 September.

Read More »

Read More »

Business cycle signals: SNB regional network

Report submitted to the Governing Board of the Swiss National Bank for its quarterly monetary policy assessment. The appraisals presented here are based on discussions between the SNB’s delegates for regional economic relations and company managers throughout Switzerland.

Read More »

Read More »

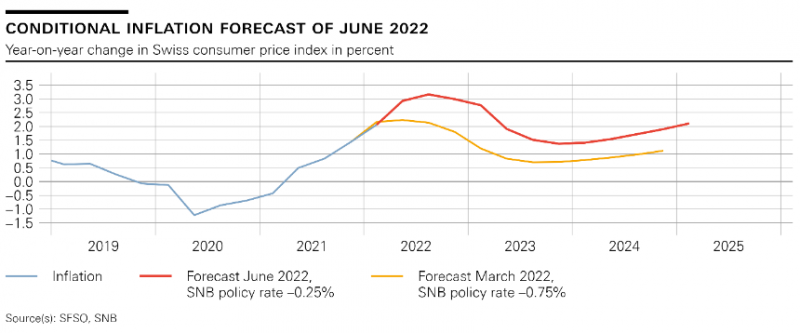

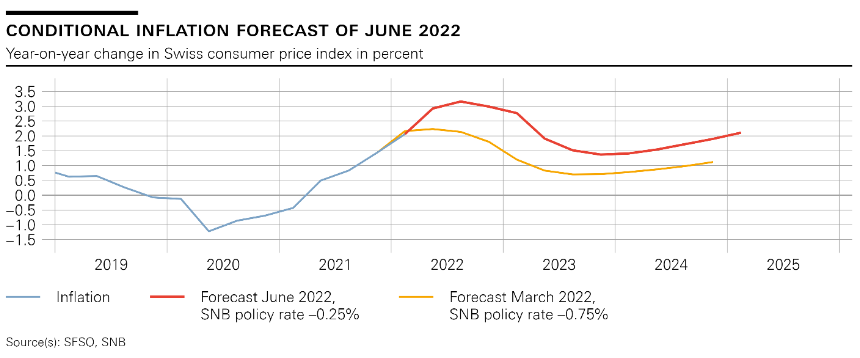

Quarterly Bulletin 2/2022

Report for the attention of the Governing Board of the Swiss National Bank for its quarterly assessment of June 2022. The report describes economic and monetary developments in Switzerland and explains the inflation forecast.

Read More »

Read More »

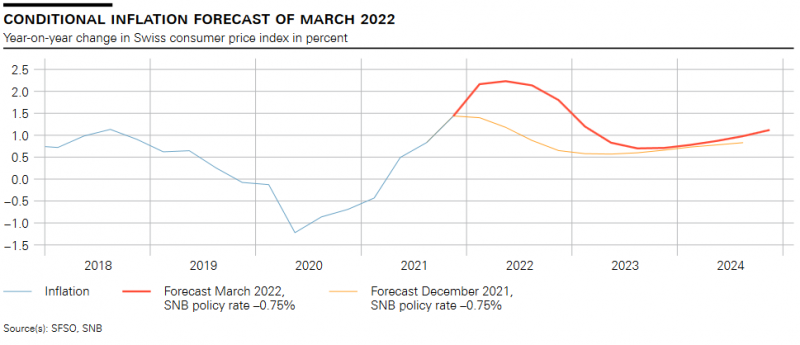

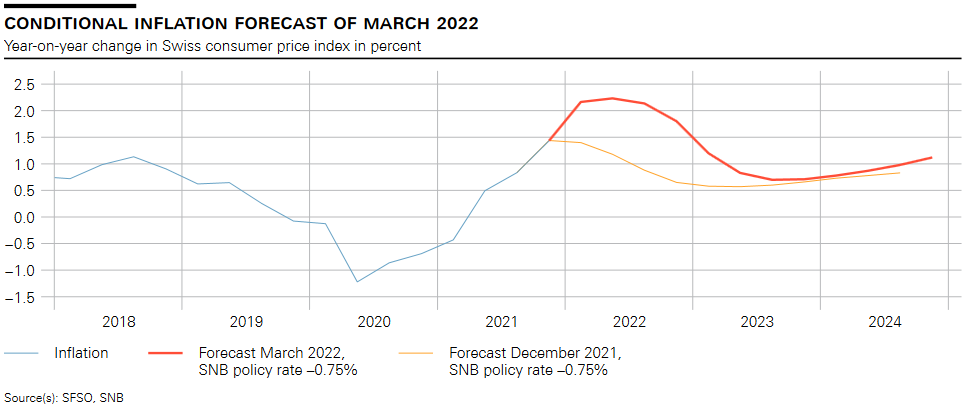

Quarterly Bulletin 1/2022 – Monetary policy report

Report for the attention of the Governing Board of the Swiss National Bank for its quarterly assessment of March 2022. The report describes economic and monetary developments in Switzerland and explains the inflation forecast. It shows how the SNB views the economic situation and the implications for monetary policy it draws from this assessment. The first section (‘Monetary policy decision of 24 March 2022’) is an excerpt from the press release...

Read More »

Read More »

2022-03-30 – 1/2022 – Business cycle signals: SNB regional network

Report submitted to the Governing Board of the Swiss National Bank for its quarterly assessment. The appraisals presented here are based on discussions between the SNB’s delegates for regional economic relations and company managers throughout Switzerland. In its evaluation, the SNB aggregates and interprets the information received. A total of 241 company talks were conducted between 18 January and 8 March.

Read More »

Read More »

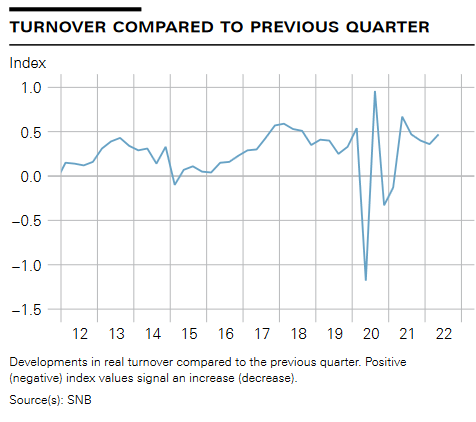

Q3/2021 – Business cycle signals: SNB regional network

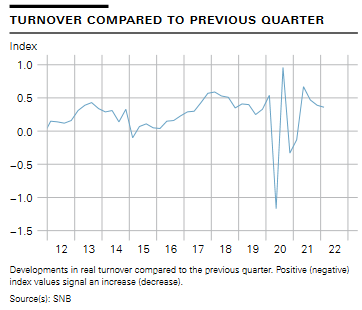

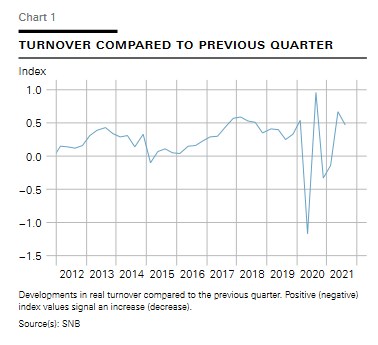

The Swiss economy continued to recover in the third quarter. Turnover increased both in the services sector and in manufacturing and construction.

Read More »

Read More »

SNB Monetary Policy Assessment June 2021

The SNB is maintaining its expansionary monetary policy with a view to ensuring price stability and providing ongoing support to the Swiss economy in its recovery from the impact of the coronavirus pandemic. It is keeping the SNB policy rate and interest on sight deposits at the SNB at −0.75%, and remains willing to intervene in the foreign exchange market as necessary, while taking the overall currency situation into consideration.

Read More »

Read More »

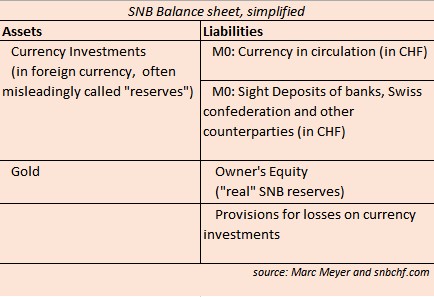

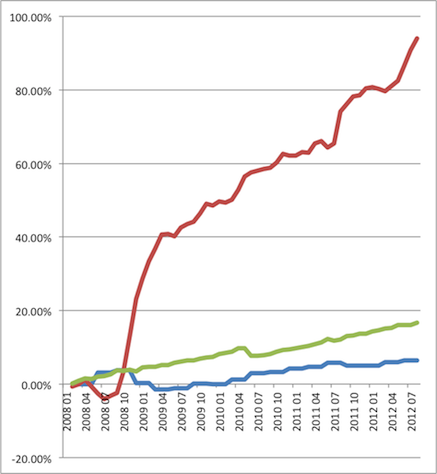

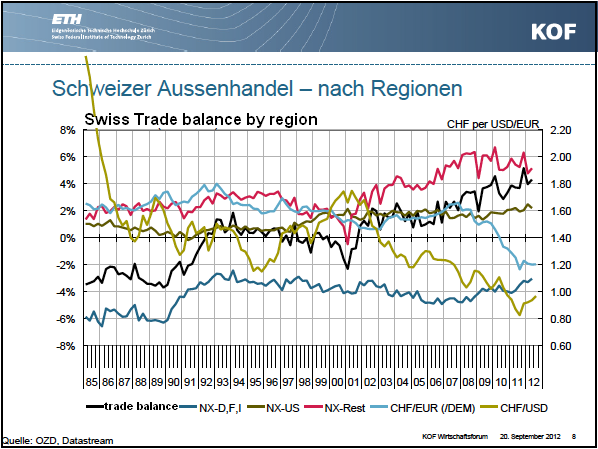

SNB interventions June 2015

Latest update for June 2015: The pace of SNB intervention is slowing. Sight deposits, the indicator for SNB interventions, rise by 0.5 billion francs per week.

April and May: Sight deposits rise by 1.5 billion CHF per week. Thanks to this intervention the SNB is able to maintain the EUR/CHF around 1.0450.

Read More »

Read More »

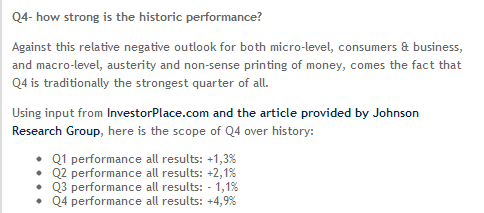

SNB Monetary Data Week October 26

Seasonal effects, the good months for the SNB and the US economy, but weaker ones for emerging markets and Switzerland Despite the seasonal effects between October and March, the SNB is not able to sell currency reserves consistently. Traditionally the USD gets stronger and stocks rise over the autumn months till January. This year’s stocks appreciation was possibly already anticipated …

Read More »

Read More »

SNB Monetary Data Week October 19

Seasonal effects, the good months for the SNB and the US economy, but weaker ones for emerging markets and Switzerland Given that the seasonal effects between October to March have started, the SNB might be able to sell some currency reserves. Traditionally both the USD gets stronger and stocks rise over the autumn months till January. This year’s stocks appreciation was …

Read More »

Read More »

SNB Monetary Data Week October 12

Seasonal effects, the good months for the SNB and the US economy, but weaker ones for emerging markets and Switzerland, have started Given that the seasonal effects between October to March have started, the SNB might be able to sell some currency reserves. Traditionally both the USD gets stronger and stocks rise over the autumn months till January. This year’s stocks …

Read More »

Read More »

SNB Monetary Data Week October 5

Seasonal effects, the good months for the SNB and the US economy, but weaker ones for emerging markets and Switzerland, have started Given that the seasonal effects between October to March have started, the SNB might be able to sell some currency reserves. Traditionally the United States and the USD dollar become stronger and stocks rise over the autumn months …

Read More »

Read More »

SNB Monetary Data Week of September 28

Seasonal effects, the good months for the SNB and the US economy, but weaker ones for emerging markets and Switzerland, have started Given that the seasonal effects between October to March have started, the SNB might be able to sell some currency reserves. Traditionally the United States and the USD dollar become stronger over the autumn months till …

Read More »

Read More »

SNB prints nearly 5 billion francs in one week, FX traders poised to get ripped off

As we expected in our post “What’s this crazy movement in EUR/CHF ? SNB Floor Hike ?“, long-time investors, global macro funds and US investment banks are moving into gold and the Swiss franc again. The SNB had to buy euros and print new Swiss francs of around 5 billion francs last week, as … Continue reading »

Read More »

Read More »