Category Archive: 1.) CHF History

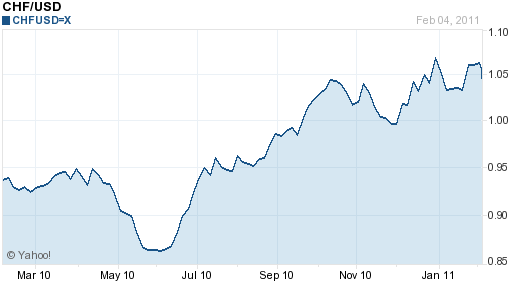

EUR/CHF, a Year of Free Market (07/2010-07/2011): August 2010

ForexLive Asian Market Open: CHF, JPY Up; GBP Down EUR/CHF will begin the new month at fresh record lows and this may encourage some of the bigger macro funds to join in the rout, those that aren’t already involved that is. I think it was Paul Tudor-Jones who said that his best trades often came … Continue reading »

Read More »

Read More »

EUR/CHF, a Year of Free Market (07/2010-07/2011): July 2010

EUR/CHF Hit Again EUR/CHF has been hit again, down at 1.3535 from early 1.3580. Recently there has been talk of the Swiss National Bank selling the cross, something I for one certainly can’t substantiate. Also yesterday there were rumours of a September rate hike in Switzerland. All very murky. The EUR/CHF cross selling has helped pressure EUR/USD, which is … Continue reading »

Read More »

Read More »

EUR/CHF: A Year of Free Market, June 2010

EUR/CHF Firmer EUR/CHF up at 1.3260 from early 1.3210. Move comes as Hungary official says government plans loan deal with IMF. Large German name seen buying the cross. By Gerry Davies || June 30, 2010 at 06:45 GMT Euro Profit Taking Rebound The euro has found some buying support across the board on profit taking. I … Continue reading »

Read More »

Read More »

SNB Abandons Intervention (June 2010)

Jun. 22nd 2010 Extracts from the history of the Swiss Franc (June 2010) The Swiss National Bank (SNB) has apparently admitted (temporary) defeat in its battle to hold down the value of the Franc. ” ‘The SNB has reached its limits and if the market wants to see a franc at 1.35 versus the euro, … Continue reading »

Read More »

Read More »

EUR/CHF: A History of Interventions, May 2010

ForexLive Asian Market Open: EUR Worries Return The big Sovereign players couldn’t get enough of the EUR when it was at 1.40 and now it looks like they can’t get out quick enough. The BIS has been a regular seller on behalf of other central banks, the SNB are quietly trying to offload what they … Continue reading »

Read More »

Read More »

EUR/CHF: A History of Interventions, April 2010

April 2010 Quick Look At The Order Books AUD/USD: stops below .9135 and again below .9070 USD/JPY: solid bids 92.70, stops below 92.40, heavy semi-official bids expected at 91.50 ( I’m hearing of “massive” stops below 90.50 so if market gets on a roll lower keep this level in mind) EUR/USD: looks like the order … Continue reading »

Read More »

Read More »

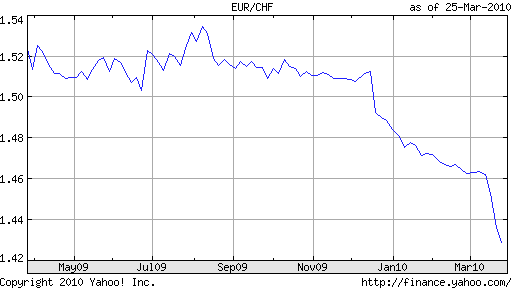

Swiss Franc Surges to Record High: Where was the SNB? (March 2010)

Mar. 26th 2010 Extracts from the history of the Swiss Franc (March 2010) One of the clear victors of the Greek sovereign debt crisis has been the Swiss Franc, which has risen 5% against the Euro over the last quarter en route to a record high. 5% may not sound like much until you … Continue...

Read More »

Read More »

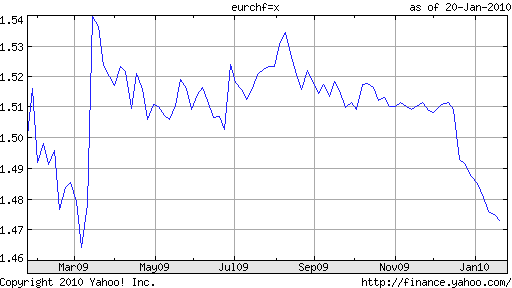

EUR/CHF: A History of Currency Interventions, January, February 2010

January, February 2010 EUR/CHF Steady As A Rock EUR/CHF sits at 1.4632, seeing very steady trade. I guess we should note that the SNB quite likes intervening on a Friday. By Gerry Davies || February 26, 2010 at 08:19 GMT Rumours Of SNB Help EUR/CHF Higher The EUR/CHF has popped from 1.4630 to 1.4675 on rumours … Continue reading »

Read More »

Read More »

The Line in Sand of 1.50 Collapses (December 2009, January 2010)

Jan. 26th 2010 Extracts from the history of the Swiss Franc Pull up a 1-year chart of the Euro against the Swiss Franc, and you’ll quickly notice a salient trend: the exchange rate has hovered slightly above €1.50 since last March, with three notable deviations. The first occurred last March, when the Swiss National Bank (SNB) …

Read More »

Read More »

EUR/CHF A history of interventions: November 2009

November 2009 Asian FX Market Open: Price Action Suggests That There’s More To Come As I wrote yesterday, the market moves reminded me of 12 months ago when risk aversion was in full flow and this has continued throughout the European session. As Lilac mentioned after the FTSE fell by over 3%, we could be … Continue reading »

Read More »

Read More »

EUR/CHF A History of Interventions: October 2009

A market view history of the EUR/CHF from the website ForexLive October 2009 Cue The Jaws Music EUR/CHF is trading below 1.5100, presently at 1.5090, very nearly at 1.5o80 where the SNB is last said to have intervened………. More Signs Of US And Global Recovery The US GDP number was yet another sign of a global economic recovery … Continue reading...

Read More »

Read More »

EUR/CHF A history of interventions: September 2009

A market view history of the EUR/CHF from the website ForexLive September 2009 Market Settles Down After More NZD-Led Volatility As Jamie said earlier, it’s amazing that an economy half the size of Norway’s can lead the market by the nose and it has now done so for the second successive day. NZD/USD rose almost … Continue reading »

Read More »

Read More »

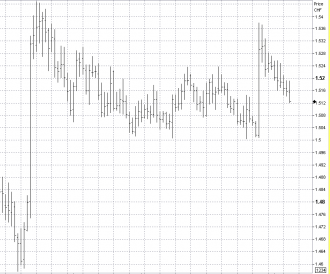

Recent History of the Swiss franc, July 2009

A market view history of the EUR/CHF from the website ForexLive July 2009 EURCHF Offers 1.5250 Im hearing that EURCHF offers at 1.5250 are lined up ready to defend the level. There was an attempt to take it higher on Friday after the German IFO number but failed. 1.5250 is proving to be quite a level. … Continue reading »

Read More »

Read More »

Swiss National Bank Still Committed to FX Intervention (July 2009)

Jul. 17th 2009 Extracts from the history of the Swiss franc (July 2009). When the Swiss National Bank (SNB) intervened three weeks ago in forex markets, the Swiss Franc instantly declined 2% against the Euro. Since then, the Franc has risen slowly, and it’s now in danger of touching the “line in the sand” of …

Read More »

Read More »

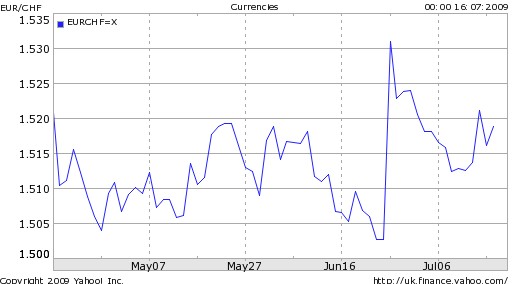

Recent History of the Swiss Franc: June 2009

A market view history of the EUR/CHF from the website ForexLive June 2009 Don’t Get Too Fancy- Most Of The Clues Are Face-Up On The Table EUR/USD: big option play has tied the market in for the last 2 weeks and there are 2 more to go we believe. 1.3750/1.4250 range on the wide but … Continue reading »

Read More »

Read More »

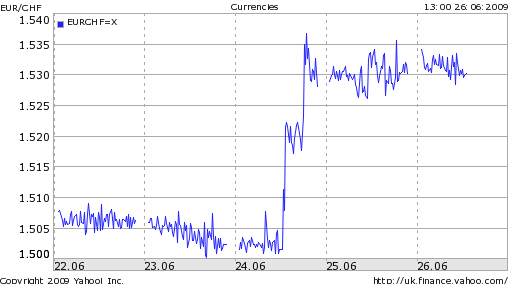

SNB Intervenes on Behalf of Franc (June 2009)

Jun. 26th 2009 Extracts from the history of the Swiss franc (June 2009) Back on March 12, the Swiss National Bank issued a stern promise that it would actively seek to hold down the value of the Swiss Franc (CHF) as a means of forestalling deflation. The currency immediately plummeted 5%, as traders made … Continue...

Read More »

Read More »

SNB rate decision June 18th 2009

Extracts from the History of the Swiss Franc Courtesy on EasyForex.com SNB rate decision June 18th 2009 Written by Michael J. Malpede Wednesday, 17 June 2009 18:23 GMT The Swiss National Bank (SNB) will hold its monetary policy meeting on Thursday June 18th.The SNB is expected to hold rate policy steady at 0.00%-0.75%.Recent Swiss economic …

Read More »

Read More »