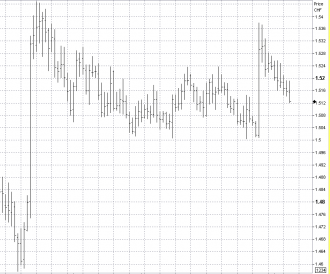

A market view history of the EUR/CHF from the website ForexLive

July 2009

EURCHF Offers 1.5250

Im hearing that EURCHF offers at 1.5250 are lined up ready to defend the level. There was an attempt to take it higher on Friday after the German IFO number but failed. 1.5250 is proving to be quite a level. Watch this level for clues to EURUSD direction tonight.

Swiss Trade Surplus 1571.7 Mln In June

The Swiss trade surplus contracted to 1571.7 mln swiss francs in June from 1996.1 mln in May, with exports dropping a seasonally adjusted 2.6% in real terms compared to May.

Exports of metals and watches were hit particularly hard.

EUR/CHF trades around 1.5200, unaffected by the poor data.

Majors Opening Unchanged From NY Close On Friday

It’s a Japanese holiday today which should ensure a quieter trading session than usual. All of the majors are opening close to their NY closing levels, with EUR/USD at 1.4100, USD/JPY at 94.25, cable at 1.6330 and AUD/USD at .8005. The EUR has regained some of its recent losses against the JPY and the GBP and is still dominated by option plays against the USD. The GBP is entering a weak phase in my opinion and will tend to be more influenced by any bad economic data. The JPY might strengthen as the month draws to an end if the much-touted Toshin maturities actually eventuate and the CHF is being manipulated by the SNB.

Good luck today.

Swiss ZEW Investor Sentiment Zero In July

Swiss ZEW investor sentiment has fallen to zero in July from +9.7 in June. Meanwhile EUR/CHF and USD/CHF are trading steadily at 1.5160 and 1.0765, pretty much unchanged on the day.

EUR/CHF Tripping Higher, Stops Noted

EUR/CHF is making some decent headway this morning, presently at 1.5165 from an early 1.5125. The moves comes with SNB’s Roth having restated the SNB’s absolute determination to arrest swiss franc strength.

I’m hearing from a source that there are buy stops gathered up at 1.5180/85. Personally haven’t heard any reports of BIS involvement.

SNB To Stick “Decidedly” To FX Policy

SNB Chairman Jean-Pierre Roth, in an interview with Handelsblatt, has said “We do not want a further appreciation of the swiss franc, because we must prevent deflation.”

When asked what the SNB would do if the upward pressure on the franc persisted, Roth said “We stick to our policy, decidedly.”

Roth also said the bank does not give fx targets, but noted that the franc hasn’t risen further.

EUR/CHF is very marginally firmer in early European trade, presently at 1.5135.

Drive-By By The BIS Gives EUR/CHF A Quick Pop

EUR/CHF got a quick ride to the topside by some BIS buying about an hour ago, traders say. Prices rallied from 1.5105 to 1.5170 before fading back to the present 1.5135 level. Traders continue to use intervention as opportunities to lighten up very long net positions in EUR/CHF.

EUR/CHF Longs Thanking Their Lucky Stars

“It coulda been me.” Relieved EUR/CHF longs are thinking their lucky stars that their cross did not go into freefall like EUR/JPY and the other JPY crosses today as risk aversion made a return to the market. The market remains quite long the cross and they pray the SNB and their allies continue to support the cross in the days ahead.

We’ve fallen back to 1.5125 thus far and are holding well above 1.5000/05, the so-called “line in the sand” that the SNB seems to have drawn as part of its quantitative ease strategy.The question is, does it make sense to hold onto positions which show relatively few prospects for explosive gains and reasonable high prospects for testing one’s dwindling patience. I’d be a seller on strength toward 1.5190/95, where we’ve stalled several times in recent sessions.

FX Market Themes Of The Moment

- Will there be any discussion at the G8 meeting about the reserve currency question? The FX market will react to any mention and the most likely outcome would be another wave of EUR/USD buying.

- What’s China up to in the EUR/USD? What are they doing with their USD trade surplus if they cannot buy and stockpile commodities and major acquisitions like Rio Tinto and Opel are considered “politically not viable”?

- What is Europe to do about it’s blatant lack of leadership and the problems in Eastern European economies?

- What effect will the SNB intervention eventually have? The market is sitting very short CHF and is relying on the SNB to hold it up. If the market breaks below 1.5000 in EUR/CHF and there is no SNB- what then?

Lots of questions. Answers expected sometime, maybe not soon.

Is That All There Is?

Reports have circulated this morning that the BIS stepped in to buy EUR/CHF around 1.5160 level but prices were only able to bounce to 1.5195. The market is weighed down with longs in this pair and at this point is hoping for a more dramatic foray into the market by the Swiss National Bank so they can unwind those longs. The SNB are no dumbies, and are unlikely to merely bailout specs nursing stale longs. We may need a purge of the longs beforea sustainable rally can unfold.

“Get Me The Swiss National Bank”

“Hello? EUR/CHF is below 1.5200. Where are you?”

That’s what traders are asking as CHF comes under some upward pressure as traders flock to the traditional safe-havens amid a round of flight to quality in the markets today. Add in to the equation that many are long EUR/CHF to the gills, expecting the SNB to bail them out on any dips.

So far the SNB has not been in the market to buck the tide today, leaving stops below 1.5150 vulnerable. Leave it to them to come in and goose the market onlt after the specs get burned on the long side of the market. EUR/CHF trades at 1.5175.

SNB’s Jordan Says Ready To Continue Interventions To Fight Rise In Swiss Franc

SNB’s Jordan says the bank is ready to continue interventions to fight rise in swiss franc on an ad-hoc basis. He feels market seems to have understood SNB’s intentions.

Jordan feels bank is in a position of strength as it pursues “massive” quantitative easing.

EUR/CHF trading firmer, presently at 1.5240 from a European opening down around 1.5200.

EUR Crosses Taking The Lead As We Enter The Doldrums

The 4th of July holiday in the US is a signal for the northern hemipshere holiday period to begin and this is our traditional ‘doldrum’ period. The EUR crosses are likely to remain the key pairs over the next few months. EUR/CHF is seeing some significant intervention (a good reason to avoid the pair in my opinion), EUR/GBP has seen a heavy sell-off and is trying to form an interim base, and EUR/JPY in my humble opinion is getting ready to surge towards 150.

Tags: IFO,Swiss National Bank