Category Archive: 9a.) Real Investment Advice

Liquidity Problems Are Closer Than You Think

Earnings growth are a function of economic growth; the US Economy is de-coupled from the rest of the world, which economy is poor. The danger of deficits (that are funding our economic growth); SOTU Preview: "The economy is great." Market continues trading in a very tight range, but ever upward; this is when complacency sets in. The market is setting up for correction as the election draws nearer. Are we in a bubble or the market top; how...

Read More »

Read More »

Proof: How Inflation is Affecting the Economy

Super Tuesday seems to have locked-up the next Presidential contest pairing; economic data is not so good, yet market exuberance continues. Fed speakers abound today ahead of the Fed's blackout period. A record-setting Yield Curve Inversion is underway, still without recession. Markets continue to trade in a narrow range, like clockwork; volatility actually declined. Are we at the top, and not a bubble? Correction this year is very likely; Bitcoin...

Read More »

Read More »

Valuation Metrics Suggest Investor Caution

Economic Data releases and Fed speeches today will resonate with a rising commentary of no rate cut(s) this year, thanks to sticky inflation. Target's earnings show the consumer is still spending; markets continue in 4-month advance, longest since 1970. Preceding a correction? Markets are operating in a narrow trend channel, with money rotating out of Magnificent Seven Stocks and into meme stocks. Markets are in the midst of bullish exuberance;...

Read More »

Read More »

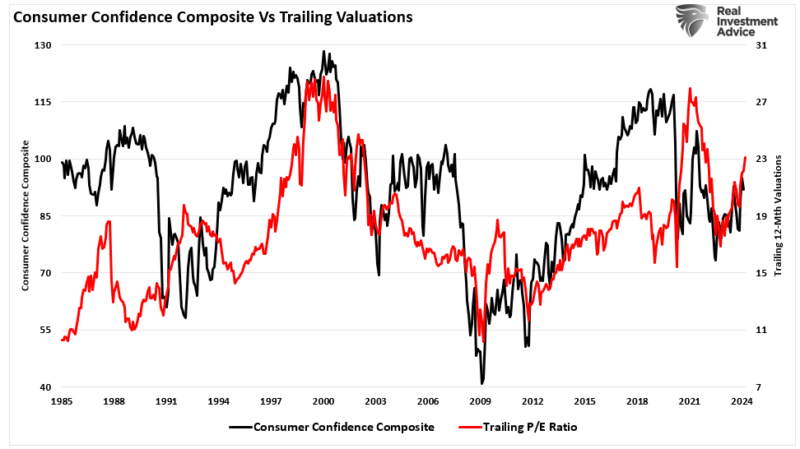

Valuation Metrics And Volatility Suggest Investor Caution

Valuation metrics have little to do with what the market will do over the next few days or months. However, they are essential to future outcomes and shouldn’t be dismissed during the surge in bullish sentiment. Just recently, Bank of America noted that the market is expensive based on 20 of the 25 valuation metrics they track.

Read More »

Read More »

Warren Buffett’s Cash Dilemma

Markets are entering the three strgonest months of the year; what if interest arwets aren't cut? February was unusually strong for a "weak" month; what happens during Presidential Election years? Looking at Volatility risk. Markets have been up for 16 of the past 18-weeks; such activity generalluy heralds a correction. Warren Buffett's annual letter: What do to with $160-B in cash? The dilemma of cash and valuations; cash held by...

Read More »

Read More »

How to Plan for Social Security “Viability”

Social Security Viability: Let the Propaganda Begin

As discussions ensue about the best way to bring the Social Security system into actuarial balance, the raising of the maximum wage base is emerging as a popular solution.

Hosted by RIA Advisors Director of Financial Planning, Richard Rosso, CFP, w Senior Financial Advisor, Danny Ratliff, CFP

Produced by Brent Clanton, Executive Producer

-------

Articles mentioned in this report:

"Apple's...

Read More »

Read More »

Five Money Habits of Unhappy Couples

Nothing sinks a marriage quicker than money issues. If the Valentine’s Day glow has faded, promise you’ll respect your lover’s credit, communicate about your money, and share together money tips to help revive your financial harmony.

Hosted by RIA Advisors' Director of Financial Planning, Richard Rosso, CFP, w Senior Financial Advisors, Danny Ratliff, CFP, & Jonathan MCCarty, CFA, CFP, NSSA

Produced by Brent Clanton, Executive Producer, &...

Read More »

Read More »

Are Buybacks Worth Paying Up For?

Stock buyback activity is on pace to reach new, all-time highs (and it's only the end of February!) One reason for the gap between large-cap companies and small- and mid-caps is bigger companies' ability to pour cash into buybacks. Will election season cause Wall St. to reduce risk? GDP and Consumer Sentiment numbers all revised downward, but confidence remains high in markets' ability to perform. Lance & Michael discuss volatility in portfolio...

Read More »

Read More »

11 Pearls of Investing Wisdom from Warren Buffett

Markets continue to trade sideways as the latest earnings season draws to a close. Stock buy-backs will continue for the next three weeks, and then halt in preparation for the NEXT round of earnings reporting. Warren Buffett on buy-backs: Need to occur when companies are under-valued relative to markets for optimal effect; companies are now buying back at high prices. Company stocks are still trading despite 40% reporting negative earnings. What...

Read More »

Read More »

This Is Nuts – An Entire Market Chasing One Stock

Preparing for this week's economic data releases; what the Fed looks at for Inflation; earnings season concludes with good beat-rate...on lowered expectations. Dow Theory theory and Amazon's joining the S&P 500: When does Nvidia enter the index? Analysts are raising targets for the S&P to 5800 by the end of the year, based on performance of Nvidia and other tech stocks: This is nuts. Markets continue to trade within narrowly-defined trading...

Read More »

Read More »

Small Cap Stocks May Be At Risk

Retail investors have started chasing small-cap stocks in hopes of both a rate-cutting cycle by the Federal Reserve and avoiding a recession. Such would seem logical given that, historically, small capitalization companies tend to perform best during the early stages of an economic recovery. Since debt-driven government spending programs have a dismal history of providing the promised economic growth, disappointment over the next year is almost...

Read More »

Read More »

What To Do When You Regret Retirement

Is Nvidia more than a market darling, and has it entered the "tulip stage?" (We don't know when the tulip will die.) How to invest with the maddening crowd without going mad. Candid Coffee preview (registration link is below!) Couples, Money, & Communication: Make it fun (Amazon shots?) Pensions vs Social Security: the confounding Windfall Elimination Provision (WEP) and Government Pension Offset (GPO) rules. Why you cannot (fully)...

Read More »

Read More »

Are The Magnificent Seven Stocks In A Bubble?

Has Nvidia become the world's most-valuable company? The S&P is aiming at more all-time highs, but can they hold? Fed minutes reveal no rush to cut rates. The disconnect with markets' expecting more cuts. Will the Fed reduce QT as money flows into markets? Meanwhile, markets continue to test rising trendline at 20-DMA, as consolidation continues. No reason to be bearish on markets...yet. What markets missed from Fed Minutes: the quantity of...

Read More »

Read More »

Will Nvidia Break the Market?

It's Nvidia earnings reporting day, and as tech companies have driven markets of late, the results, and the company's forward guidance, could have a huge effect. Earnings expectations are extremely high; risk of disappointment is high. The S&P is testing a rising trendline at the 20-DMA, against a negative divergence in relative strength. The dichotomy is unsustainable. The Conference Board releases latest survey of leading economic indicators,...

Read More »

Read More »

Don’t Fear the All-time Highs

There are "Dow Days" and "NSDQ Days;" CPI inflation is still transitory; emerging influence of presidential election on Congress' ability to manage debt & spending, M-2 as % of GDP. There is little expectation for earnings growth this year. Markets remain in bullish trend, but a negative day today could trigger MCD Sell-signal. Time to reduce portfolio risk and wait until correction to put capital back to work. Instead of...

Read More »

Read More »

Should I Delay Social Security?

The Fed is in no rush to lower rates, based on the latest economic data; we've gone from transitory to permatory inflation; rents are not going to fall, but rates are not going to go up. Fed Gov. Bostick: Rates are not going down until later, based on Labor data. Candid Coffee preview: The problem with Financial Infidelity; does it pay to delay taking Social Security? (It depends...) What's the best claiming strategy? Rich & Danny critique...

Read More »

Read More »

Fed Chair Powell Just Said The Quiet Part Out Loud

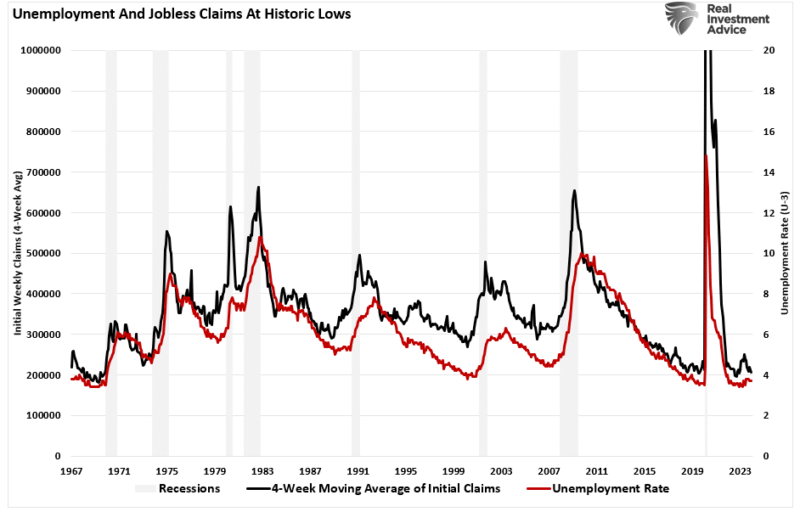

Regarding the surprisingly strong employment data, Fed Chair Powell said the quiet part out loud. The media hopes you didn’t hear it as we head into a contentious election in November. Over the last several months, we have seen repeated employment reports from the Bureau of Labor Statistics (BLS) that crushed economists’ estimates and seemed to defy logic. Such is particularly the case when you read commentary about the state of the average...

Read More »

Read More »

Is Toyota the Next Tesla?

The post-Valentine's Day afterglow; Markets are not behaving like it's February (typically a weaker month), so far. The NFIB Small Business Survey belies weaker conditions and negative sentiment; there is a correlation between the NFIB and Small Cap Index. Markets continue to do well, despite weaker economic activity; bonds showing promise; NVIDIA captures 3rd place in S&P 500, unseating Amazon & Google. Commentary on pending legislation...

Read More »

Read More »

So You Think You’re Ready to Retire… (2/14/24)

(2/14/24) Financial advisors have significantly different perceptions of their clients’ retirement readiness than do the clients themselves, according to Allspring Global Investments’ annual retirement survey, released Tuesday.

While some two-thirds of retirees and near-retirees considered themselves ready for retirement, only 40% of advisors, who were included in the survey for the first time, said their clients were ready.

Hosted by RIA...

Read More »

Read More »

It’s CPI Day! – the Impact Gas prices may Have

(2/13/24) It's CPI Day (the Consumer Price Index increased .3% in January; on an annualized basis, CPI dropped from December 3.4% to 3.1% for January.) Actors, do not lie on your application (especially involving roller skates and the Super Bowl Halftime!) Amazon hit with class action lawsuit over upcharge for ad-free viewing. Markets start Monday flat, spike a bit, and end flat. Correction is one day closer today than yesterday; why managing risk...

Read More »

Read More »