Category Archive: 9a.) Real Investment Advice

Allocating Tax Dollars: Ensuring Funding Truly Helps American Citizens

Fair share of taxes spurs debate on where it goes. Investing in infrastructure or supporting veterans? What's your take? #Taxation #Debate

Watch the entire show here: https://cstu.io/4aa4be

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

9-23-24 Will this Week’s Data Support Fed Rationale for Cutting Rates?

We're entering the last-half of September, which is typically the weaker period of an already, traditionally weak month in the markets. Earnings seasons is about to beging, and Q3 estimates have already been slashed; this isn't 1995, though: Is the Fed's rationaled for cutting raates going to be validated by this week's economic data? Markets ended slightly lower on Friday, but still holding onto breakout level. Lance relate's Mrs. Robert's most...

Read More »

Read More »

Divergence in Market Metrics: Sales, Earnings, and Economic Surprises

Market data showing divergence between economic, sales, and earnings surprises. Earnings high, sales and economic data declining. How long can this last? ? #MarketInsights

Watch the entire show here: https://cstu.io/c58161

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Invest Smart: Understanding Yield Curve Normalization and Current Market Trends

Economic update: Yield curves are normalizing, with only one curve still inverted. Stay informed with our upcoming newsletter! ? #EconomicUpdate

Watch the entire show here: https://cstu.io/aff84f

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

The Challenges of Adjusting Corporate Tax Rates in Government Negotiations

? Understanding the complexities of tax policies and negotiations in government. Watch to learn more! ?? #taxes #government #negotiations

Watch the entire show here: https://cstu.io/e18216

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

9-20-24 Fed Rate Shock: How the Latest Cut Could Ignite or Crash Your Investments

Was the Fed's 50bps rate cut a just a "calibration?' We are still not at the Fed's target for unemployment; the Fed's action was in response to conditions, not to help anyone politically. What will the Fed do next? The 50bps cut does nothing to help consumers. What is the neutral, real interest rate, now? Why a Fed rate cut is really bad news. How now to fund your goals: Time to trim exposure and move to cash, awaiting opportunities....

Read More »

Read More »

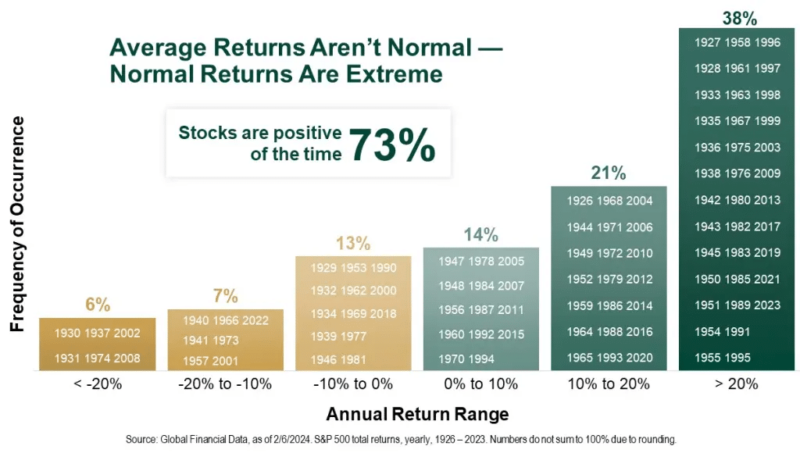

Market Declines And The Problem Of Time

When stock markets rise, the bullish narrative tends to dominate, overlooking the potential impact of market declines. This oversight stems from two main problems: a basic misunderstanding of math and time’s critical role in investing. Every year, I receive the following chart as a counterargument when discussing the importance of managing risk during a portfolio’s life cycle. The chart shows that while the average bull market advance is 149%, the...

Read More »

Read More »

Nvidia: Why Goldman Sachs Calls It The Most Important Company in the Market

Big news on Nvidia's earnings! ? According to Goldman Sachs, Nvidia is the most important company in the market right now. AI focus is key! #Nvidia #AI

Watch the entire show here: &t=2083s

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

9-19-24 What Does the Fed’s 50-bps Rate Cut Mean for Your Money?

The markets were right: The Federal Reserve cut interest rates by a half percent on Wednesday, and markets initially climbed, then sold off to end negative for the day. But after pondering overnight, market futures indicated a strong start to Thursday's trading day. If markets rally and hold through Friday, they will be set to hit all time highs, once again. Will we see rotation into other sectors as a by product? The Fed is trying to position...

Read More »

Read More »

Don’t Chase Performance: The Key to Long-Term Investment Success

Focus on more than just performance! Comparing yourself to others will only lead to unhappiness. Quality service is key! ? #InvestingTips

Watch the entire show here: https://cstu.io/adb451

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

9-18-24 Fed Rate Decision 2024: Boom or Bust for Your Investments?

Lance Roberts & Danny Ratliff discuss the potential outcomes of the upcoming Federal Reserve interest rate decision and how it could impact inflation, market trends, and your portfolio in 2024. Stay ahead of the market by understanding the key indicators to watch and strategies for navigating possible volatility.

Hosted by RIA Advisors Chief Investment Strategist Lance Roberts, CIO, w Senior Financial Advisor Danny Ratliff, CFP

Produced by...

Read More »

Read More »

Trump Or Harris: Corporate Tax Winners And Losers

Not surprisingly, Donald Trump and Kamala Harris are taking opposite approaches to modifying the corporate tax code. If enacted, both proposals would significantly impact corporate profits and, thus, share prices.

Read More »

Read More »

Investing Wisdom: Why Rebalancing Your Portfolio Is Crucial

Skate to where the puck is going, not where it's been ? Wise words for investing! Consider taking profits and rebalancing risk for the future. #InvestingTips

Watch the entire show here: https://cstu.io/4e6c52

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

9-17-24 Momentum Investing Gives You An Edge, Until It Doesn’t

Today marks the start of the FOMC meeting, to be concluded with the latest interest rate announcement. Markets' expectations are for a half-percent cut; could a quarter-percent cut create disappointment on Wall Street? Microsoft announces and increase in its dividend payment (very different from a stock buy back). Kamala Harris' plans to raise taxes on corporations is in fact an crease in taxes on consumers; corporations are tax collectors for the...

Read More »

Read More »

Momentum Investing Gives You An Edge, Until It Doesn’t

Since 2020, momentum investing has generated significantly better returns than other strategies. Such is not surprising, given the massive amounts of stimulus injected into the financial system. However, Brett Arends for Marketwatch noted in 2021 that momentum investing can give you an edge.

Read More »

Read More »

The Shift from Fresh Food to Processed Meals in Modern Households

Reflecting on the shift in US households from fresh food to sugary, lower quality options. Times have changed. #food #health #family

Watch the entire show here: https://www.youtube.com/live/VG5OqhPFss4?si=gV8CSTgQfOyrEfMA

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

9-16-24 Market Risks We Are Watching

It's Fed week, and many are predicting a 60% chance the FOMC will drop rates by a half percent; elections are drawing nearer: How will markets behave? (Why the polls are never right) Markets' 4% loss two weeks ago followed by 4% recovery last week; reversal days tend to mark bottoms, but not always. Last weeks' reversal was very bullish, but that doesn't mean we cannot have another correction. One risk is oil prices. XLE is over sold. The three...

Read More »

Read More »

Social Security Concerns Rise Amid Government Delay: What It Means for Americans

Government delays? Social Security concerns? ? Check out this clip discussing the impact on Americans. #SocialSecurity #Government #FinancialSecurity ??

Watch the entire show here: https://www.youtube.com/live/VG5OqhPFss4?si=gV8CSTgQfOyrEfMA

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

AI Chip Impact: How Nvidia Profits Differ from Other Industries

AI is transforming industries! Companies like Google, Apple, Amazon are leveraging it to boost profits. Will all succeed? #AI #Innovation

Watch the entire show here: https://cstu.io/83dfbb

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Finding the Next Nvidia: Exploring Future AI Investment Opportunities

? Exciting times ahead with new technology and AI companies emerging! ? Keep an eye out for the next big player in the market. #TechTrends #AI #Innovation

Watch the entire show here: https://cstu.io/eabc12

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »