Category Archive: 9a.) Real Investment Advice

Analyzing Post-Election Economic Data: What It Means for Future Investments

Navigating through post-election economy! ?? Stay informed on economic data and market trends. Changes take time to impact!

Watch the entire show here: https://cstu.io/6a2976

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Trump Presidency – Quick Thoughts On Market Impact

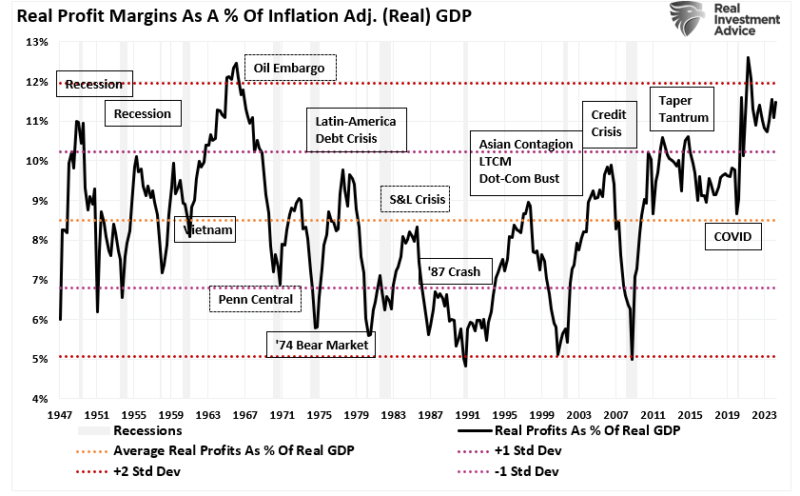

The prospect of a Trump presidency has led to much debate and speculation about how markets might react. Depending on what policies are eventually passed, there are potential risks and opportunities in both the stock and bond markets. While the market surged immediately following the election, many potential future headwinds may impact returns from economic growth, monetary and fiscal policy, and geopolitical events.

Here are some quick...

Read More »

Read More »

How New Presidential Policies Boost Small Business Optimism and Investment

? New president, new optimism! Small businesses are expected to thrive with a jump in confidence index post-election. ?? #SmallBusiness #ElectionBoost

Watch the entire show here: https://cstu.io/bbf4d1

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

The Reality of Political Promises: What Truly Happens in Office

Political promises vs. reality! Campaign talk vs. getting things done in the White House. ?️? #Politics #CampaignTrail #RealityCheck

Watch the entire show here: https://cstu.io/e50a20

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

A Second Trump Term Stokes The Inflation Narrative

After Tuesday night's initial election results started to point to increasing odds of a Trump victory, bond yields began to rise sharply, as shown below. The surge in rates was not a sudden move. Over the past month, betting odds favoring a second Trump term and bond yields rose in unison. The narrative emerging from …

Read More »

Read More »

11-7-24 Fed Day Arrives

In the aftermath of the 2024 Election, attention now turns to today's Fed announcement, with odds makers giving 96% chance of a quarter-percent rate cut. Meanwhile, markets are roiling as foreign investors try to position after the election. Managers are scrambling to re-risk in time for year-end reporting; Wednesday was a huge day for Small Caps. Lance and Michael discuss the frequency of Mexican Food, our up coming 2025 Economic Summit, and what...

Read More »

Read More »

Economic Upheaval: How Reducing Government Size Can Lead to Recession

Clear communication is key! While reducing government size may cause short-term disruption, it's crucial for long-term benefits. Let's navigate through the economic changes together. ? #Government #Economy #Communication

Watch the entire show here: https://cstu.io/25b549

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Long-Term Investing: Focusing on Building Returns Over Time

Focus on what truly matters when trading - the rate of return. Don't let external factors like elections and debt affect your emotions. Trade wisely! ?? #TradingTips #Investing101

Watch the entire show here: https://cstu.io/2d8a35

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

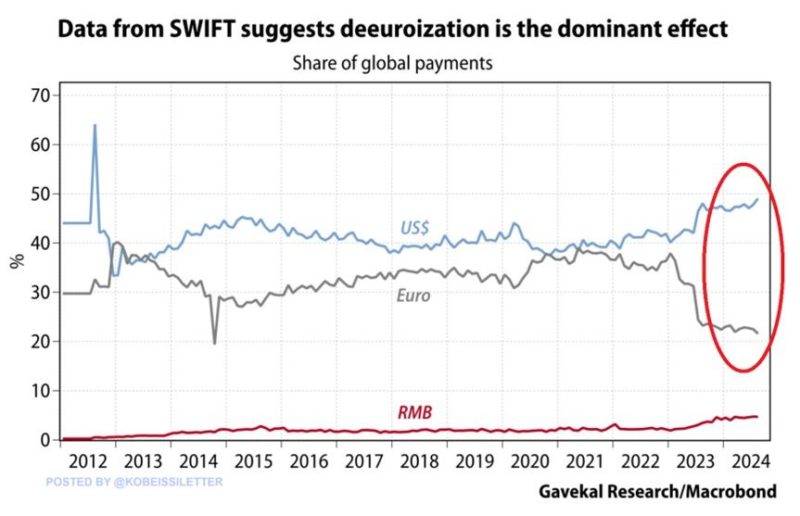

De-dollarization Or Re-dollarization?

Some gold and Bitcoin bugs claim the U.S. dollar is being inflated away and that our politicians and the Fed are abusing its status as the world's reserve currency. While the narrative may sound logical, the fact of the matter is that the opposite is occurring. Despite growing de-dollarization narratives in traditional and social media, …

Read More »

Read More »

Why Is Gold Surging?

Record deficit spending, soaring money supply, and inflation are among the likely responses we would hear from investors to the question of why gold is surging. Instead of presuming those or other market narratives about gold prices are correct, let's analyze historical correlations between gold and economic and market data. In addition to helping you …

Read More »

Read More »

11-6-24 Trump Wins!

The 2024 Election outcome is sharply affecting pre-market, with Donald Trump's election sending stocks higher. The S&P trendline is aiming for the 6000 or 6100 level. The question that remains is whether markets can sustain that trend. This time is different from the previous Trump win: Interest rates are falling and tax rates are lower now; yet, there are still plenty of questions for investors: what will Trump's tax policy be? What will be...

Read More »

Read More »

Why Is Gold Surging?

Record deficit spending, soaring money supply, and inflation are among the likely responses we would hear from investors to the question of why gold is surging. Instead of presuming those or other market narratives about gold prices are correct, let’s analyze historical correlations between gold and economic and market data.

In addition to helping you better appreciate why gold is surging, our analysis will help you recognize that market...

Read More »

Read More »

Achieving 6% Returns with Simple Portfolio Math and Easy Gains

Learn how to strategically build a portfolio for success! ?? #InvestingTips #FinancialFreedom #EasyMath

Watch the entire show here: https://cstu.io/2f49c9

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Residential Construction Jobs At Risk

The number of residential construction workers has almost doubled since the aftermath of the financial crisis and housing bust. The graph below on the left shows that after a brief hiccup during the early days of the pandemic, the number of jobs in residential construction continued to rise despite higher interest rates. Moreover, the job …

Read More »

Read More »

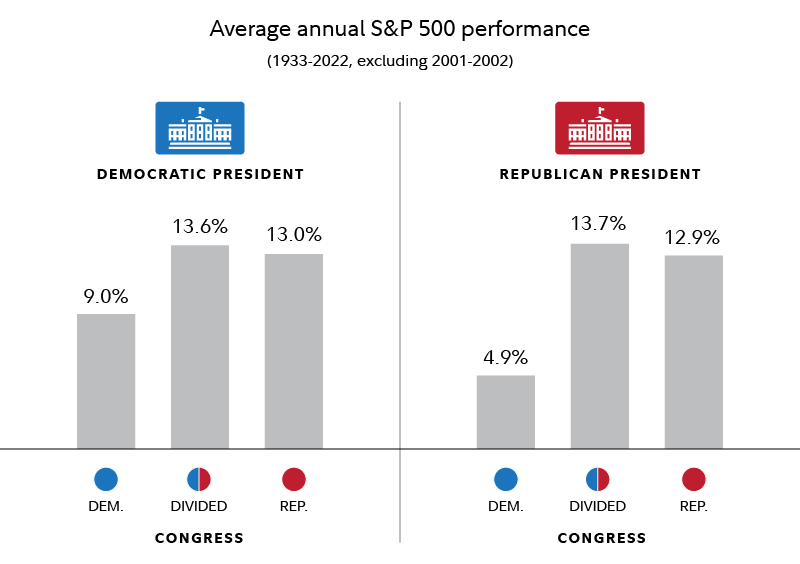

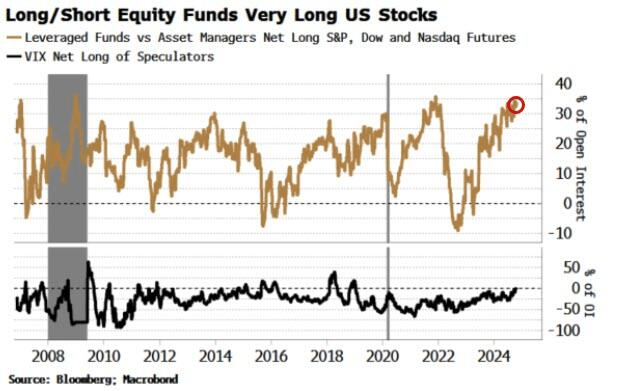

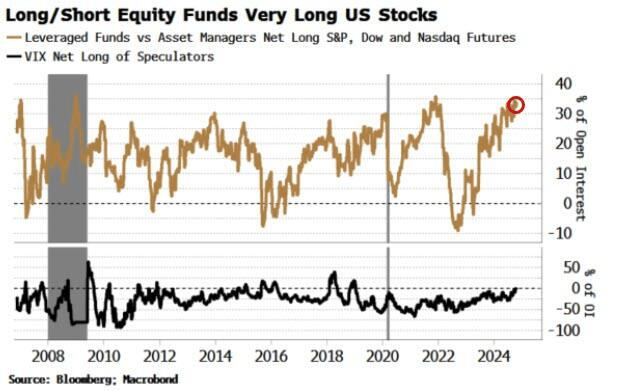

Election Day! Plan For Volatility

With Election Day finally here, markets are bracing for potential volatility. History shows that the stock market can react unpredictably to election outcomes, especially when the results are unclear or contested. In past elections, sudden policy shifts, political uncertainty, or contentious outcomes caused heightened volatility—making it essential to prepare your portfolio now to weather whatever …

Read More »

Read More »

11-5-24 Election Day! Plan For Volatility

Will the 2025 Election be The Most Important Election Ever? Yes...until 2028. Vote for the policy, not the personality: Child Care Credits case study. Markest are hangin' on ahead of the election, setting up for a post-election rally.Bond yields are the result of pre-election positioning; bond auction is next week. It's hard to buy when it's unpopular. Why are Small Caps having a hard time: They're not growing earnings. Most sensitive to difficult...

Read More »

Read More »

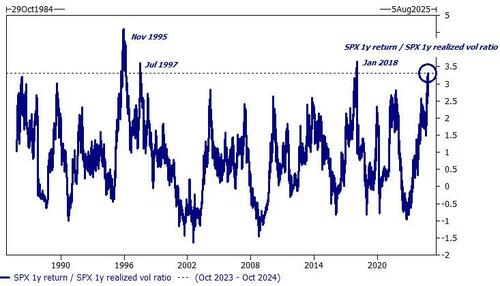

Election Day! Plan For Volatility

With Election Day finally here, markets are bracing for potential volatility. History shows that the stock market can react unpredictably to election outcomes, especially when the results are unclear or contested. In past elections, sudden policy shifts, political uncertainty, or contentious outcomes caused heightened volatility—making it essential to prepare your portfolio now to weather whatever the day brings.

The S&P 500 has averaged a...

Read More »

Read More »

Assessing Investment Risks: How to Protect Your Money When Things Go Wrong

?? Don't speed through investments! Just like driving fast, taking too much risk can lead to trouble. Remember, it's about minimizing losses! #InvestWisely ?

Watch the entire show here: https://cstu.io/d6282c

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Market Polls To Help Handicap The Election

With election eve upon us, we thought it would be helpful to share market based presidential election polls along with Greg Valliere's final thoughts. The graph on the top left shows the price of Trump Media & Technology Group (DJT), which runs Truth Social Media. Truth will be a clear beneficiary if Trump wins and …

Read More »

Read More »

11-4-24 The Presidential Election Cometh

It's 2024 Election-eve: Hedge funds are long on a presumed outcome; watch for a pick up in volatility. The Fed meets on the day after the election; there are still about 100 S&P Companies left to report. Reference Lance's weekend article on buy backs, Wolf in Sheep's Clothing: Apple spent $100-B on stock buy backs, when they could have purchased Intel for $99-B and produced their own chips. But, no. investors should do nothing on this day...

Read More »

Read More »