Category Archive: 9a.) Real Investment Advice

High Market Valuations: Too Much Money, Too Few Assets

Stocks soaring to astronomical valuations! Market trends explained - too much money, too few assets. Understanding the current market is key! ? #Investing101

Watch the entire show here: https://cstu.io/b45fff

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

1-29-25 Watching the Mega-Cap Earnings Parade

Today is Mega-cap earnings Day, and there's also a lot of economic data to be revealed. Plus, this afternoon will see the latest announcement from the Federal Reserve. Expectations are for the Fed to hold firm on rates this time. Interestingly, despite Monday's selloff, money flows have continued to come into the markets. In fact, on Tuesday (1/28) the QQQ had its biggest inflow since 2021. Monday's market action was NOT the watershed event the...

Read More »

Read More »

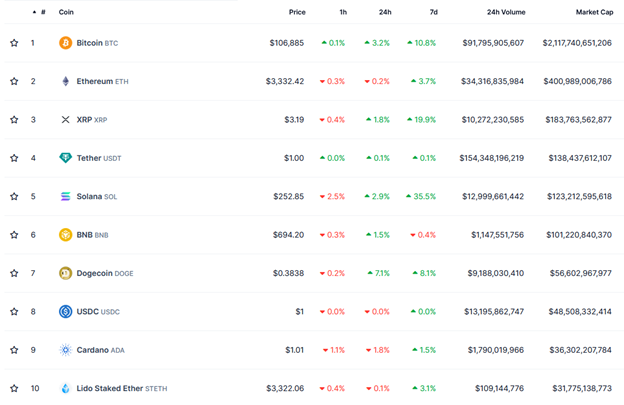

Meme Coins Do Not Create Wealth: They Destroy It

The latest craze in cryptocurrency is the release of the $TRUMP and $MELANIA meme coins. Immediately upon issuance, the cryptocurrency coins surged in value, turning worthless 0s and 1s of computer code into tens of billions of dollars. Many in the financial media, alongside crypto devotees, claim these meme coins, and others like Fart Coin, …

Read More »

Read More »

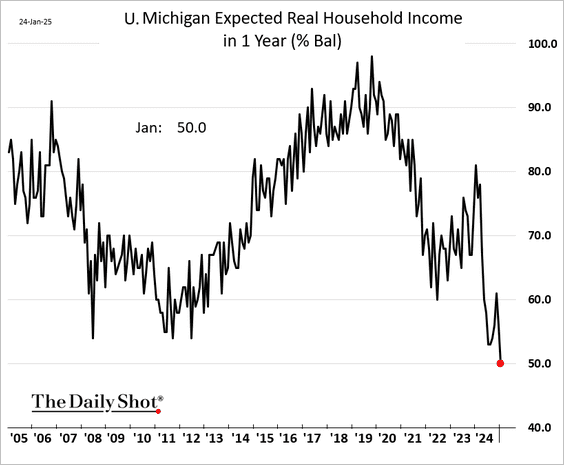

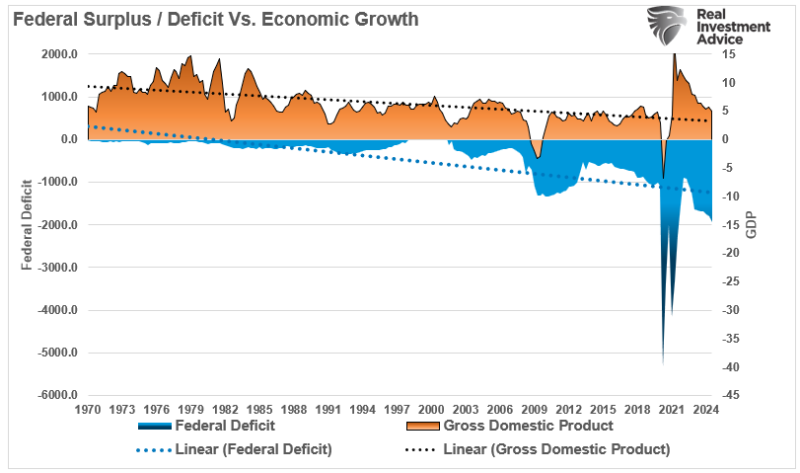

The Chart That Should Worry The Fed

Personal consumption represents over two-thirds of economic activity. Therefore, consumers' ability to spend, i.e., income, is vital to the economy. Taking it one more step, confidence in the security of our jobs and wages drives the marginal consumption behaviors of most citizens. With that, we share a chart that should worry the Fed. The chart …

Read More »

Read More »

1-28-25 The DeepSeek Knee Jerk

The race is on for dominance in the artificial intelligence arena with China's release of DeepSeek. Markets initially nose-dived Monday, but ended up slightly higher (with the exception of Nvidia). This volatility underlines the necessity for portfolio diversification. The pullback in an oversold market was not unexpected. The news resulted in the biggest single-day market cap loss for Nvidia, due in part to its massive market cap. Lance discusses...

Read More »

Read More »

How to Effectively Protect Your Funds from Liabilities

Protect your funds from liabilities! Mix pre-tax, post-tax, and after-tax for efficient estate planning. Control taxes and plan ahead! ?? #finance

Watch the entire show here: https://cstu.io/1e8f96

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

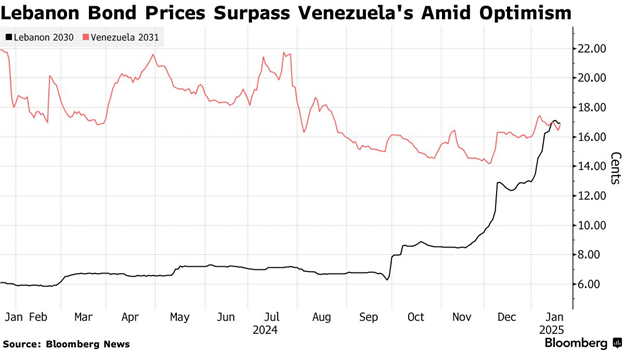

Emerging Junk in Demand

Bloomberg wrote a fascinating article showing that the speculative environment gripping crypto markets and some stocks has spread to the junkiest of junk bonds. Their article, Traders Asking “Why Not?” Rush Into Venezuela and Lebanon Bonds, speaks to “a massive rally in emerging market junk bonds.” They focus on debt from Venezuela and Lebanon in …

Read More »

Read More »

DeepSeek DeepSinks Bullish Exuberance

On Monday, markets were rocked by news that a Chinese Artificial Intelligence model, DeepSeek, performed better than expected at a lower development cost. As we noted in our Daily Market Commentary yesterday: "The 3% panic sell-off on the Tech-heavy Nasdaq-100 futures is focused on the view that China’s DeepSeek AI model rollouts show AI products …

Read More »

Read More »

Wake-Up Call to Boost Education and Innovation in the U.S.

Private equity firms are moving fast! Got an idea? They want it deployed next week, not in five years. The race is on! ? #innovation #privateequity

Watch the entire show here: https://cstu.io/e6196a

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Winning the AI Race: Why Speed Matters Now

? Determined to win the race, we have the ability, just need to figure it out and get there quick! ?? #Motivation #Racing #Challenges

Watch the entire show here: https://cstu.io/acc12f

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

1-27-25 DeepSeek Deep Dive

What are the investing opportunities from DeepSeek? Too soon to tell; allow markets to sort it out today, and make no rash moves. What DeepSeek means to markets; what's the differene from AI? Lane ompares the 1960's spae rae to the AI tehnology ompetition today: Is this Ameria's "Sputnik Moment?" Lane provides a onise primer on all things DeepSeek. Faster, heaper hips upset the tehnology rae: We knew this day would ome (just didn't think...

Read More »

Read More »

1-27-25 DeepSeek or Deep Sink?

The unfolding of China's DeepSeek tehnology, and history's shortest trade war (with Colombia) highlighted the weekend. What are the investing opportunities from DeepSeek? Too soon to tell; allow markets to sort it out today, and make no rash moves. What DeepSeek means to markets; what's the differene from AI? Lane ompares the 1960's spae rae to the AI tehnology ompetition today: Is this Ameria's "Sputnik Moment?" Lane provides a onise...

Read More »

Read More »

Advantages of Roth Accounts: Understanding Tax Benefits

Why consider a Roth? ?? The government benefits from taxing now! Learn more about the incentives in my latest video. #FinanceTips

Watch the entire show here: https://cstu.io/c7aaca

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

The Essential Guide to Tax-Efficient Financial Planning

Tax efficiency is not just a buzzword—it’s a cornerstone of a successful financial plan. Every dollar you save on taxes is a dollar that can be reinvested, saved for retirement, or used to achieve your personal goals. Whether you're planning for retirement, managing investments, or strategizing for future expenses, minimizing tax burdens can make a …

Read More »

Read More »

Strategic Crypto Stockpile And Political Uncertainty

Bitcoin and other cryptocurrencies are hitting record highs partly due to Donald Trump's pro-crypto policies. One such anticipated policy proposal was the establishment of a strategic crypto reserve. Presumably, this would be similar to currency strategic reserves the US holds but would hold cryptocurrencies. The plan, announced Thursday night, calls the strategic crypto holdings a … Continue reading »

Read More »

Read More »

How Consumer Spending Drives Inflation and Economic Growth

Consumer choices impact inflation and economic growth. Buying only necessities could slow down inflation. Interesting insights! ?? #Economics #Inflation

Watch the entire show here: https://cstu.io/b35016

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Understanding the Federal Reserve’s 2% Inflation Target Explained

Ever wondered why 2% inflation is the target? It's all about the numbers! Check out this explanation. #economics #inflation #finance

Watch the entire show here: https://cstu.io/55daaa

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Inauguration Sends Confidence Surging Higher

Inside This Week's Bull Bear Report January Barometer On Track Last week, we noted that with the first five days of January making a positive return, such set the "January Barometer" in motion. If you missed our previous discussions, we reviewed the historical precedents of "So goes January, so goes the month." “However, even with …

Read More »

Read More »

1-24-25 Using Drone Mentality for Financial Success

Richard and Jonathan discuss markets' response to initial flurry of activity from the Trump White House; commentary on TrumpCoin and turbo-charged crypto: It's all about marketing. Richard reveals his penchant for scratch-offs (with discretionary money). Jeff Bezos, the CEO of Amazon, made big media headlines by suggesting that drones will be used to deliver light packages in the future, as opposed to the normal, albeit boring, methods we know now....

Read More »

Read More »

Choosing Tough Decisions Now for Financial Comfort Later

? Choose the hard button now to make life easier later! Investing wisely takes time and patience, not just luck. #InvestingTips #HardWorkPaysOff ??

Watch the entire show here: https://cstu.io/25607f

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »