Category Archive: 9a.) Real Investment Advice

Consumers Are Losing Confidence

Consumer Confidence, as surveyed by the Conference Board and University of Michigan, shows consumers are starting to lose economic confidence. Given that consumer spending drives the economy and influences inflation, confidence and the means to spend can significantly impact markets. Based on recent job data, the means (i.e., wages) to consume appear to be in …

Read More »

Read More »

Retirement Savings Tips: Balancing Roth and Traditional Accounts for a Secure Future

? Planning for retirement? Remember, it's YOUR money first! Enjoy your lifestyle while securing your future. Diversify your savings for a stable retirement! ??️ #RetirementPlanning #FinancialTips

Watch the entire show here: https://cstu.io/1c9b19

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

2-26-25 How to Avoid an Inheritance Nightmare

Planning ahead has never been so vital to preserving your estate and hat happens to it after you're gone. Lance and Danny tackle the in's and out's of inheritance planning, and examine returning legislation to cut the estate tax in half and loer gift taxes. They'll expose Inheritance planning mistakes, provide important Estate planning tips that can help you avoid family inheritance disputes; plus, Wills and trusts guidance and financial legacy...

Read More »

Read More »

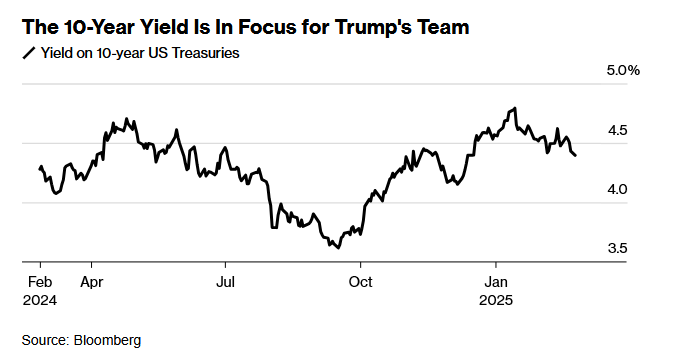

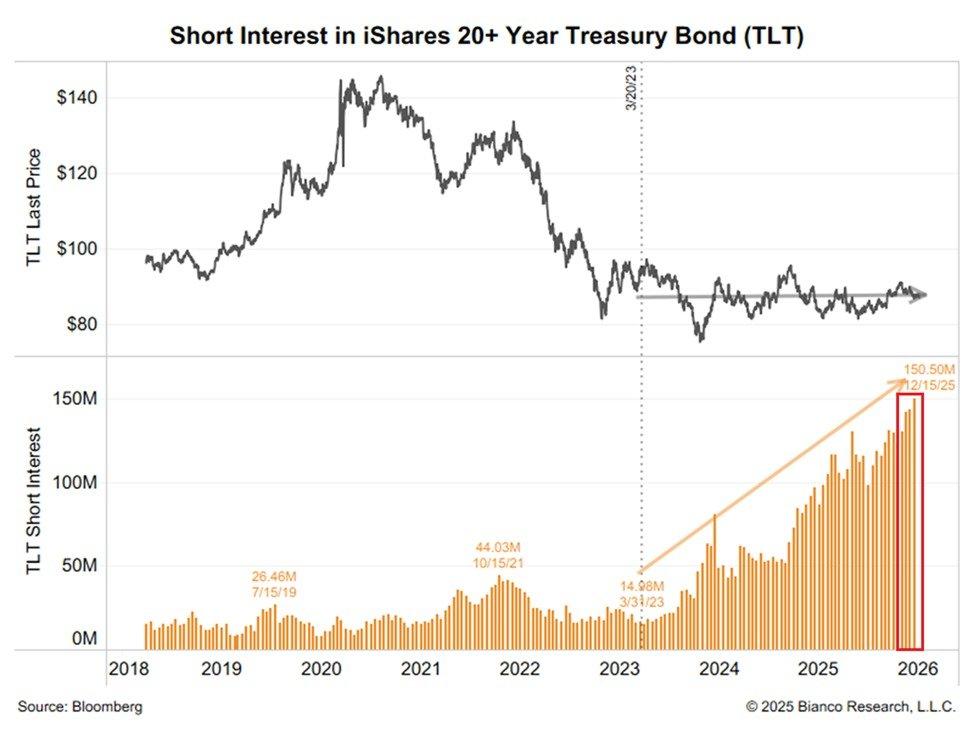

The Trump 2.0 Put: Got Bonds?

During Donald Trump's first term, some investors bought into the Trump 1.0 Put. The trade was based on the market's belief that Trump believed the stock market's performance was a referendum on his presidency. Accordingly, investors thought that Trump would do everything he could to backstop the stock market if it fell. Thus, some investors …

Read More »

Read More »

Behavioral Economics: Managing Your Inner Voice

The combination of extremely rich equity valuations, high interest rates, and a new President taking bold actions will likely continue to whip stocks around for the foreseeable future. Alongside those volatility-provoking factors is that the S&P 500 just posted two annual twenty-plus percent gains in a row. Accordingly, seeing average or below-average returns this year …

Read More »

Read More »

Enhancing Your Portfolio: Why Patience with New Investments is Key

Patience is key with investments. Let them go through corrections and prove themselves. If they outperform S&P, they're portfolio-worthy. #InvestingTips

Watch the entire show here: https://cstu.io/91c0ef

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

2-25-25 Estimates By Analysts Have Gone Parabolic

The Chicago Fed's National Activity Index falls to -4.3: Looks like the data is catching up ith reality. Excess Savings Metric: Most are in no better financial shape than before the pandemic; implications to companies' earnings that the bottom 90% are beginning to struggle. Markets challenged the 50-DMA and failed on Monday; likely to be in a corrective phase for a hile. "If I ere President, the first thing I ould do..." Lance and...

Read More »

Read More »

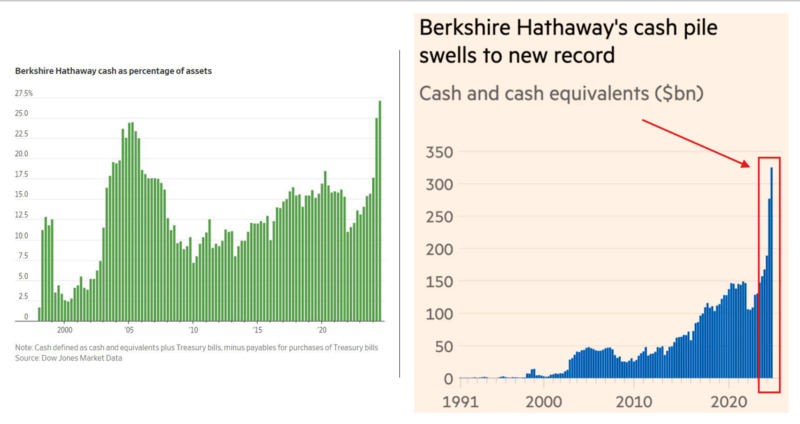

Cash At Buffett’s Berkshire Continues To Grow

In its annual letter to shareholders this past weekend, Warren Buffett's Berkshire Hathaway announced that it had increased its cash holdings to $334 billion. As the Financial Times chart on the right shows, Berkshire's cash balances have more than doubled over the last few quarters to its highest level. Additionally, cash as a percentage of …

Read More »

Read More »

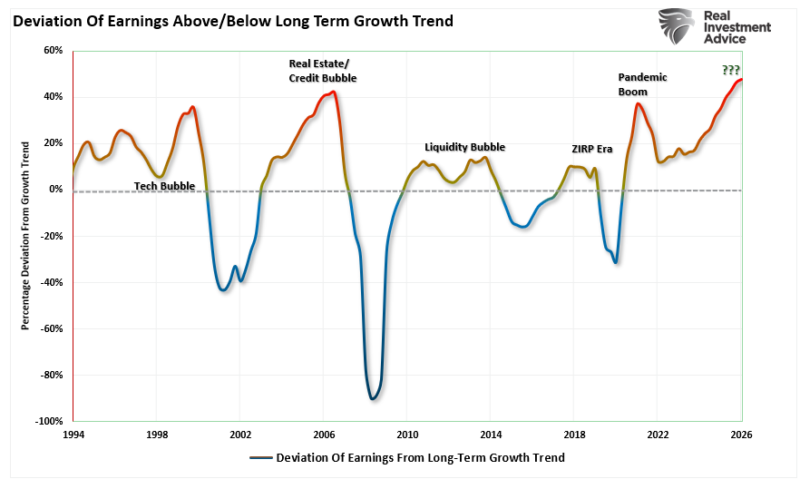

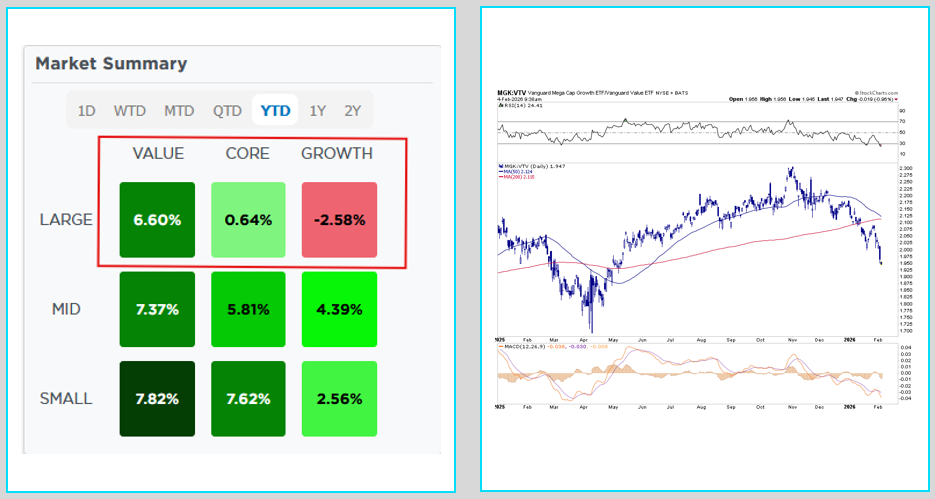

Estimates By Analysts Have Gone Parabolic

Just recently, S&P Global released its 2026 earnings estimates, which, for lack of a better word, have gone parabolic. Such should not be surprising given the ongoing exuberance on Wall Street. As noted last week, correlations between all asset classes, whether international or emerging markets, gold or bitcoin, have all gone to one. Unsurprisingly, rationalizations …

Read More »

Read More »

Liquidity and Diversification in High Net Worth Investment Portfolios

Diversify your investment portfolio wisely! High net worth individuals allocate only 15-20% to alternatives. Liquidity matters! ?? #InvestingTips

Watch the entire show here: https://cstu.io/fc3507

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

2-24-25 New Coronavirus Discovery Shakes Markets

Lance has come up with a new business model for a Help Desk subscription service. It works on anything. The problem with margin debt; there's no appetite for IPO's. What Wall st. is doing instead. market sell off on Friday more the result of volatility around options expiration than Wuhan Lab news of the second coming of Covid. Don't expect any reflex rally today to hold. Economic indicators continue to hint at weaknesses; be aware of the content...

Read More »

Read More »

Government Job Cuts May Be The Tip Of The Iceberg

The coming unprecedented government job cuts will undoubtedly impact the job market. Given the labor market's importance to Fed policy and the economy, it's worth fully appreciating the size of the government workforce and other employees whose jobs might be affected. The following graph, courtesy of John Burns Research & Consulting, shows that 3.8 million …

Read More »

Read More »

How to Incorporate Real Estate Investments Into Your Retirement Portfolio

Real estate has long been considered a valuable investment option due to its potential for steady income, appreciation, and diversification benefits. For individuals planning for retirement, incorporating real estate retirement investments into a financial strategy can enhance income streams, hedge against inflation, and provide long-term stability. However, like any investment, it comes with risks and …

Read More »

Read More »

Understanding Your Investments: Importance of Knowing What You Own

Know what you own! ? Don't invest blindly based on recommendations. Take control of your portfolio and make informed decisions. #investingtips

Watch the entire show here: https://cstu.io/a995e1

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Understanding Portfolio Sizing for Risk Management in Investments

Regular portfolio check-ins are crucial! Evaluate sizing and impact of each position to avoid trouble. #investingtips #financialplanning

Watch the entire show here: https://cstu.io/1f237a

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Margin Balances Suggests Risks Are Building

Inside This Week's Bull Bear Report New Coronavirus Discovery Shakes Markets Last week, we discussed that continued bullish exuberance and high levels of complacency can quickly turn into volatility. As we noted then, introducing an unexpected, exogenous event can soon lead to a price decline if investors begin to reprice forward expectations. On Friday, that …

Read More »

Read More »

2-21-25 When Bears Come Out Of Hibernation – Hour-2

Richard & Jonathan are covering the 7am CST hour for the host of our terrestrial Radio partner; think of it as a bonus show: arkets aren't Red or Blue, per elections, but Green; learning from mistakes we made curing COVID; deflation and price consciousness; why tariffs will not be inflationary;; consumers will make product substitutions. Why Social Security has become the defactor pension; notes from William Shatner's "Wrath of Khan"...

Read More »

Read More »

2-21-25 When Bears Come Out Of Hibernation

Richard & Jonathan discuss market activity for the week; the price of admission that investors must pay. Consumers (and companies) do not have a lot of pricing power. The European Conundrum: What happens when the US drops Ukraine support? Tariff talk & pressure on small cap companies; why we don't have to be invested in every asset class (where diversification really came from). Dad pants, Build-a-Bear, leanring to give up some stocks, and...

Read More »

Read More »

The Impact of Ignoring PE Ratios and Valuations in Today’s Market

Understanding PE ratios made simple! It's the price you pay vs. earnings per share. For example, a PE ratio of 10 means paying $10 for $1 in earnings! ? #Investing101

Watch the entire show here: https://cstu.io/ab7a6b

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

Alien Technology: Are ETFs Getting Too Creative?

The ETF industry has undoubtedly gotten creative over the last few years. However, nothing tops the latest ETF proposed by Tuttle Capital. Per its SEC registration, the Tuttle Capital UFO Disclosure AI Powered ETF (UFOD) will purportedly invest over 80% of the fund's assets in companies that they believe "have potential exposure to advanced or …

Read More »

Read More »