Category Archive: 9a.) Real Investment Advice

Investment Risk Is Underappreciated

🔎 At a Glance 🏛️ Market Brief - The "Greenland" Impact This week's markets were driven by headline risk, economic uncertainty, and the early innings of earnings season. With the markets closed last Monday for the Martin Luther King holiday, U.S. equities sold off sharply on Tuesday. President Trump’s tariff threats against key European allies, …

Read More »

Read More »

1-23-26 The Hardest Part of Legacy Planning – Starting the Conversation

Most people think the hardest part of legacy planning is legal documents, estate taxes, or complex strategies. In reality, the most difficult part is much simpler—and more uncomfortable: starting the conversation.

Richard Rosso and Jonathan McCarty discuss why these conversations are so difficult, why avoiding them creates greater risk for families...and offer a starting point solution.

0:00 INTRO

0:19 - Punxsutawny Ted Cruz & Texas Winters...

Read More »

Read More »

1-26-26 Bitcoin: Diversifier or Distraction – The Parker White Interview

Bitcoin and cryptocurrencies are once again at the center of investor debate—but for very different reasons than past cycles. Lance Roberts and special guest, DeFi Development Corp's COO, Parker White, examine what’s been happening beneath the surface of the crypto market, including the growing divide between older and younger Bitcoin cohorts and the increasing fractionalization of crypto ownership.

Is Bitcoin’s volatility evolving in a way that...

Read More »

Read More »

1-23-26 Why Strong Growth Could Force the Fed to Pause or Even Hike

Everyone expects strong economic growth, falling inflation, and endless Fed cuts.

In this short video, Lance Roberts & Michael Lebowitz discuss why that combo is far from guaranteed—and how a pause (or even hike) could hit valuations fast.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

The South Park Market Of 2026

I have been a "South Park" fan for as long as I can remember, and while the show isn't a market guidebook, its brutal satire cuts through nonsense better than many Wall Street commentaries. Just like on the show, characters make absurd decisions and face absurd consequences, which is familiar to investors today. For example, … Continue...

Read More »

Read More »

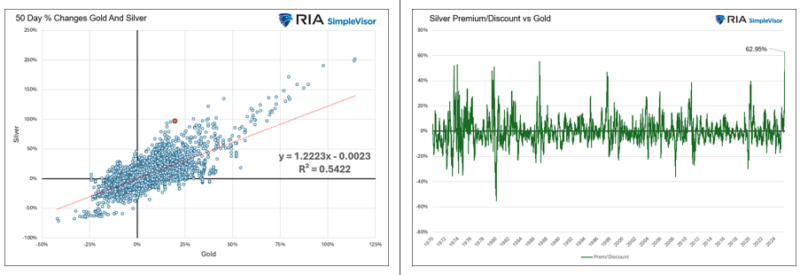

Silver Math: Gold Warns Of Silver Correction

Over the last few months, we have questioned the dollar debasement narrative. However, in this commentary, we suspend our views and assume that debasement is real and, further, that it fully explains why gold and silver are rising rapidly. The goal of this exercise is to use gold returns and math to find a fair … Continue...

Read More »

Read More »

1-22-26 Stop Letting Headlines Blow Up Your Portfolio

Headlines don’t move markets—real buying and selling do.

In this short video, Lance Roberts & Michael Lebowitz I discuss why media narratives are often just after-the-fact explanations that ignore actual facts, like strong Treasury auctions and foreign buying, and why focusing on market structure and demand matters more than reacting to the news.

📺Full episode:

Catch me daily on The Real Investment Show:...

Read More »

Read More »

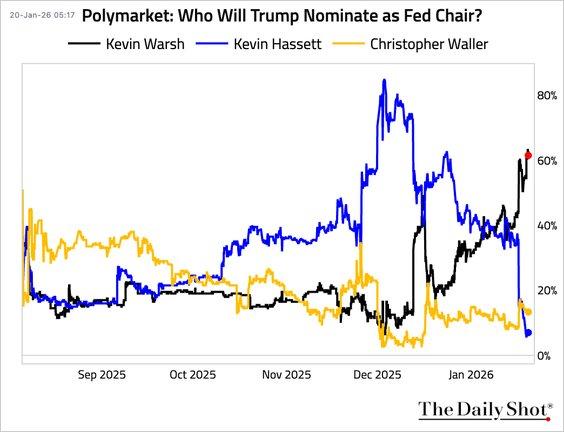

1-22-26 What Kevin Warsh Brings to the Fed

Betting markets are increasingly pointing to Kevin Warsh as a potential successor to Jerome Powell, with Kevin Hassett expected to remain in his White House role under Donald Trump. Which begs the question: What would a Warsh-led Federal Reserve actually bring to markets?

Lance Roberts & Michael Lebowitz explore the possibilities of a Warsh Fed: Would such likely be more tolerant of volatility, rely less on emergency interventions, and place...

Read More »

Read More »

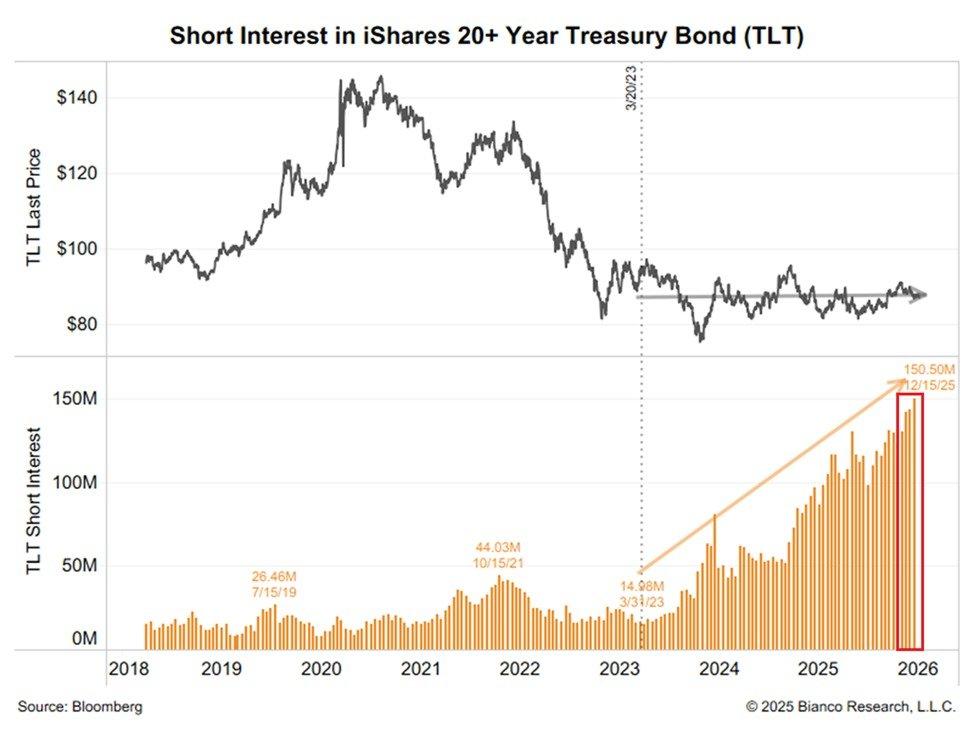

Akademiker Pension Serves The US A Warning

A Danish pension fund, Akademiker Pension, which manages roughly $25 billion in retirement assets for teachers, announced that it plans to sell all of its U.S. Treasury holdings by the end of January.

Read More »

Read More »

What Does Kevin Warsh Bring To The Fed?

It appears that President Trump wants Kevin Hassett to remain in his role at the White House. With the supposed frontrunner to replace Powell out of the running, the nomination now seems open to Kevin Warsh. As the graph below shows, Polymarket bettors are assigning 60% odds that Kevin Warsh will be nominated.

Read More »

Read More »

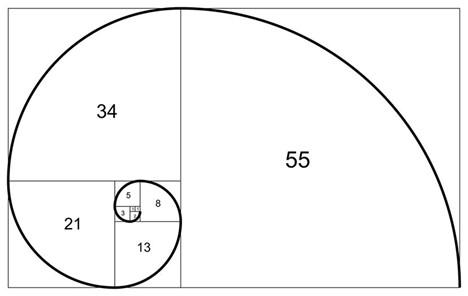

Fibonacci In Mona Lisa And Markets

Did you know there is a kind of technical analysis that shares structural similarities with hurricanes, nautilus shells, sunflowers, music, and human dimensions? These examples, along with countless others, follow proportions related to the sequence of numbers: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89...

Read More »

Read More »

1-20-26 Tariff Headlines = Another Buying Opportunity?

Tariff headlines over Greenland are creating noise, not new risk.

In this Short video, Lance Roberts explains why past tariff threats didn’t derail earnings or inflation, why this pullback looks normal, and how markets often turn headline panic into buying opportunities.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

1-20-26 Is a House Still a Good Investment in 2026?

Is buying a house still a good investment—or has the market pulled too much future return forward? Lance Roberts & Jonathan Penn break down the housing investment debate through a time-horizon lens, comparing housing to stocks, examining historical “win rates,” and explaining why transaction costs, leverage, and holding period matter far more in real estate than most buyers realize.

0:00 INTRO

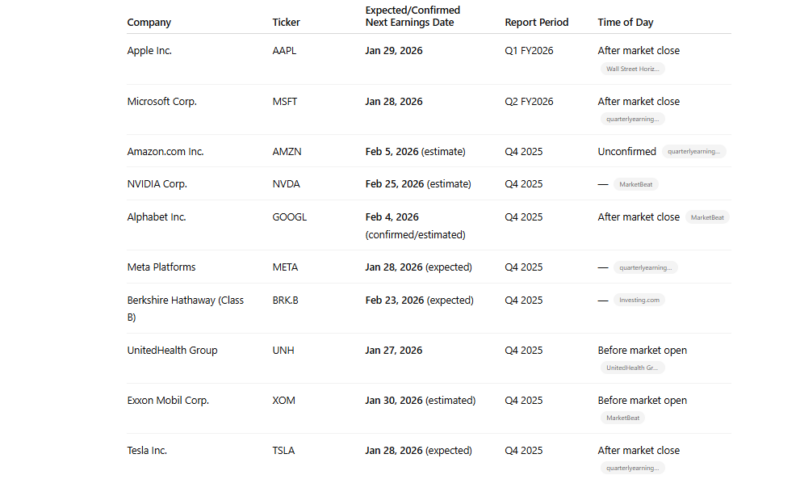

0:19 - Moving into the Heart of Earnings Season...

Read More »

Read More »

The Money Supply Myth: Context Matters

Supporting the dollar-debasement narrative is the claim that money supply growth is out of control. For instance, we saw a post claiming “US money creation is happening at an alarming pace.” Specifically, he says the money supply increased by $1.65 trillion in 2025. Quoting the money supply, as he does, in absolute dollar terms is …

Read More »

Read More »

1-19-26 The Illusion of Economic Acceleration: What’s Really Driving Markets

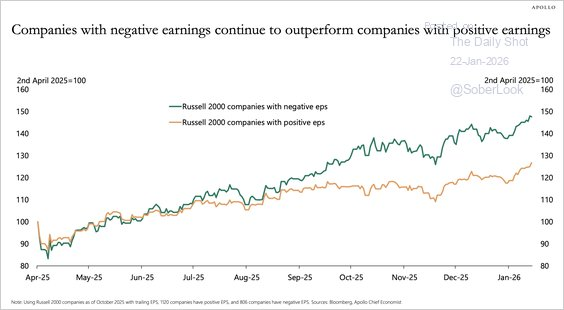

The economic acceleration story doesn’t hold up when you look at the data.

In this Short video, Michael Green and I discuss why GDP trends look unchanged, earnings quality is weakening, small-cap profits are negative, and passive flows—not growth—are driving markets.

📺Full episode: -GazpbG0

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

1-17-26 Why Position Size Matters More Than Stock Picks

Position sizing, not stock picking, is what determines long-term investing success.

In this Short video, Lance Roberts explains why oversized positions create hidden risk, how greed compounds losses, and why managing exposure is essential for compounding wealth over time.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

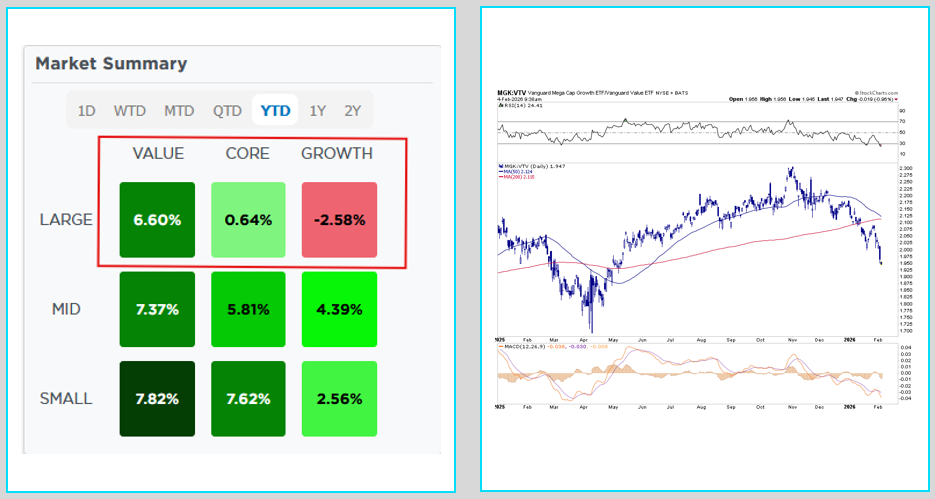

Rotation Continues As Markets Remain Bullish

Sector rotation is this weekend's 2026 Investment Summit. I am presenting at the conference as you are reading this. However, I would be remiss not to share a brief market update as we head into next week. The full newsletter will return next week. That said, U.S. equity markets delivered mixed performance last week. Major …

Read More »

Read More »

1-16-26 Why Silver Might Be the Next Micro-Bubble

$SLV recent surge looks more like a narrative-fueled micro-bubble than a durable macro trend.

In this Short video, Michael Lebowitz and I discuss why key cross-asset signals fail to confirm dollar debasement and what that means for #silver risk ahead.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

1-16-26 Social Security Reform: Expansion or Cuts?

Congress is debating major changes to Social Security—and the outcome could mean benefit expansion or future cuts. With trust fund shortfalls projected by 2033, lawmakers have introduced a wave of bills aimed at increasing benefits, changing cost-of-living calculations, and redefining how and when Americans claim Social Security.

Richard Rosso breaks down the key Social Security reform proposals currently circulating in Congress, what they would...

Read More »

Read More »

A Weak Yen, The BOJ, And The Carry Trade

Bank of Japan (BOJ) officials are increasingly discussing the weak yen as a source of inflation. Their concern is that prolonged yen weakness raises import costs and encourages businesses to pass those costs on to consumers. Bear in mind that […] The post A Weak Yen, The BOJ, And The Carry Trade appeared first on … Continue reading...

Read More »

Read More »