Category Archive: 9a.) Real Investment Advice

Deficits And The Tradeoffs Required To Fix Them

By falling significantly short of its intended savings goals, the DOGE program underscores the substantial challenges that hinder efforts to reduce federal spending and cut the deficit. Furthermore, its failure suggests that a more expedient way to reduce the deficit might be to increase federal revenue. Thus, we pose the simple hypothetical question: What if …

Read More »

Read More »

6-10-25 Private Equity is Coming for Your Money

Lance Roberts & Jonathan Penn uncover how private equity investments are no longer just for the ultra-wealthy...but is that the best plan? With Wall Street's latest push, retail investors are now being targeted as the next frontier for capital. From alternative investments in 2025 to the growing trend of private equity entering 401(k) plans, we break down what you need to know about the risks of private equity, the lack of transparency compared...

Read More »

Read More »

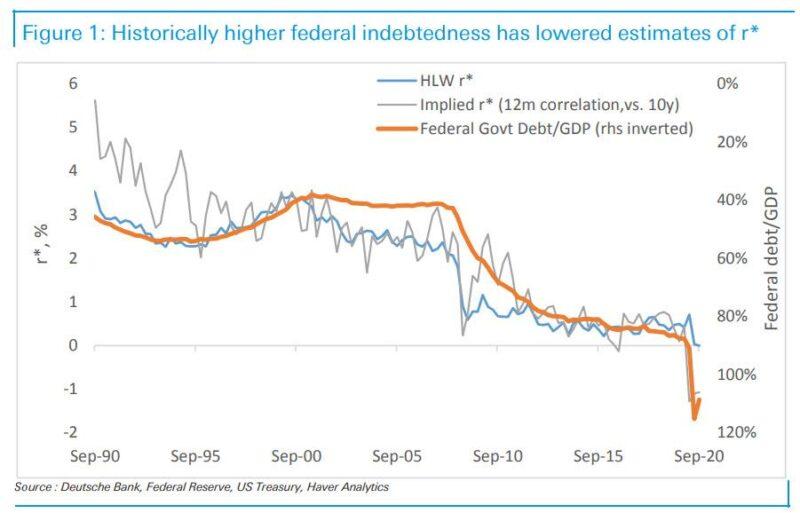

The Economy Is The Real Deficit Problem

The deficit fearmongers are out in full force, warning that massive debt payments will further exacerbate the deficit and ultimately bankrupt the country. While we agree that steadily increasing deficits are a significant problem, we believe it's not for the reasons most people give. To that end, a recent Tweet by George Gammon succinctly makes …

Read More »

Read More »

Top 5 Mistakes High Net Worth Individuals Make Without a Financial Plan

When you’ve worked hard to build wealth, protecting it becomes just as important as growing it. However, even high net worth individuals (HNWIs) often fall into avoidable traps, especially when navigating wealth without a formal financial plan. Without a clear strategy, even sophisticated investors may overlook important details, leading to costly consequences over time. In …

Read More »

Read More »

6-9-25 Buying the Dip is Not an Easy Thing

The time when you are most fearful of buying into the market is exactly when you should; it's counter-intuitive: We look at all the bearish sentiment, and add our own bias, and talk ourselves out of it.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on...

Read More »

Read More »

6-9-25 How to Buy the Dip–Technically Speaking

Are you waiting for the perfect moment to "buy the dip" but unsure how to spot it?

Lance Roberts reveals how to identify smart entry points using technical analysis. From recognizing key support levels and reversal patterns, to understanding what oversold indicators are really telling you, we’ll walk you through the tools, charts, and signals that professional investors rely on.

Whether you're a seasoned trader or a long-term investor...

Read More »

Read More »

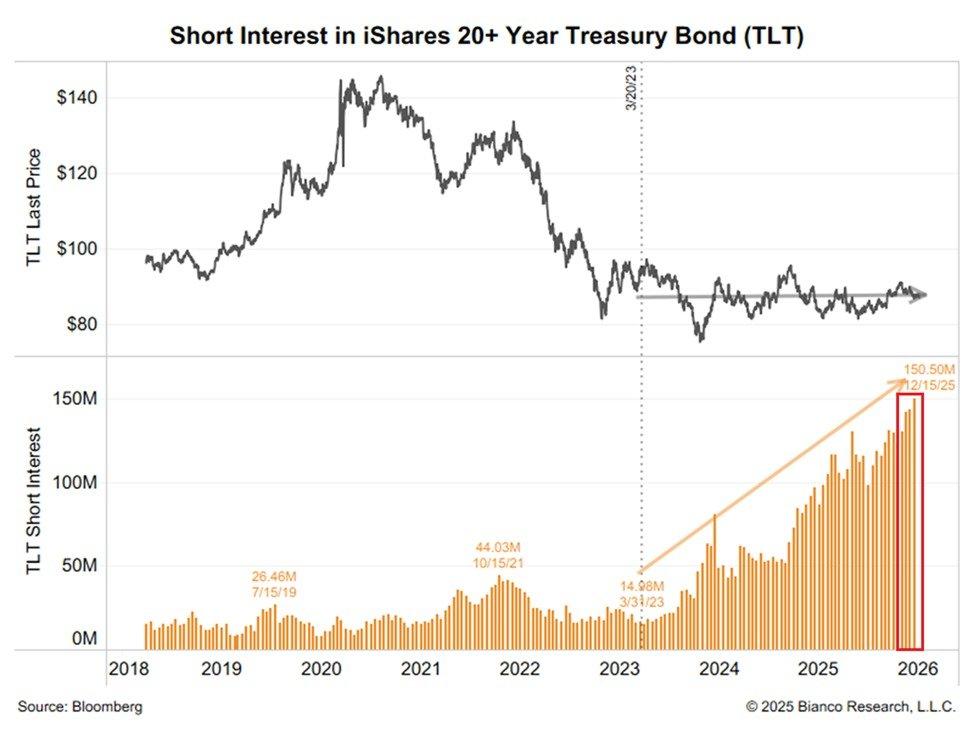

Bond Yield Chasing: Tomorrow’s Narrative?

Numerous bond narratives are driving long-term bond yields higher. “Crippling deficits” and a tariff-induced inflation sit at the top the list. We have repeatedly poked holes in these narratives. Instead of dwelling further on them, let's consider what tomorrow's narratives might be. When the bond market changes direction and yields fall, the two narratives we …

Read More »

Read More »

“Buying The Dip” – Here’s A Technical Way To Do It

Recently, I did an interview about "buying the dip" in the market, which generated many comments. Most were, "You're stupid; the market is going to crash," but one comment deserved a more thorough discussion. "When buying the dip, how do you know when to do it, or not?" That is the right question. Of course, you will never know … Continue...

Read More »

Read More »

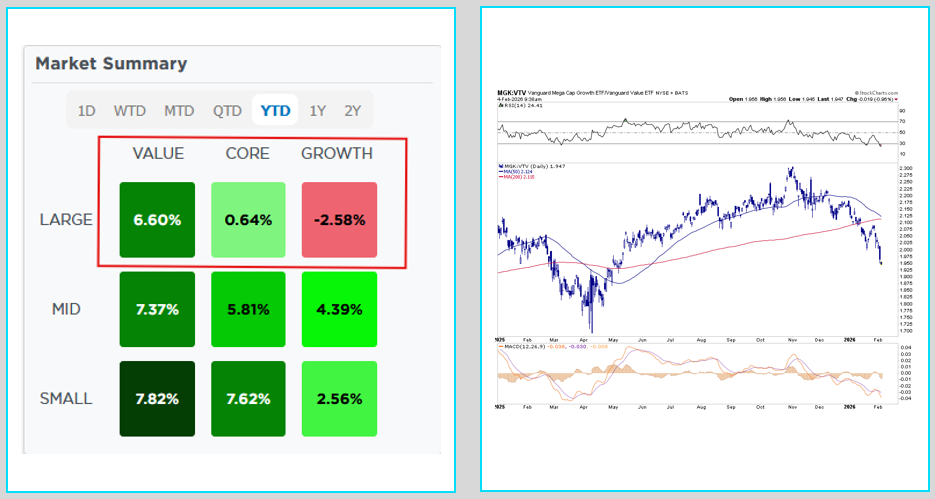

Stock Market Performance As Summer Arrives

Inside This Week's Bull Bear Report Breakout! Next Stop, Previous Highs Last week, we discussed the successful test of the 200-DMA. "Most notably, this past week was the successful test of the 200-DMA. The pullback to that previous broken resistance level and subsequent bounce highly suggests that the April correction is complete and that market …

Read More »

Read More »

6-6-25 What is the Next Catalyst to Move Markets?

There are always big, scary headlines for markets to digest...and they always absorb the data; the news has been priced-in. What we don't have presently is a catalyst.

Hosted by Director of Financial Planning, Richard Rosso, CFP

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on Apple Podcasts:...

Read More »

Read More »

6-6-25 Is 70 the New 65? Rethinking Retirement in America

Should the new retirement age be 70?

Richard Rosso explores the financial, social, and personal implications of delaying retirement. What does working longer mean for your retirement planning in 2025 and beyond? Is it a necessity—or a trap? Whether you're nearing retirement or decades away, understanding how changes to the retirement age could affect your benefits and financial independence is critical. Listen or watch to hear what raising the...

Read More »

Read More »

The Deficit Crisis Is Really A Recession Problem

The graph below provides a clearer understanding of the US fiscal deficit. First, focus on the red line below, graphing the ratio of federal debt to GDP. Note that it is at the same level today as it was in 2021. Similarly, before the pandemic, it had been relatively flat for seven years. This highlights … Continue reading...

Read More »

Read More »

Does Consumer Spending Drive Earnings Growth?

It would seem evident that most investors would understand that consumer spending drives economic growth, ultimately creating corporate earnings growth. Yet, despite this somewhat tautological statement, Wall Street appears to ignore this simple reality when forecasting forward earnings. As discussed recently, S&P Global's current estimates show earnings are growing far above the long-term exponential growth …

Read More »

Read More »

6-5-25 Focus on the Data that Drives the Markets

The markets don't care about your personal inflation problem; they care only about the numbers generated by the government (whether they're accurate or not); so as investors, forget your personal narrative an focus on what's driving the markets.

Hosted by Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:...

Read More »

Read More »

6-5-25 Fed Rate Cuts Do Not Equal Inflation

Are investors wrong to assume that rate cuts will automatically tame inflation?

Lance Roberts and Michael Lebowitz challenge the belief that the Fed’s rate cuts always translate into lower inflation. Using historical data and current economic conditions, we explore how monetary policy really interacts with price pressures—and why rate cuts may actually stoke inflation under the wrong conditions. Specifically, Lance and Mike address the real impact...

Read More »

Read More »

An ETF Like No Others: The Pudgy Penguin Project

The cryptocurrency sphere and that of traditional finance continue to merge in ways that were previously unthinkable. To wit, Canary Capital filed documentation with the SEC to start the first ETF backed by non-fungible digital tokens. Non-fungible tokens are digital assets representing ownership of a specific piece of content. Most often, they are backed by …

Read More »

Read More »

Comprehensive Financial Planning: What It Means for High Net Worth Families

For affluent families, financial success isn't solely about accumulating wealth; it's about preserving it across generations, optimizing tax strategies, and aligning financial decisions with personal values and long-term goals. Comprehensive financial planning offers a holistic approach, integrating various financial aspects to provide clarity, control, and confidence in one's financial journey. Understanding Comprehensive Financial Planning...

Read More »

Read More »

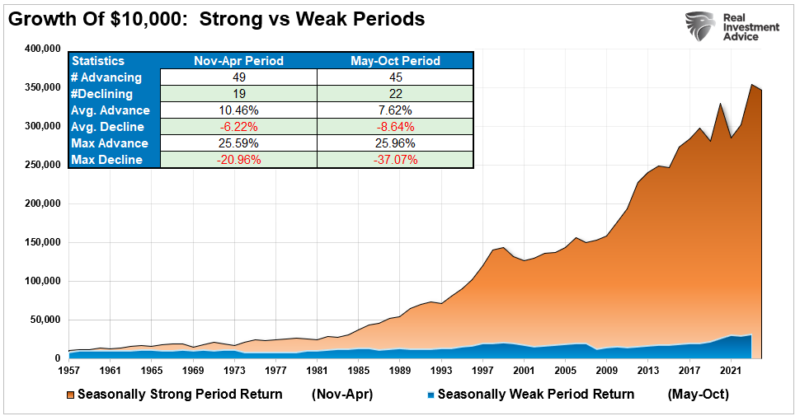

6-4-25 Be Careful of Market Maxims

"Sell in May and go away" is not necessarily good advice, because getting out of the market for the Summer could backfire, and the hard part is getting back into the market when it's time to do so.

Hosted by Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our Youtube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on Apple...

Read More »

Read More »

6-4-25 Will There Be a Summer Swoon?

Is a summer swoon looming in the stock market for 2025?

Lance Roberts & Danny Ratliff explore the historical performance of the S&P 500 and major sectors during the summer months—June through August, and examine whether investors should brace for a seasonal pullback, looking at historical June-to-August returns and volatility trends, what typically drives a summer slowdown in stocks, and sector-by-sector analysis: What holds up best in...

Read More »

Read More »

Sellers Outnumber Buyers In The Housing Market

The following commentary is from Redfin "There are 34% more sellers in the market than buyers. At no other point in records dating back to 2013 have sellers outnumbered buyers this much. In other words, it’s a buyer’s market. Redfin expects home prices to drop 1% by the end of the year as a result. … Continue reading...

Read More »

Read More »