Category Archive: 9a.) Real Investment Advice

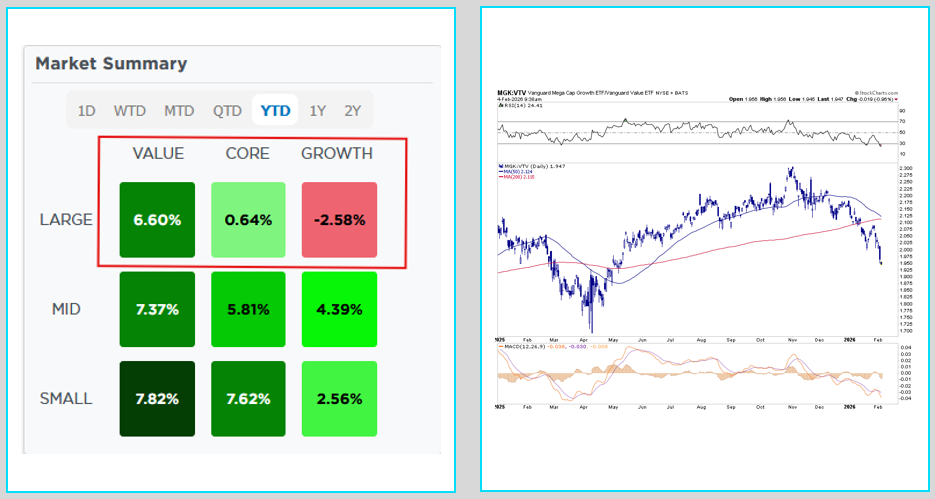

Bears Are An Endangered Species

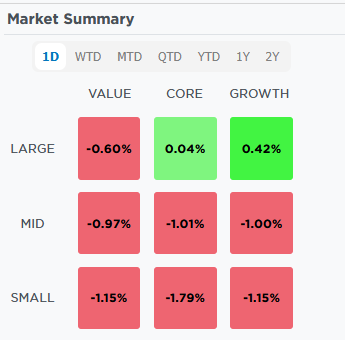

🔎 At a Glance 🏛️ Market Brief - Market Volatility Returns Markets ended the week mixed as investors processed the Federal Reserve’s latest policy decision, rising geopolitical tensions, and the early results of the S&P 500 earnings season. The Fed held the federal funds rate steady at 3.50–3.75 percent, as expected. Chair Jerome Powell maintained …

Read More »

Read More »

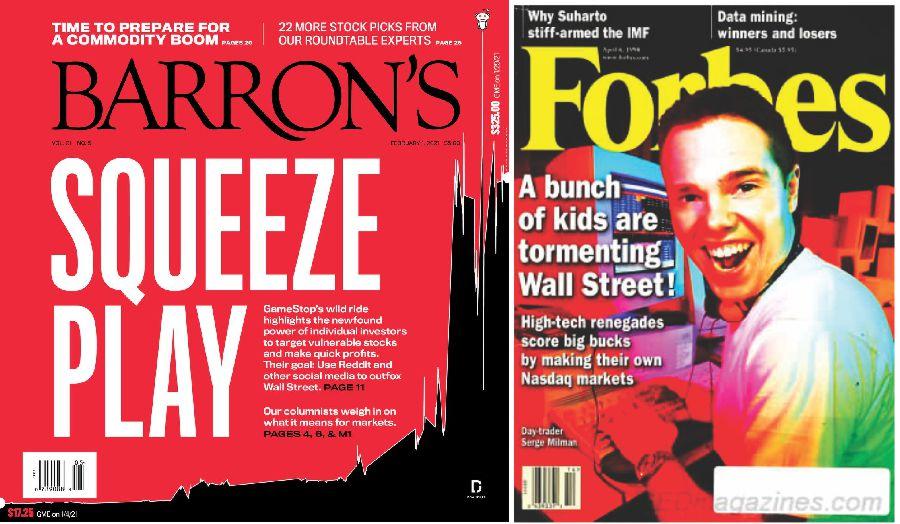

1-30-26 This Indicator Is Screaming 2021-Level Speculation Again

Retail risk appetite has surged to extreme levels last seen in early 2021, a period marked by peak speculation.

Margin debt is accelerating as speculative money rapidly rotates across assets, with $SLV and $GLD the latest examples.

In this short video, Lance Roberts & Michael Lebowitz explain why history shows these conditions often lead to sharp volatility, not smooth market advances.

📺Full episode:

Catch me daily on The Real...

Read More »

Read More »

1-30-26 Retirement Income When Markets Are Expensive

Markets may still enjoy short-term momentum, but long-term retirement planning must confront a different reality: elevated valuations, lower forward returns, and rising sequence-of-returns risk.

Richard Rosso explains why retirees face a near-term tailwind in market returns—but potentially long-term secular stagnation that demands tighter portfolio guardrails. Rich will discuss why historically tested retirement income strategies matter more today...

Read More »

Read More »

Meta And Microsoft: Great Earnings But Different Results

On the heels of strong fourth-quarter earnings reports, Microsoft is opening down 8%, while Meta is trading up 10%. Microsoft topped expectations for earnings and revenues. However, there is some concern about its total cloud revenue. They reported cloud revenue of 26% versus expectations of 28-29%. That said, their leading cloud computing product, Azure, grew …

Read More »

Read More »

Mainstream Expectations: Hope Vs. Potential Risk

Mainstream expectations, those from Wall Street, economists, and corporate strategists, have congealed around a bullish economic outlook for 2026. Most forecasts project stronger economic growth, with contained inflation, and continued investment in technology and capital expenditure. As such, many institutional investors interpret this as a year of opportunity for markets and corporate earnings.That was a …

Read More »

Read More »

1-29-26 What The Fed Really Said & What To Expect Next

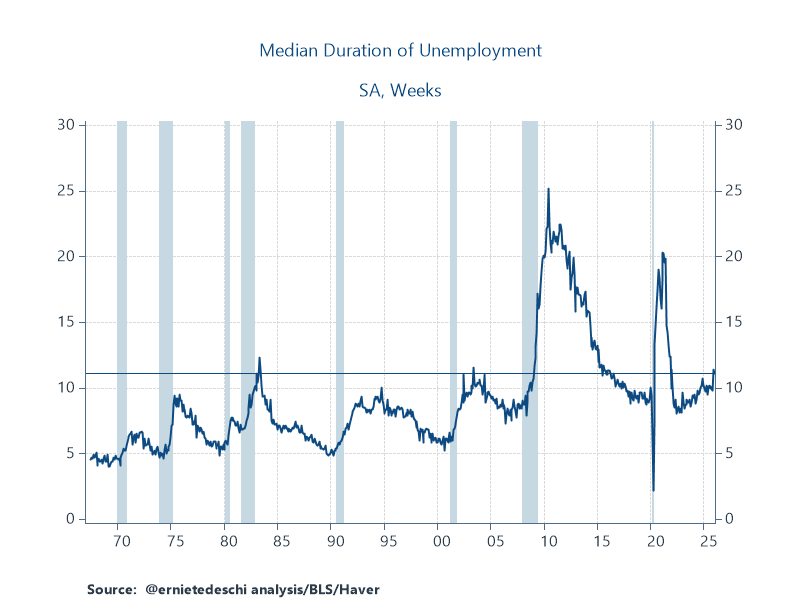

The Fed sees inflation easing and believes policy is already restrictive, making rate hikes very unlikely and keeping cuts as the more probable next move.

In this short video, @michaellebowitz and I break down what Powell actually said, what the Fed is signaling on growth and labor, and what to expect next for markets.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

1-29-26 Market Risks Behind Powell’s “Nonrestrictive” Stance

The Federal Reserve is holding interest rates steady, keeping policy in a 3.5%–3.75% range.

Lance Roberts and Michael Lebowitz examine how markets are reacting to Chair Jerome Powell’s message, and break down what the Fed is signaling—and why it could fuel market volatility ahead.

0:00 - INTRO

0:19 - Mega Reports & Fed Fallout

4:31 - Markets Struggle after 7,000

9:33 - Inflation, Truflation, & Labor

14:14 - Chances of Rate Changes Higher...

Read More »

Read More »

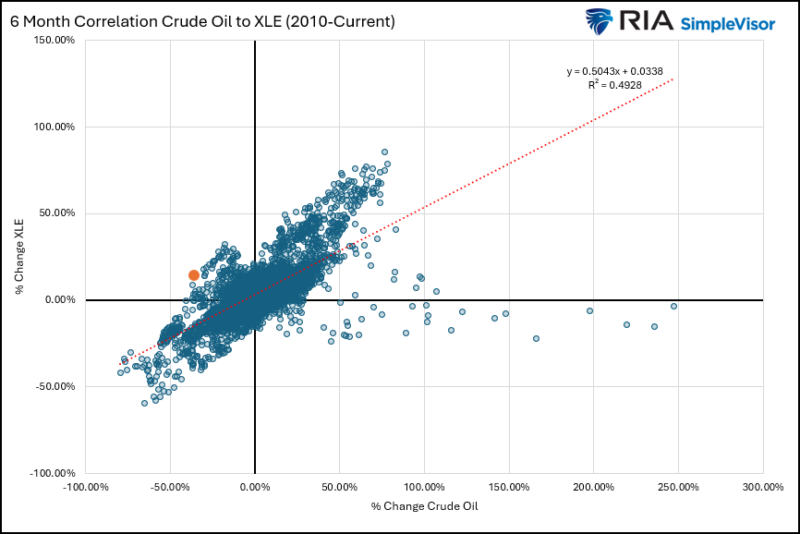

The Energy Sector Is Outpacing Energy Prices

Over the last year, energy stocks have traded well despite crude oil prices languishing. For instance, over the last six months, XLE, the energy ETF, has risen 14%, while crude oil prices have fallen by 12%. The two largest components of XLE, Exxon and Chevron, which account for 40% of the ETF, are up 30% … Continue reading...

Read More »

Read More »

1-28-26 The Narrative Trap: How Investors Justify Buying Silver Higher

$SLV rally is fueled by narrative and retail chasing.

Historically, it ended with painful mean reversion.

In this short video, I discuss why investors justify buying #silver higher, how psychology overrides fundamentals, and why parabolic moves in industrial metals rarely last. $GLD

📺Full episode: -IGAw

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

1-28-26 Q&A Wednesday, the YouTube Chat Free-for-all

Welcome to Q&A Wednesday: The YouTube Chat Free-for-All — our most interactive show of the week.

Lance Roberts & Danny Ratliff answer real-time questions straight from the YouTube live chat. No scripts. No pre-selected topics. Just timely, unfiltered discussion on the issues investors are wrestling with right now.

#QAWednesday #InvestorQuestions #MarketVolatility #FinancialEducation #RiskManagement

Read More »

Read More »

European Buyers Strike Or Performance Chasing?

Bloomberg recently published "Wall Street Grapples With A New Risk: A European Buyers Strike." The article notes that stock indexes in Europe, Japan, Canada, and South Korea are all beating US equities in both nominal and dollar terms. As a result, some European pension funds and other foreign buyers are trimming their exposure to US …

Read More »

Read More »

2026 Economic Summit Recap: Where Investing, AI, and Digital Assets Converged

The 2026 Economic Summit brought together forward-thinking investors, advisors, and industry leaders for two days of timely insights, candid conversations, and actionable takeaways on the future of money, markets, and technology. A Strong Start: VIP Pre-Event Mixer The event kicked off on Friday evening, January 16, with an intimate VIP Pre-Event Mixer. Attendees from all …

Read More »

Read More »

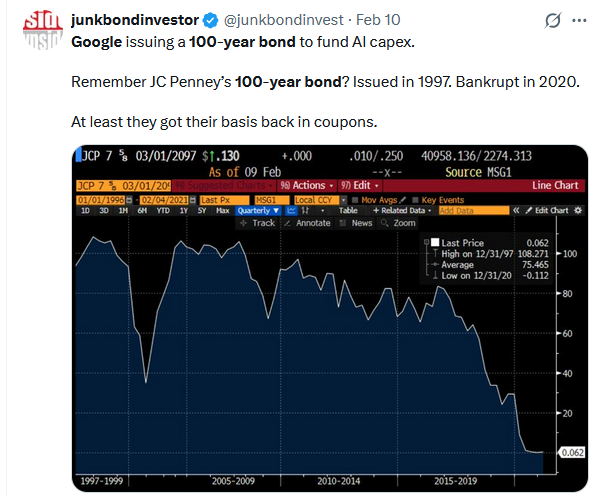

AI Bubble: History Says Caution Is Warranted

Larry Fink, CEO of BlackRock, recently declared: “I do not believe there’s an AI bubble by any imagination.” We agree and disagree. We believe AI is a technological game-changer on par with the invention of the computer and the internet. AI technology is not a bubble and will prove incredibly valuable and productive. However, it's …

Read More »

Read More »

1-27-26 Fed Week Meets Mega-Cap Earnings: Volatility Incoming

This week’s Fed meeting and mega-cap earnings window could set the tone for markets in the weeks ahead.

In this short video, Lance Roberts breaks down why Powell’s guidance matters more than the rate decision and how recent pullbacks in $AAPL, $MSFT, $META, and $AMZN may offer tactical trading opportunities.

📺Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

1-27-26 Work Sucks…Or Does It?

Lance Roberts & Jonathan Penn take a hard look at how Millennials and Gen Z view work, career stability, and success in a rapidly changing economy. From corporate burnout and hustle culture to freelancing, side hustles, and remote work, the rules around employment are shifting fast.

0:00 - INTRO

0:20 - Baylor Hockey & Headphone Parties

3:28 - Fed Week preview

6:57 - Markets' Rally & Earnings Preview

12:55 - The Evolution of Work

15:48...

Read More »

Read More »

Do Sentiment Trends Boost Reflation Odds

On Monday, we discussed how the Truflation inflation gauge points to a sudden price decline, which clouds the reflation outlook. Today, we share recent consumer sentiment readings that counter the disinflation story and support the reflation narrative. On Friday, the University of Michigan reported that its consumer sentiment index improved in January to a five-month …

Read More »

Read More »

1-26-26 Is Bitcoin Entering a New Regime or Just Another Cycle?$IBIT $BTCUSD

Bitcoin’s usual links to $QQQ, Fed policy, and the four-year cycle have broken down.

In this short video, Parker White and I discuss why key correlations have broken down and whether institutional buyers are changing the depth and shape of the next #Bitcoin bear market.

📺Full interview: https://www.youtube.com/watch?v=_6F1ITCnF0A

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

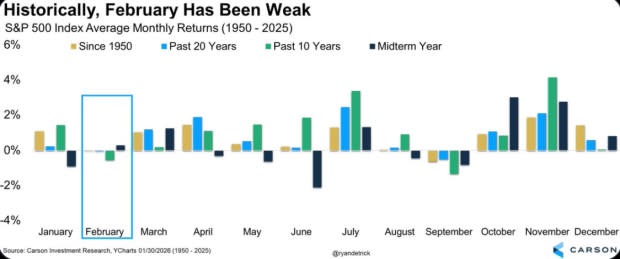

The Bullish And Bearish Case For 2026

The year ahead presents both a bullish and bearish case for investors. Will 2026 be another year of above-average returns, or will it be a year of disappointment? The bulls argue that the key ingredients for a sustained rally are in place. A powerful technology cycle, aggressive corporate spending, and supportive policy measures all point …

Read More »

Read More »

The Reflation Narrative Stumbles Out Of The Gate

With a 4.4% increase in economic growth in the third quarter and expectations that it could be higher in the fourth quarter, the so-called reflation narrative appears primed to dash out of the gates in 2026 at its current strong pace. The problem with assuming the reflation narrative will hold in 2026 is that it … Continue reading...

Read More »

Read More »

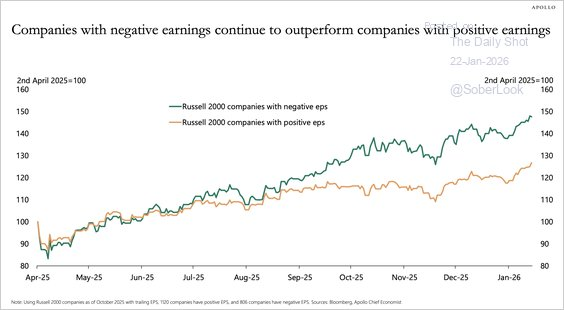

1-24-26 How Index Funds Inflate Stocks With No Profits

Index investing is inflating unprofitable stocks like $OKLO and breaking real price discovery.

In this short video, Michael Lebowitz and I discuss how passive ETF flows force money into “story” names, push prices higher without fundamentals, and why that risk can unwind fast.

📺Full episode: -GazpbG0

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »