Category Archive: 9a.) Real Investment Advice

7-30-25 How to Effectively Hedge Against Inflation

IIt's a mega-earnings report day, and a Fed Meeting day, to boot; the notion among some investors that 20% returns are normal is scary. The Fed is expected to hold steady on interest rates, but there is dissention in the ranks of Fed Governors. Inflation erodes your purchasing power—are you prepared? Lance Roberts & Danny Ratliff break down smart strategies to hedge against inflation and protect your wealth. Lance and Danny commiserate on kids...

Read More »

Read More »

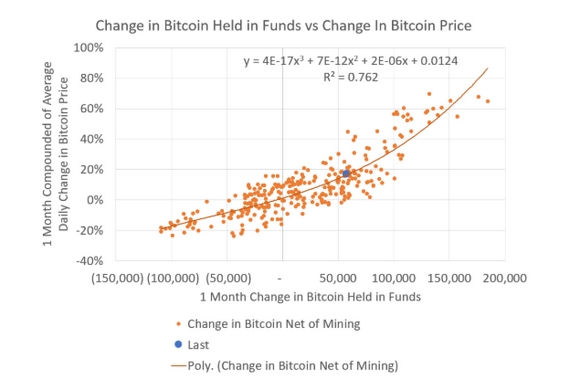

A Ponzi Scheme: The Graph Driving MicroStrategy And Others

The graph below, from Michael Green (@profplum99), is the best way to show the logic that drives a Ponzi scheme in Bitcoin. The Ponzi scheme graph illustrates that there is a robust correlation between changes in the amount of Bitcoin held in funds (ETFs) and the price change. Simply, as new capital is used to …

Read More »

Read More »

The High Beta Melt Up: Echoes Of 1999

In our recent article, "The Magnificent Seven Are Mediocre," we pondered whether the stock market is entering a melt-up phase, where investors driven by extreme speculative behavior and hopes for exponential returns favor volatile stocks with high betas. To be clear, we do not know whether we are in a melt-up phase. The market could …

Read More »

Read More »

There Will Always Be a Need for Human Connection Even With AI

While AI may replace some jobs, it’s important to remember that certain roles will always require the human touch—no matter how advanced technology becomes.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO,

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our YouTube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on Apple Podcasts:...

Read More »

Read More »

7-29-25 Two Dads on Money: Grit, Grind, & Glam

Markets continue their bullish trend; Infrastructure build-out for AI is beginning to show up in data. Money flows return to US markets. Lance shares the bet he has with his dog; Lance & Jon share their "Two Dads" wisdom for fresh college grads' job searched & career choices, and offer three pillars for success:

○ Grit: Passion + perseverance. Stick through setbacks, stay committed, believe effort matters more than innate...

Read More »

Read More »

Tax-Efficient Wealth Transfer Strategies for Business Owners

As a business owner, you've worked hard to build wealth for yourself, your family, and future generations. Yet without the right plan, a significant portion of your estate could be lost to taxes. That’s where tax-efficient wealth transfer strategies come into play. These strategies help you reduce estate tax exposure, preserve your legacy, and support …

Read More »

Read More »

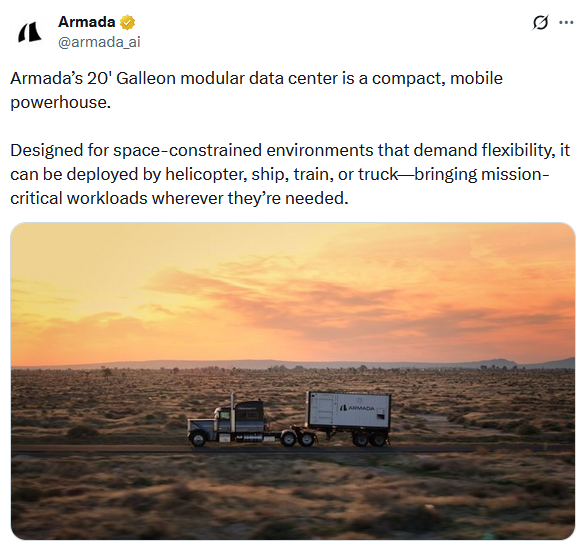

Portable Data Centers

Construction of AI data centers can take anywhere from six months to multiple years to complete. Accordingly, they can't build data centers quickly enough to keep up with the demand. Accordingly, we will need new, innovative solutions to meet the demand. For example, a startup private company named Armada makes portable AI data centers for …

Read More »

Read More »

Not Everything Goes Down During a Correction

Money doesn't leave the market during a correction; not everything goes down during a corrective action in the markets. So where do you look to place extra cash?

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO,

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on our YouTube Channel:

www.youtube.com/c/TheRealInvestmentShow

➢ Listen daily on Apple Podcasts:...

Read More »

Read More »

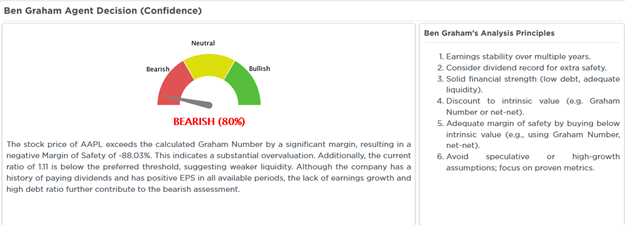

7-28-25 Big Tech Earnings

Big Tech Earnings: Lance Roberts reviews what Apple, Google, and Microsoft Just Revealed, plus Market Reaction & Forecast on #TheRealInvestmentShow.

#BigTechEarnings #TechStocks2025 #EarningsSeason

#StockMarketNews #FAANG

Read More »

Read More »

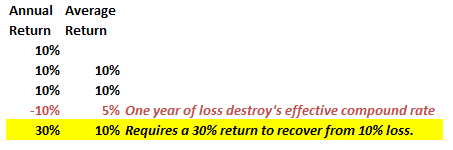

Portfolio Benchmarking: 5-Reasons Underperformance Occurs

When markets decline—especially after long periods of sustained growth—the familiar advice resurfaces: "Be patient. Stay invested. Ride it out." The rationale? The market always goes up over time. But there's a critical flaw in this narrative. Your portfolio and a portfolio benchmark are entirely different things. And portfolio benchmarking, or the constant comparison of your …

Read More »

Read More »

The Week Ahead: Volatility Is In The Forecast

Typically, in Monday's Commentaries, we share a few paragraphs titled "The Week Ahead' in a lower section. This week, the amount and importance of the data could have a meaningful impact on markets and the Fed. Thus, this week's' "The Week Ahead' gets top billing. Let's review the calendar: Between this week's labor and inflation … Continue...

Read More »

Read More »

Retail Data Sends A Warning

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ … Continue reading...

Read More »

Read More »

7-25-25 Are You a Meme Stock Mania DORK?

Is your portfolio full of DORKs? Jonathan Penn and Jonathan McCarty unpack the return of meme stock mania and four speculative favorites: DNUT (Krispy Kreme), OPEN (Opendoor), RKLB (Rocket Lab), and KSS (Kohl's). These retail-loved names are soaring again—but should you follow the hype or stay grounded? We'll discuss why these stocks are rallying, the behavioral finance behind retail speculation, and the portfolio risks in chasing "lottery...

Read More »

Read More »

Is Private Equity A Wolf In Sheep’s Clothing?

In July 2007, just before the financial crisis erupted, Citigroup CEO Chuck Prince summed up Wall Street's dangerous exuberance: “When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you've got to get up and dance. We're still dancing.” Eighteen years later, Wall Street is …

Read More »

Read More »

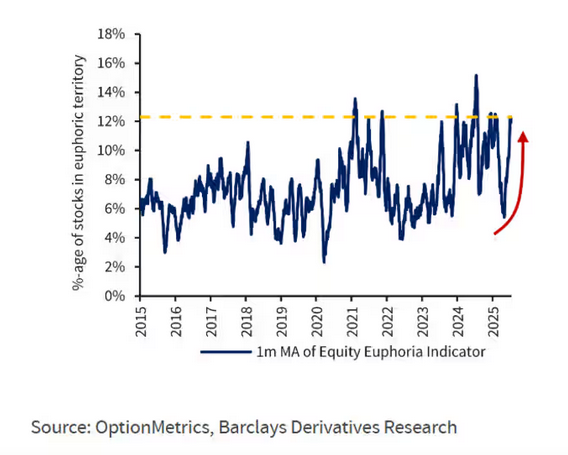

Retail Traders Are Driving Euphoria

Recent surges in speculative stocks are among several indicators that retail traders are introducing a bit of euphoria to the stock market. In an interesting article, MarketWatch notes that Wall Street is paying close attention to speculative trading behavior among retail traders. The following is from the article: Barclays strategists led by Venu Krishna have …

Read More »

Read More »

7-24-25 The Impact of AI on Market Volatility

The use of artificial intelligence in stock market trading could be a double-edged sword: While exponentially increasing the velocity of trading, and the heightened possibility of another Flash Crash, AI might also recognize the signs of such before they could occur.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO, w Portfolio Manager, Michael Lebowitz, CFA

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live...

Read More »

Read More »

7-24-25 How AI is Driving the Market

Artificial intelligence is no longer the future—it’s the engine behind today’s market moves. Lance Roberts & Michael Lebowitz break down how AI and machine learning are reshaping investing strategies, influencing algorithmic trading, and transforming financial analysis. Lance looks at earnings season and esla's results; there's nothing wrong with the markets, but all the ingredients are in place for a market reversion; what will be the...

Read More »

Read More »

Japan Financing Seals The Deal And Toyota Jumps

Japan and the US appear to have finalized a trade agreement that reduces the threatened 25% tariffs on Japan to 15%. Beyond the tariff rate, the deal has several important facets, including opening Japanese markets to US goods. However, most intriguing is that Japan will be financing the US with a $550 billion investment fund. …

Read More »

Read More »

7-23-25 Major Market Moves are Always Related to Credit or Forward Earnings Expectations

The major market collapses of 1974, 1999, and 2008 were all similar in that they were caused by issues of credit or forward earnings expectations. If someone says markets are going to crash 50%, and it's not because of credit or forward earnings expectations, it's not a valid reason.

Hosted by RIA Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

➢ Watch Live Mon-Fri, 6a-7a Central on...

Read More »

Read More »