Category Archive: 9a.) Real Investment Advice

9/9/25 The Best Way to Buy Bitcoin: Smart Investors Guide

Thinking about buying Bitcoin but not sure of the best approach? You’re not alone. With so many options—crypto exchanges, ETFs, custodians, and even payment apps—the path can feel overwhelming.

In this episode, we break down the smartest ways to buy Bitcoin while considering security, fees, custody, and long-term investing strategy. Should you buy directly on an exchange, use a crypto wallet, or stick to regulated investment vehicles like ETFs?...

Read More »

Read More »

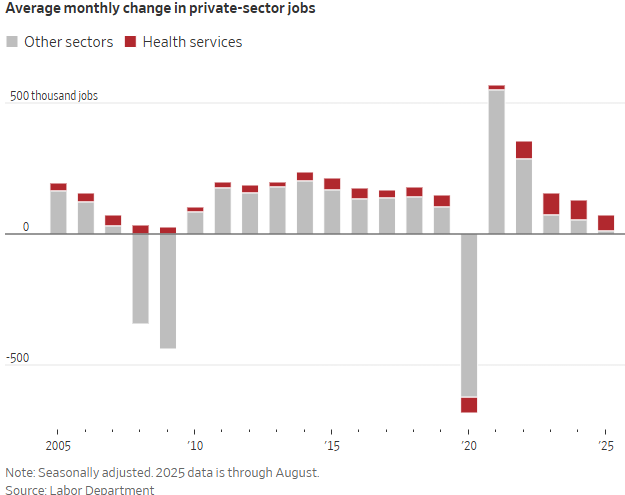

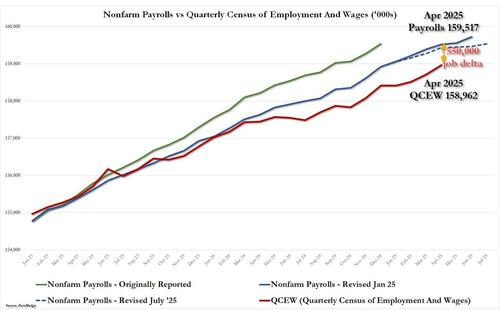

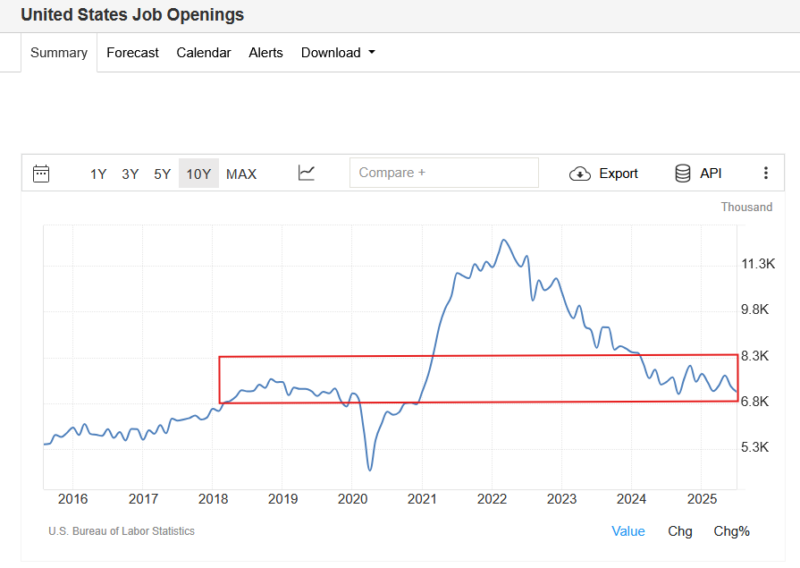

Healthcare Jobs Keep Labor Market Afloat: But For How Long?

The August jobs report clarified what many investors already suspect: the U.S. labor market is stalling. Outside of healthcare and social assistance, private-sector job creation has nearly flatlined this year. So far in 2025, the economy has added an average of 74,000 private-sector jobs per month. Stripping out the ~64,000 monthly additions from healthcare jobs, …

Read More »

Read More »

9/8/25 Why Diversification Is Failing In The Age Of Passive Investing

NOTE: As of 10:50a CDT YouTube has yet to process this video sufficiently for us to edit or add time codes. We'll revise all of these as soon as YouTube allows.

Lance Roberts explores how the rise of passive index funds and ETFs has reshaped markets, leading to higher correlations across asset classes and eroding the traditional benefits of diversification. Once considered the cornerstone of portfolio risk management, diversification now struggles...

Read More »

Read More »

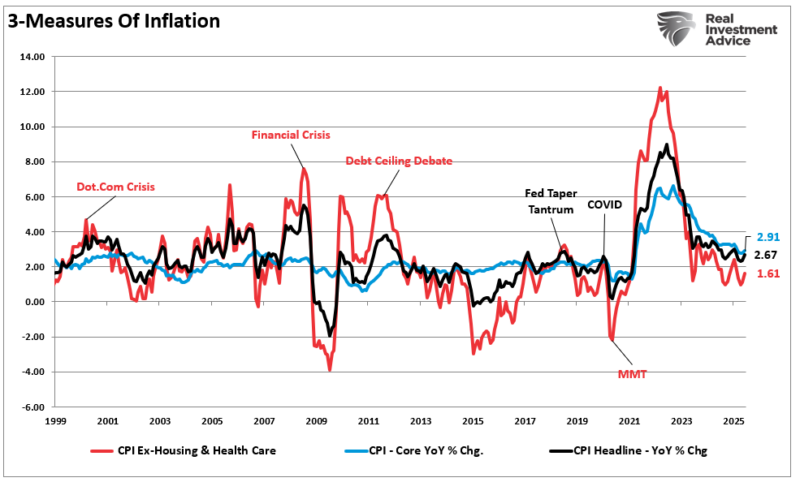

9-8-25 Don’t Be Fooled By The Market: Jobs Report Signals Trouble

Friday’s jobs report revealed deeper cracks: a multi-month downtrend in employment, quality of hires is deteriorating, etc.

Since employment drives growth & earnings, any $SPY / $QQQ pop may be short-lived – disinflation & slowing growth still point to mounting risk for equities.

In this short video, I explain why Friday’s data could matter more than you'd think.

📺 Catch me daily on The Real Investment Show:...

Read More »

Read More »

Why Diversification Is Failing In The Age Of Passive Investing

Diversification has been the backbone of "buy and hold" strategies for the last few decades. It was a boon to financial advisors who couldn't actively manage portfolios, and it created a massive Exchange-Traded Funds (ETFs) industry that allowed for even further simplification of investing. The message was basic: "Buy a basket of assets, dollar cost …

Read More »

Read More »

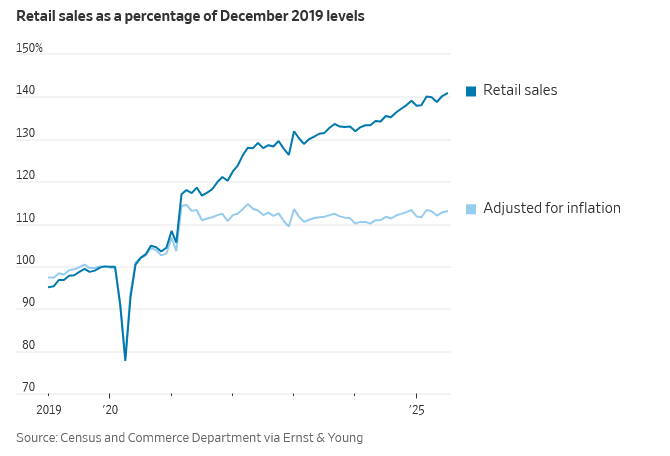

Earnings Are Becoming Harder To Come By

Another round of quarterly earnings reports has come and gone, and once again, many companies beat profit expectations. Yet a glance at the graph below from The Wall Street Journal, showing that retail sales have been flat excluding inflation, suggests that the ways in which companies are growing their earnings must be changing. The Wall …

Read More »

Read More »

Using MACD To Manage Portfolio Risk

🔎 At a Glance 💬 Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? 📩 Email: [email protected]🐦 Follow & DM on X: @LanceRoberts📰 Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue! 🏛️ … Continue...

Read More »

Read More »

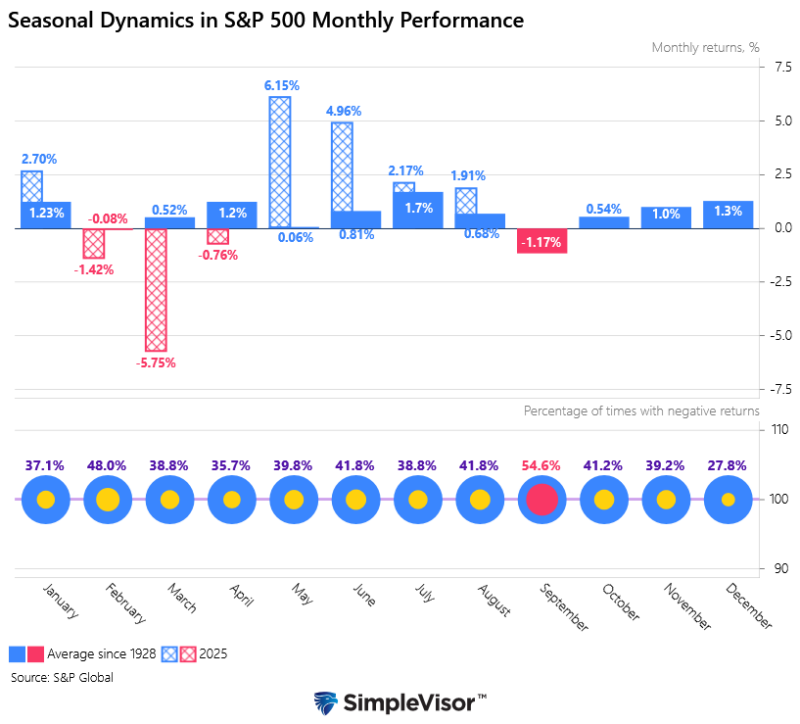

Pullback or Not? & Time to Trim Gold

A weak jobs report has traders betting on a Fed rate cut – but don’t rule out a pullback in $SPY / $QQQ in September.

Gold $GLD, meanwhile, looks overbought – a good spot to take profits.

In this short video, I break it all down.

📺 Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

#StockMarket #FedRateCut #SPY #QQQ #GoldInvesting #MarketOutlook

Read More »

Read More »

9/5/25 Financial Planning Secrets: Why Your Advisor Should Do More Than Pick Stocks

Too many people think financial planning is just about picking investments—but it’s much more than that. A great plan is a living, breathing roadmap that evolves as your life changes.

Richard Rosso & Jonathan McCarty uncover what makes the perfect financial planning experience—from getting your head straight, to gathering the right documents, to partnering with a fiduciary advisor who looks beyond just returns.

You’ll learn:

• Why real...

Read More »

Read More »

Fed Policy Is More Restrictive Since Rate Cuts

The Fed has cut the Fed Funds rate by 1% since late 2024, and the presumption from many market participants is that the Fed has made policy less restrictive. Technically, they are somewhat correct. Banks and other financial institutions that borrow over very short periods have seen their borrowing costs decline due to the Fed’s …

Read More »

Read More »

Why Keynes’ Economic Theories Failed In Reality

A recent post from Daniel Lacalle, “How Keynesians Got The US Economy Wrong Again,” exposed the widening gap between John Maynard Keynes' economic theory and reality. Despite the confident forecasts of leading Keynesian economists, the U.S. economy in 2025 continues to defy expectations. The Federal Reserve’s tightening cycle failed to trigger the widely predicted “hard …

Read More »

Read More »

Bad Jobs Report = Good News For Markets?

A weak jobs print with sharp negative revisions could become bullish fuel, lifting hopes of a 50 bps Fed rate cut.

In this short video, I break down why bad news might be good news for $SPY / $QQQ.

📺 Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

➢ Upcoming personal finance free online events:

https://riaadvisors.com/events/

➢ Sign up for the Newsletter:

https://realinvestmentadvice.com/newsletter/...

Read More »

Read More »

9/4/25 Stock Market Bubble? Extreme Valuations & What Investors Should Do Now

Stock valuations are at extreme levels — some call it a bubble, while others argue the bull market has more room to run. So, who’s right? And more importantly, what should YOU do as an investor?

Lance Roberts & Michael Lebowitz expose the conflicting market narratives and explain why selling everything may not be the smartest move. Instead, they’ll explore how active investing, technical signals, and disciplined risk management can help you...

Read More »

Read More »

Robots Are Tesla’s Future: EVs No Longer The Value Proposition

Tesla is the leading manufacturer of electric vehicles (EVs) in the US and second, behind BYD, in the world. Despite its strong position in the EV market, Tesla is only the fourteenth largest auto manufacturer. Despite its low ranking, it has a market capitalization that is almost four times that of Toyota, the second-largest auto …

Read More »

Read More »

9-3-25 Why Most People Fail at Day Trading

It's an interesting conundrum that some retirees go into day trading as a "side gig," which in turn becomes another full time job, monitoring all of the data and news. Just because you have access to information doesn't mean you have to act upon it. Sometimes it's better to let the dust settle before making a move.

RIS Advisors Chief Investment Strategist, Lance Roberts, CIO, w Senior Financial Advisors, Danny Ratliff, CFP

Produced by...

Read More »

Read More »

9/3/25 10 Reasons You Shouldn’t Retire (but what to do if you do)…

Thinking about retirement? Think again.

Lance Roberts & Danny Ratliff present 10 powerful reasons you shouldn’t retire too soon—from financial stability to maintaining purpose and health. But if you do decide to retire, they’ll also show you exactly what steps to take to protect your money, lifestyle, and long-term security.

0:19 - How ChatGPT Saved Google in Anti-trust Court

2:49 - Why the 50-DMA is Key

8:18 - Looking Ahead to Employment...

Read More »

Read More »

Monthly Market Trends: Do They Matter?

The graph below breaks down the monthly performance of the S&P 500 since 1928. As shown, September is the only month that has seen more negative monthly performances than positive ones. September's record joins February as the only two months with a negative average, albeit February is only down 0.08%, versus the more significant 1.17% …

Read More »

Read More »

Valuations Are Extreme: Navigating A Bubble

Some pundits warn that, given extremely high stock valuations, one should sell everything. Yet, despite having the same information, other pundits show little concern and believe the bull market has further to run. The stark contradiction of opinions in today’s market leaves many investors understandably confused and anxious about what to do. Based on valuations, …

Read More »

Read More »

9-2-25 Investing is About Patience

Investing is all about patience, especially when you're young. Speculate if you want, but put most of your nest egg money into the S&P and allow it to grow and do it's thing. Over the long haul, you're better off.

RIS Advisors Chief Investment Strategist, Lance Roberts, CIO

Produced by Brent Clanton, Executive Producer

-------

Sign up for Lance's newsletter:

https://realinvestmentadvice.com/newsletter/

-------

➢ Watch Live Mon-Fri, 6a-7a...

Read More »

Read More »

9/2/25 DIY Investing Mistakes & Why Swing Trading Isn’t Long-Term Wealth

Think you can outsmart the market?

Many DIY investors fall into the same traps: chasing hype, trying to time the market, concentrating in one hot sector, or lacking patience. Lance Roberts & Jonathan Penn break down five of the biggest mistakes DIY investors make — and why they can derail your financial future. They'll also explore swing trading vs. long-term investing:

* How short-term trading chases quick wins with high risk.

* Why...

Read More »

Read More »