Category Archive: 9a.) Real Investment Advice

2-7-26 The Rise of Passive Flows and What It Means for Returns

For the past 15 years, shallow dips and fast recoveries taught investors that risk management doesn’t really matter. That complacency won’t last forever.

Markets may stay supported this decade by liquidity, speculation, and passive flows, but the longer term points to more volatility and lower returns.

ETF growth funnels capital into the same stocks, creating a performance-chasing loop.

As assets become financialized, arbitrage compresses...

Read More »

Read More »

Technology Stocks: Dead Or An Opportunity?

🔎 At a Glance 🏛️ Market Brief - Market Volatility Returns Markets stumbled into February, a historically weak month. February tends to deliver modest returns, with average performance trailing the stronger gains typically seen in January and March. Seasonal tailwinds, such as earnings season and new-year fund flows, begin to fade, while macro headwinds, such …

Read More »

Read More »

2-6-26 Skate to Where the Money Is Going Next

Most investors lose money by chasing whatever narrative is hot, whether it’s $SLV or $MSTR.

Real investing is about anticipating where capital will rotate next and building positions gradually, not trying to time exact bottoms or going all in.

Start small, size positions wisely, and let rotations work in your favor.

In this short video, Lance Roberts & Michael Lebowitz discuss why fundamentals matter more than headlines, and being early...

Read More »

Read More »

2-6-26 This Inflation Signal Says “Trouble in Paradise”

Real-time inflation (Truflation) data is signaling sub-1% inflation, and historically CPI and PCE tend to follow it lower with a short lag. That puts pressure on hawkish policy narratives.

At the same time, consumer spending is staying elevated while incomes are flat and savings have fallen to stressed levels.

In this short video, Lance Roberts & Michael Lebowitz discuss the risk of a growing disconnect between the reflation narrative and...

Read More »

Read More »

2-6-26 The Wealth-Health Gap

Why do wealthier households tend to live longer and experience fewer chronic diseases? Richard Rosso & Jonathan McCarty break down the Wealth-Health Gap—how income, savings, and environment shape health through housing quality, access to care, and financial resilience. We also flip the lens: poor health can reduce earnings, drain savings, and create a vicious cycle that widens disparities across generations. Finally, we discuss systemic factors...

Read More »

Read More »

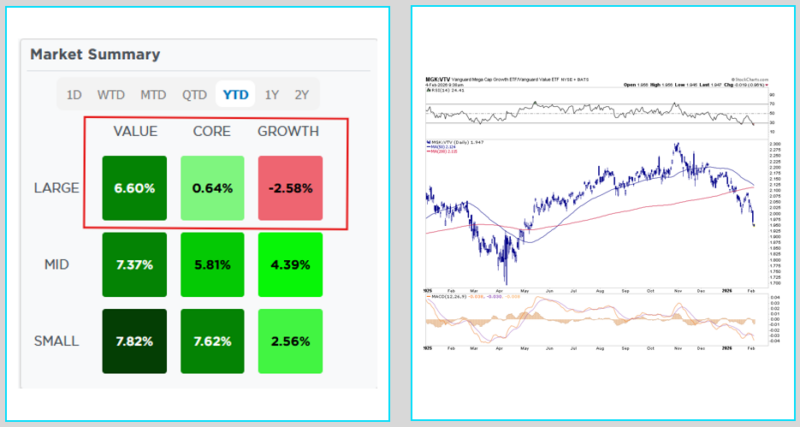

Value or Growth Is Not A Debate, Its An Opportunity

At the start of 2026, we introduced our Factor Rotation Model. The model summary below was posted in SimpleVisor: We launched a new model on January 2nd called the Factor Rotation Model. Historically, the performance of value and growth factors relative to the S&P 500 exhibits a strong negative correlation. Michael Lebowitz provided an overview …

Read More »

Read More »

The Reflation Narrative

The market got off to a strong start in 2026, with investors chasing industrials, materials, and commodity-related stocks as the reflation narrative gained traction. The "reflation narrative" is the belief that a range of policies will boost the rate of economic growth in the U.S. without triggering inflation. As I discussed at our recent 2026 …

Read More »

Read More »

2-5-26 Truflation vs CPI: What Inflation Is Really Doing Today

Is inflation actually cooling—or just being measured differently?

Lance Roberts & Michael Lebowitz break down Truflation’s real-time inflation readings (built from millions of point-of-purchase prices across multiple providers) versus the official CPI/PCE framework, which relies far more on surveys and sampling.

We’ll also address the big caveat: neither CPI/PCE nor Truflation perfectly captures what you feel “in the shops,” because...

Read More »

Read More »

Eli Lilly Shares Boosted BY GLP-1s

On Wednesday, Eli Lilly, the largest holding (15%) in XLV, the State Street healthcare sector ETF, reported earnings well above expectations, and its shares initially rose by 10%. Its fourth-quarter adjusted EPS of $7.54 easily beat the consensus estimate of $6.98. Further boosting Eli Lilly shares, its revenue surged 43% to $19.29 billion, almost $1.5 …

Read More »

Read More »

2-4-26 AI Isn’t Killing Software-As-A-Service — The Market Narrative Is

AI is pressuring software margins, but the market has pushed this narrative to an extreme.

Just like past cycles, investors are extrapolating disruption into total collapse.

SaaS stocks $IGV are now deeply oversold, with many down 40–60% $NOW $CRM and valuations near cycle lows.

Some companies will fail, but the entire sector won’t disappear.

Stepping away from the hype and analyzing businesses—not headlines—is how real opportunities begin...

Read More »

Read More »

2-4-26 Q&A Wednesday: Your Questions, Real Answers

Today’s live YouTube Chat Q&A covers the full spectrum—earnings season takeaways, the selloff-to-rebound pattern, and the big debate around Big Tech, AI, and margins. We walk through where tech and AI leadership stand now, whether AI is pressuring software profitability, and the “real world” constraint markets may be underpricing: power demand (including what ERCOT could mean for data-center expansion).

We also hit the energy transition...

Read More »

Read More »

Japan Is Normalizing: Risks To The Yen Carry Trade

“Japan Bond Meltdown Sends Yields to Record High on Fiscal Fears,” read a January 2026 Bloomberg article. Headlines like this, and many others, warn that Japan’s abrupt interest rate increase is an omen of dire trouble. While that may be the case, given decades of economic woes, declining demographics, and extreme levels of outstanding debt, …

Read More »

Read More »

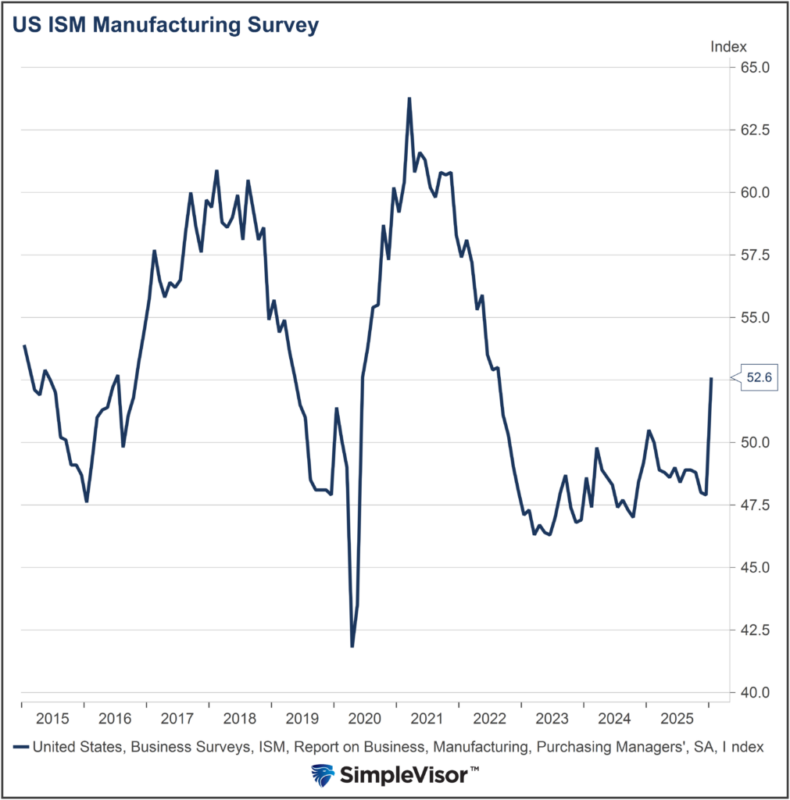

ISM Manufacturing Supports Reflationary Forecasts

Over the last couple of weeks, we have shared evidence that supports the reflationary narrative and some that defies it. Today, we share the latest ISM Manufacturing data, which lends credence to the reflationary narrative. The ISM Manufacturing survey showed a big improvement in sentiment, as shown below. The gauge shot up 4.7 to 52.6, …

Read More »

Read More »

2-3-26 Buy What Nobody Wants, Sell What Everyone Loves

Chasing what’s already performing well is how most investors buy tops—for example, $SLV last week.

Successful investing usually means owning assets nobody wants and selling them once everyone does—but most investors do the opposite.

This leads to complacency, unrealistic return expectations, and knee-jerk decisions driven by standout performers instead of the health of the overall portfolio, ultimately hurting long-term results.

📺Full episode:...

Read More »

Read More »

2-3-26 The Trap of Chasing Returns

Most investors don’t blow up because they “didn’t know enough.” They blow up because they frame the decision wrong.

Lance Roberts & Jonathan Penn break down narrow framing—the behavior where investors judge one investment in isolation (“Why don’t I own that?”) instead of evaluating results through the entire portfolio and a long-term plan.

When something becomes “hot,” it feels obvious, safe, and inevitable. But return-chasing often ends the...

Read More »

Read More »

Private Credit Funds Falling Out Of Favor

Private credit funds were all the rage in 2024 and 2025 as institutional and high-net-worth retail investors sought more risk and higher returns. Over the last few months, that trend has started reversing. The FT reports that private credit investors pulled more than $7 billion from some of the biggest private credit funds in the …

Read More »

Read More »

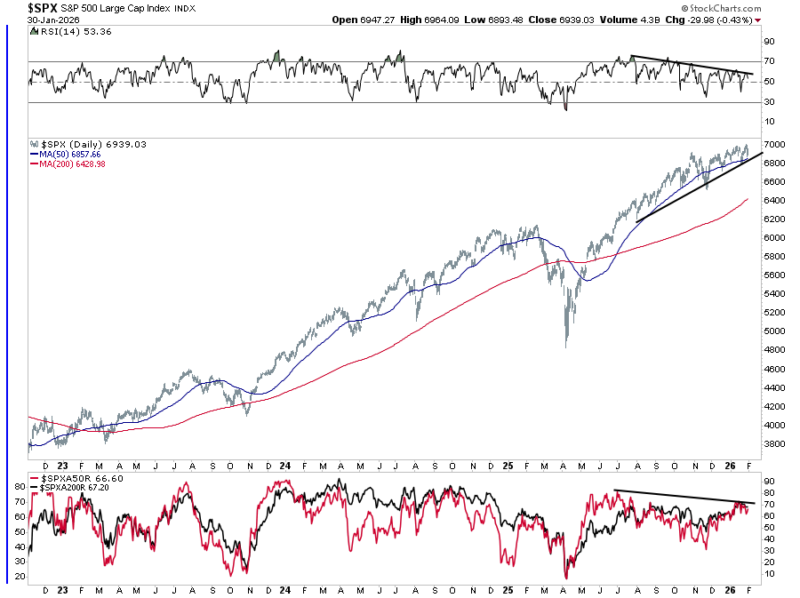

2-2-26 Bears Are an Endangered Species

Lance Roberts examines why bears have become an endangered species—and why that may be a warning sign rather than a confirmation of safety. Investor sentiment is extreme, margin debt is surging, speculative behavior is accelerating, and market leadership remains narrowly concentrated. When optimism becomes unanimous, history shows future returns tend to disappoint.

#MarketRisk #InvestorSentiment #StockMarketOutlook #RiskManagement #FinancialPlanning

Read More »

Read More »

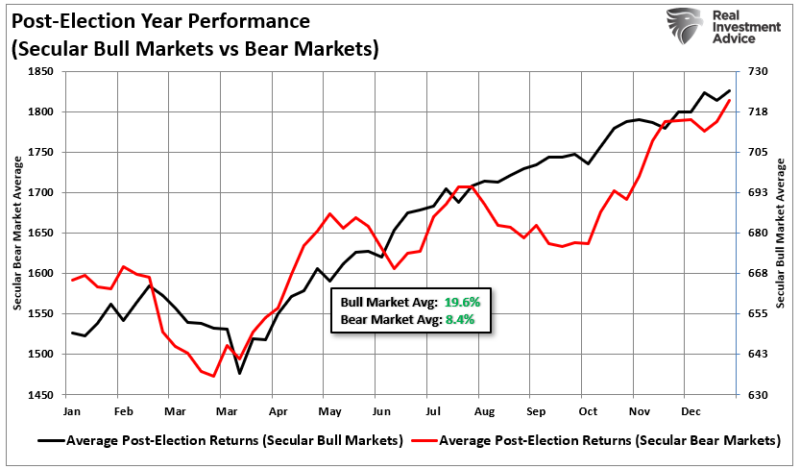

The Market Cycles Potentially Driving 2026 Returns

Market cycles are once again at the center of the investment narrative as we head into 2026. The optimism is familiar as earnings held up in 2025, the economy avoided recession, and big tech lifted the indexes. However, those victories are already reflected in the price. As we head into 2026, with valuations extended, the …

Read More »

Read More »

Warsh To Head The Fed

The wait is over, and President Trump has nominated Kevin Warsh to head the Federal Reserve. To better appreciate Warsh's views on monetary policy and what they may entail for markets, we summarize a recent Wall Street Journal editorial he wrote, The Federal Reserve's Broken Leadership. Our market-related thoughts are below the bullet points. From …

Read More »

Read More »

1-31-26 Margin Debt Explained: Bullish Today, Dangerous Tomorrow

In this short video, Lance Roberts & Michael LebowitzI discuss margin debt in detail.

Margin debt at record highs isn’t a sell signal. Rising leverage adds buying power and supports prices.

The real risk comes when margin debt reverses and deleveraging accelerates downside.

Watch the rate of change, not the headline level.

📺Full episode:

Catch Lance daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »