Category Archive: 9a.) Real Investment Advice

10-3-25 Forget the Shutdown, Jobs Are Getting Weaker and Weaker

The real story isn’t the government shutdown. ADP just showed another 32,000 job losses, with prior months revised lower.

In this short video, @michaellebowitz and I discuss why the labor market is deteriorating even without the BLS report and what it means for $SPY / $QQQ.

Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »

10-3-25 Protecting Your Family’s Future: Financial Basics You Cannot Ignore

Protecting your family starts with the right financial basics. Jon Penn & Jonathan McCarty break down the must-have estate planning tools, insurance coverage, and financial safeguards every household needs.

🔔 Subscribe for more practical strategies to protect your wealth, family, and future.

#FamilyProtection #EstatePlanning #FinancialBasics #MoneyTalk #WealthPlanning

Read More »

Read More »

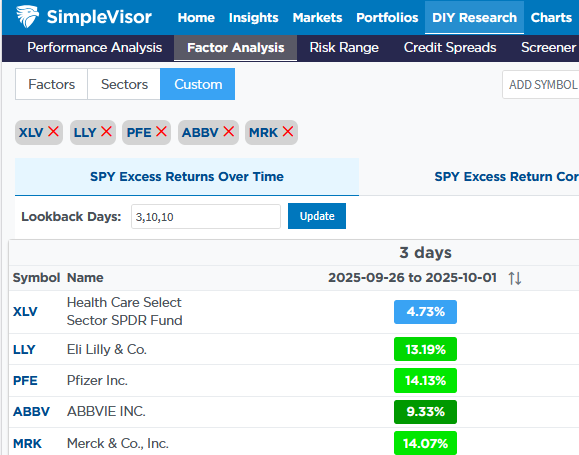

Eli Lilly And Its Competitors Pop On The Pfizer News

Eli Lilly and other US-based drug makers have led the market over the last few days. The reason appears to be Pfizer’s agreement with President Trump to sell its drugs through Medicaid at cheaper prices. It's not just Pfizer; Eli Lilly is reportedly in active discussions with the administration to participate in a similar deal. …

Read More »

Read More »

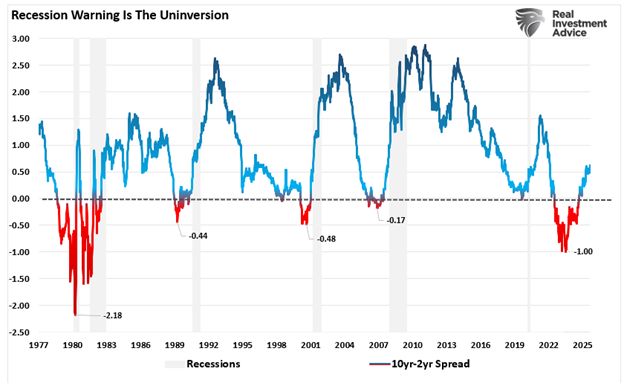

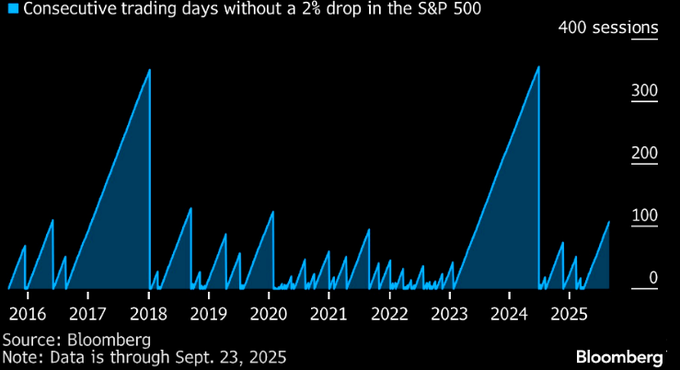

Promised Recession…So Where Is It?

Over the past three years, the economic conversation has been a "promised recession." If you read the headlines, tracked economist surveys, or even listened to Wall Street strategists, you would have assumed a downturn was imminent. Many investors, bloggers, and YouTubers have had a "parade of horribles" promising a recession is just on the horizon.The logic was …

Read More »

Read More »

10/2/25 Valuations Don’t Matter… Until They Do

Markets are trading at near all-time record valuations with little fundamental support.

Momentum is currently driving prices across all asset classes, but when earnings reality fails to match lofty expectations, valuations start to matter. And that’s when the music stops.

In this short video, I show why history warns against ignoring valuations and what it means for risk and returns ahead.

Full episode:

Catch me daily on The Real...

Read More »

Read More »

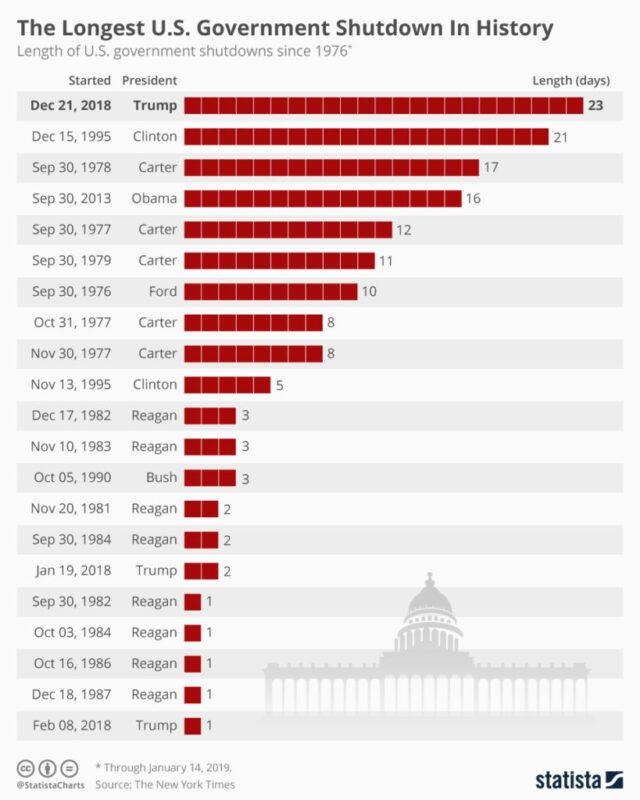

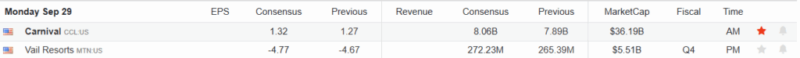

10-2-25 Who Needs the BLS:? Shutdown Silences Jobs Report

The government shutdown has silenced the Bureau of Labor Statistics, leaving investors without the monthly jobs report. But does Wall Street really need the BLS to keep moving?

Lance Roberts & Michael Lebowitz explore what happens when government labor data goes missing, how traders adapt, and what alternative indicators might offer clues about the state of the economy. Lance and Mike also examine valuation metrics in the markets, and discuss...

Read More »

Read More »

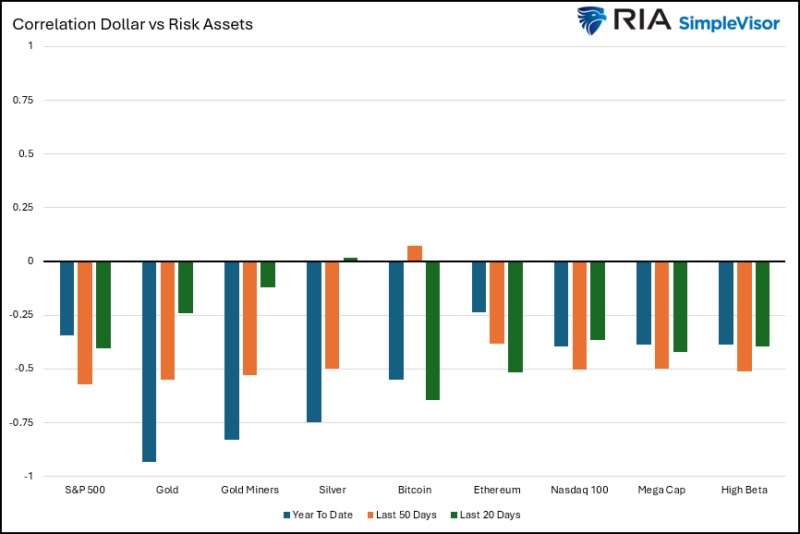

A Dollar Reversal Could Halt The Gold Bull

In Monday’s Commentary, we alerted readers that the dollar could be setting up for a reversal higher. Furthermore, we noted that if such a turn comes to fruition, some investors may encounter surprises. To wit: As such, investors should examine their portfolios for risks that have developed with the reversal of the previously overbought dollar, to …

Read More »

Read More »

AI Boom: This Time Is Different… Or Is It?

AI is undoubtedly transformative, but massive spending and debt-fueled deals, such as $ORCL $300B investment with OpenAI, reveal a circular flow of money between $ORCL, $NVDA, & OpenAI that bears a striking resemblance to the dot-com bubble.

In this short video, I explain why current expectations likely exceed what AI companies can realistically deliver.

Full episode: ?si=T7XTri40KAdGXnO4

Catch me daily on The Real Investment Show:...

Read More »

Read More »

10-1-25 Government Shutdown Begins: What It Means for Markets & Investors {REVISED*]

The U.S. government shutdown has officially started. What does this mean for the economy, markets, and your investments? Lance Roberts covers the immediate fallout from the shutdown on federal spending, workers, and services ; how markets have historically reacted during shutdowns—and what to expect this time; the risk to GDP, delayed economic data releases, and consumer confidence.

This shutdown is more than politics—it’s a real test for the...

Read More »

Read More »

Kimonos For Bitcoin: 150 Year Old Company Goes Crypto

In a bold and unusual pivot, a traditional Japanese manufacturer of Kimonos is transitioning to a cryptocurrency treasury company. Marusho Hotta, which has been manufacturing kimonos since 1861, will rebrand as the Bitcoin Japan Corporation. The transformation stems from a June acquisition by Bakkt Holdings (BKKT), which took a controlling stake in the company to …

Read More »

Read More »

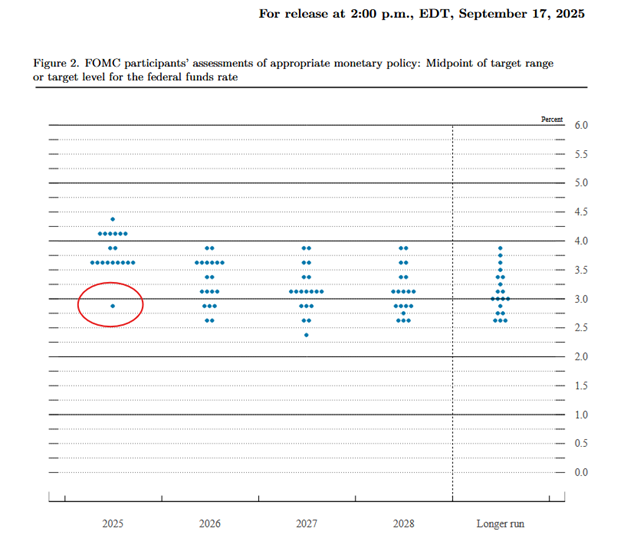

Miran Says Rates Are Too High: Politics Or Reality?

Stephen Miran, Donald Trump's recent addition to the Fed, joined the Federal Reserve the day before the last meeting. At that meeting, he was the only dissenting vote, supporting a 50-basis-point rate cut. All other members voted for a 25-basis-point cut. Additionally, Miran is likely the FOMC participant who thinks the Fed Funds rate should …

Read More »

Read More »

9/30/25 The Truth About Government Shutdowns

A government shutdown is likely but not catastrophic, as the media portrays it.

In this Short video, I break down what actually happens when the government shuts down.

Full episode: https://www.youtube.com/live/OAZFiVQoJYU?si=tD3sA1GaxNZdAMrp

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

e

Read More »

Read More »

9-30-25 Why Do We Invest? 10 Powerful Reasons Explained

Why do we invest? The answer goes far beyond just making money. Lance Roberts & Jonathan Penn, Two Dads on Money, break down the most important reasons people put their money to work in the markets.

Lance and Jon also show why investing is not just for Wall Street professionals—it’s for everyone.

Whether you’re just starting out or refining your long-term strategy, this episode will give you a clear framework for why investing is essential...

Read More »

Read More »

The Government Is Shutting Down Again: Who Cares?

If Congress can’t come to a budget resolution in the next 24 hours, the government will shut down. Sound familiar? We have become numb to the prospect of a government shutdown because it occurs so frequently. Most often, continuing resolution bills are agreed upon before a shutdown, thus enabling the government to continue operating. In …

Read More »

Read More »

9/26/25 2026 Growth Expectations Are Ahead of Reality

Wall Street expects a broad earnings rebound (beyond MAG7) in 2026, but the data says otherwise.

In this short video, I discuss why hopes for strong economic growth—without stimulus, with weakening leading indicators, and with the yield curve still inverted—are ahead of reality.

Read More »

Read More »

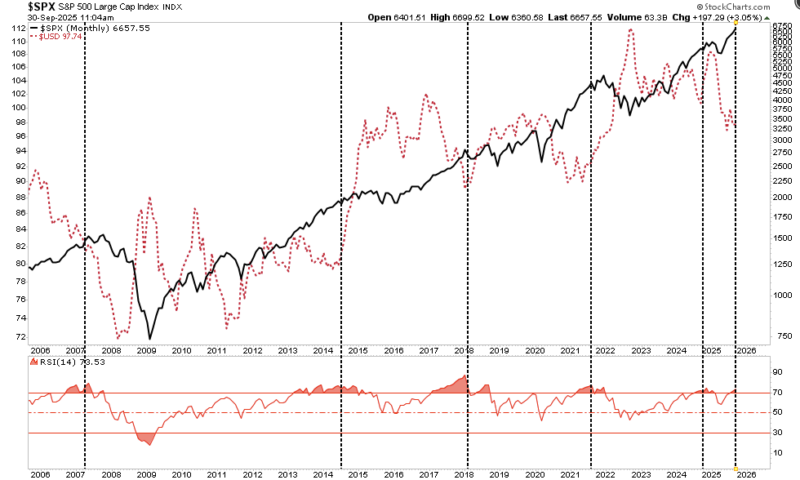

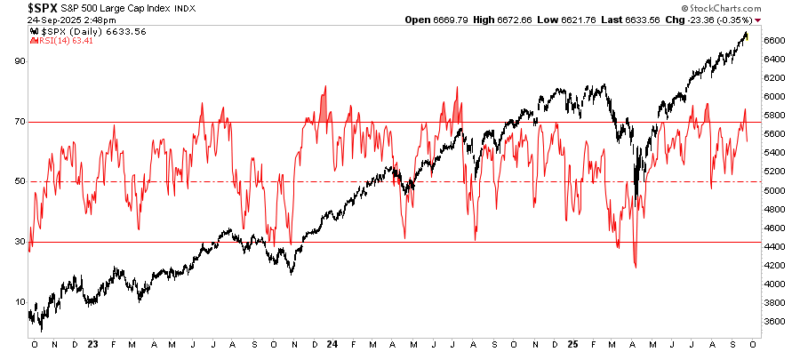

9/29/25 Is the Relative Strength Indicator (RSI) Flashing Caution? [REVISED*]

Lance Roberts examines one of the most reliable technical analysis tools investors use to measure market risk: the Relative Strength Index (RSI). The RSI helps identify when markets are overbought, oversold, or diverging from price action.

While RSI is not a perfect “buy or sell” signal, it is a powerful guardrail for risk management. History shows that overbought conditions can persist much longer than expected, but when momentum fades,...

Read More »

Read More »

RSI (Relative Strength Index): Timing The Next Correction

In the world of technical analysis, there is one reliable indicator for measuring market risk. The relative strength index (RSI) measures overextension (in either direction). Developed by J. Welles Wilder in 1978, the RSI is a momentum oscillator. As such, it measures the velocity and magnitude of price changes, plotting those on a scale from 0 …

Read More »

Read More »

Myth Busting: Foreigners Are Selling Treasuries

There appears to be a frequently repeated myth on social media that foreigners are selling US Treasury bonds in large quantities. Often, the myth is supported by the belief that certain foreign governments, such as China, Japan, and Saudi Arabia, are rapidly selling down their US Treasury securities. Concerns about trade deficits, inflation, and geopolitical …

Read More »

Read More »

Markets Detached From Economic Fundamentals

At a Glance Ask a Question Have a question about the markets, your portfolio, or a topic you'd like us to cover in a future newsletter? Email: [email protected] Follow & DM on X: @LanceRoberts Subscribe on Substack: @LanceRoberts We read every message and may feature your question in next week’s issue!

Read More »

Read More »

Defensive Rotation? Energy Stocks on the MoveThe Real Investment Show

Energy stocks $XLE are breaking out, even as oil remains flat near $64.

In this short video, I explain why a bullish golden cross and rising strength point to a potential defensive rotation from $SPY / $QQQ.

Full episode:

Catch me daily on The Real Investment Show: https://www.youtube.com/@TheRealInvestmentShow

Read More »

Read More »